- United States

- /

- Banks

- /

- NasdaqGS:TCBK

TriCo Bancshares And 2 Other Prominent Dividend Stocks

Reviewed by Simply Wall St

As the major U.S. indexes rebound from recent losses, with the Dow Jones, S&P 500, and Nasdaq Composite all posting solid weekly gains, investors are once again turning their attention to dividend stocks as a reliable source of income in a fluctuating market. Amidst this backdrop of economic optimism and record highs in gold prices, TriCo Bancshares and two other prominent dividend stocks stand out for their potential to provide consistent returns through regular payouts.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Valley National Bancorp (VLY) | 4.79% | ★★★★★☆ |

| Peoples Bancorp (PEBO) | 5.81% | ★★★★★☆ |

| Huntington Bancshares (HBAN) | 3.91% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 6.53% | ★★★★★★ |

| Ennis (EBF) | 5.56% | ★★★★★★ |

| Douglas Dynamics (PLOW) | 3.83% | ★★★★★☆ |

| Dillard's (DDS) | 5.56% | ★★★★★★ |

| Columbia Banking System (COLB) | 6.09% | ★★★★★★ |

| Citizens & Northern (CZNC) | 6.09% | ★★★★★☆ |

| Archer-Daniels-Midland (ADM) | 3.53% | ★★★★★☆ |

Click here to see the full list of 142 stocks from our Top US Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

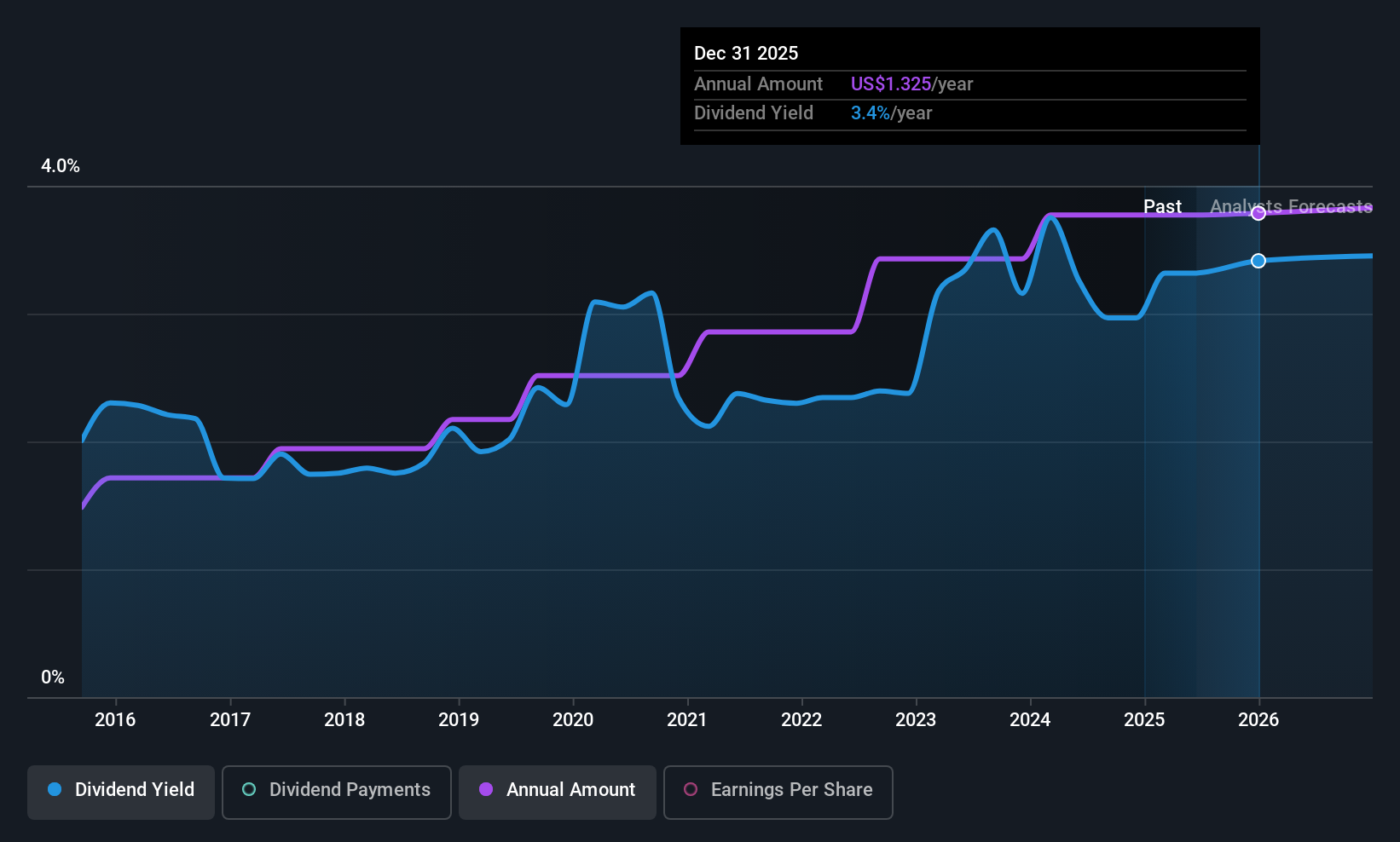

TriCo Bancshares (TCBK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: TriCo Bancshares is a bank holding company for Tri Counties Bank, offering commercial banking services to individual and corporate customers, with a market cap of approximately $1.35 billion.

Operations: TriCo Bancshares generates its revenue primarily from its Community Banking segment, which accounted for $385.49 million.

Dividend Yield: 3.2%

TriCo Bancshares maintains a stable dividend history with a current yield of 3.23%, though it falls short of the top tier in the US market. The company's dividends are well-covered by earnings, indicated by a payout ratio of 38.8%. Despite recent net income declines, TriCo continues to distribute consistent dividends, recently affirming its quarterly payment at $0.33 per share. Additionally, their ongoing share buyback program reflects confidence in financial stability and shareholder value enhancement.

- Click here to discover the nuances of TriCo Bancshares with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that TriCo Bancshares is priced lower than what may be justified by its financials.

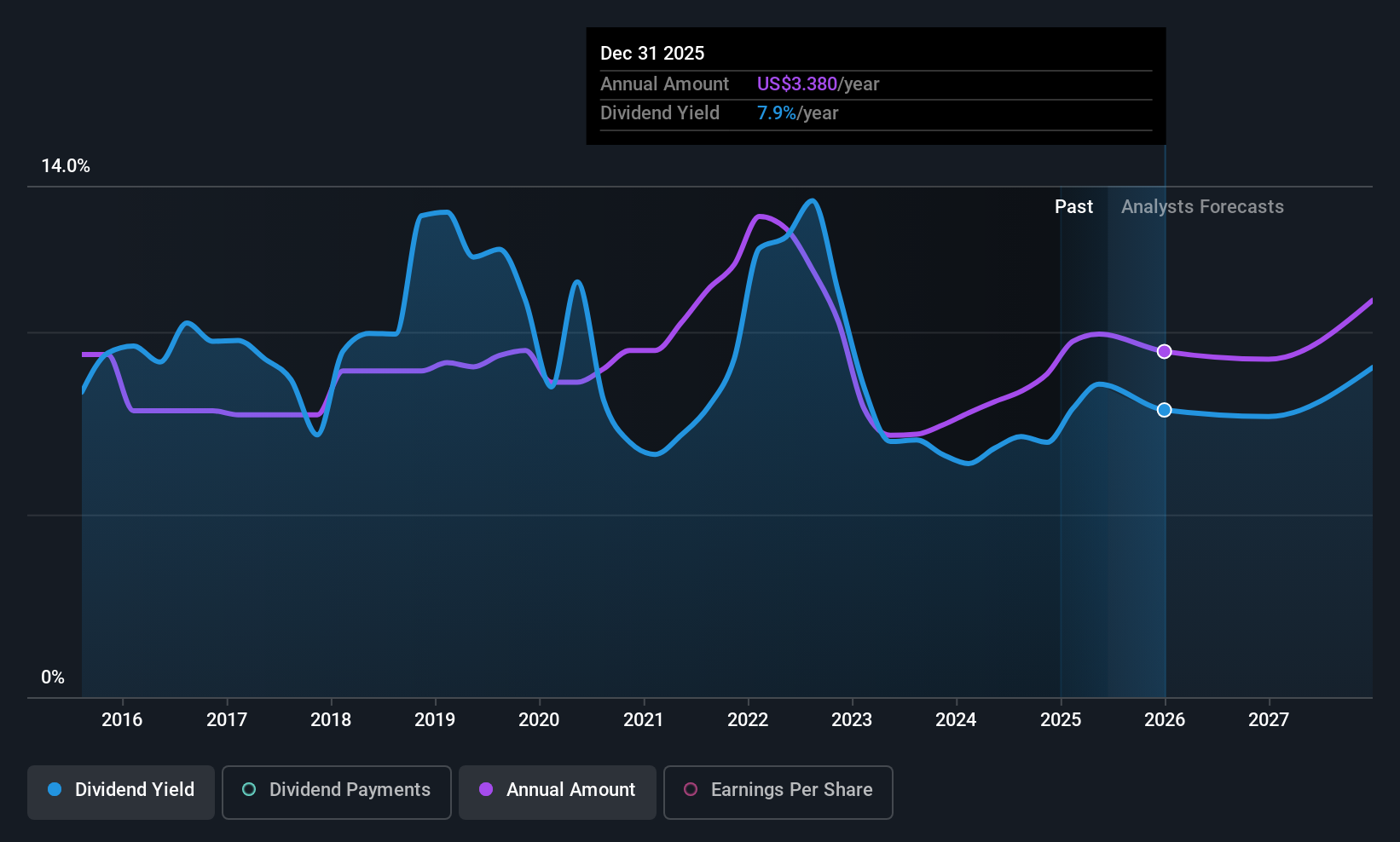

Artisan Partners Asset Management (APAM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Artisan Partners Asset Management Inc. is a publicly owned investment manager with a market cap of approximately $3.73 billion.

Operations: Artisan Partners Asset Management Inc. generates revenue primarily from its Investment Management Industry segment, which accounts for $1.14 billion.

Dividend Yield: 7.9%

Artisan Partners Asset Management offers a high dividend yield of 7.89%, ranking in the top 25% of US payers, but its dividend history is volatile with past drops over 20%. Recent earnings growth supports dividends, with a payout ratio of 81.2% covered by earnings and cash flows. Despite significant insider selling, recent revenue and net income increases reflect operational strength. The stock trades at a discount to its estimated fair value, suggesting potential investment appeal for value-focused investors.

- Delve into the full analysis dividend report here for a deeper understanding of Artisan Partners Asset Management.

- According our valuation report, there's an indication that Artisan Partners Asset Management's share price might be on the cheaper side.

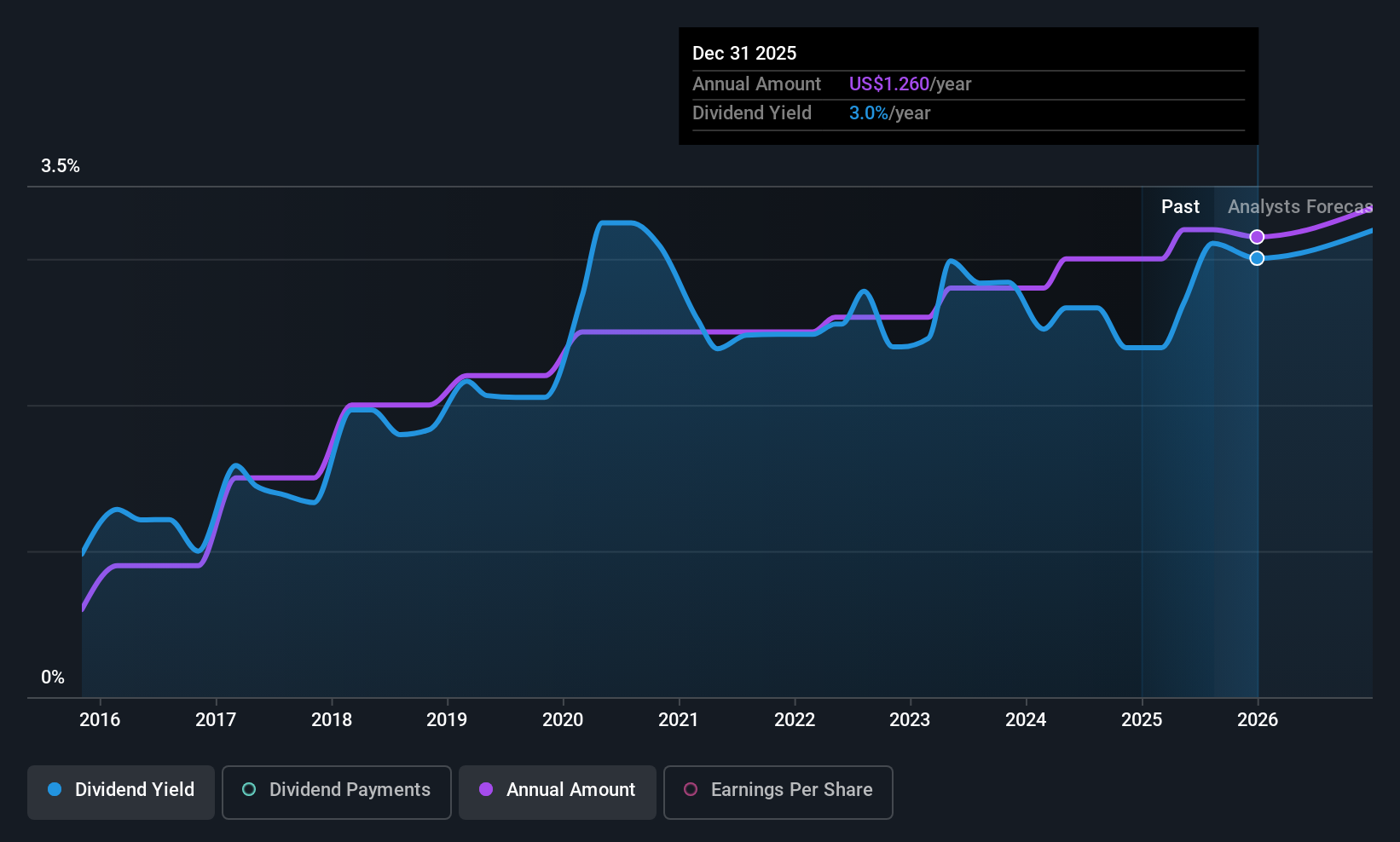

Employers Holdings (EIG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Employers Holdings, Inc., with a market cap of approximately $982.55 million, operates through its subsidiaries to offer workers' compensation insurance and services in the United States.

Operations: Employers Holdings generates its revenue primarily from its Insurance Operations segment, which accounted for $889.50 million.

Dividend Yield: 3.1%

Employers Holdings maintains a stable dividend history with consistent growth over the past decade. Its dividends are well-covered by earnings and cash flows, reflected in low payout ratios of 29.6% and 40.3%, respectively. Despite a forecasted decline in earnings, recent quarterly results showed modest income drops, while the company affirmed its regular dividend of US$0.32 per share for August 2025. Additionally, Employers Holdings completed a share buyback worth US$25.61 million, enhancing shareholder value through capital returns.

- Unlock comprehensive insights into our analysis of Employers Holdings stock in this dividend report.

- In light of our recent valuation report, it seems possible that Employers Holdings is trading behind its estimated value.

Taking Advantage

- Discover the full array of 142 Top US Dividend Stocks right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TriCo Bancshares might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TCBK

TriCo Bancshares

Operates as a bank holding company for Tri Counties Bank that provides commercial banking services to individual and corporate customers.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives