Commonwealth Bank (ASX:CBA): Valuation in Focus Following AI Job Reversal and Surge in Home Loan Demand

Reviewed by Simply Wall St

If you’re keeping tabs on Commonwealth Bank of Australia (ASX:CBA), the last few weeks have delivered plenty to think about. The bank’s reversal of 45 job cuts, initially made after introducing an AI chatbot to its call centres, signals the challenges of balancing tech innovation with customer and staff needs. On top of this, CBA has rolled out fresh interest rate cuts for home loan customers. This move coincided with a surge in home loan pre-approvals, suggesting positive momentum in borrower sentiment.

All these changes arrive against a backdrop of solid performance this year. For context, CBA shares have climbed over 26% during the past 12 months. While the short-term share price has edged down in the past month, the bank’s longer-term return picture remains strong, with nearly doubled value over three years. Recent events such as the job reversal, dividend lift, and buyback extension are all contributing to heightened market attention. These factors raise fresh questions about the sustainability of growth and efficiency gains.

With this wave of news and share price momentum, investors may be considering whether there is a real buying opportunity, or if the market has already priced in the bank’s rebound and growth ambitions.

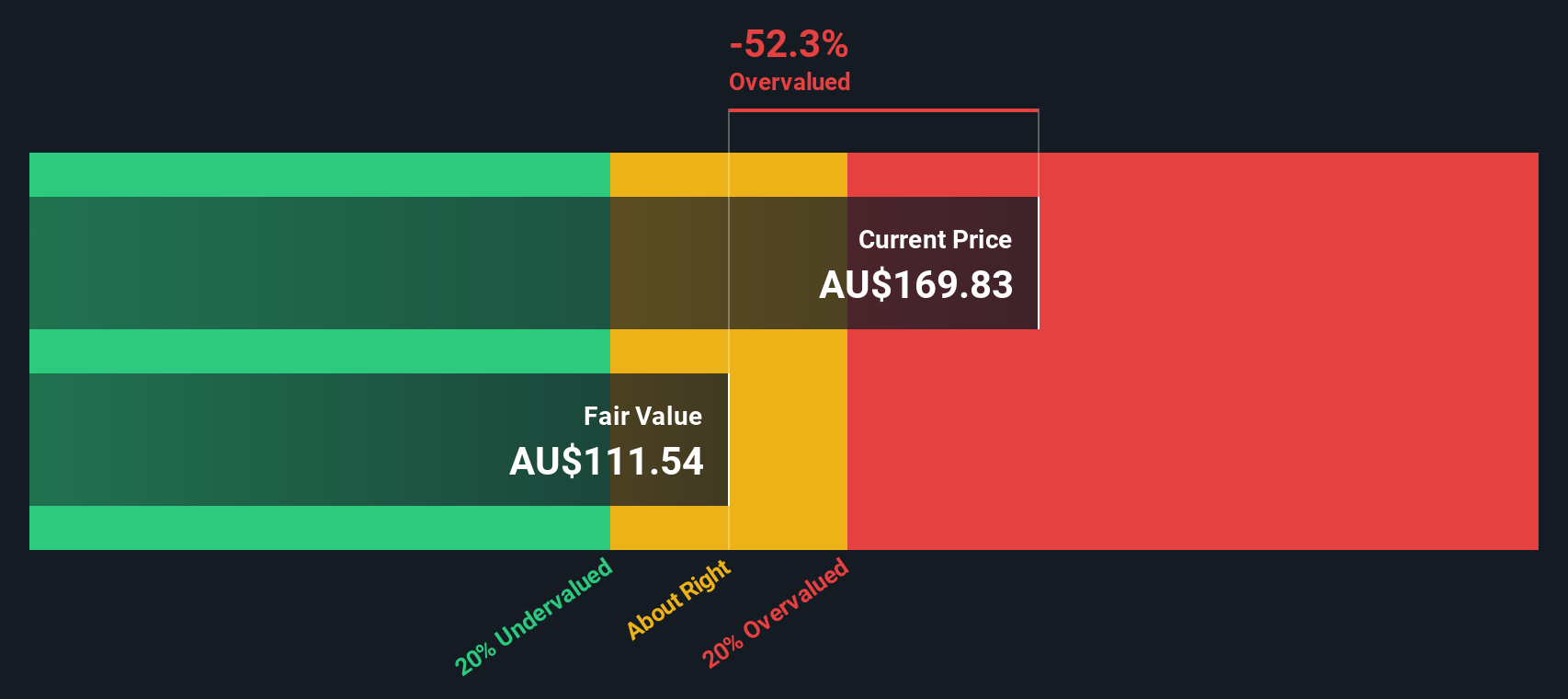

Most Popular Narrative: 45.8% Overvalued

According to community narrative, Commonwealth Bank of Australia appears heavily overvalued when measured against analyst expectations for future growth, margins, and earnings. The current consensus price target is well below recent share prices, indicating a disconnect between market optimism and analyst valuation models.

Analysts have a consensus price target of A$116.844 for Commonwealth Bank of Australia based on their expectations of its future earnings growth, profit margins, and other risk factors. There is some disagreement among analysts, with the most bullish reporting a price target of A$146.0 and the most bearish reporting a price target of just A$100.0.

What is fueling such a dramatic valuation gap? The community’s narrative points to ambitious growth expectations and a profit profile rarely seen in the banking sector. Which core assumptions drive this standout pricing call, and why do analysts think the risks may outweigh the rewards this time? Explore the figures behind the narrative's forecast and see which growth targets would need to be met for bullish investors to succeed.

Result: Fair Value of $116.84 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, stronger-than-expected productivity gains from CBA's digital investments, or continued growth in lending, could quickly alter this cautious valuation outlook.

Find out about the key risks to this Commonwealth Bank of Australia narrative.Another View: Discounted Cash Flow

For a different lens on value, our DCF model approaches things from projected future cash flows rather than analyst targets. It currently suggests the shares are not cheap either. How does this change your take?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Commonwealth Bank of Australia Narrative

If you’re inclined to challenge these perspectives or want to investigate the figures first-hand, you can build your own view in just a few minutes, or simply do it your way.

A great starting point for your Commonwealth Bank of Australia research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Take your investing journey further and unlock fresh opportunities tailored to your interests. Don’t miss your chance to strengthen your portfolio and boost your financial confidence. Explore these handpicked themes, each designed to help you spot standout stocks before the crowd:

- Maximize your income by targeting leading companies boasting dividend stocks with yields > 3% that can add steady cash flow to your portfolio.

- Tap into the AI boom by seeking out innovative businesses behind AI penny stocks that are transforming industries at a rapid pace.

- Get ahead of the curve by finding cryptocurrency and blockchain stocks set to benefit from advancements in digital finance and blockchain technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CBA

Commonwealth Bank of Australia

Provides retail and commercial banking services in Australia, New Zealand, and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives