- United Arab Emirates

- /

- Real Estate

- /

- DFM:EMAAR

Top Middle Eastern Dividend Stocks For December 2025

Reviewed by Simply Wall St

As most Gulf markets experience gains ahead of the Federal Reserve's anticipated interest rate decision, investors in the Middle East are closely monitoring how these developments might impact regional economic stability and corporate earnings. In this context, dividend stocks become particularly attractive as they offer potential income streams that can provide a cushion against market volatility and economic shifts.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Yeni Gimat Gayrimenkul Yatirim Ortakligi (IBSE:YGGYO) | 5.45% | ★★★★★★ |

| Turkiye Garanti Bankasi (IBSE:GARAN) | 3.14% | ★★★★★☆ |

| Saudi Awwal Bank (SASE:1060) | 6.23% | ★★★★★☆ |

| Riyad Bank (SASE:1010) | 6.58% | ★★★★★☆ |

| National General Insurance (P.J.S.C.) (DFM:NGI) | 7.63% | ★★★★★☆ |

| Göltas Göller Bölgesi Cimento Sanayi ve Ticaret (IBSE:GOLTS) | 3.54% | ★★★★★☆ |

| Emaar Properties PJSC (DFM:EMAAR) | 7.07% | ★★★★★☆ |

| Computer Direct Group (TASE:CMDR) | 8.13% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 5.80% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 5.76% | ★★★★★☆ |

Click here to see the full list of 62 stocks from our Top Middle Eastern Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Emaar Properties PJSC (DFM:EMAAR)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Emaar Properties PJSC, along with its subsidiaries, operates in property investment, development, and management both in the United Arab Emirates and internationally, with a market capitalization of AED 125.07 billion.

Operations: Emaar Properties PJSC generates revenue through three primary segments: Hospitality (AED 2.22 billion), Real Estate (AED 35.14 billion), and Leasing, Retail, and Related Activities (AED 7.46 billion).

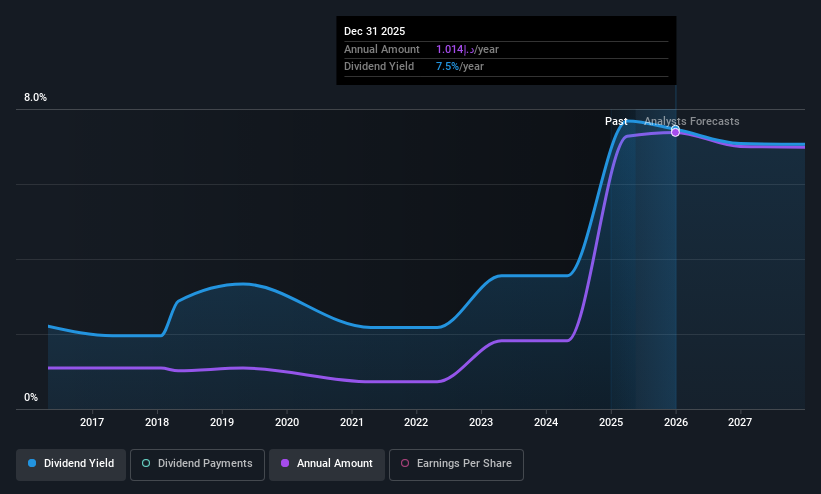

Dividend Yield: 7.1%

Emaar Properties PJSC's dividend appeal is bolstered by a solid payout ratio of 53.4%, indicating dividends are well-covered by earnings. The company trades at a significant discount to its estimated fair value, enhancing its attractiveness relative to peers. Despite a top-tier dividend yield of 7.07% in the AE market, Emaar has an unstable dividend track record with past volatility over 10 years. Recent strong earnings growth supports potential future stability and sustainability in payouts.

- Take a closer look at Emaar Properties PJSC's potential here in our dividend report.

- Our valuation report unveils the possibility Emaar Properties PJSC's shares may be trading at a discount.

National General Insurance (P.J.S.C.) (DFM:NGI)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: National General Insurance Co. (P.J.S.C.) operates in the United Arab Emirates, providing underwriting services for life, general insurance, and reinsurance, with a market cap of AED973.20 million.

Operations: National General Insurance Co. (P.J.S.C.) generates its revenue primarily from insurance activities amounting to AED764.20 million, supplemented by investment income of AED97.94 million.

Dividend Yield: 7.6%

National General Insurance (P.J.S.C.) offers a compelling dividend yield of 7.63%, placing it in the top quartile of dividend payers within the AE market. The company's dividends are well-supported by both earnings and cash flows, with payout ratios at 59.7% and 32.8%, respectively. However, its dividend history is marked by volatility over the past decade, despite recent increases in payments. Recent earnings showed a decline in Q3 net income to AED 20.32 million from AED 27.83 million year-on-year, reflecting potential challenges ahead for consistent payouts.

- Unlock comprehensive insights into our analysis of National General Insurance (P.J.S.C.) stock in this dividend report.

- Our comprehensive valuation report raises the possibility that National General Insurance (P.J.S.C.) is priced higher than what may be justified by its financials.

Yeni Gimat Gayrimenkul Yatirim Ortakligi (IBSE:YGGYO)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Yeni Gimat Gayrimenkul Yatirim Ortakligi A.S. operates in the real estate investment sector with a market capitalization of TRY30.81 billion.

Operations: Yeni Gimat Gayrimenkul Yatirim Ortakligi A.S. has not provided specific revenue segments in the available data.

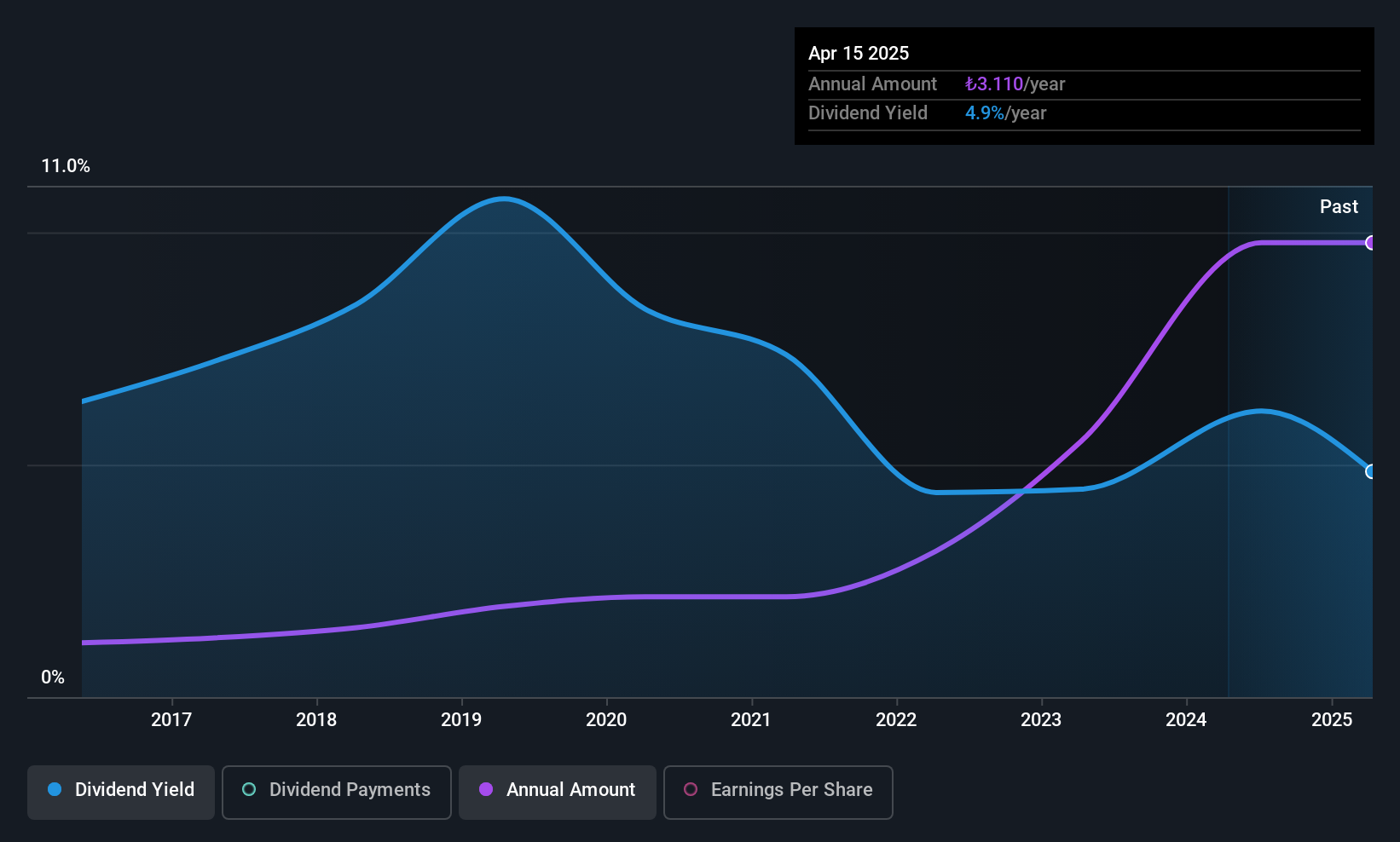

Dividend Yield: 5.4%

Yeni Gimat Gayrimenkul Yatirim Ortakligi offers a robust dividend yield of 5.45%, ranking it among the top quartile of dividend payers in Turkey. Its dividends are well-covered, with a payout ratio of 33.6% from earnings and 65% from cash flows, ensuring sustainability. Over the past decade, dividends have been stable and reliable without significant volatility. Despite recent declines in quarterly sales to TRY 740.97 million and net income to TRY 553.05 million, the company's strong dividend coverage remains intact.

- Get an in-depth perspective on Yeni Gimat Gayrimenkul Yatirim Ortakligi's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that Yeni Gimat Gayrimenkul Yatirim Ortakligi is trading beyond its estimated value.

Key Takeaways

- Click here to access our complete index of 62 Top Middle Eastern Dividend Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Emaar Properties PJSC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DFM:EMAAR

Emaar Properties PJSC

Engages in the property investment, development, and development management business in the United Arab Emirates and internationally.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion