- United Kingdom

- /

- Specialty Stores

- /

- LSE:MOON

UK Market: NIOX Group And Two Other Stocks Estimated Below Intrinsic Value

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, highlighting concerns about global economic recovery. In such a climate, identifying undervalued stocks can be crucial for investors seeking opportunities that may offer potential value over time. This article will explore three stocks estimated to be trading below their intrinsic value, including NIOX Group.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Pinewood Technologies Group (LSE:PINE) | £4.205 | £7.83 | 46.3% |

| PageGroup (LSE:PAGE) | £2.28 | £4.42 | 48.5% |

| On the Beach Group (LSE:OTB) | £2.18 | £4.23 | 48.5% |

| Mitie Group (LSE:MTO) | £1.386 | £2.61 | 46.9% |

| Likewise Group (AIM:LIKE) | £0.27 | £0.52 | 48.3% |

| Hollywood Bowl Group (LSE:BOWL) | £2.54 | £4.88 | 47.9% |

| Gym Group (LSE:GYM) | £1.476 | £2.93 | 49.6% |

| Gooch & Housego (AIM:GHH) | £5.74 | £10.88 | 47.2% |

| Essentra (LSE:ESNT) | £1.036 | £1.97 | 47.4% |

| Begbies Traynor Group (AIM:BEG) | £1.155 | £2.20 | 47.6% |

Underneath we present a selection of stocks filtered out by our screen.

NIOX Group (AIM:NIOX)

Overview: NIOX Group Plc is involved in the design, development, and commercialization of medical devices for asthma diagnosis, monitoring, and management on a global scale with a market cap of £305.85 million.

Operations: The company's revenue is primarily generated from its NIOX® segment, which reported £41.80 million.

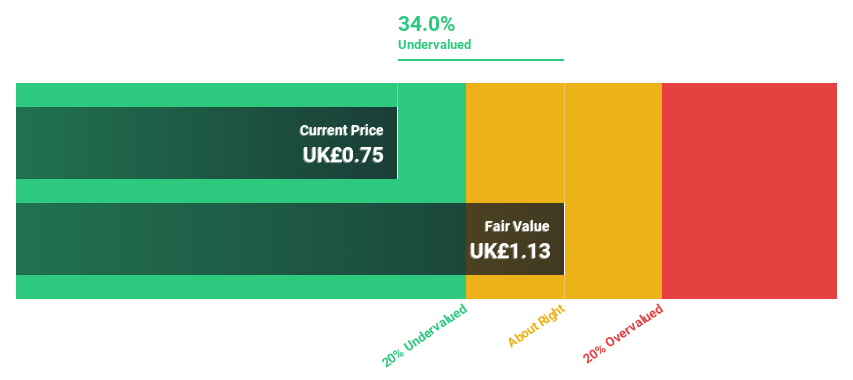

Estimated Discount To Fair Value: 34.7%

NIOX Group is trading at £0.73, significantly below its estimated fair value of £1.12, indicating it may be undervalued based on cash flows. While forecasted earnings growth of 34% per year outpaces the UK market's 14%, profit margins have decreased from 25.8% to 8.1%. Revenue growth projections at 10.8% annually surpass the UK's average but remain moderate overall, suggesting potential for appreciation if financial performance aligns with forecasts.

- Our expertly prepared growth report on NIOX Group implies its future financial outlook may be stronger than recent results.

- Navigate through the intricacies of NIOX Group with our comprehensive financial health report here.

Moonpig Group (LSE:MOON)

Overview: Moonpig Group PLC operates as a data and technology platform specializing in online greeting cards and gifting across the Netherlands, Ireland, Australia, the United States, and the United Kingdom with a market cap of £716.59 million.

Operations: The company's revenue is primarily derived from its Moonpig segment at £262 million, followed by Greetz at £48.85 million, and Experiences contributing £39.21 million.

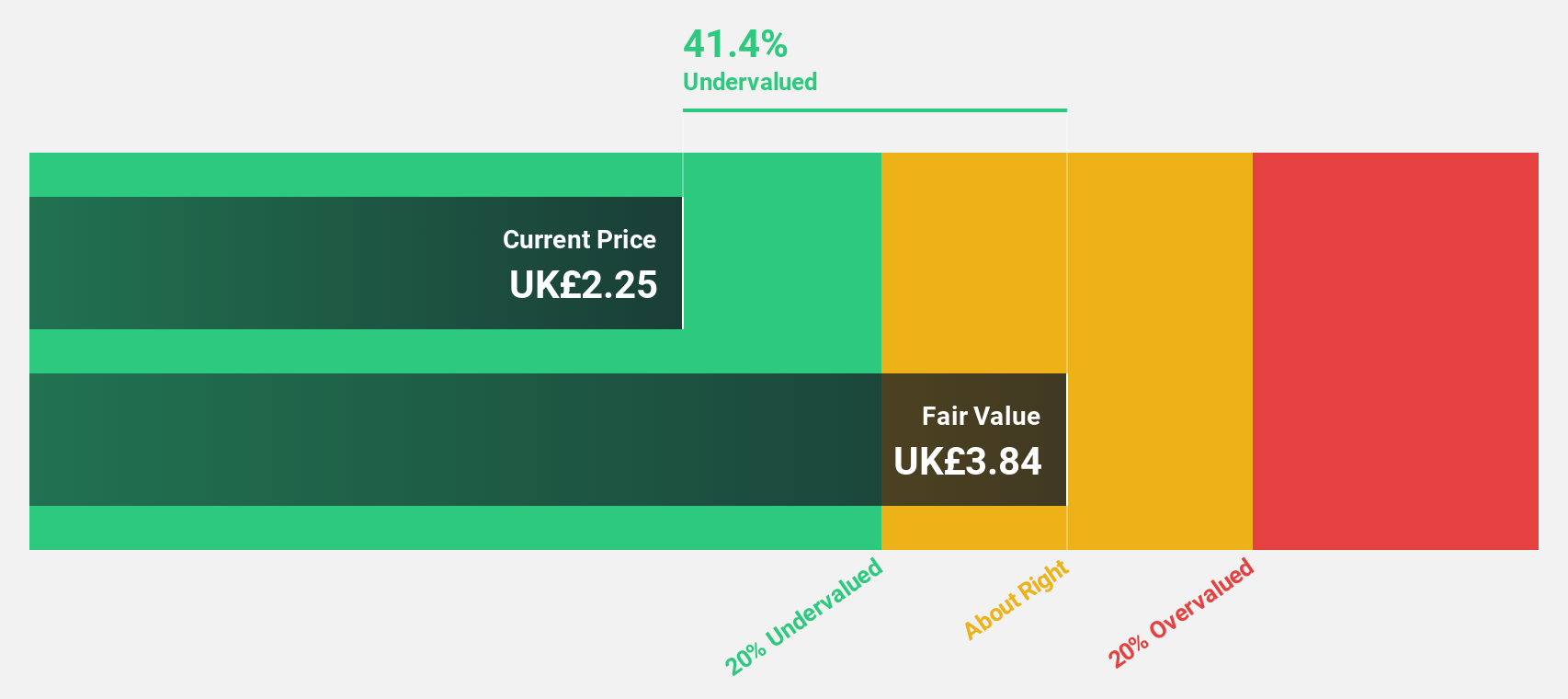

Estimated Discount To Fair Value: 39.9%

Moonpig Group is trading at £2.22, well below its estimated fair value of £3.69, highlighting potential undervaluation based on cash flows. Analysts anticipate the stock price to rise by 36.6%, with revenue growth forecasted at 7.1% annually, outpacing the UK market's average of 4.1%. Despite high debt levels and recent insider selling, Moonpig is expected to achieve profitability within three years and boasts a very high future return on equity projection.

- Our earnings growth report unveils the potential for significant increases in Moonpig Group's future results.

- Click here to discover the nuances of Moonpig Group with our detailed financial health report.

S&U (LSE:SUS)

Overview: S&U plc operates in the United Kingdom, offering motor, property bridging, and specialist finance services with a market cap of £212.03 million.

Operations: The company generates its revenue primarily from motor finance (£79.92 million) and property bridging finance (£14.58 million) services in the United Kingdom.

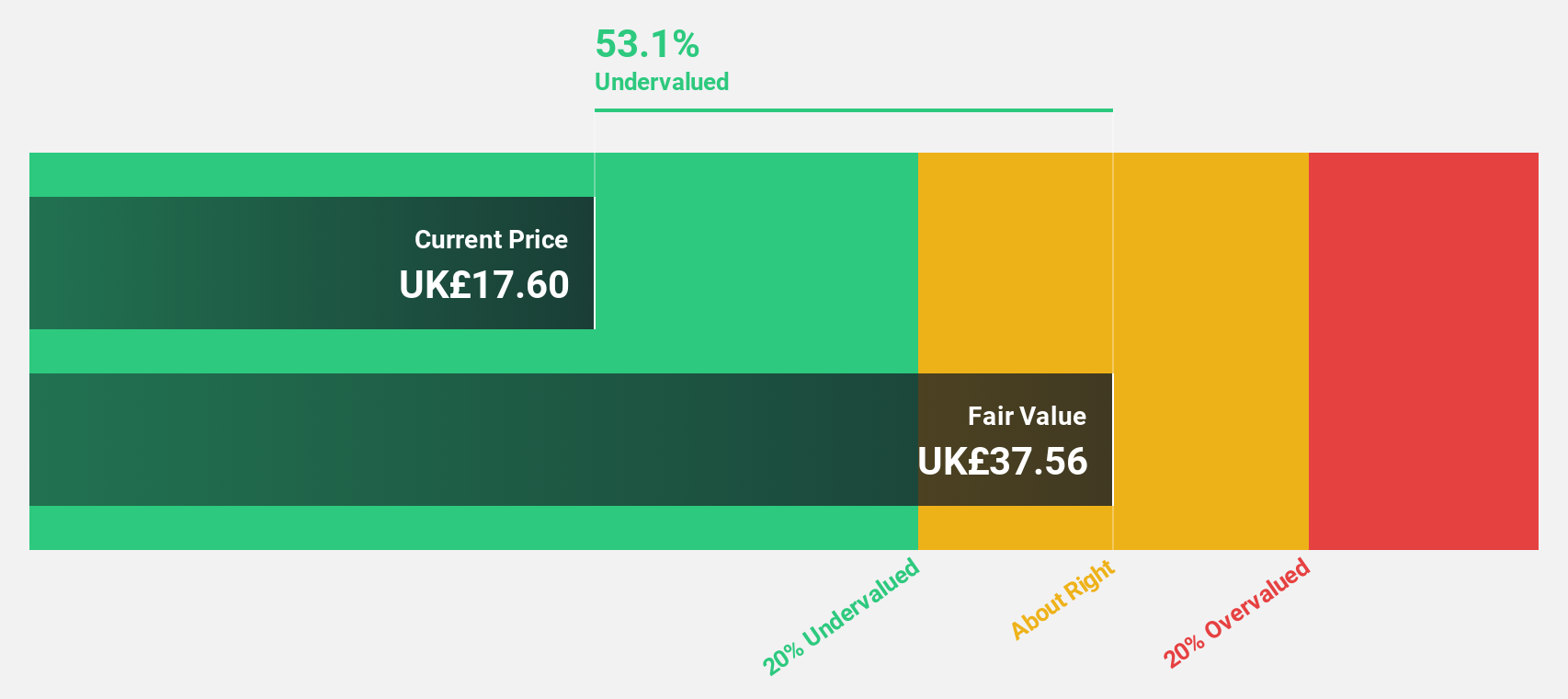

Estimated Discount To Fair Value: 32.1%

S&U is trading at £17.45, significantly below its estimated fair value of £25.7, suggesting it may be undervalued based on cash flows. Despite a high debt level and an unstable dividend track record, S&U's revenue is projected to grow 22.2% annually, surpassing the UK market average of 4.1%. Earnings are expected to rise by 17.9% per year, outpacing the market's 14%, although future return on equity remains modest at 11.7%.

- The analysis detailed in our S&U growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of S&U stock in this financial health report.

Make It Happen

- Reveal the 53 hidden gems among our Undervalued UK Stocks Based On Cash Flows screener with a single click here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:MOON

Moonpig Group

Operates as a data and technology platform for online greeting cards and gifting in the Netherlands, Ireland, Australia, the United States, and the United Kingdom.

High growth potential and fair value.

Market Insights

Community Narratives