- United Kingdom

- /

- Capital Markets

- /

- LSE:ICG

Top UK Dividend Stocks To Watch In November 2025

Reviewed by Simply Wall St

As the FTSE 100 and FTSE 250 indices experience downturns amid weak trade data from China, investors in the UK market are closely watching how global economic challenges affect their portfolios. In such uncertain times, dividend stocks can offer a measure of stability and income potential, making them an attractive consideration for those navigating these turbulent market conditions.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Treatt (LSE:TET) | 3.84% | ★★★★★☆ |

| Seplat Energy (LSE:SEPL) | 7.59% | ★★★★★☆ |

| Pets at Home Group (LSE:PETS) | 6.32% | ★★★★★★ |

| OSB Group (LSE:OSB) | 6.34% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 5.22% | ★★★★★☆ |

| MONY Group (LSE:MONY) | 6.61% | ★★★★★★ |

| Macfarlane Group (LSE:MACF) | 5.72% | ★★★★★☆ |

| Keller Group (LSE:KLR) | 3.35% | ★★★★★☆ |

| Hargreaves Services (AIM:HSP) | 5.87% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 4.73% | ★★★★★☆ |

Click here to see the full list of 53 stocks from our Top UK Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

City of London Investment Group (LSE:CLIG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: City of London Investment Group PLC is a publicly owned investment manager with a market cap of £175.17 million.

Operations: City of London Investment Group PLC generates revenue primarily from its Asset Management segment, which amounts to $73.04 million.

Dividend Yield: 9.2%

City of London Investment Group's dividend yield is among the top 25% in the UK, offering an attractive 9.18%. However, its high payout ratio of 112.9% indicates dividends are not well covered by earnings, despite being supported by cash flows with an 84% cash payout ratio. Recent affirmations confirm a stable annual dividend of £0.33 per share, but auditor concerns about going concern status and significant insider selling raise caution for investors seeking reliability.

- Navigate through the intricacies of City of London Investment Group with our comprehensive dividend report here.

- The valuation report we've compiled suggests that City of London Investment Group's current price could be quite moderate.

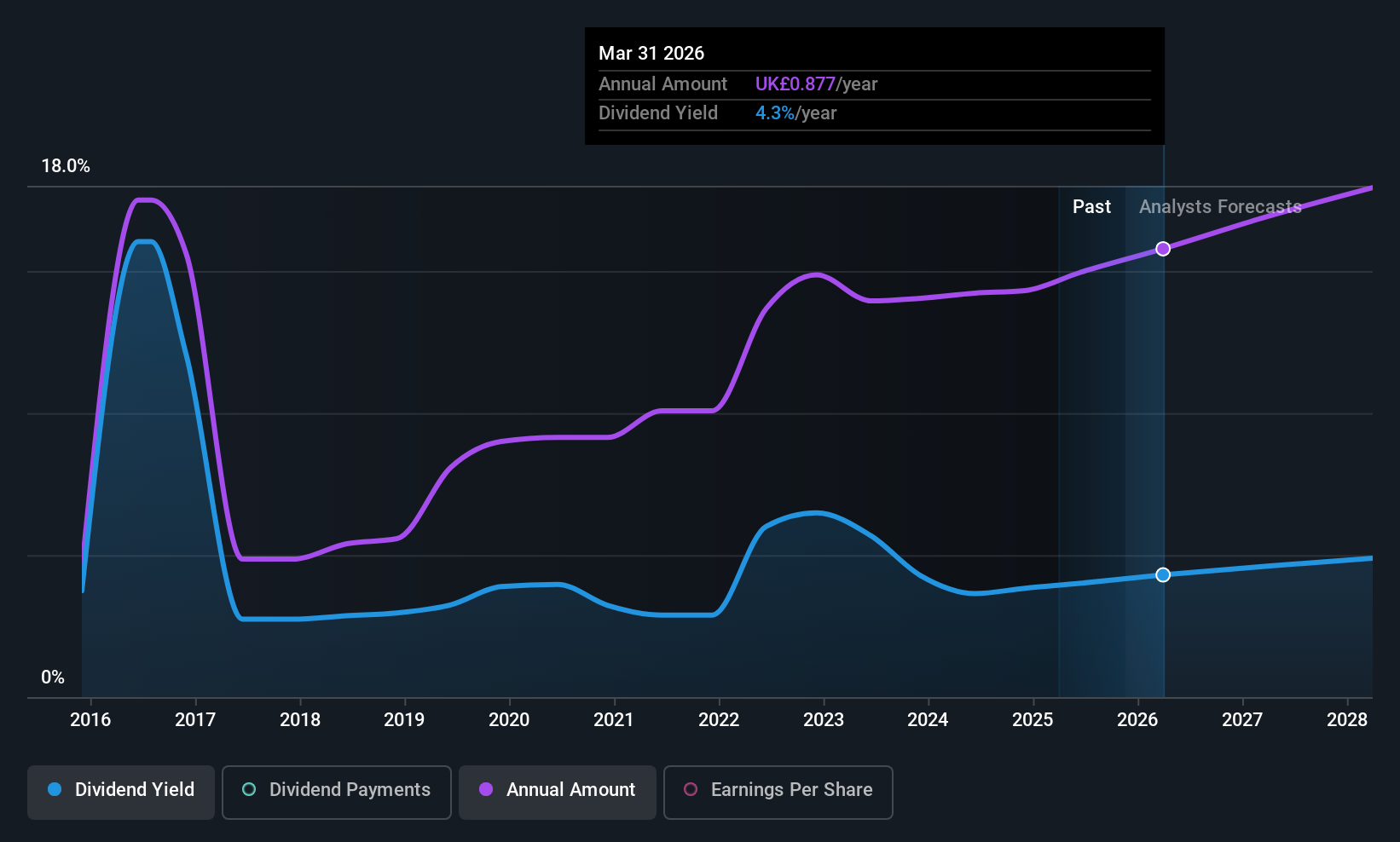

4imprint Group (LSE:FOUR)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: 4imprint Group plc is a direct marketer of promotional products operating in North America, the United Kingdom, and Ireland, with a market cap of £1.08 billion.

Operations: 4imprint Group plc generates revenue primarily from its operations in North America, contributing $1.33 billion, and the UK & Ireland, adding $25 million.

Dividend Yield: 4.7%

4imprint Group offers a reliable dividend yield of 4.73%, supported by a payout ratio of 57.2% and cash flow coverage at 54.2%. Despite being below the top tier UK dividend yields, its dividends have grown steadily over the past decade with minimal volatility. The stock trades at good value, 20.1% below fair value estimates, and analysts expect a price increase of 28.3%. However, earnings are forecasted to decline by an average of 9.9% annually for the next three years. Recent guidance suggests full-year revenue will reach $1.32 billion, aligning with high-end analyst forecasts.

- Unlock comprehensive insights into our analysis of 4imprint Group stock in this dividend report.

- Our comprehensive valuation report raises the possibility that 4imprint Group is priced lower than what may be justified by its financials.

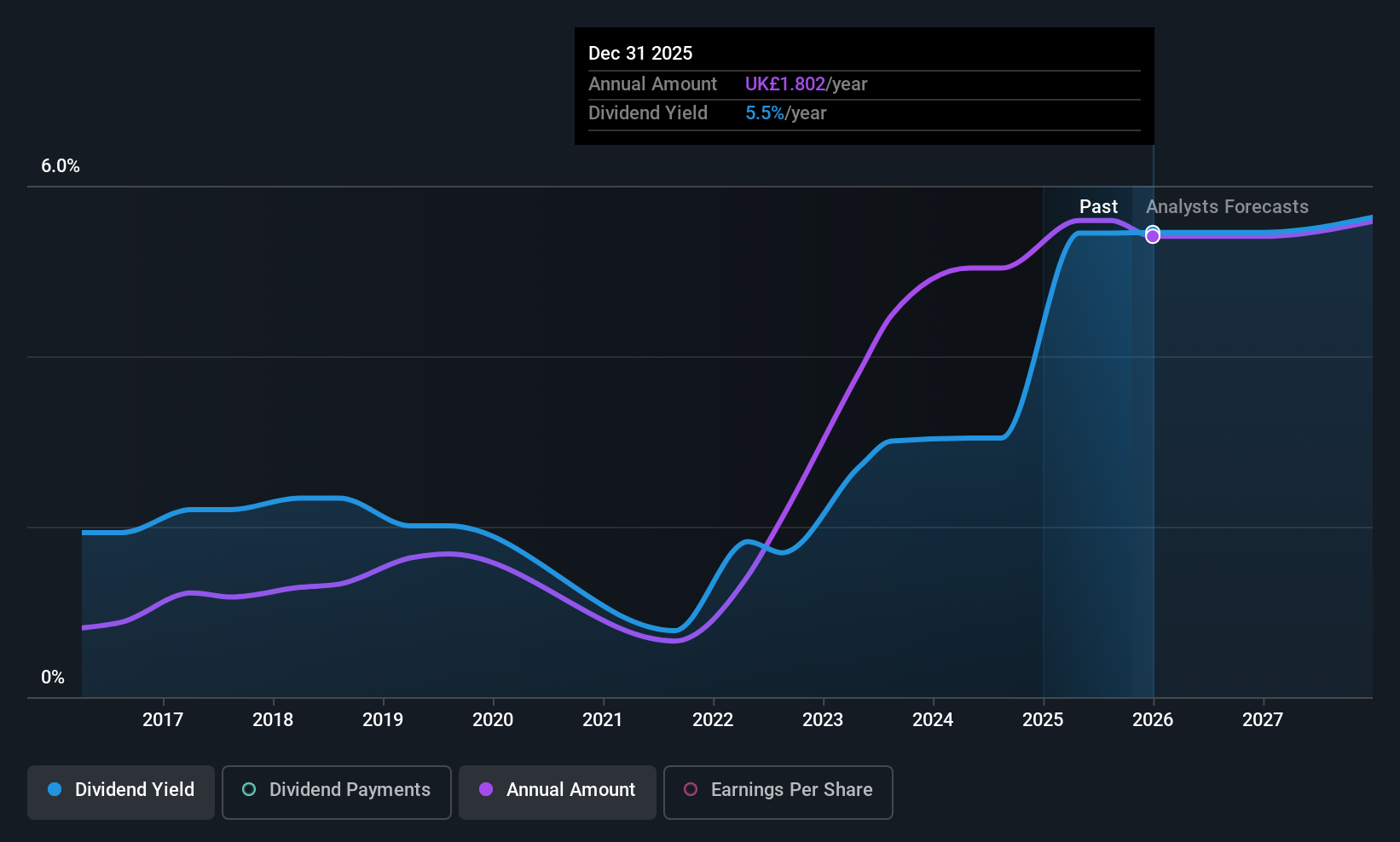

ICG (LSE:ICG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ICG plc is a private equity firm that focuses on direct and fund of fund investments, with a market cap of £5.89 billion.

Operations: ICG plc generates its revenue from three primary segments: Consolidated Entities (£48.10 million), Investment Company (IC) (£162.60 million), and Fund Management Company (FMC) (£892.20 million).

Dividend Yield: 4%

ICG's dividends are well-covered by earnings and cash flows, with payout ratios of 40.6% and 40.8% respectively, but its dividend yield of 4.04% lags behind the UK's top tier. Despite a history of volatility, recent growth is evident with an interim dividend increase to 27.7 pence per share. A strategic partnership with Amundi enhances distribution capabilities and positions ICG for future growth in private markets while trading at a significant discount to fair value estimates.

- Get an in-depth perspective on ICG's performance by reading our dividend report here.

- Our expertly prepared valuation report ICG implies its share price may be lower than expected.

Make It Happen

- Discover the full array of 53 Top UK Dividend Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:ICG

ICG

A private equity firm specializing in direct and fund of fund investments.

Very undervalued with outstanding track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)