- Saudi Arabia

- /

- Machinery

- /

- SASE:4147

Middle East's Undiscovered Gems To Explore In December 2025

Reviewed by Simply Wall St

As Gulf markets mostly gain ahead of the Federal Reserve's anticipated interest rate cut, investor sentiment in the Middle East is buoyant, with regional indices showing positive momentum despite challenges such as fluctuating oil prices. In this environment, identifying stocks with robust fundamentals and growth potential becomes crucial for investors looking to capitalize on emerging opportunities in the region.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Qassim Cement | NA | 4.02% | -11.40% | ★★★★★★ |

| Baazeem Trading | 10.02% | -1.27% | -1.66% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Terminal X Online | 12.94% | 13.43% | 44.27% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.26% | 17.17% | 23.30% | ★★★★★★ |

| Najran Cement | 14.49% | -4.20% | -30.16% | ★★★★★★ |

| Gür-Sel Turizm Tasimacilik ve Servis Ticaret | 4.69% | 36.04% | 53.41% | ★★★★★☆ |

| Etihad GO Telecom | 0.85% | 38.36% | 57.78% | ★★★★★☆ |

Let's uncover some gems from our specialized screener.

Bank Of Sharjah P.J.S.C (ADX:BOS)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Bank Of Sharjah P.J.S.C. operates as a provider of commercial and investment banking products and services in the United Arab Emirates, with a market capitalization of AED3.87 billion.

Operations: The company's revenue streams include AED450.68 million from commercial banking and AED326.19 million from investment and treasury activities.

Bank of Sharjah, with total assets of AED49.6 billion and equity at AED4.3 billion, stands out due to its substantial earnings growth of 262.7% over the past year, far surpassing the industry average of 15%. However, it grapples with a high bad loans ratio at 6.6%, coupled with a low allowance for these bad loans at 85%. Despite this challenge, the bank's price-to-earnings ratio is an attractive 7.4x compared to the AE market's 11.7x, indicating potential value for investors seeking opportunities in smaller financial entities within the Middle East region.

- Take a closer look at Bank Of Sharjah P.J.S.C's potential here in our health report.

Evaluate Bank Of Sharjah P.J.S.C's historical performance by accessing our past performance report.

Ajman Bank PJSC (DFM:AJMANBANK)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Ajman Bank PJSC offers a range of banking products and services to individuals, businesses, and government institutions in the United Arab Emirates, with a market capitalization of approximately AED3.90 billion.

Operations: Ajman Bank generates revenue primarily from its Wholesale Banking and Consumer Banking segments, contributing AED447.74 million and AED279.19 million respectively. The Treasury segment adds an additional AED184.52 million to the bank's revenue streams.

Ajman Bank, a compact financial player in the Middle East, has shown resilience by becoming profitable this year with high-quality earnings. Total assets are AED28 billion, supported by total equity of AED3.4 billion, while deposits stand at AED22 billion against loans of AED15.2 billion. However, the bank faces challenges with a high bad loan ratio of 8.9% and a low allowance for these loans at 47%. Despite these hurdles, its price-to-earnings ratio is an attractive 7.9x compared to the AE market's 11.7x, indicating potential value for investors seeking opportunities in emerging markets.

- Navigate through the intricacies of Ajman Bank PJSC with our comprehensive health report here.

Understand Ajman Bank PJSC's track record by examining our Past report.

Consolidated Grunenfelder Saady Holding (SASE:4147)

Simply Wall St Value Rating: ★★★★★★

Overview: Consolidated Grunenfelder Saady Holding Company specializes in the manufacturing of refrigeration and cold-storage solutions, with a market capitalization of SAR981 million.

Operations: The company's revenue streams are primarily derived from contract activities (SAR94.17 million) and service activities (SAR37.58 million). Segment adjustments account for SAR343.56 million, impacting the overall financial structure.

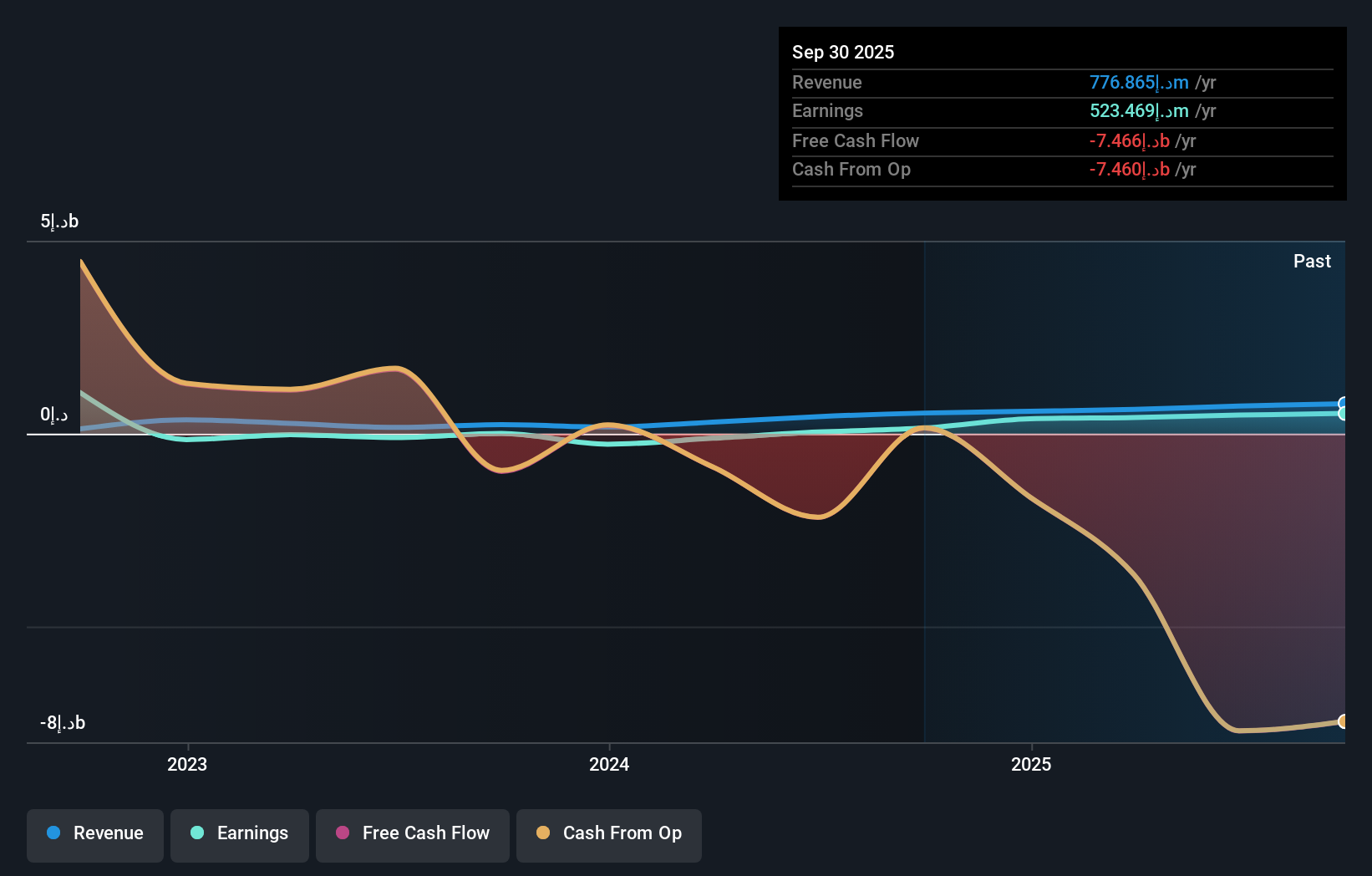

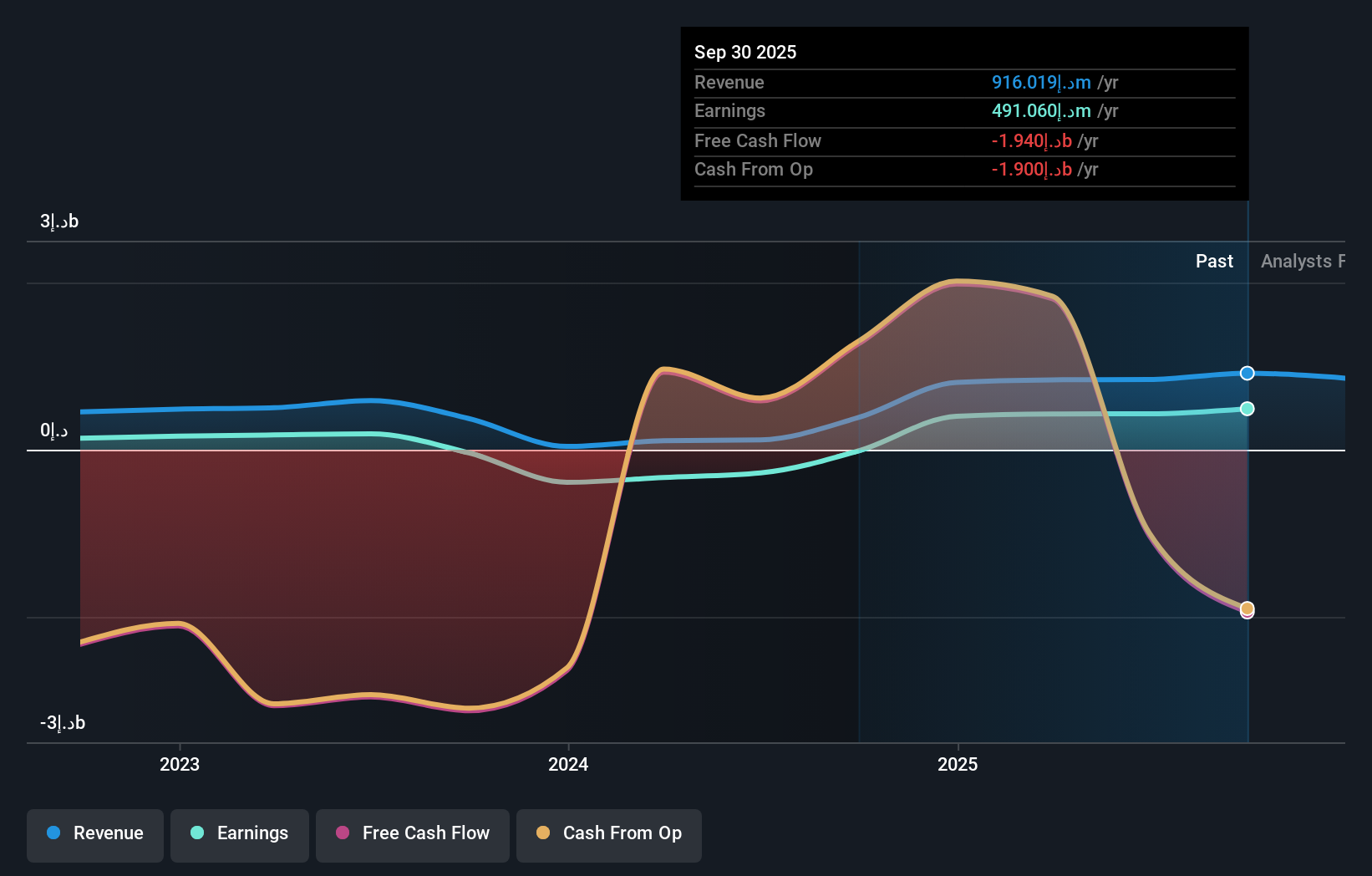

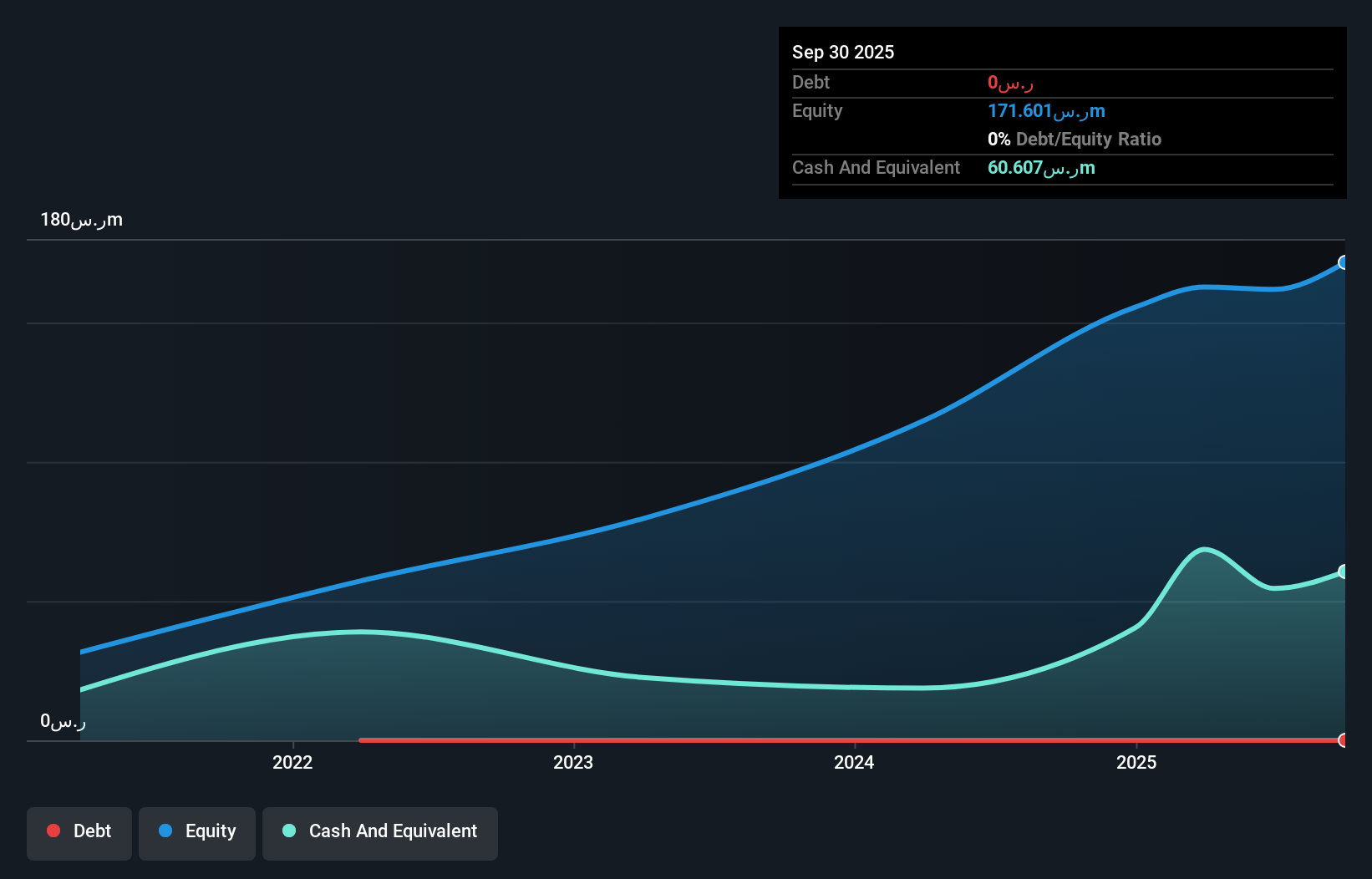

Consolidated Grunenfelder Saady Holding, a compact player in the Middle East, recently completed an IPO raising SAR 300 million. Despite facing a negative earnings growth of -4.1% over the past year against the Machinery industry average of 7.4%, it remains debt-free with high-quality earnings and trades at 65.1% below its estimated fair value, indicating potential undervaluation. The company has shown positive free cash flow with SAR 72.47 million as of September 2025 while maintaining no debt for five years, suggesting financial prudence amidst market volatility and illiquid shares.

Next Steps

- Navigate through the entire inventory of 180 Middle Eastern Undiscovered Gems With Strong Fundamentals here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:4147

Consolidated Grunenfelder Saady Holding

Engages in the manufacturing of refrigeration and cold-storage solutions.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion