3 Top Undervalued Small Caps In Australia With Insider Buying

Reviewed by Simply Wall St

Over the last 7 days, the Australian market has dropped 1.3%, although it is up 11% over the past year with earnings forecast to grow by 12% annually. In this context, identifying undervalued small-cap stocks with insider buying can present unique opportunities for investors seeking to capitalize on potential growth within a fluctuating market.

Top 10 Undervalued Small Caps With Insider Buying In Australia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Magellan Financial Group | 6.7x | 4.2x | 45.87% | ★★★★★☆ |

| Corporate Travel Management | 19.1x | 2.3x | 11.29% | ★★★★★☆ |

| Beach Energy | NA | 1.4x | 40.51% | ★★★★★☆ |

| Lycopodium | 9.1x | 1.3x | 27.10% | ★★★★☆☆ |

| GWA Group | 15.9x | 1.5x | 43.99% | ★★★★☆☆ |

| Credit Corp Group | 19.9x | 2.7x | 43.51% | ★★★★☆☆ |

| Domino's Pizza Enterprises | 28.6x | 1.1x | 29.44% | ★★★☆☆☆ |

| Dicker Data | 20.7x | 0.7x | -69.32% | ★★★☆☆☆ |

| BSP Financial Group | 7.7x | 2.7x | 3.79% | ★★★☆☆☆ |

| Abacus Group | NA | 5.9x | 26.73% | ★★★☆☆☆ |

We're going to check out a few of the best picks from our screener tool.

BSP Financial Group (ASX:BFL)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: BSP Financial Group operates as a banking and financial services provider in Papua New Guinea and the Pacific, with a market cap of PGK 10.45 billion.

Operations: BSP Financial Group generates revenue primarily from its PNG Bank, Pacific Markets, and Non-Bank Entities segments. The company reported a net income margin of 44.08% as of June 30, 2023.

PE: 7.7x

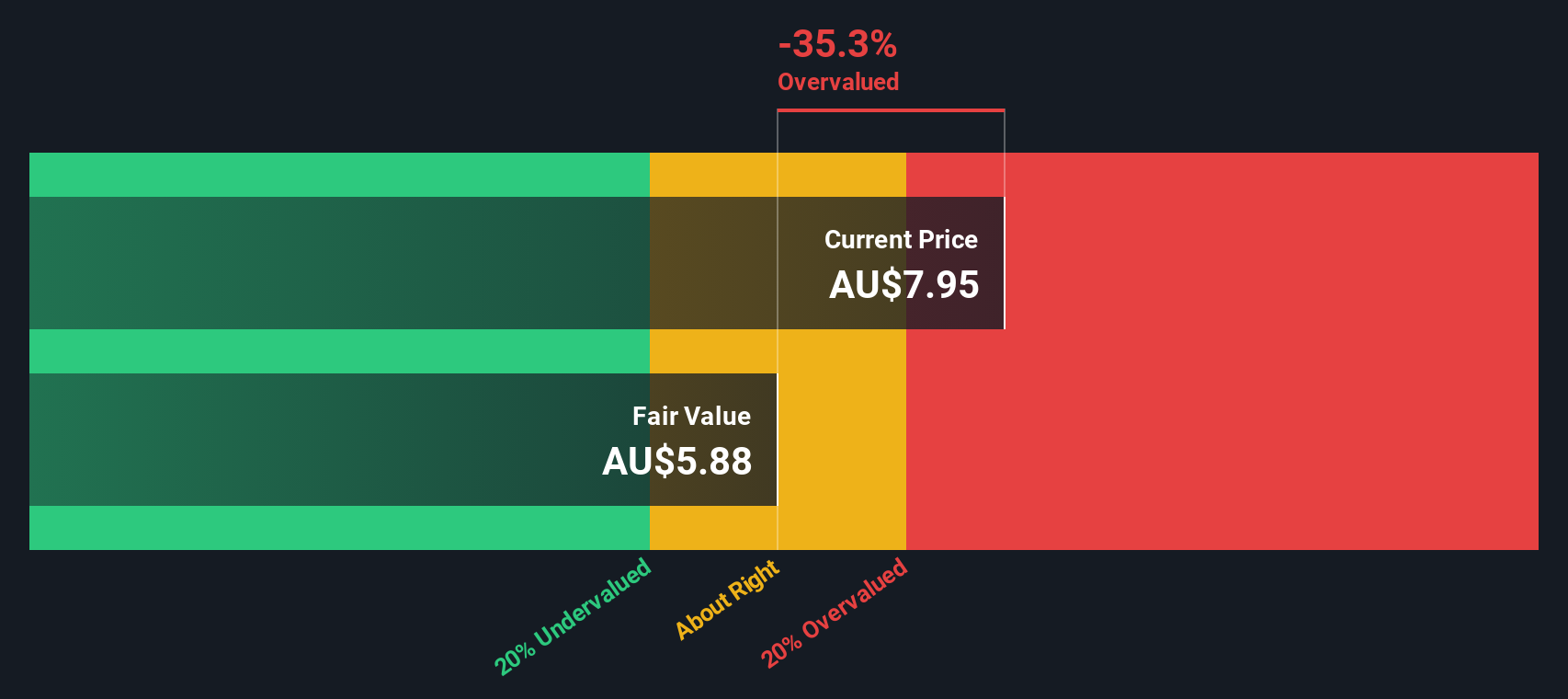

BSP Financial Group, a smaller player in the Australian market, reported strong earnings for H1 2024 with net interest income rising to PGK 981.86 million from PGK 900.52 million last year and net income reaching PGK 520.46 million up from PGK 427.17 million. The company announced an interim dividend of PGK 0.45 per share, payable on September 20, reflecting solid financial health despite a higher level of non-performing loans at around 4%. Recent insider confidence is evident with significant share purchases by executives throughout August, signaling potential growth prospects amidst ongoing executive reshuffles and strategic appointments within the management team.

- Get an in-depth perspective on BSP Financial Group's performance by reading our valuation report here.

Understand BSP Financial Group's track record by examining our Past report.

Ingenia Communities Group (ASX:INA)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ingenia Communities Group is an Australian company specializing in the development and management of lifestyle and holiday communities, with a market cap of A$1.89 billion.

Operations: Ingenia Communities Group generates revenue primarily from its Tourism - Ingenia Holidays and Residential - Lifestyle Development segments, contributing A$134.84 million and A$205.81 million respectively. The company has seen fluctuations in its net income margin, with a recent low of 3.01% as of June 2024. Operating expenses have increased to A$165.03 million for the same period, impacting profitability despite a gross profit margin of 61.56%.

PE: 152.3x

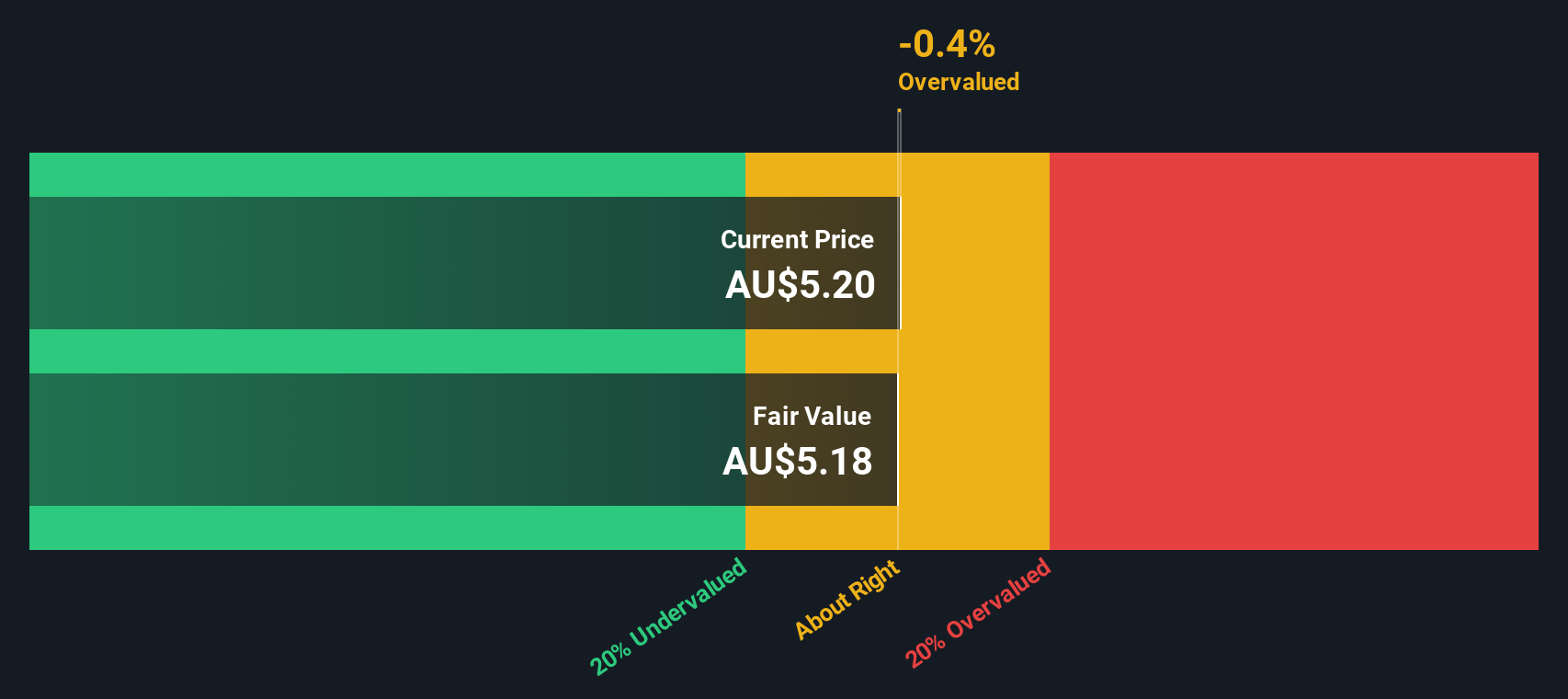

Ingenia Communities Group, a small cap in Australia, has seen insider confidence with recent share purchases by executives. Despite a challenging year with net income dropping to A$14 million from A$64.37 million, revenue increased to A$472.29 million from A$394.47 million the previous year. The company announced a dividend increase to A$.061 per share for the six months ended June 30, 2024. Recent board changes include John Carfi’s appointment as Managing Director and CEO on April 1, 2024.

- Navigate through the intricacies of Ingenia Communities Group with our comprehensive valuation report here.

Gain insights into Ingenia Communities Group's past trends and performance with our Past report.

Navigator Global Investments (ASX:NGI)

Simply Wall St Value Rating: ★★★★★★

Overview: Navigator Global Investments is an asset management firm primarily operating through its Lighthouse investment segment, with a market cap of approximately A$0.35 billion.

Operations: Navigator Global Investments generates revenue primarily through its Lighthouse segment, amounting to $95.93 million. The company’s net profit margin has shown significant variability, peaking at 2.11% in December 2014 and reaching a low of -22.67% in December 2017. Operating expenses and non-operating expenses have major impacts on the net income, with notable fluctuations over the periods observed.

PE: 8.5x

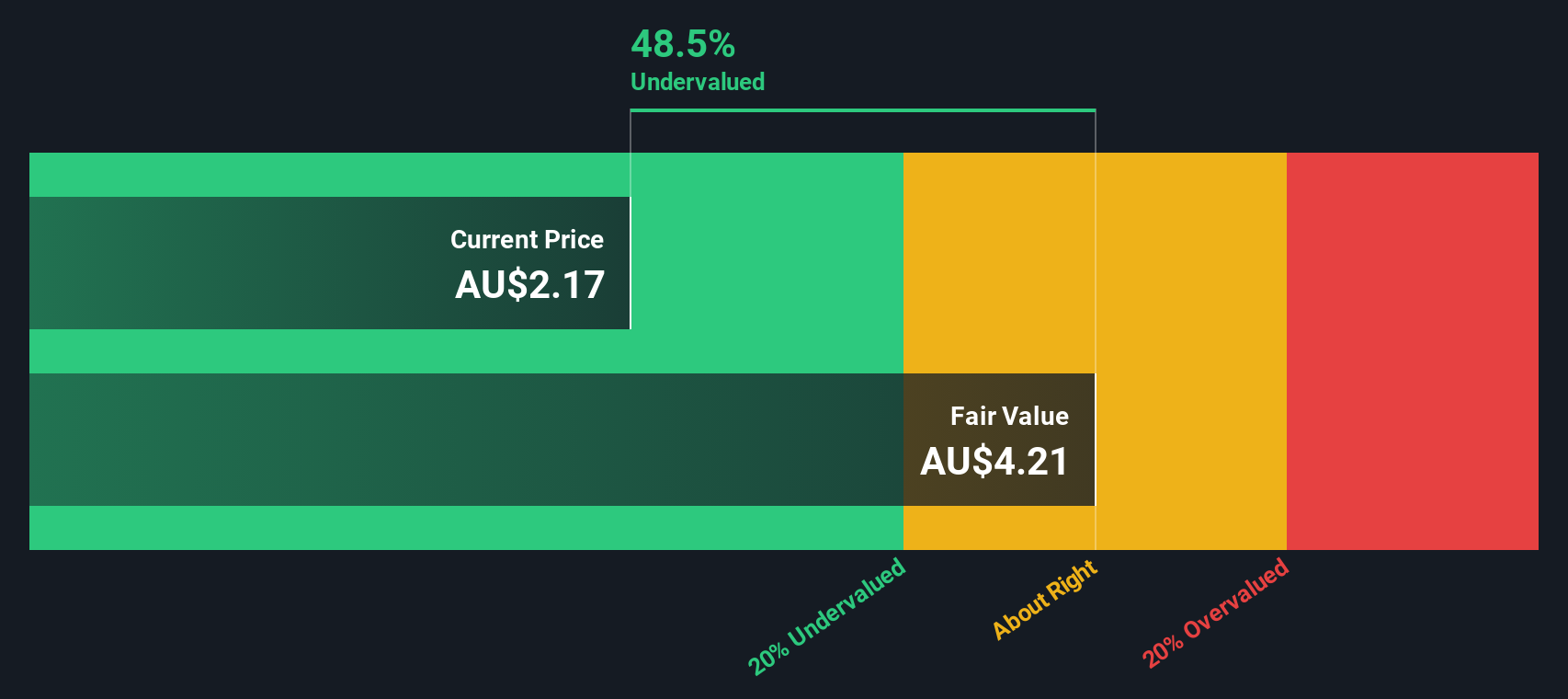

Navigator Global Investments, a small cap in Australia, reported significant growth with revenue increasing to US$276.28 million for the year ending June 30, 2024, up from US$184.9 million the previous year. Net income also rose to US$66.31 million from US$35.51 million. Despite having higher-risk funding sources and substantial shareholder dilution over the past year, insider confidence is evident through recent share purchases by executives within the last quarter of 2024.

Make It Happen

- Reveal the 30 hidden gems among our Undervalued ASX Small Caps With Insider Buying screener with a single click here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BSP Financial Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:BFL

BSP Financial Group

Provides commercial banking and finance services to individual and corporate customers in Papua New Guinea, the Solomon Islands, Fiji, the Cook Islands, Samoa, Tonga, Vanuatu, Cambodia, and Laos.

Excellent balance sheet with acceptable track record.