- United Kingdom

- /

- Retail Distributors

- /

- LSE:ULTP

UK Penny Stocks To Watch In August 2025

Reviewed by Simply Wall St

The UK market has experienced a downturn, with the FTSE 100 index closing lower due to weak trade data from China, highlighting the interconnectedness of global economies. Despite these broader market challenges, there remains potential in lesser-known investment avenues such as penny stocks. Although the term "penny stocks" may seem outdated, it still points to smaller or newer companies that could offer growth opportunities when backed by strong financial health and solid fundamentals.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.54 | £508.28M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £3.17 | £256.1M | ✅ 5 ⚠️ 2 View Analysis > |

| FDM Group (Holdings) (LSE:FDM) | £1.228 | £134.24M | ✅ 2 ⚠️ 4 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.41 | £44.36M | ✅ 4 ⚠️ 3 View Analysis > |

| RWS Holdings (AIM:RWS) | £0.854 | £315.79M | ✅ 5 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.70 | £277.66M | ✅ 4 ⚠️ 1 View Analysis > |

| Alumasc Group (AIM:ALU) | £3.60 | £129.47M | ✅ 4 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.16 | £184.37M | ✅ 4 ⚠️ 2 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.775 | £10.67M | ✅ 2 ⚠️ 3 View Analysis > |

| Samuel Heath & Sons (AIM:HSM) | £3.35 | £8.49M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 298 stocks from our UK Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Calnex Solutions (AIM:CLX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Calnex Solutions plc designs, produces, and markets test and measurement instrumentation for the telecoms and cloud computing industries globally, with a market cap of £46.58 million.

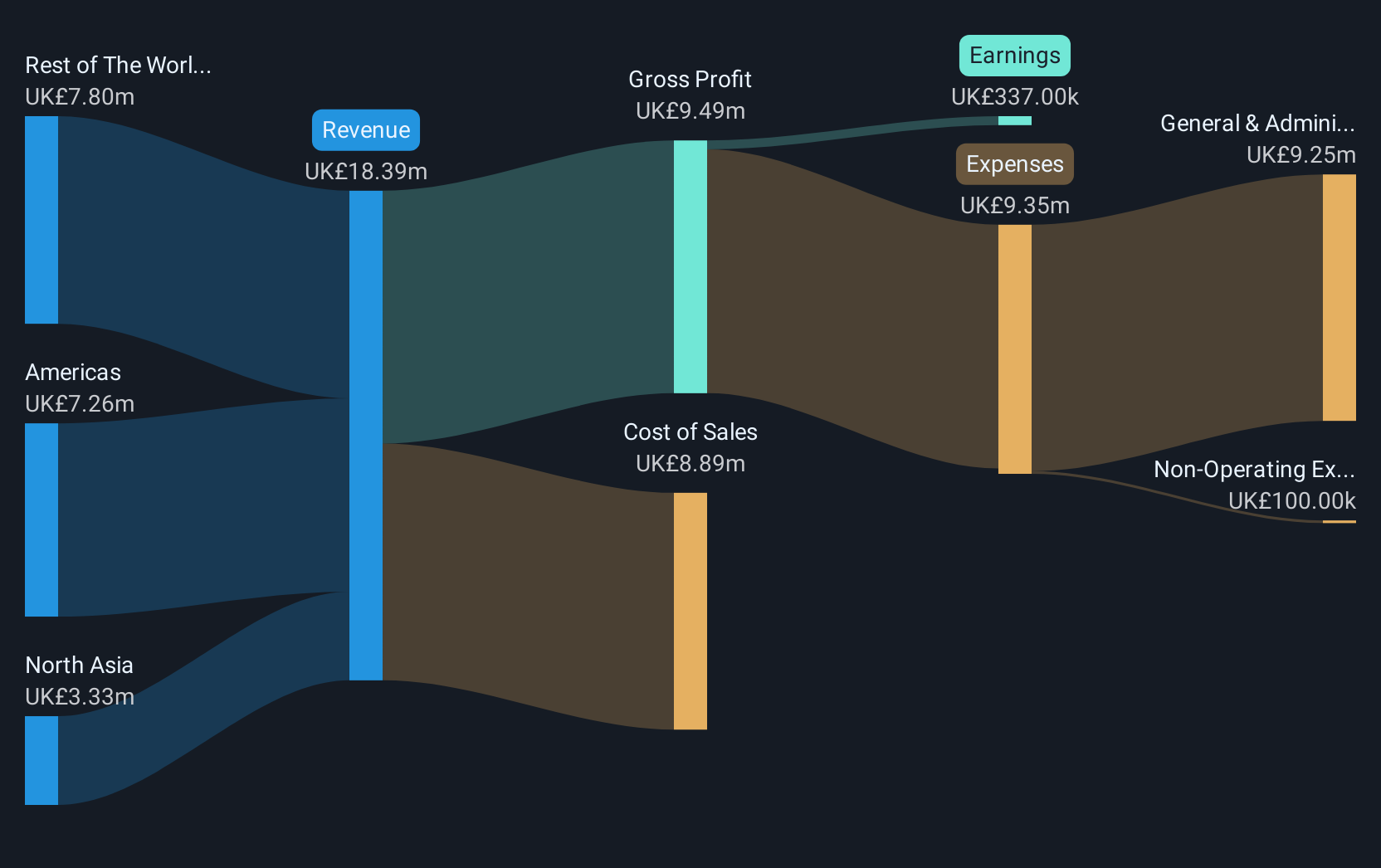

Operations: The company generates revenue of £18.39 million from its Electronic Test & Measurement Instruments segment.

Market Cap: £46.58M

Calnex Solutions, with a market cap of £46.58 million, has shown substantial earnings growth over the past year, significantly outperforming its industry. Despite declining earnings over the past five years, recent performance indicates potential recovery with improved profit margins and no debt burden. The company’s short-term assets comfortably cover both short- and long-term liabilities. Recent financial results highlighted increased sales and net income compared to the previous year, alongside a proposed dividend for shareholders. While trading below estimated fair value suggests it may be undervalued, investors should consider its historically volatile earnings trajectory.

- Click to explore a detailed breakdown of our findings in Calnex Solutions' financial health report.

- Review our growth performance report to gain insights into Calnex Solutions' future.

Deliveroo (LSE:ROO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Deliveroo plc operates an online on-demand food and non-food delivery platform across several countries, including the United Kingdom and Singapore, with a market cap of £2.67 billion.

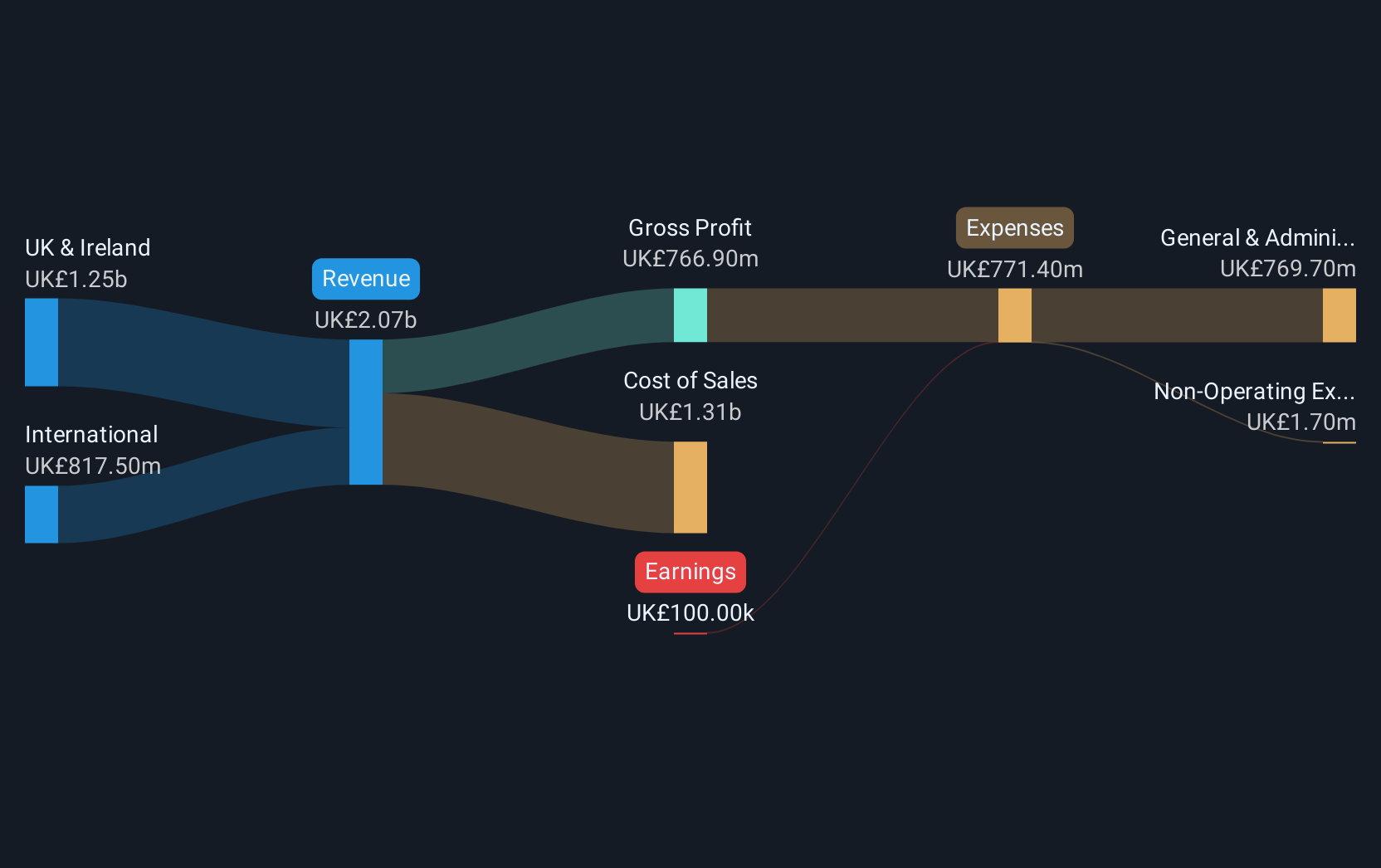

Operations: Deliveroo plc does not report specific revenue segments.

Market Cap: £2.67B

Deliveroo, with a market cap of £2.67 billion, remains unprofitable but has managed to reduce its losses by 49.1% annually over the past five years. The company is debt-free and maintains a strong cash position, ensuring more than three years of runway if current free cash flow trends continue. Recent earnings showed increased sales to £1.05 billion for H1 2025 but also reported a net loss of £19.2 million compared to last year's net income. Deliveroo's shares trade significantly below estimated fair value, offering potential upside despite ongoing profitability challenges and recent board-approved structural changes related to DoorDash's acquisition offer.

- Get an in-depth perspective on Deliveroo's performance by reading our balance sheet health report here.

- Learn about Deliveroo's future growth trajectory here.

Ultimate Products (LSE:ULTP)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Ultimate Products Plc, along with its subsidiaries, supplies branded household products across the United Kingdom, Germany, the rest of Europe, and internationally, with a market cap of £52.30 million.

Operations: The company generates revenue through its Wholesale - Miscellaneous segment, which amounts to £150.80 million.

Market Cap: £52.3M

Ultimate Products Plc, with a market cap of £52.30 million, faces challenges with negative earnings growth and declining profit margins, currently at 4.7% compared to last year's 7.6%. Despite trading below its estimated fair value and having stable short-term assets exceeding liabilities, the company struggles with high volatility and insufficient operating cash flow to cover debt effectively. The board is experienced but recent executive changes could impact strategic direction. Revenue forecasts indicate a potential decline from £149.2 million in 2025 to £137.7 million in 2026, reflecting broader uncertainties in the retail distribution sector amidst volatile market conditions.

- Navigate through the intricacies of Ultimate Products with our comprehensive balance sheet health report here.

- Explore Ultimate Products' analyst forecasts in our growth report.

Seize The Opportunity

- Explore the 298 names from our UK Penny Stocks screener here.

- Looking For Alternative Opportunities? Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:ULTP

Ultimate Products

Supplies branded household products in the United Kingdom, Rest of Europe, and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)