Does Legal Action Over Alleged Outsourcing Change The Bull Case For Commonwealth Bank (ASX:CBA)?

Reviewed by Simply Wall St

- Earlier this week, Commonwealth Bank of Australia denied union claims that it cut Australian jobs in favor of outsourcing positions to its Indian subsidiary, following legal action initiated by the Finance Sector Union in the Fair Work Commission.

- This dispute brings renewed attention to CBA’s workforce management practices and the potential reputational and operational effects of employment-related controversies.

- With the bank under legal scrutiny for alleged outsourcing, we'll explore how these workforce concerns could influence its investment outlook.

Commonwealth Bank of Australia Investment Narrative Recap

To be a shareholder in Commonwealth Bank of Australia, you need to have confidence in its scale, focus on technology, and resilient customer base that have driven profits and sustained dividends. The recent legal dispute over alleged outsourcing does not appear material to the bank’s near-term earnings or core risk profile, which are more closely tied to competitive pressures on margins and ongoing investment in digital infrastructure.

Among recent updates, CBA’s extension of its share buyback plan until August 2025 underscores the bank’s efforts to return capital to shareholders. The buyback complements a series of dividend payments and reflects management’s continued focus on shareholder returns, even as market attention is drawn to regulatory and reputational issues like the current employment dispute. Investors should watch how these combined factors interact with the operational and margin risks ahead.

Yet against a backdrop of strong business lending and solid customer loyalty, workplace controversies remain a risk investors should keep in mind, especially as...

Read the full narrative on Commonwealth Bank of Australia (it's free!)

Commonwealth Bank of Australia is expected to reach A$31.3 billion in revenue and A$11.0 billion in earnings by 2028. This projection is based on a 5.4% annual revenue growth rate and an increase in earnings of A$1.2 billion from the current A$9.8 billion.

Exploring Other Perspectives

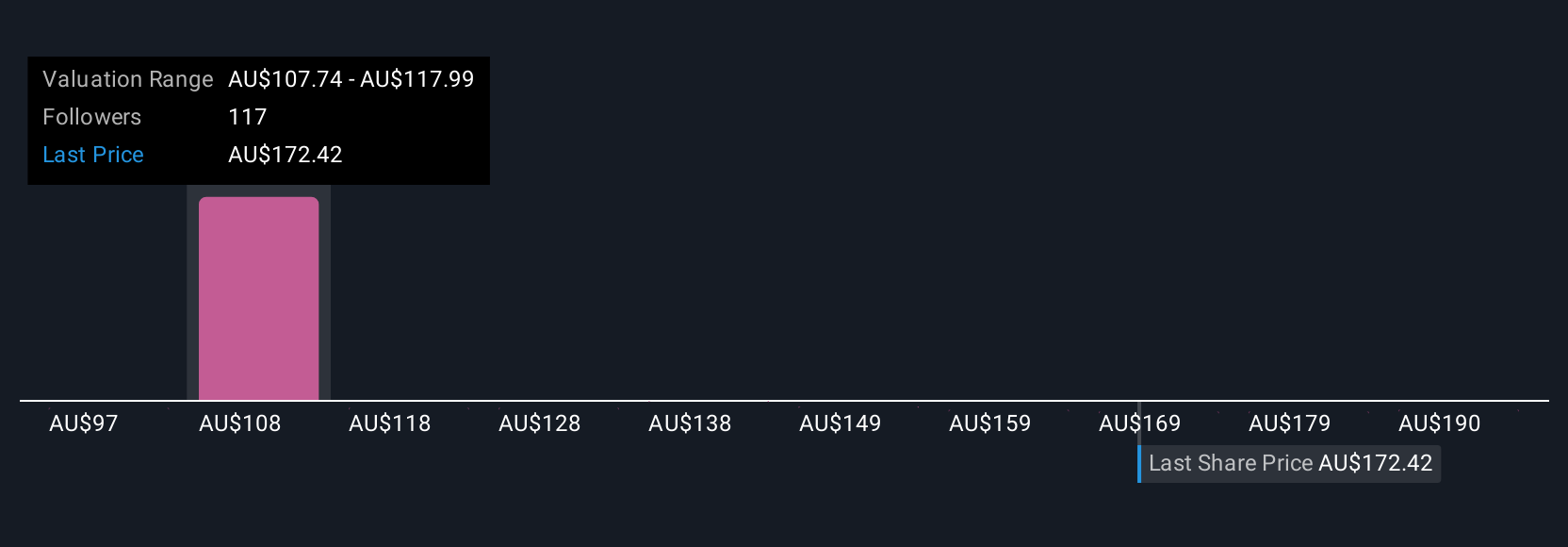

Fair value estimates from 18 Simply Wall St Community members range from A$93.33 to A$200 per share. Many are watching whether heightened tech and digital spending will bolster returns or weigh on short-term earnings, look for contrasting views and see how your outlook aligns.

Build Your Own Commonwealth Bank of Australia Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Commonwealth Bank of Australia research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Commonwealth Bank of Australia research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Commonwealth Bank of Australia's overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 25 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CBA

Commonwealth Bank of Australia

Provides retail and commercial banking services in Australia, New Zealand, and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives