- United Arab Emirates

- /

- Real Estate

- /

- DFM:EMAAR

3 Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

In a week marked by rate cuts from the ECB and SNB, global markets saw mixed performances, with the Nasdaq Composite reaching new heights while other major indexes generally declined. As investors brace for a potential Federal Reserve rate cut amidst softening labor markets and inflationary pressures, dividend stocks can offer stability and income in uncertain times. A strong dividend stock typically combines reliable payouts with solid fundamentals, making it an attractive option for those looking to enhance their portfolios amid fluctuating market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.62% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.23% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.72% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.19% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.35% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.01% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.60% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.36% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.85% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.67% | ★★★★★★ |

Click here to see the full list of 1937 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

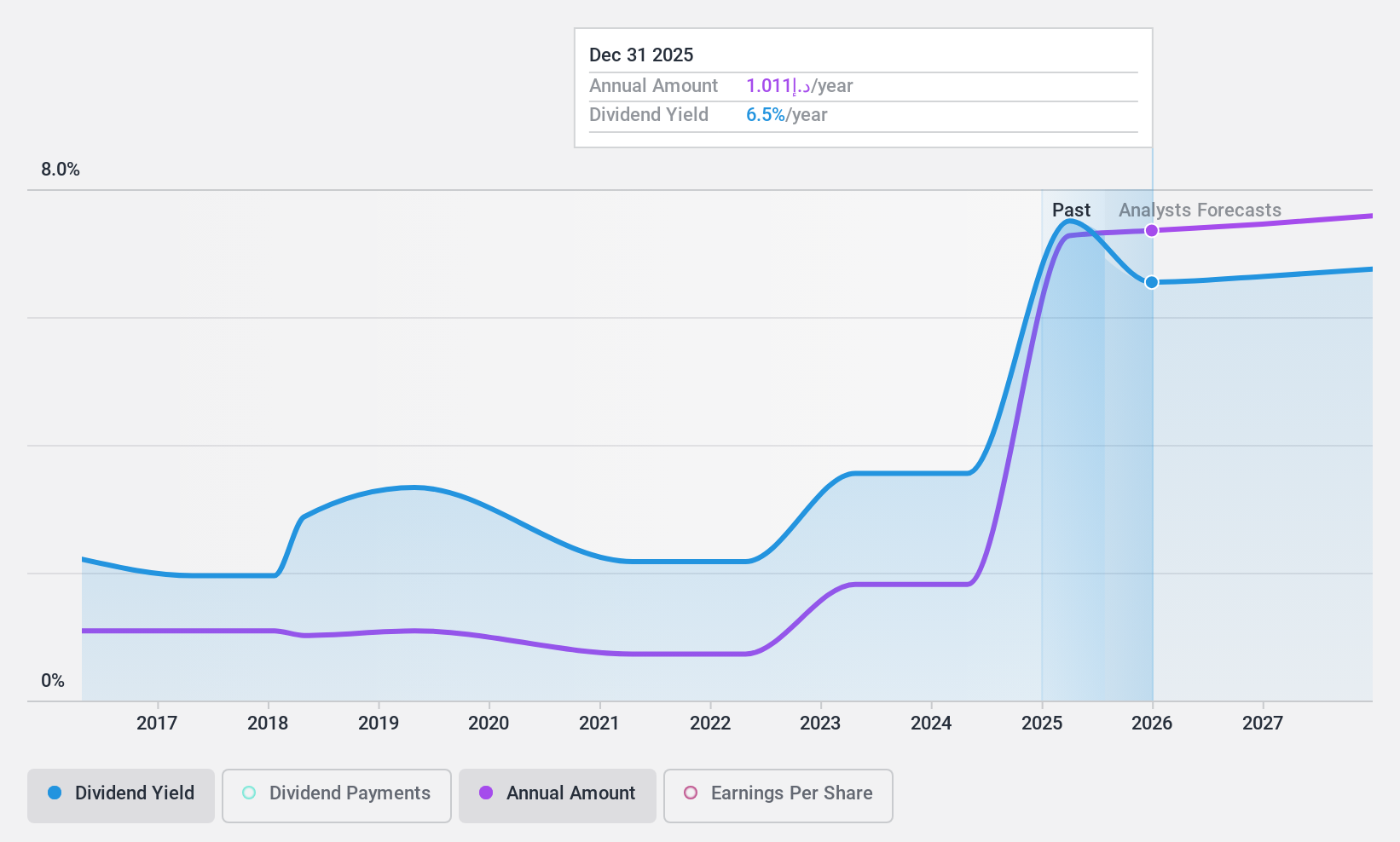

Emaar Properties PJSC (DFM:EMAAR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Emaar Properties PJSC, along with its subsidiaries, operates in property investment, development, and management both within the United Arab Emirates and internationally, with a market cap of AED84.76 billion.

Operations: Emaar Properties PJSC generates revenue from its segments in Real Estate (AED23.24 billion), Leasing, Retail and Related Activities (AED6.98 billion), and Hospitality (AED1.96 billion).

Dividend Yield: 4.5%

Emaar Properties PJSC's dividend yield of 4.55% is below the top quartile in the AE market, yet its dividends are well-covered by earnings and cash flows, with payout ratios of 37.2% and 21.7%, respectively. Despite trading at a significant discount to estimated fair value, Emaar's dividend history has been volatile over the past decade, though it has shown growth in recent years. Recent earnings report shows strong revenue growth to AED 23.79 billion for nine months ending September 2024.

- Click to explore a detailed breakdown of our findings in Emaar Properties PJSC's dividend report.

- Our expertly prepared valuation report Emaar Properties PJSC implies its share price may be lower than expected.

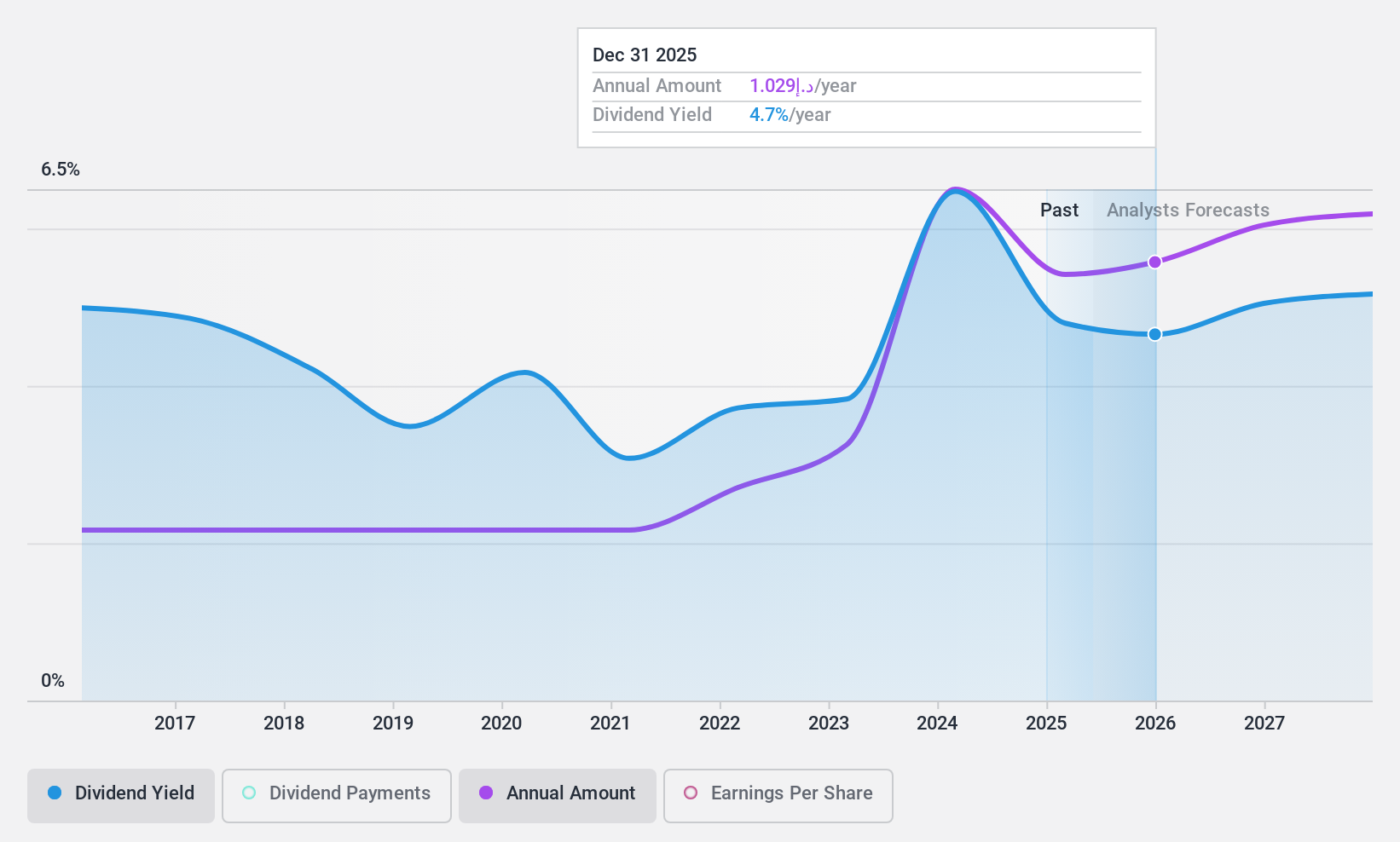

Emirates NBD Bank PJSC (DFM:EMIRATESNBD)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Emirates NBD Bank PJSC, along with its subsidiaries, offers a range of corporate, institutional, retail, treasury, and Islamic banking services and has a market cap of AED125.07 billion.

Operations: Emirates NBD Bank PJSC generates revenue through its diverse offerings in corporate, institutional, retail, treasury, and Islamic banking services.

Dividend Yield: 5.6%

Emirates NBD Bank PJSC offers a stable dividend with a yield of 5.56%, though it is lower than the top quartile in the AE market. The bank's dividends are well-covered by earnings, with current and forecast payout ratios at 33.7% and 42.1%, respectively, ensuring sustainability despite high non-performing loans at 3.9%. Recent financials show steady net income growth to AED 18.99 billion for the first nine months of 2024, supporting its reliable dividend history over the past decade.

- Navigate through the intricacies of Emirates NBD Bank PJSC with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, Emirates NBD Bank PJSC's share price might be too pessimistic.

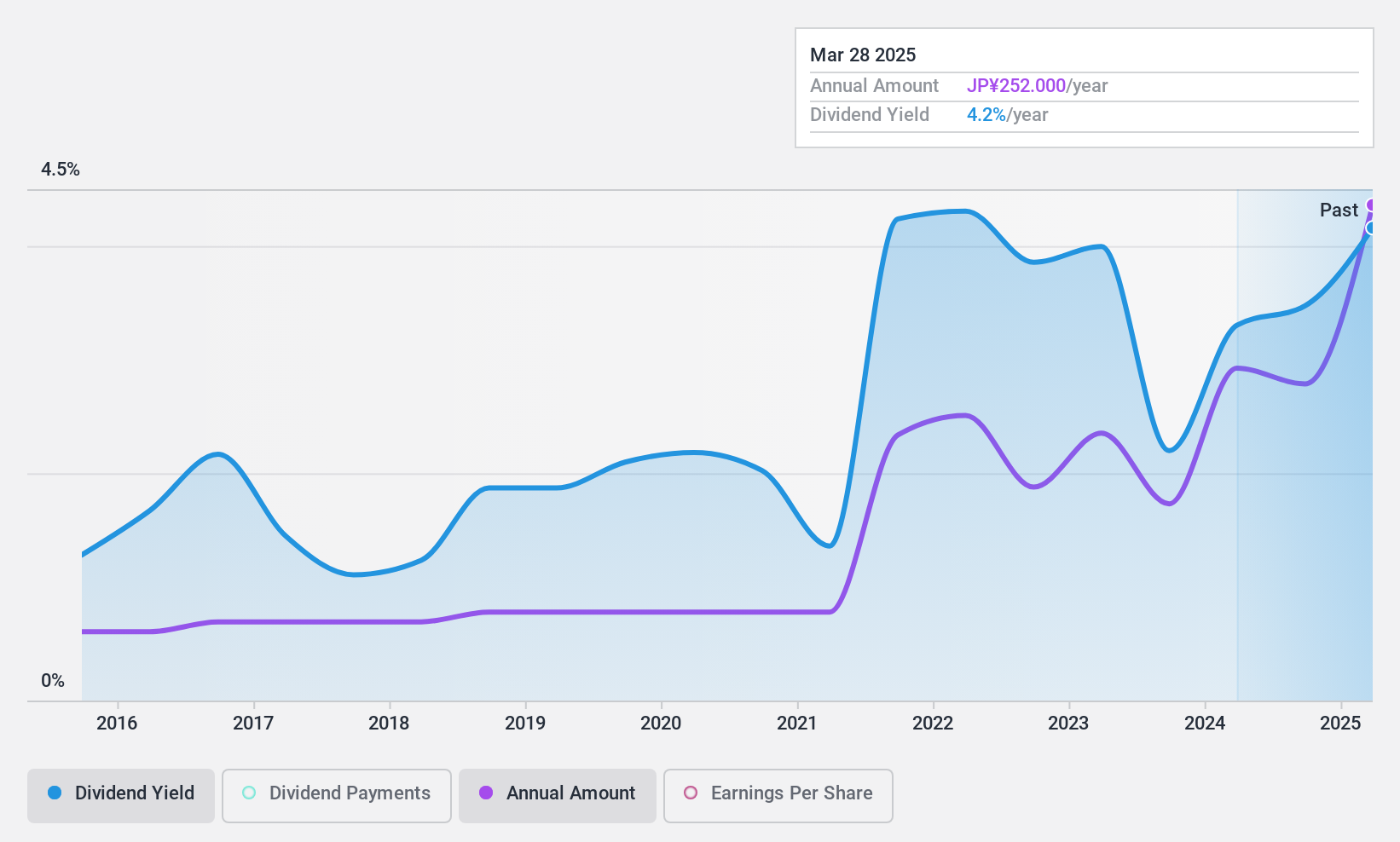

Nittetsu Mining (TSE:1515)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nittetsu Mining Co., Ltd. engages in mining activities both in Japan and internationally, with a market cap of ¥69.29 billion.

Operations: Nittetsu Mining Co., Ltd. generates revenue from various segments, including Ore (¥62.59 billion), Metal (¥99.64 billion), Immovable Properties (¥2.88 billion), Machinery and Environment (¥14.91 billion), and Renewable Resource Energy (¥1.77 billion).

Dividend Yield: 4.2%

Nittetsu Mining's dividend yield of 4.22% is among the top 25% in Japan, though its payments have been volatile over the past decade. Despite a low payout ratio of 37.9%, dividends are not covered by free cash flows, raising sustainability concerns. Recent guidance revisions indicate improved earnings expectations due to higher metallic mineral revenues and lower operational costs. The company increased its dividend forecast for fiscal year-end March 2025, targeting a consolidated payout ratio of 40%.

- Unlock comprehensive insights into our analysis of Nittetsu Mining stock in this dividend report.

- The valuation report we've compiled suggests that Nittetsu Mining's current price could be inflated.

Make It Happen

- Explore the 1937 names from our Top Dividend Stocks screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Emaar Properties PJSC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DFM:EMAAR

Emaar Properties PJSC

Engages in the property investment, development, and development management business in the United Arab Emirates and internationally.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives