- United Kingdom

- /

- IT

- /

- AIM:BKS

UK Penny Stocks: Beeks Financial Cloud Group And 2 More Promising Picks

Reviewed by Simply Wall St

The United Kingdom's stock market has recently experienced a downturn, with the FTSE 100 closing lower due to weak trade data from China, highlighting global economic challenges. Despite these broader market pressures, there remain opportunities for investors willing to explore beyond established blue-chip stocks. Penny stocks, though often seen as relics of past market eras, continue to offer potential for growth at lower price points when backed by strong financials and sound fundamentals.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.55 | £509.4M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £3.10 | £250.44M | ✅ 5 ⚠️ 2 View Analysis > |

| FDM Group (Holdings) (LSE:FDM) | £1.242 | £135.77M | ✅ 2 ⚠️ 4 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.41 | £44.36M | ✅ 4 ⚠️ 3 View Analysis > |

| RWS Holdings (AIM:RWS) | £0.829 | £306.55M | ✅ 5 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.72 | £279.73M | ✅ 4 ⚠️ 1 View Analysis > |

| Alumasc Group (AIM:ALU) | £3.65 | £131.26M | ✅ 4 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.155 | £183.58M | ✅ 4 ⚠️ 2 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.775 | £10.67M | ✅ 2 ⚠️ 3 View Analysis > |

| Braemar (LSE:BMS) | £2.55 | £78.36M | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 299 stocks from our UK Penny Stocks screener.

We'll examine a selection from our screener results.

Beeks Financial Cloud Group (AIM:BKS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Beeks Financial Cloud Group plc offers managed cloud computing, connectivity, and analytics services for capital markets and financial services sectors globally, with a market cap of £148.85 million.

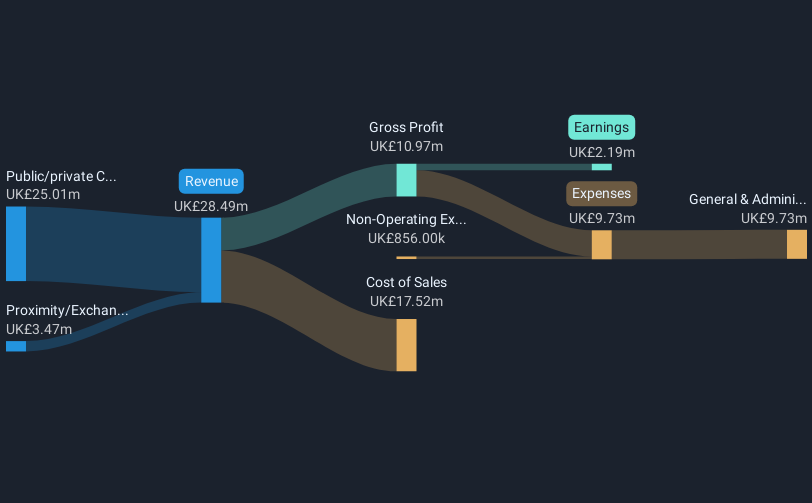

Operations: The company generates revenue from two main segments: Public/private Cloud, contributing £26.01 million, and Proximity/Exchange Cloud, contributing £5.32 million.

Market Cap: £148.85M

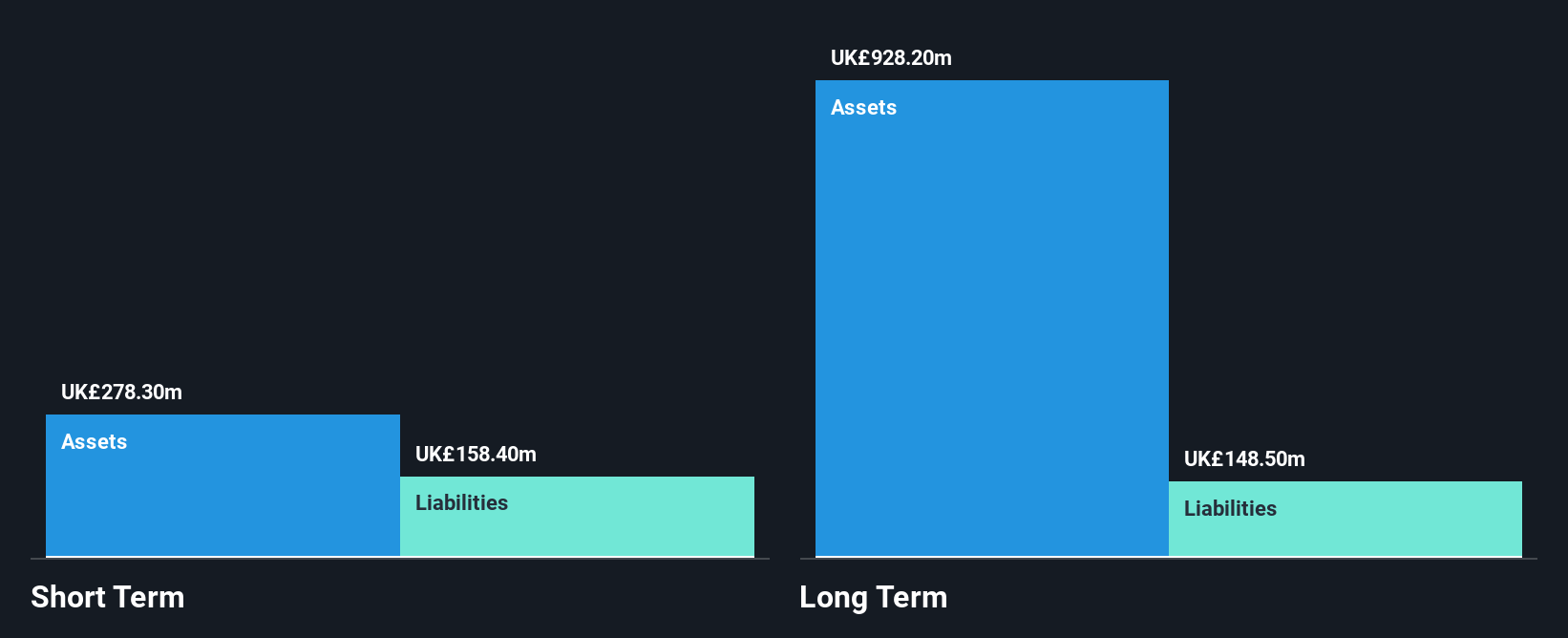

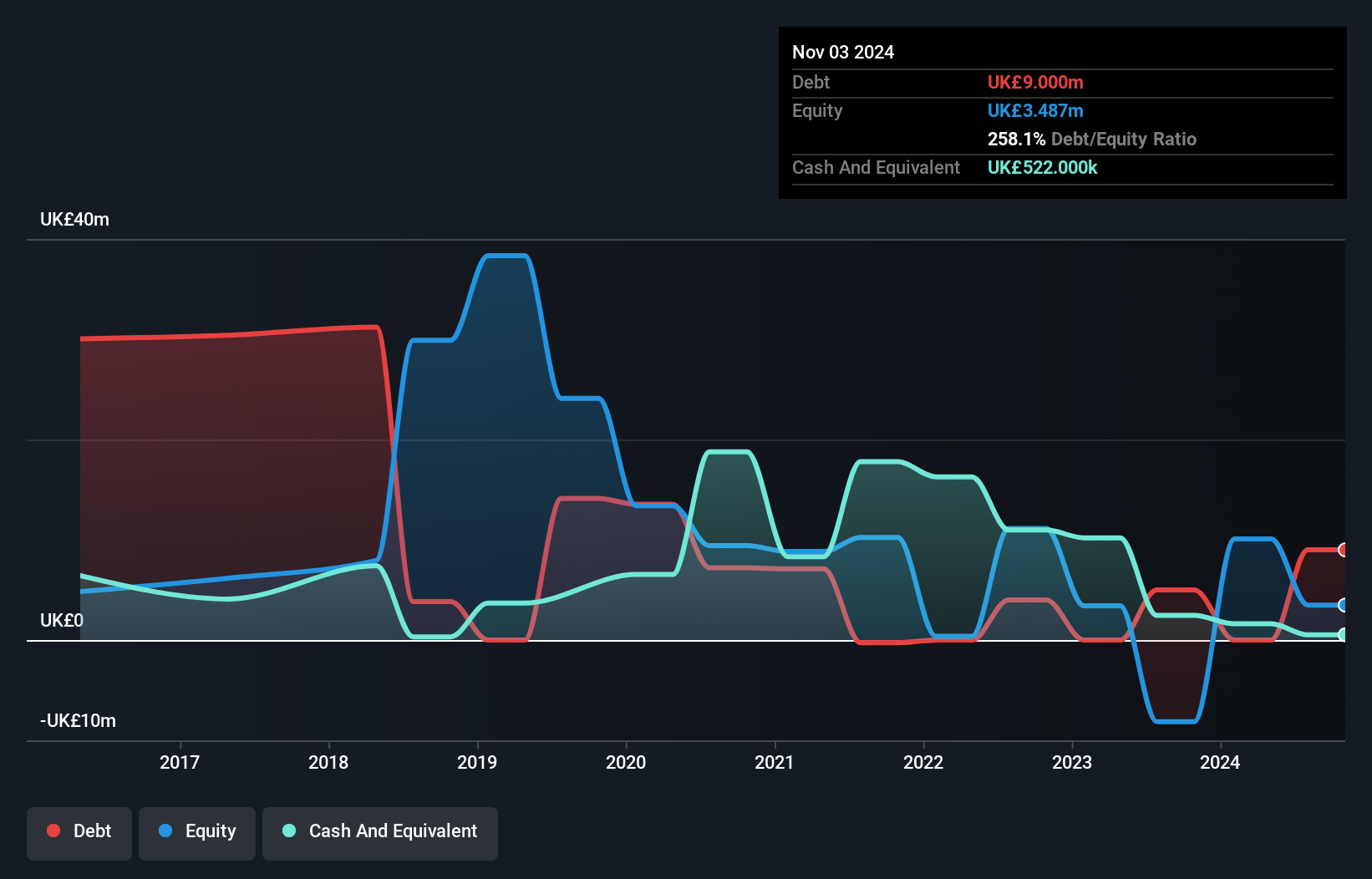

Beeks Financial Cloud Group plc has shown strong growth potential, highlighted by its impressive earnings increase of 293.4% over the past year, outpacing the broader IT industry. The company is debt-free and maintains a healthy balance sheet with short-term assets exceeding liabilities. Recent developments include the launch of Market Edge Intelligence, an AI-driven solution for capital markets data analysis, which could enhance Beeks' market reach and revenue streams. Additionally, significant contract wins such as a $10 million Proximity Cloud deal and a multi-year Exchange Cloud partnership with ASX bolster its recurring revenue base and future growth prospects.

- Take a closer look at Beeks Financial Cloud Group's potential here in our financial health report.

- Understand Beeks Financial Cloud Group's earnings outlook by examining our growth report.

RWS Holdings (AIM:RWS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: RWS Holdings plc offers technology-enabled language, content, and intellectual property services across the UK, Continental Europe, the US, and globally with a market cap of £306.55 million.

Operations: The company's revenue is derived from four main segments: IP Services (£98.2 million), Language Services (£329 million), Regulated Industries (£140.3 million), and Language & Content Technology (£144.7 million).

Market Cap: £306.55M

RWS Holdings plc, with a market cap of £306.55 million, has recently become profitable, though its earnings have declined by 21.2% annually over the past five years. The company faces challenges such as low return on equity at 2.9% and unsustainable dividends not covered by earnings or cash flows. However, RWS's debt management is satisfactory with a net debt to equity ratio of 3.1%, and its short-term assets cover both short- and long-term liabilities effectively. Recent strategic partnerships with Copyleaks for AI-driven content integrity solutions highlight RWS's efforts to enhance service offerings in response to evolving market needs.

- Click here and access our complete financial health analysis report to understand the dynamics of RWS Holdings.

- Learn about RWS Holdings' future growth trajectory here.

TheWorks.co.uk (AIM:WRKS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: TheWorks.co.uk plc is a retailer of art and craft products, stationery, toys, games, books, gifts, and seasonal items in the UK and Ireland with a market cap of £33.28 million.

Operations: The company generates £277.04 million in revenue from its retail operations in toys and hobby stores.

Market Cap: £33.28M

TheWorks.co.uk plc, with a market cap of £33.28 million, has shown profitability growth over the past five years, boasting an outstanding return on equity of 51.6%. However, it faces challenges as its short-term assets (£46.9M) do not cover its liabilities (£54.2M). Despite no debt and a low price-to-earnings ratio (4.1x), indicating potential value relative to the UK market average (15.8x), volatility remains high compared to other UK stocks. Recent board changes include appointing Nick Wharton as Independent Non-Executive Director and Chairman of the Audit Committee, bringing extensive finance experience to support strategic goals amidst evolving market conditions.

- Unlock comprehensive insights into our analysis of TheWorks.co.uk stock in this financial health report.

- Evaluate TheWorks.co.uk's prospects by accessing our earnings growth report.

Summing It All Up

- Get an in-depth perspective on all 299 UK Penny Stocks by using our screener here.

- Contemplating Other Strategies? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beeks Financial Cloud Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:BKS

Beeks Financial Cloud Group

Provides managed cloud computing, connectivity, and analytics services for capital markets and financial services sectors in the United Kingdom, Europe, the United States, and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives