As we enter January 2025, global markets are marked by volatility, with U.S. equities experiencing declines amid inflation concerns and political uncertainty. Despite these challenges, value stocks have shown resilience compared to their growth counterparts, highlighting the importance of identifying stocks that may be undervalued in such turbulent times. Recognizing undervalued stocks requires a keen eye for those trading below their intrinsic value, making them potential opportunities for investors looking to navigate the current economic landscape effectively.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Ningbo Sanxing Medical ElectricLtd (SHSE:601567) | CN¥27.91 | CN¥55.63 | 49.8% |

| Alltop Technology (TPEX:3526) | NT$265.50 | NT$529.34 | 49.8% |

| Türkiye Sise Ve Cam Fabrikalari (IBSE:SISE) | TRY39.24 | TRY78.32 | 49.9% |

| FINDEX (TSE:3649) | ¥920.00 | ¥1836.04 | 49.9% |

| Solum (KOSE:A248070) | ₩18740.00 | ₩37472.86 | 50% |

| Pluk Phak Praw Rak Mae (SET:OKJ) | THB15.50 | THB30.86 | 49.8% |

| Mobvista (SEHK:1860) | HK$8.05 | HK$16.09 | 50% |

| Zhende Medical (SHSE:603301) | CN¥20.94 | CN¥41.80 | 49.9% |

| Shinko Electric Industries (TSE:6967) | ¥5870.00 | ¥11691.00 | 49.8% |

| Mobileye Global (NasdaqGS:MBLY) | US$16.51 | US$32.92 | 49.9% |

We're going to check out a few of the best picks from our screener tool.

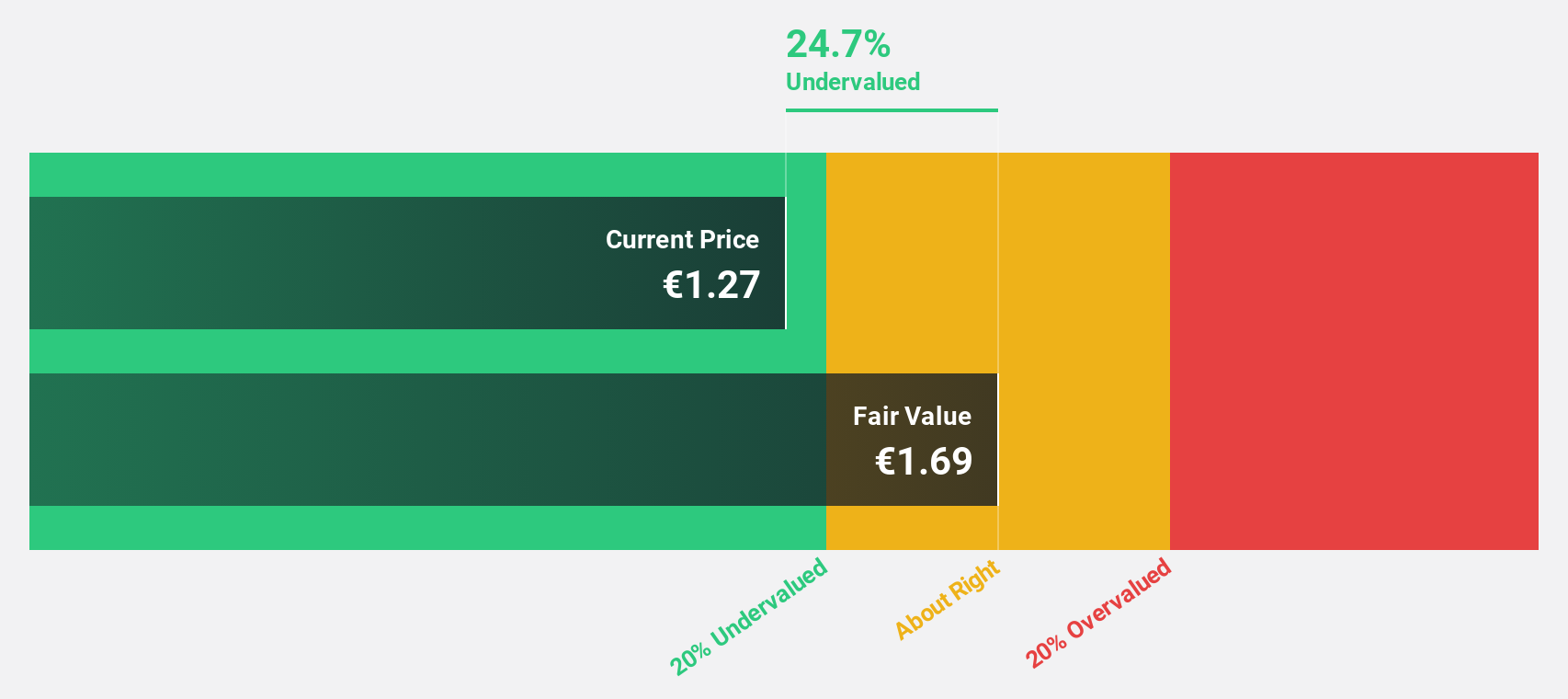

Línea Directa Aseguradora Compañía de Seguros y Reaseguros (BME:LDA)

Overview: Línea Directa Aseguradora, S.A., Compañía de Seguros y Reaseguros operates in the insurance and reinsurance sectors in Spain and Portugal, with a market cap of approximately €1.15 billion.

Operations: The company's revenue segments include €841.53 million from cars, €152.27 million from home insurance, and €21.27 million from health insurance.

Estimated Discount To Fair Value: 30.7%

Línea Directa Aseguradora appears undervalued, trading 30.7% below its estimated fair value of €1.52, with a current price of €1.06. Despite slower revenue growth forecasts at 0.4%, earnings are expected to grow significantly at 20.81% annually, outpacing the Spanish market's 8.3%. Recent profitability improvements and a third-quarter net income of €15.33 million highlight positive cash flow trends, though dividend sustainability remains a concern due to insufficient free cash flow coverage.

- Our comprehensive growth report raises the possibility that Línea Directa Aseguradora Compañía de Seguros y Reaseguros is poised for substantial financial growth.

- Navigate through the intricacies of Línea Directa Aseguradora Compañía de Seguros y Reaseguros with our comprehensive financial health report here.

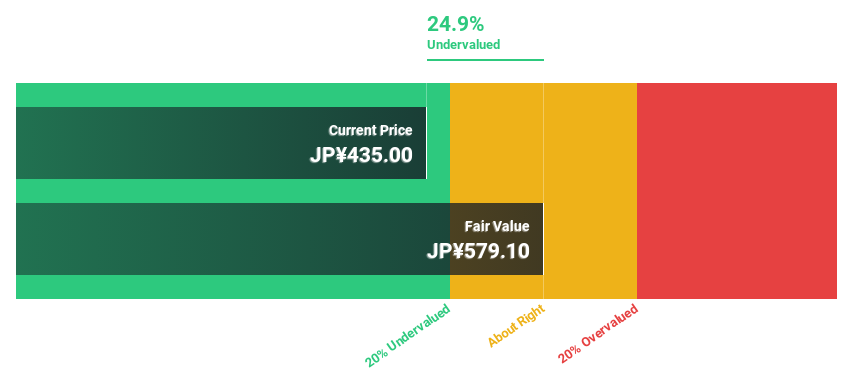

North Pacific BankLtd (TSE:8524)

Overview: North Pacific Bank, Ltd. offers a range of banking products and services to individuals and corporations in Japan, with a market cap of ¥171.84 billion.

Operations: The company generates revenue through its banking operations amounting to ¥112.17 billion and leasing business contributing ¥23.99 billion.

Estimated Discount To Fair Value: 20.3%

North Pacific Bank, Ltd. trades at ¥453, 20.3% below its fair value of ¥568.6, indicating potential undervaluation based on cash flows. Earnings are projected to grow significantly by 23.8% annually, surpassing the JP market's growth rate of 8%. Despite a low bad loan allowance and an unstable dividend history, recent dividend increases to JPY 6.50 per share reflect improved financial health and positive revenue growth forecasts at 12.2% annually against the market's 4.3%.

- The analysis detailed in our North Pacific BankLtd growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of North Pacific BankLtd stock in this financial health report.

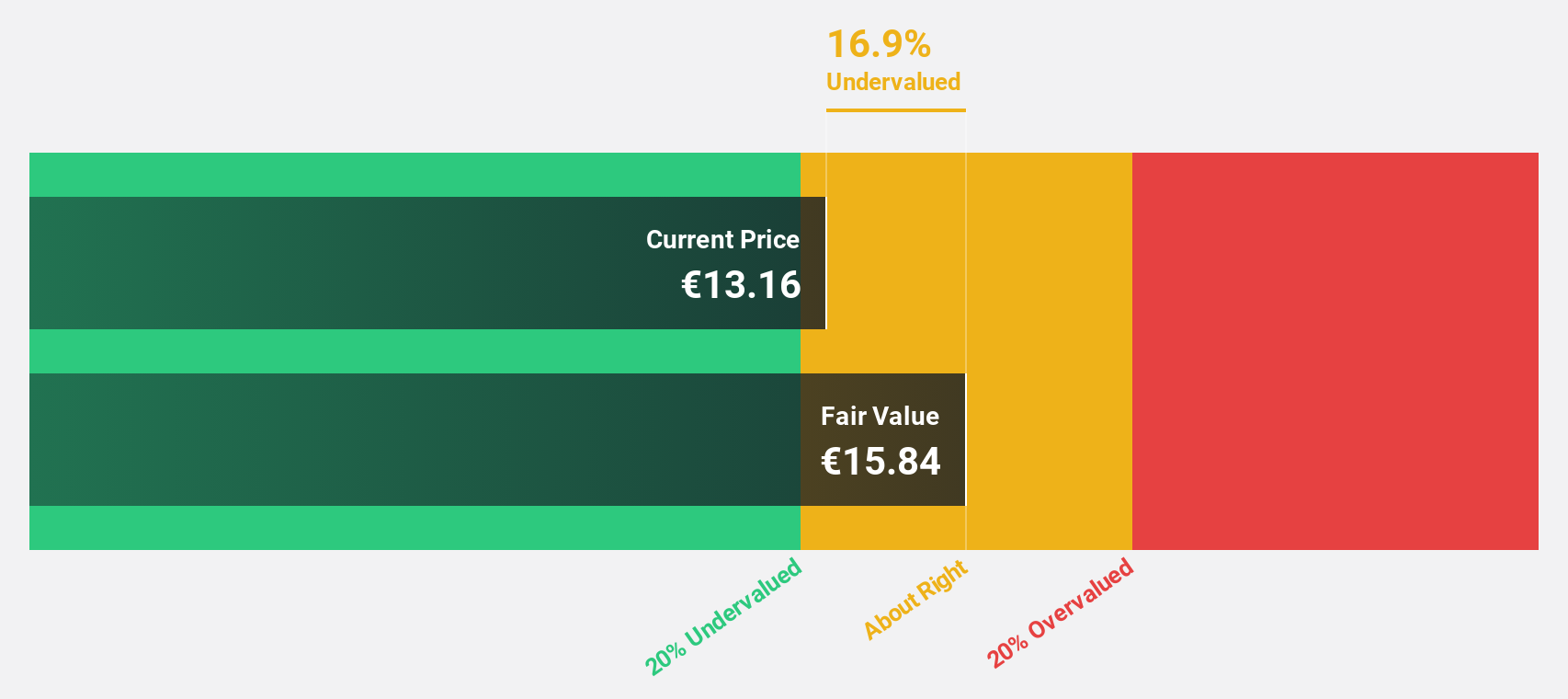

Semperit Holding (WBAG:SEM)

Overview: Semperit Aktiengesellschaft Holding is a company that develops, produces, and sells rubber products for the medical and industrial sectors globally, with a market cap of €284.32 million.

Operations: The company's revenue segments include €34.32 million from Surgical Operations, €380.82 million from Semperit Engineered Applications, and €288.16 million from Semperit Industrial Applications.

Estimated Discount To Fair Value: 49.3%

Semperit Holding trades at €13.82, significantly undervalued compared to its estimated fair value of €27.26, based on discounted cash flow analysis. Earnings are forecasted to grow substantially by 34.7% annually, outpacing the Austrian market's 9.1%. Despite recent profit margin declines and a dividend not fully covered by free cash flows, Semperit has transitioned from a net loss to a net income of €7.14 million over nine months in 2024, showing improved financial performance.

- Upon reviewing our latest growth report, Semperit Holding's projected financial performance appears quite optimistic.

- Click here to discover the nuances of Semperit Holding with our detailed financial health report.

Key Takeaways

- Take a closer look at our Undervalued Stocks Based On Cash Flows list of 867 companies by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WBAG:SEM

Semperit Holding

Develops, produces, and sells rubber products for the medical and industrial sectors worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives