Is Now The Time To Put National Australia Bank (ASX:NAB) On Your Watchlist?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in National Australia Bank (ASX:NAB). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for National Australia Bank

How Quickly Is National Australia Bank Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. It certainly is nice to see that National Australia Bank has managed to grow EPS by 29% per year over three years. If growth like this continues on into the future, then shareholders will have plenty to smile about.

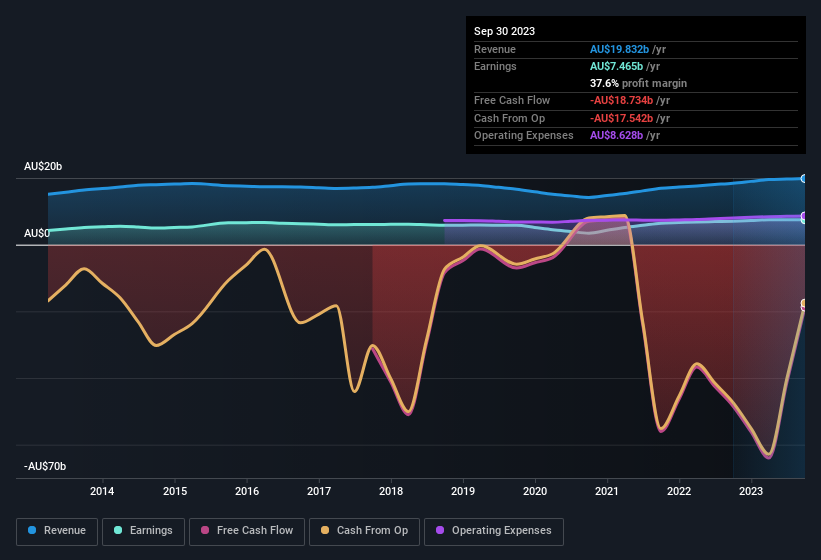

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. It's noted that National Australia Bank's revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. EBIT margins for National Australia Bank remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 7.5% to AU$20b. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for National Australia Bank's future profits.

Are National Australia Bank Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Not only did National Australia Bank insiders refrain from selling stock during the year, but they also spent AU$149k buying it. This is a good look for the company as it paints an optimistic picture for the future.

Along with the insider buying, another encouraging sign for National Australia Bank is that insiders, as a group, have a considerable shareholding. As a matter of fact, their holding is valued at AU$34m. That's a lot of money, and no small incentive to work hard. While their ownership only accounts for 0.03%, this is still a considerable amount at stake to encourage the business to maintain a strategy that will deliver value to shareholders.

Should You Add National Australia Bank To Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into National Australia Bank's strong EPS growth. Furthermore, company insiders have been adding to their significant stake in the company. Astute investors will want to keep this stock on watch. Even so, be aware that National Australia Bank is showing 1 warning sign in our investment analysis , you should know about...

There are plenty of other companies that have insiders buying up shares. So if you like the sound of National Australia Bank, you'll probably love this curated collection of companies in AU that have witnessed growth alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if National Australia Bank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:NAB

National Australia Bank

Provides financial services to individuals and businesses in Australia, New Zealand, Europe, Asia, the United States, and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives