Raiffeisen Bank International (WBAG:RBI): Revisiting Valuation in Light of Austria’s Sanctions Delay and Russia Privatization Moves

Reviewed by Kshitija Bhandaru

Austria’s decision to delay new EU sanctions on Russia, partly to help Raiffeisen Bank International (WBAG:RBI) recover frozen assets, comes at a time when Russia is increasing efforts to privatize foreign holdings within its borders.

See our latest analysis for Raiffeisen Bank International.

While political headlines have dominated the conversation around Raiffeisen Bank International, investors have been steadily bidding up the shares. The stock’s impressive 55.1% year-to-date price return reflects renewed confidence, and the 70.2% total return over twelve months shows momentum is firmly on the upswing despite heightened uncertainty from recent Russian and EU developments.

If you’re following how geopolitics impact financials, now is a great time to discover fast growing stocks with high insider ownership

With momentum picking up but political clouds remaining, the key question now is whether Raiffeisen Bank International’s shares are still undervalued relative to risk and earnings, or if the market has already priced in the next phase of growth.

Most Popular Narrative: 10.3% Overvalued

With Raiffeisen Bank International’s latest close at €29.64 and the most widely followed narrative fair value at €26.88, current pricing stands in premium territory. This sets up a key debate around how long robust earnings momentum can offset analyst caution about the coming years.

Continued investment in digital transformation and operational efficiency is demonstrating progress, with a focus on improving cost-to-income ratios and reducing staff expenses relative to revenues. This is expected to support margin expansion and increased profitability.

What if the real story behind this valuation is the belief that higher profit margins may soon outshine declining top-line growth? Dig into the narrative and see for yourself which assumptions are tipping the scales.

Result: Fair Value of €26.88 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing legal disputes in Poland and persistent exposure to Russian operations remain key risks. These factors could quickly undermine analyst optimism.

Find out about the key risks to this Raiffeisen Bank International narrative.

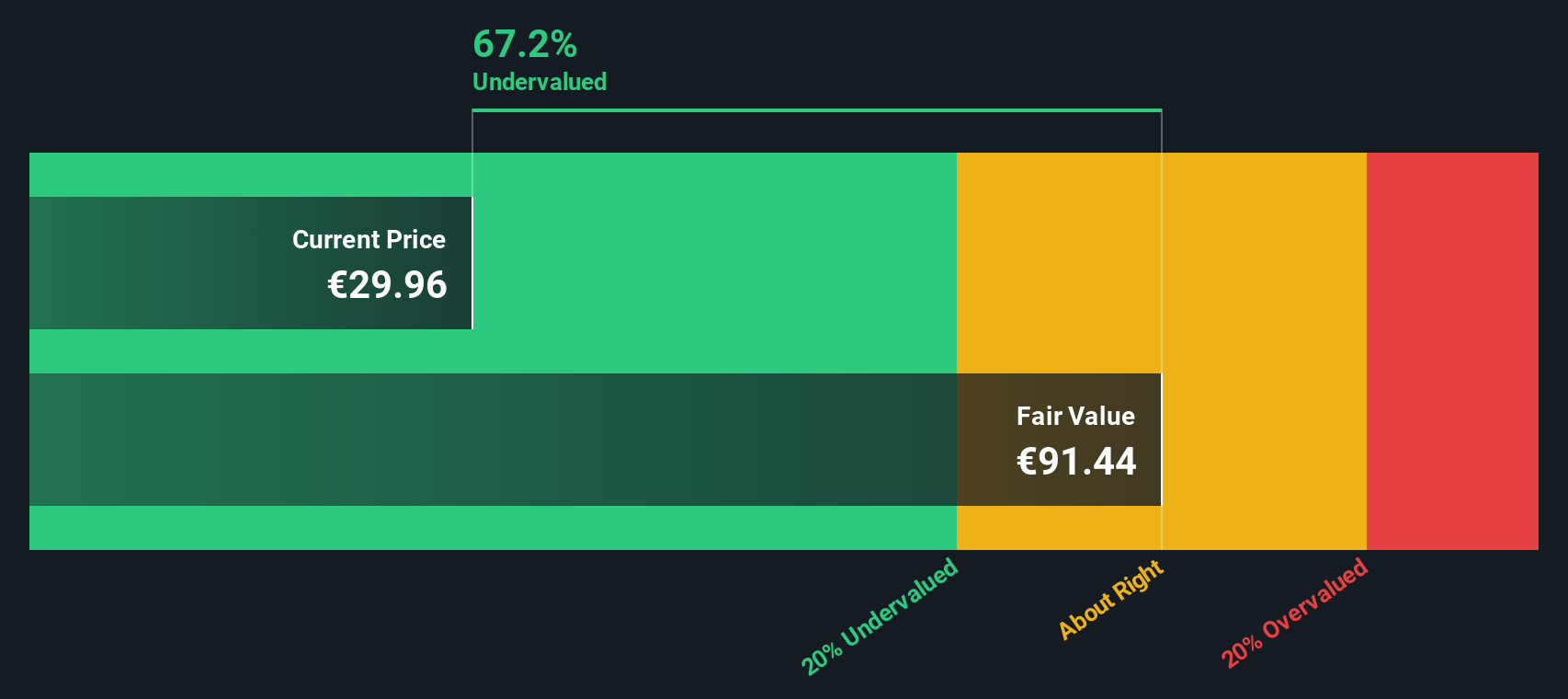

Another View: SWS DCF Model Points to Undervaluation

While the analyst consensus suggests Raiffeisen Bank International is overvalued based on current pricing, our DCF model tells a very different story. It estimates fair value at €91.36, which suggests the stock is actually trading well below its intrinsic worth. Does this wide gap signal hidden upside, or is it a sign of market caution?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Raiffeisen Bank International for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Raiffeisen Bank International Narrative

If the analyst and model perspectives do not match your outlook, you can dive into the numbers and craft your own story in just a few minutes with Do it your way.

A great starting point for your Raiffeisen Bank International research is our analysis highlighting 2 key rewards and 6 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Tapping into the right opportunities now can put you ahead of the pack. See what else might spark your next move using these smart stock screeners:

- Uncover penny stocks with robust financials by starting your search with these 3574 penny stocks with strong financials and spot companies making waves on strong fundamentals.

- Find higher income potential today by zeroing in on these 18 dividend stocks with yields > 3% offering yields above 3% for consistent returns beyond price appreciation.

- Catch the momentum in digital innovation. Check out these 78 cryptocurrency and blockchain stocks to see which businesses are breaking ground with blockchain and cryptocurrency technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WBAG:RBI

Raiffeisen Bank International

Offers banking services to corporate, private, and institutional customers.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives