- United Kingdom

- /

- Retail Distributors

- /

- LSE:ULTP

UK Penny Stocks Under £700M Market Cap: 3 Picks To Watch

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices both experiencing declines following weak trade data from China. Despite these broader market pressures, there remains a segment of the market that continues to intrigue investors: penny stocks. While the term might seem outdated, it still signifies opportunities in smaller or newer companies that can offer substantial growth potential when backed by solid financials. In this article, we explore three UK penny stocks that stand out for their strong fundamentals and potential for future success.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| FRP Advisory Group (AIM:FRP) | £1.235 | £306.34M | ✅ 5 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £4.25 | £343.35M | ✅ 4 ⚠️ 2 View Analysis > |

| Cairn Homes (LSE:CRN) | £1.802 | £1.12B | ✅ 4 ⚠️ 2 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.435 | £47.07M | ✅ 5 ⚠️ 2 View Analysis > |

| RWS Holdings (AIM:RWS) | £0.88 | £325.4M | ✅ 4 ⚠️ 3 View Analysis > |

| Alumasc Group (AIM:ALU) | £3.65 | £131.26M | ✅ 4 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.095 | £174.69M | ✅ 4 ⚠️ 2 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.845 | £11.63M | ✅ 4 ⚠️ 3 View Analysis > |

| Braemar (LSE:BMS) | £2.17 | £67.23M | ✅ 3 ⚠️ 4 View Analysis > |

| ME Group International (LSE:MEGP) | £2.24 | £845.53M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 295 stocks from our UK Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Serica Energy (AIM:SQZ)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Serica Energy plc, along with its subsidiaries, focuses on identifying, acquiring, and exploiting oil and gas reserves in the United Kingdom with a market capitalization of £631.99 million.

Operations: The company generates revenue of $727.18 million from its oil and gas exploration, development, and production activities.

Market Cap: £631.99M

Serica Energy, with a market cap of £631.99 million and revenue of US$727.18 million, shows both promise and challenges as a penny stock investment. The company recently completed maintenance at its Triton FPSO, resuming production with potential boosts from new wells. Despite stable weekly volatility and satisfactory debt levels, Serica's earnings have declined by 27.7% over the past year, with forecasts indicating further declines. While trading below estimated fair value and maintaining high-quality earnings, the company's dividend is unsustainable given current coverage levels. Management and board experience remain limited with short tenures noted.

- Unlock comprehensive insights into our analysis of Serica Energy stock in this financial health report.

- Understand Serica Energy's earnings outlook by examining our growth report.

Virgin Wines UK (AIM:VINO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Virgin Wines UK PLC operates as a direct-to-consumer online wine retailer in the United Kingdom with a market cap of £32.58 million.

Operations: The company's revenue segment primarily consists of the sale of alcohol, totaling £58.80 million.

Market Cap: £32.58M

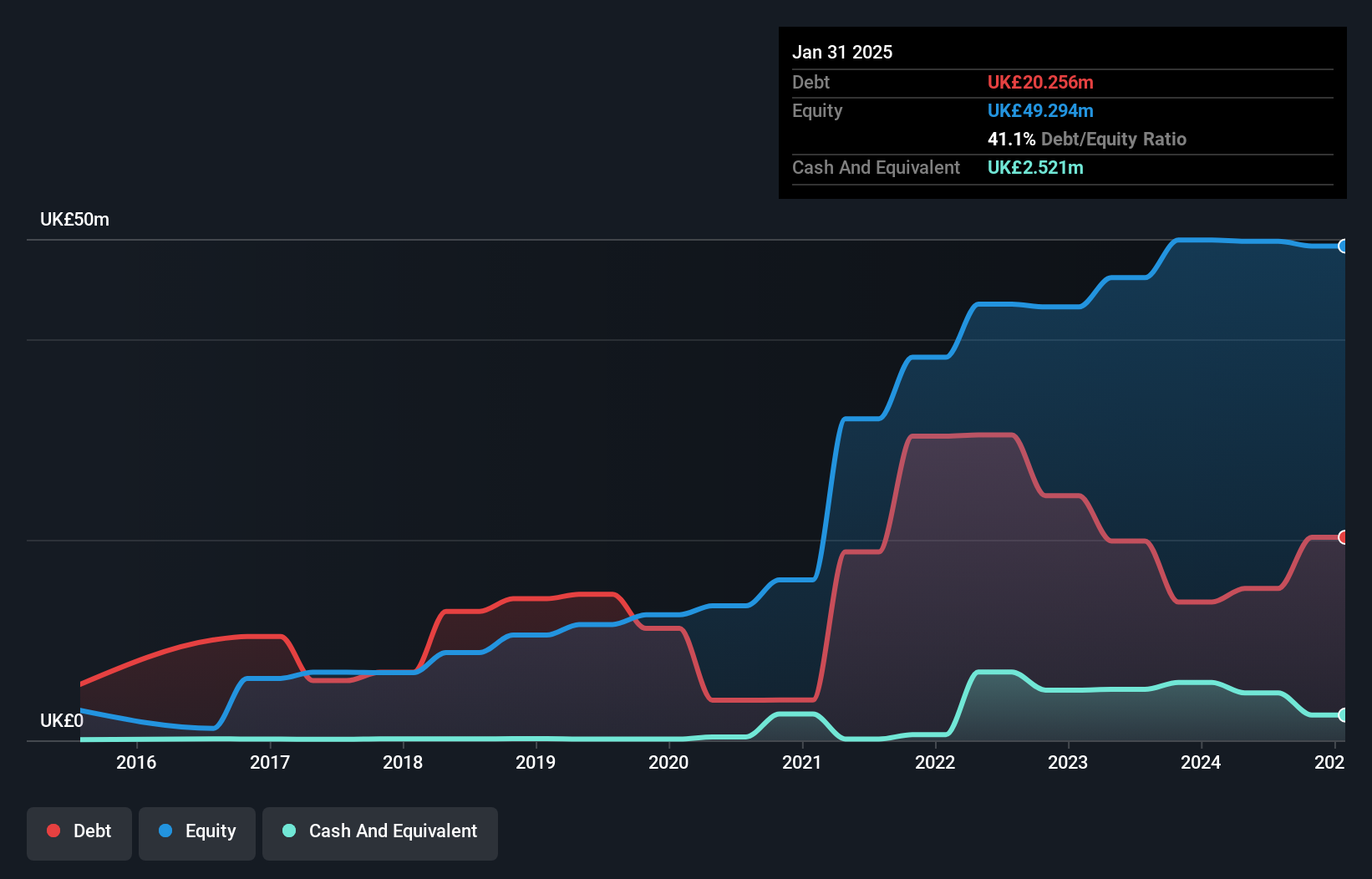

Virgin Wines UK, with a market cap of £32.58 million, presents a mixed picture for penny stock investors. The company is debt-free and boasts high-quality earnings, with recent profits showing significant growth over the past year. However, its earnings are forecast to decline substantially in the coming years. Despite improved profit margins and stable weekly volatility, Virgin Wines initiated a share buyback program to repurchase up to 15% of its issued shares by March 2026. While this move could signal confidence in future prospects, potential investors should weigh these factors carefully against expected earnings declines.

- Navigate through the intricacies of Virgin Wines UK with our comprehensive balance sheet health report here.

- Learn about Virgin Wines UK's future growth trajectory here.

Ultimate Products (LSE:ULTP)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Ultimate Products Plc, with a market cap of £47.56 million, supplies branded household products across the United Kingdom, Germany, the rest of Europe, and internationally.

Operations: The company generates revenue from its Wholesale - Miscellaneous segment, amounting to £150.80 million.

Market Cap: £47.56M

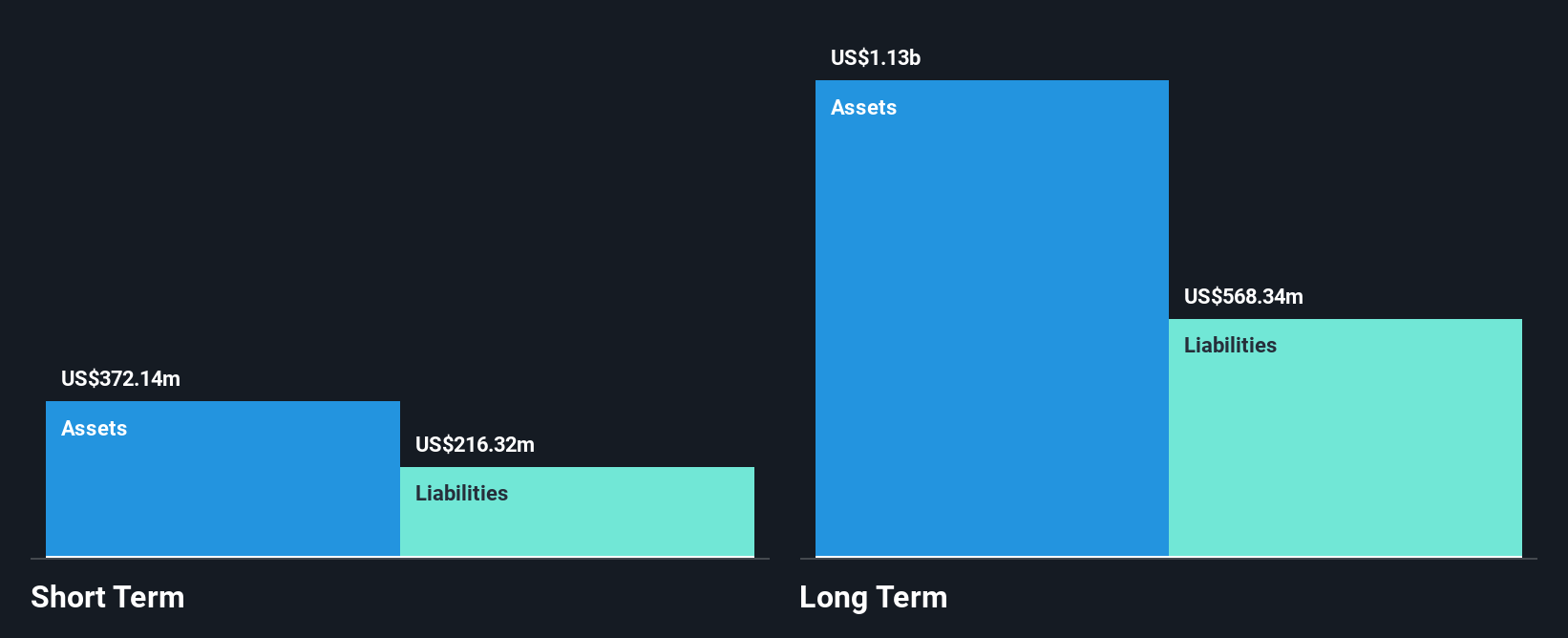

Ultimate Products Plc, with a market cap of £47.56 million, offers a complex profile for penny stock investors. The company trades significantly below its estimated fair value and maintains satisfactory debt levels with a net debt to equity ratio of 36%. However, its dividend yield is not supported by free cash flows, and recent profit margins have declined from last year. While short-term assets exceed liabilities, earnings are forecasted to decline by an average of 15% annually over the next three years. Despite these challenges, Ultimate Products has experienced management and board teams which could provide stability amidst volatility.

- Get an in-depth perspective on Ultimate Products' performance by reading our balance sheet health report here.

- Assess Ultimate Products' future earnings estimates with our detailed growth reports.

Where To Now?

- Get an in-depth perspective on all 295 UK Penny Stocks by using our screener here.

- Curious About Other Options? These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:ULTP

Ultimate Products

Supplies branded household products in the United Kingdom, Germany, Rest of Europe, and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success