- United States

- /

- Aerospace & Defense

- /

- NasdaqCM:RADA

Three Value Stocks Estimated To Be Below Their Intrinsic Worth In May 2025

Reviewed by Simply Wall St

Over the last 7 days, the United States market has dropped 2.7%, yet it has risen by 9.1% over the past year, with earnings expected to grow by 14% per annum in the coming years. In this environment, identifying stocks that are estimated to be below their intrinsic worth can provide opportunities for investors seeking value amidst fluctuating market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Mid Penn Bancorp (NasdaqGM:MPB) | $26.65 | $52.26 | 49% |

| Burke & Herbert Financial Services (NasdaqCM:BHRB) | $55.38 | $108.55 | 49% |

| Super Group (SGHC) (NYSE:SGHC) | $8.41 | $16.48 | 49% |

| UMH Properties (NYSE:UMH) | $16.47 | $32.47 | 49.3% |

| Advanced Flower Capital (NasdaqGM:AFCG) | $4.72 | $9.39 | 49.7% |

| Excelerate Energy (NYSE:EE) | $28.93 | $57.38 | 49.6% |

| TXO Partners (NYSE:TXO) | $15.30 | $29.92 | 48.9% |

| ZEEKR Intelligent Technology Holding (NYSE:ZK) | $29.17 | $57.33 | 49.1% |

| FinWise Bancorp (NasdaqGM:FINW) | $14.445 | $28.38 | 49.1% |

| Clearfield (NasdaqGM:CLFD) | $38.30 | $74.77 | 48.8% |

Let's review some notable picks from our screened stocks.

Lindblad Expeditions Holdings (NasdaqCM:LIND)

Overview: Lindblad Expeditions Holdings, Inc. offers marine expedition adventures and travel experiences globally, with a market cap of $557.47 million.

Operations: The company's revenue is divided into two main segments: Lindblad, generating $436.11 million, and Land Experiences, contributing $234.72 million.

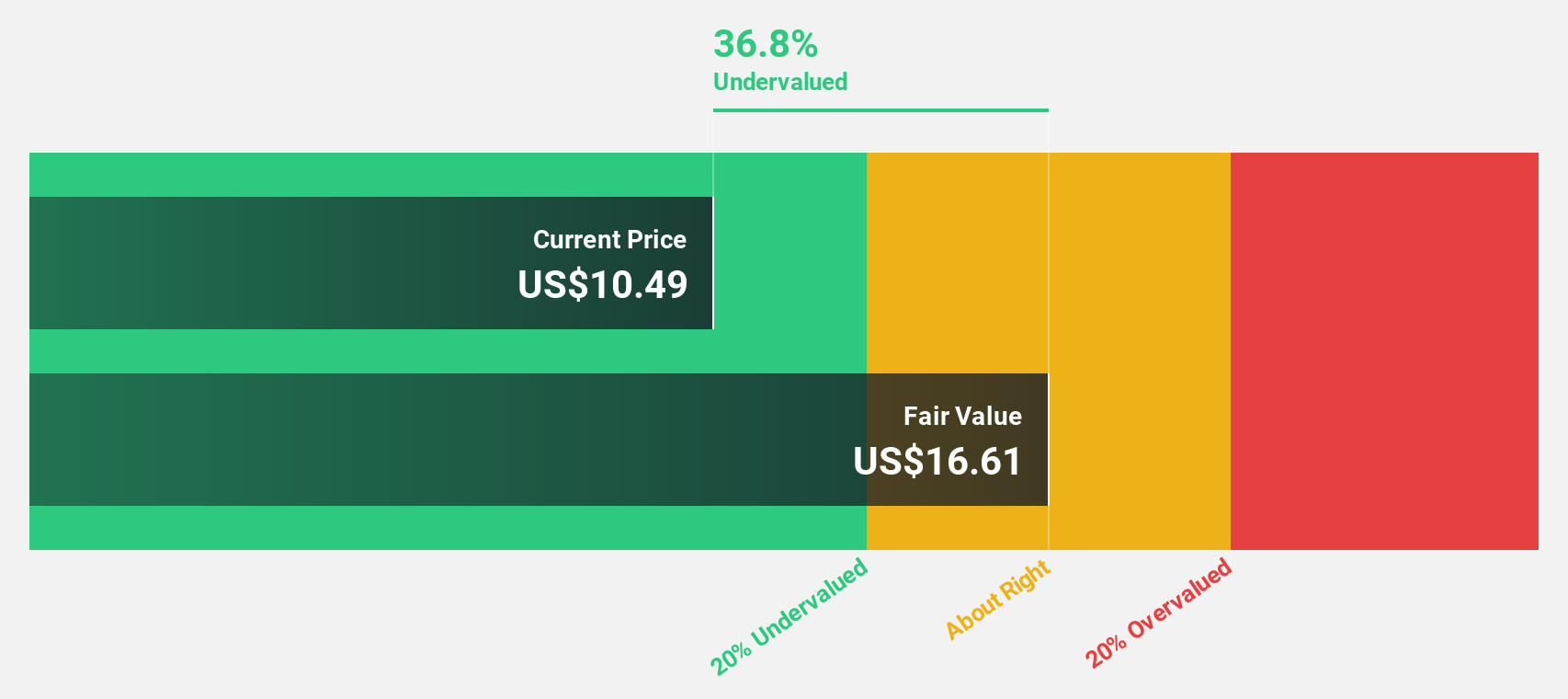

Estimated Discount To Fair Value: 38.1%

Lindblad Expeditions Holdings is trading at US$10.19, significantly below its estimated fair value of US$16.45, indicating potential undervaluation based on cash flows. Recent earnings reports show improved financial performance with Q1 2025 sales at US$179.72 million and a net income of US$1.16 million, reversing a loss from the previous year. The company forecasts tour revenues between $700 million to $750 million for 2025 and has formed strategic alliances to expand European river cruising operations through 2028.

- Upon reviewing our latest growth report, Lindblad Expeditions Holdings' projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of Lindblad Expeditions Holdings stock in this financial health report.

RADA Electronic Industries (NasdaqCM:RADA)

Overview: RADA Electronic Industries Ltd. is a defense technology company that develops, manufactures, markets, and sells defense electronics to air forces and companies globally, with a market cap of $490.92 million.

Operations: RADA Electronic Industries Ltd. generates revenue through the development, manufacturing, marketing, and sale of defense electronics to air forces and companies worldwide.

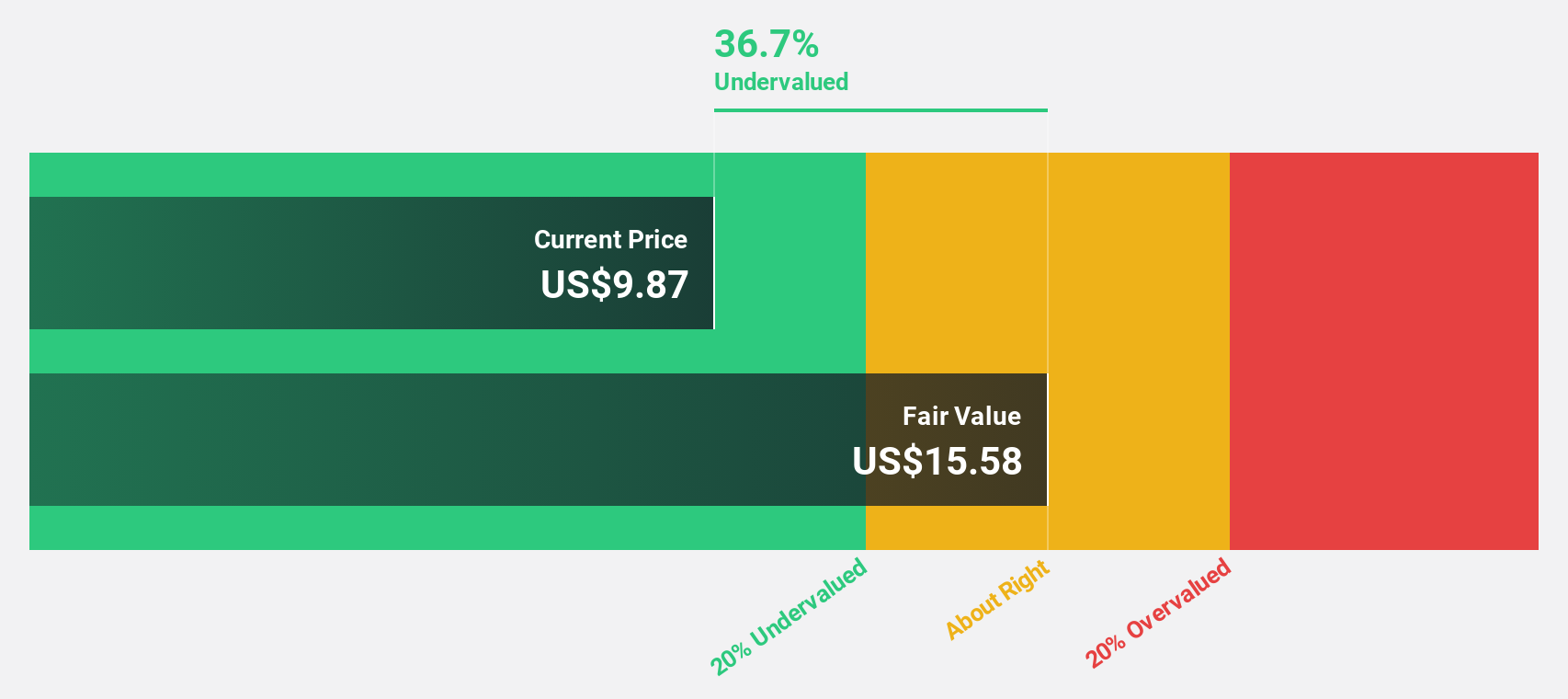

Estimated Discount To Fair Value: 36.7%

RADA Electronic Industries, priced at $9.87, is trading 36.7% below its estimated fair value of $15.58, highlighting potential undervaluation based on cash flows. The company's earnings are projected to grow significantly at 83.7% per year, outpacing the US market's growth rate of 15%. However, profit margins have decreased from 19.5% last year to 5.3%, which may be a concern for investors despite the expected revenue growth of 16.1% annually surpassing the market average.

- The growth report we've compiled suggests that RADA Electronic Industries' future prospects could be on the up.

- Dive into the specifics of RADA Electronic Industries here with our thorough financial health report.

West Bancorporation (NasdaqGS:WTBA)

Overview: West Bancorporation, Inc. is a financial holding company that offers community banking and trust services to individuals and small- to medium-sized businesses in the United States, with a market cap of approximately $327.30 million.

Operations: The company generates revenue primarily through its community banking segment, which accounted for $82.85 million.

Estimated Discount To Fair Value: 36.7%

West Bancorporation, trading at US$19.34, is priced 36.7% below its estimated fair value of US$30.55, suggesting it may be undervalued based on cash flows. The company's earnings grew by 18% last year and are expected to grow significantly over the next three years, surpassing the US market's growth rate. Recent results show net income increased to US$7.84 million from US$5.81 million a year ago, with a steady dividend of $0.25 per share declared for May 2025.

- Our earnings growth report unveils the potential for significant increases in West Bancorporation's future results.

- Click here and access our complete balance sheet health report to understand the dynamics of West Bancorporation.

Seize The Opportunity

- Investigate our full lineup of 171 Undervalued US Stocks Based On Cash Flows right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:RADA

RADA Electronic Industries

RADA Electronic Industries Ltd., a defense technology company, develops, manufactures, markets, and sells defense electronics to various air forces and companies worldwide.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives