- Saudi Arabia

- /

- Basic Materials

- /

- SASE:3005

United Arab Bank P.J.S.C And 2 Other Undiscovered Gems In The Middle East

Reviewed by Simply Wall St

The Middle East stock markets have been experiencing mixed performances, with Saudi Arabia's main index recently recording its worst weekly performance in over a month due to declining crude oil exports and fluctuating oil prices. Meanwhile, Dubai's benchmark index showed resilience by ending higher after consecutive declines, buoyed by international business agreements. In such a dynamic environment, identifying promising stocks often involves looking for companies with strong fundamentals and the potential to thrive despite broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Alf Meem Yaa for Medical Supplies and Equipment | NA | 17.03% | 18.37% | ★★★★★★ |

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| Baazeem Trading | 6.93% | -1.88% | -2.38% | ★★★★★★ |

| Nofoth Food Products | NA | 14.41% | 31.88% | ★★★★★★ |

| Sure Global Tech | NA | 11.95% | 18.65% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 2.07% | 16.18% | 21.11% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.55% | 29.05% | ★★★★★☆ |

| Amanat Holdings PJSC | 11.28% | 31.80% | 1.00% | ★★★★★☆ |

| National Corporation for Tourism and Hotels | 19.25% | 0.67% | 4.89% | ★★★★☆☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

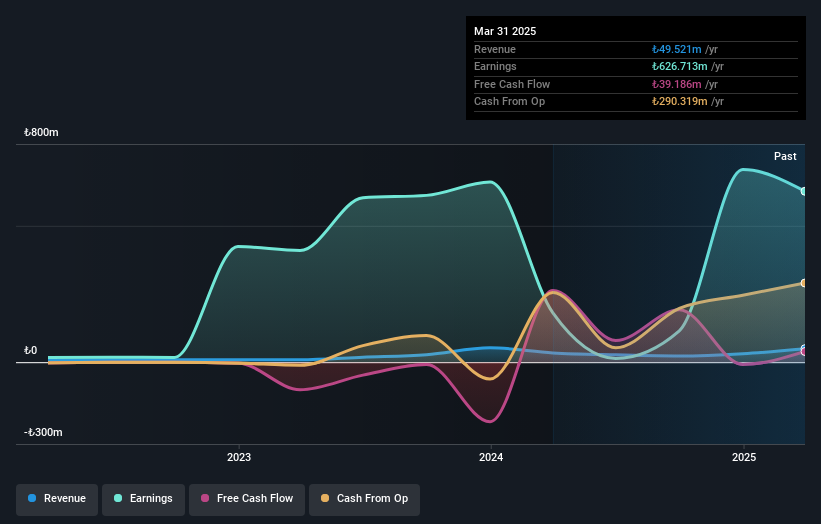

United Arab Bank P.J.S.C (ADX:UAB)

Simply Wall St Value Rating: ★★★★★☆

Overview: United Arab Bank P.J.S.C. operates as a commercial bank offering products and services to institutional and corporate clients in the UAE, with a market capitalization of AED2.58 billion.

Operations: United Arab Bank P.J.S.C. generates revenue primarily through its Wholesale Banking segment, contributing AED425.35 million, followed by Treasury and Capital Markets at AED193.07 million, and Retail Banking at AED76.82 million.

In the bustling landscape of Middle Eastern finance, United Arab Bank P.J.S.C. stands out with its recent earnings growth of 24.4%, surpassing the industry average of 14.4%. Despite facing a high level of bad loans at 3.4%, it has a sufficient allowance for these at 118%. The bank's total assets amount to AED23.4 billion, supported by AED17.4 billion in deposits and AED12.5 billion in loans, indicating robust operations backed by primarily low-risk funding sources (84% from customer deposits). With a price-to-earnings ratio of 7.7x below the AE market's average, UAB presents an intriguing investment narrative despite challenges ahead.

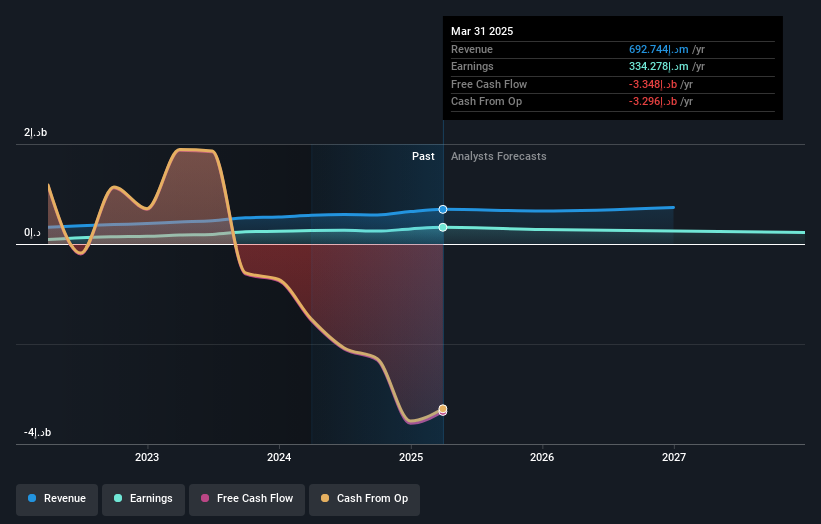

Pera Yatirim Holding Anonim Sirketi (IBSE:PEHOL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Pera Yatirim Holding Anonim Sirketi operates as a publicly owned real estate investment trust with a market capitalization of TRY14.59 billion.

Operations: The company generates revenue primarily through its real estate investments. It has a market capitalization of TRY14.59 billion, indicating significant scale in the industry.

Pera Yatirim Holding, a smaller player in the investment landscape, has shown significant earnings growth of 246.9% over the past year, outpacing its industry peers. Despite this surge, recent financials reveal a net loss of TRY 57.6 million for Q1 2025 against a previous net income of TRY 21.97 million in the same quarter last year. The company's debt to equity ratio improved from 52.3% to a satisfactory 15.6% over five years, indicating effective debt management strategies despite high volatility in share price recently observed over three months and non-cash earnings contributing heavily to reported profits.

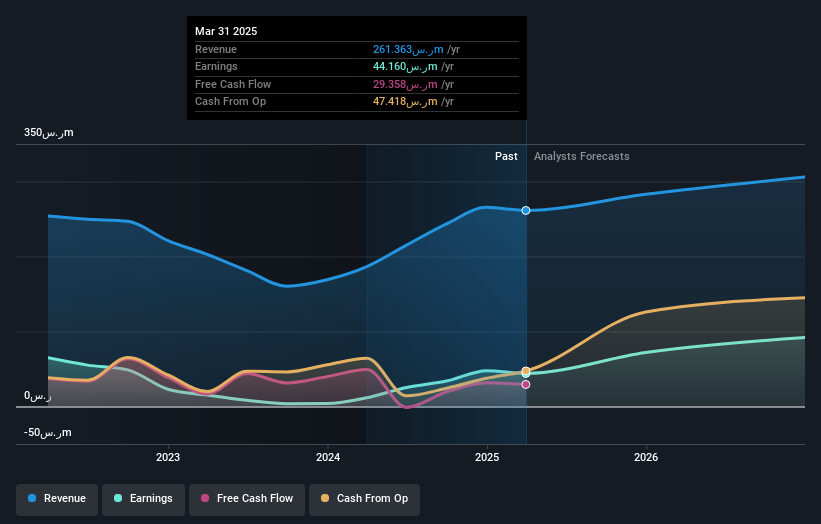

Umm Al-Qura Cement (SASE:3005)

Simply Wall St Value Rating: ★★★★★☆

Overview: Umm Al-Qura Cement Company is involved in the manufacturing and sale of clinker and cement products within the Kingdom of Saudi Arabia, with a market capitalization of SAR943.80 million.

Operations: The primary revenue stream for Umm Al-Qura Cement comes from its cement segment, generating SAR261.36 million. The company's financial performance is influenced by its ability to manage production costs and optimize operational efficiency, impacting its overall profitability.

Umm Al-Qura Cement, a nimble player in the cement industry, has shown impressive earnings growth of 279% over the past year, outpacing its sector's 38.5%. This small entity boasts a satisfactory net debt to equity ratio of 28.2%, reflecting prudent financial management. With interest payments covered by EBIT at 6.1 times, liquidity seems robust. Despite recent quarterly sales dipping to SAR 60.46 million from SAR 64.68 million and net income sliding to SAR 10.91 million from SAR 14.47 million year-on-year, full-year figures tell a different story with sales jumping to SAR 265.59 million and net income soaring to SAR 47.72 million compared to last year's results.

Summing It All Up

- Access the full spectrum of 233 Middle Eastern Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Umm Al-Qura Cement, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:3005

Umm Al-Qura Cement

Manufactures and sells clinker and cement products in the Kingdom of Saudi Arabia.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives