The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like EVN (VIE:EVN). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide EVN with the means to add long-term value to shareholders.

Our analysis indicates that EVN is potentially undervalued!

EVN's Earnings Per Share Are Growing

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. It certainly is nice to see that EVN has managed to grow EPS by 30% per year over three years. If growth like this continues on into the future, then shareholders will have plenty to smile about.

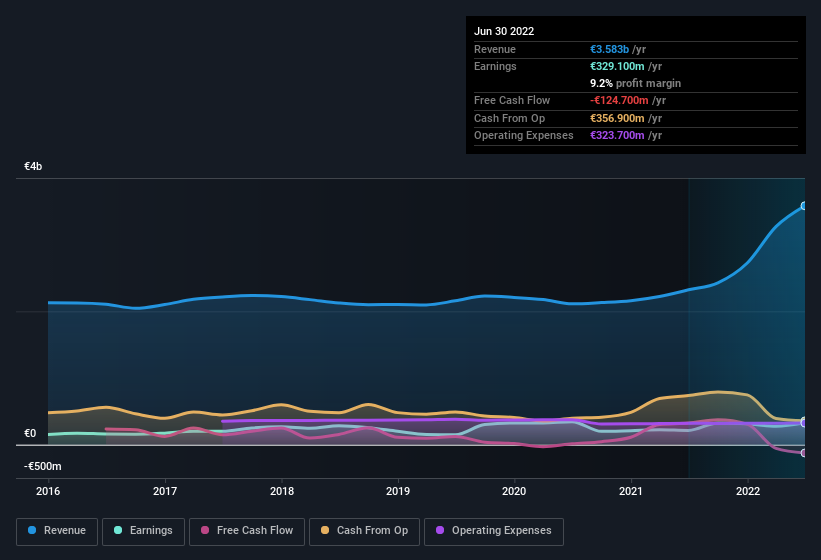

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. On the one hand, EVN's EBIT margins fell over the last year, but on the other hand, revenue grew. If EBIT margins are able to stay balanced and this revenue growth continues, then we should see brighter days ahead.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check EVN's balance sheet strength, before getting too excited.

Are EVN Insiders Aligned With All Shareholders?

It's a good habit to check into a company's remuneration policies to ensure that the CEO and management team aren't putting their own interests before that of the shareholder with excessive salary packages. The median total compensation for CEOs of companies similar in size to EVN, with market caps between €1.9b and €6.1b, is around €2.2m.

The EVN CEO received total compensation of just €633k in the year to September 2021. That looks like a modest pay packet, and may hint at a certain respect for the interests of shareholders. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Does EVN Deserve A Spot On Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into EVN's strong EPS growth. With swiftly growing earnings, the best days may still be to come, and the modest CEO pay suggests the company is careful with cash. We think that based on its merits alone, this stock is worth watching into the future. You should always think about risks though. Case in point, we've spotted 1 warning sign for EVN you should be aware of.

Although EVN certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if EVN might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WBAG:EVN

EVN

Provides energy and environmental services in Austria, Bulgaria, North Macedonia, Croatia, Germany, and Albania.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives