TSX Value Opportunities: Discover Three Stocks Trading Below Estimated Worth June 2025

Reviewed by Simply Wall St

As the Canadian market navigates ongoing tariff uncertainties and inflationary pressures, investors are cautiously optimistic, with recent months showing resilience and growth in major indices like the TSX. In this environment, identifying stocks that are trading below their estimated worth can offer strategic opportunities for those looking to capitalize on potential value plays.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| OceanaGold (TSX:OGC) | CA$6.41 | CA$10.47 | 38.8% |

| K92 Mining (TSX:KNT) | CA$14.96 | CA$22.56 | 33.7% |

| Docebo (TSX:DCBO) | CA$37.19 | CA$57.34 | 35.1% |

| Groupe Dynamite (TSX:GRGD) | CA$16.28 | CA$28.14 | 42.1% |

| Magna Mining (TSXV:NICU) | CA$1.60 | CA$3.18 | 49.7% |

| VersaBank (TSX:VBNK) | CA$15.85 | CA$28.74 | 44.8% |

| Lithium Royalty (TSX:LIRC) | CA$5.40 | CA$8.58 | 37.1% |

| TerraVest Industries (TSX:TVK) | CA$171.25 | CA$303.52 | 43.6% |

| Timbercreek Financial (TSX:TF) | CA$7.34 | CA$11.03 | 33.5% |

| Journey Energy (TSX:JOY) | CA$1.78 | CA$2.88 | 38.3% |

Let's take a closer look at a couple of our picks from the screened companies.

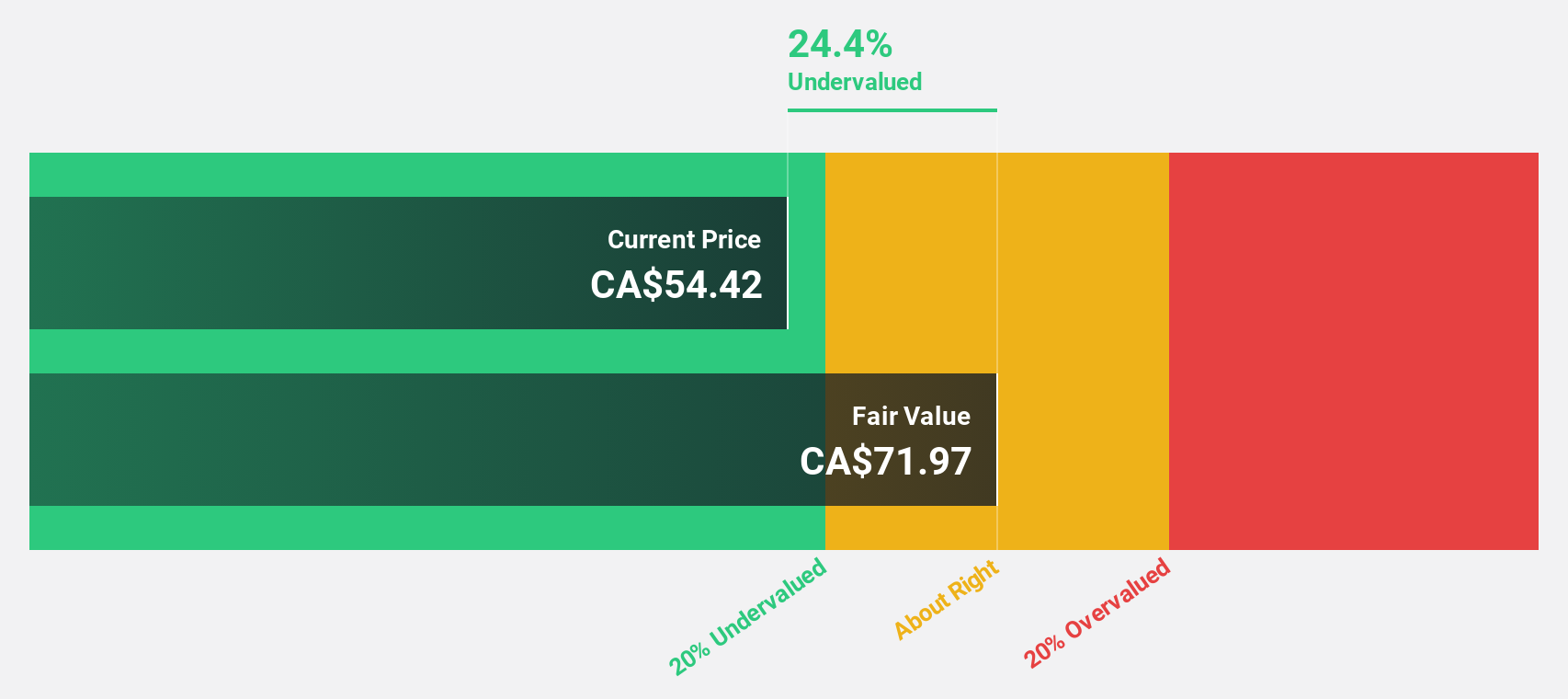

Badger Infrastructure Solutions (TSX:BDGI)

Overview: Badger Infrastructure Solutions Ltd. offers non-destructive excavating and related services across Canada and the United States, with a market cap of CA$1.51 billion.

Operations: The company's revenue segment includes $756.02 million from its Badger division, which focuses on non-destructive excavating and related services in Canada and the United States.

Estimated Discount To Fair Value: 14.4%

Badger Infrastructure Solutions is trading at CA$45.36, below its estimated fair value of CA$53, indicating it may be undervalued based on cash flows. Recent earnings show growth with Q1 2025 net income rising to US$3.26 million from US$1.78 million a year ago. Although the company has a high level of debt, its earnings are forecast to grow significantly at 28.13% annually, outpacing the Canadian market's expected growth rate of 12.2%.

- Our earnings growth report unveils the potential for significant increases in Badger Infrastructure Solutions' future results.

- Click here and access our complete balance sheet health report to understand the dynamics of Badger Infrastructure Solutions.

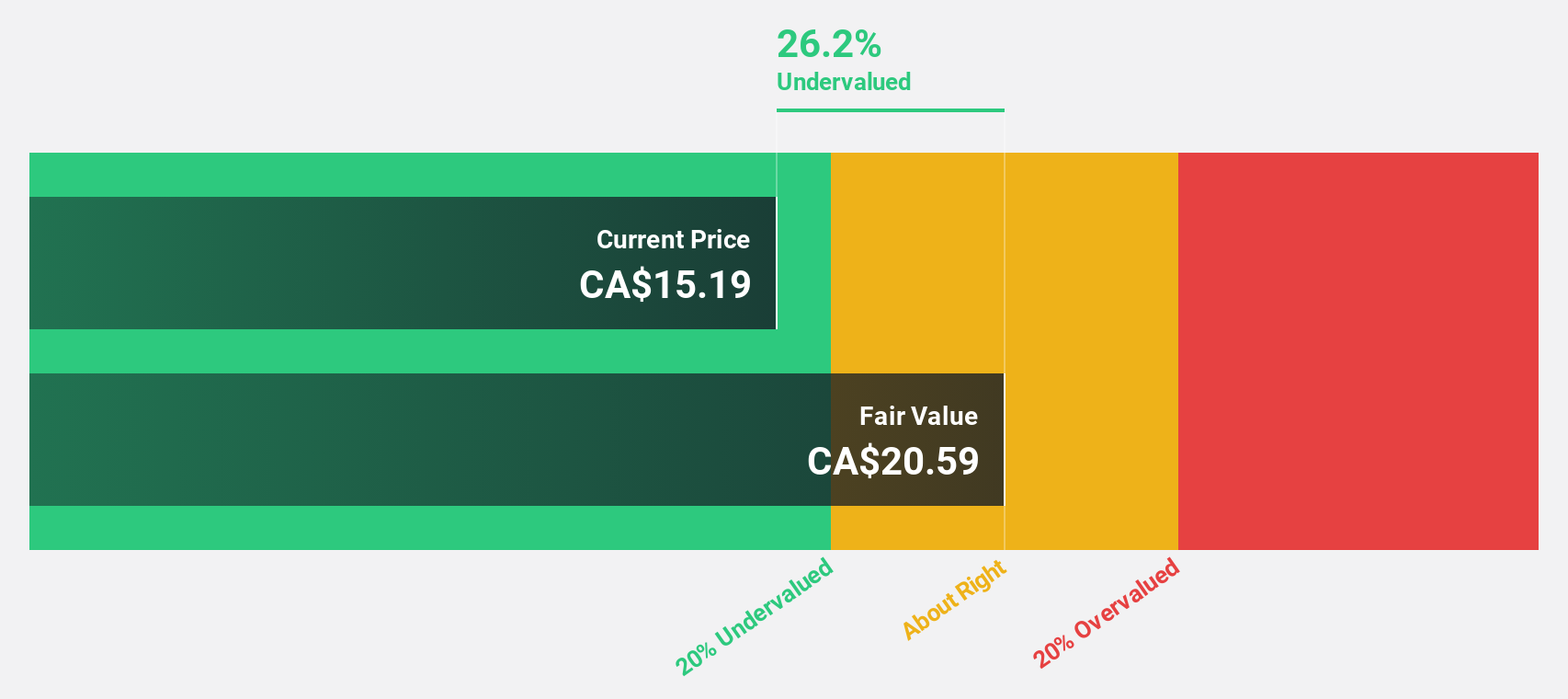

Docebo (TSX:DCBO)

Overview: Docebo Inc. develops and provides a learning management platform for training across North America and internationally, with a market cap of CA$1.09 billion.

Operations: The company's revenue segment consists of educational software, generating $222.82 million.

Estimated Discount To Fair Value: 35.1%

Docebo, trading at CA$37.19, is significantly undervalued with a fair value estimate of CA$57.34. Its earnings are forecast to grow substantially at 35.4% annually, surpassing the Canadian market average of 12.3%. Recent developments include achieving FedRAMP Moderate Authorization for its LearnGov platform, enhancing its position in the U.S. federal sector and supporting secure e-learning initiatives, potentially driving further growth and operational expansion in government markets.

- The analysis detailed in our Docebo growth report hints at robust future financial performance.

- Dive into the specifics of Docebo here with our thorough financial health report.

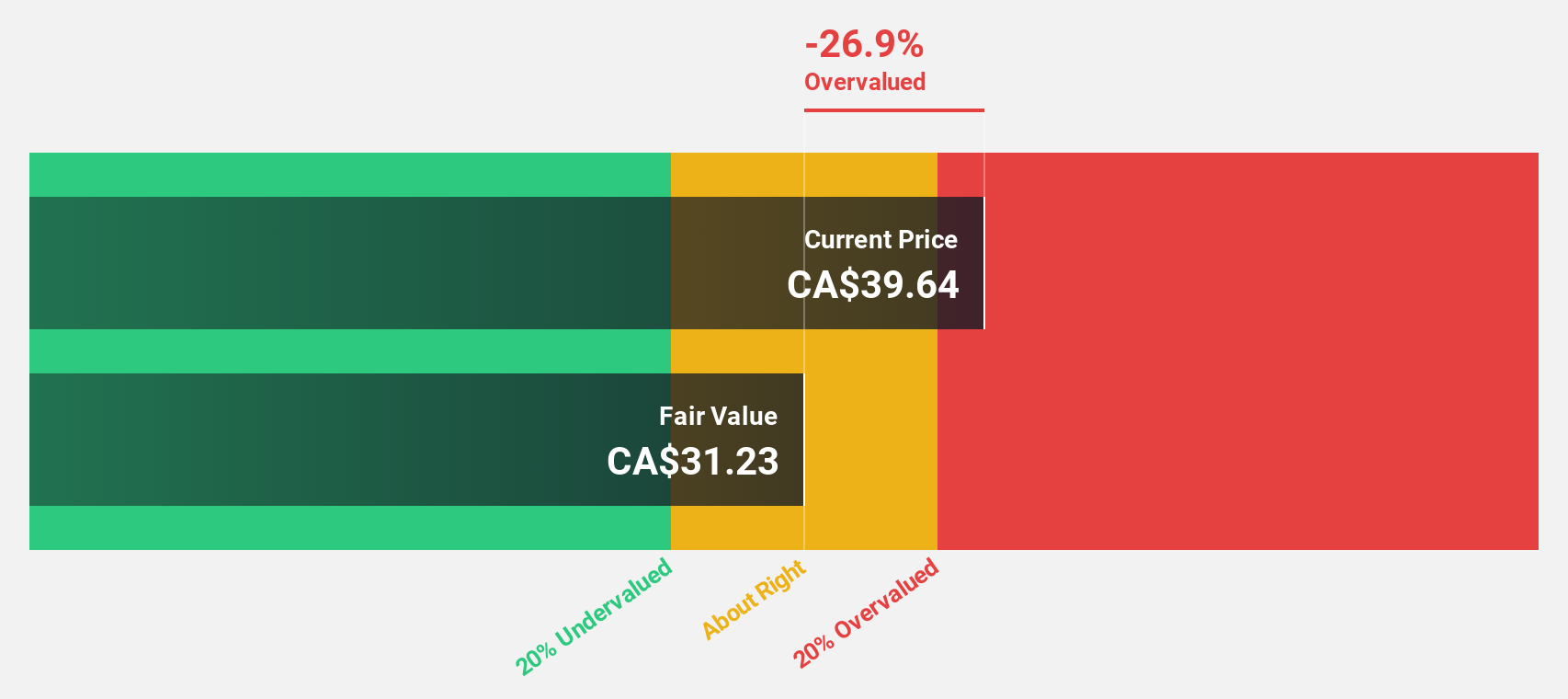

VersaBank (TSX:VBNK)

Overview: VersaBank offers a range of banking products and services in Canada and the United States, with a market cap of CA$501.44 million.

Operations: VersaBank's revenue segments include CA$98.06 million from Digital Banking in Canada and CA$9.71 million from DRTC, which encompasses cybersecurity services and banking and financial technology development.

Estimated Discount To Fair Value: 44.8%

VersaBank, priced at CA$15.85, is significantly undervalued with a fair value estimate of CA$28.74 and trades 44.8% below this estimate. Its earnings are projected to grow substantially at 55.2% annually, outpacing the Canadian market's 12.2%. Recent strategic moves include a share repurchase program for up to 6.15% of its shares, potentially enhancing shareholder value by reducing dilution and aligning with strong cash flow forecasts despite recent profit declines.

- Insights from our recent growth report point to a promising forecast for VersaBank's business outlook.

- Take a closer look at VersaBank's balance sheet health here in our report.

Key Takeaways

- Click this link to deep-dive into the 22 companies within our Undervalued TSX Stocks Based On Cash Flows screener.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:VBNK

VersaBank

Provides various banking products and services in Canada and the United States.

High growth potential with excellent balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion