- United States

- /

- Life Sciences

- /

- NasdaqGS:BRKR

Three Stocks That May Be Trading Below Estimated Value In June 2025

Reviewed by Simply Wall St

As the United States market continues to navigate the complexities of US-China trade talks, major indices like the S&P 500 and Nasdaq Composite have reached their highest levels since February. In this environment, identifying stocks that may be trading below their estimated value can present opportunities for investors looking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Verra Mobility (VRRM) | $24.14 | $47.84 | 49.5% |

| TXO Partners (TXO) | $15.03 | $29.95 | 49.8% |

| TAL Education Group (TAL) | $10.83 | $21.61 | 49.9% |

| Reddit (RDDT) | $117.53 | $229.23 | 48.7% |

| Mid Penn Bancorp (MPB) | $26.64 | $52.26 | 49% |

| Lyft (LYFT) | $15.63 | $30.54 | 48.8% |

| Insteel Industries (IIIN) | $36.31 | $72.06 | 49.6% |

| First Busey (BUSE) | $22.82 | $45.56 | 49.9% |

| Brookline Bancorp (BRKL) | $10.52 | $20.74 | 49.3% |

| Berkshire Hills Bancorp (BHLB) | $25.19 | $49.25 | 48.9% |

Here's a peek at a few of the choices from the screener.

Enphase Energy (ENPH)

Overview: Enphase Energy, Inc. designs, develops, manufactures, and sells home energy solutions for the solar photovoltaic industry globally, with a market cap of approximately $5.40 billion.

Operations: The company generates revenue of $1.42 billion from designing, manufacturing, and selling solutions for the solar photovoltaic industry.

Estimated Discount To Fair Value: 28.5%

Enphase Energy's stock appears undervalued, trading at US$43.26 against a fair value estimate of US$60.52, based on discounted cash flow analysis. Despite a decline in profit margins from 15.1% to 10.4%, earnings are projected to grow significantly at 24.16% annually, outpacing the broader U.S. market growth rate of 14.4%. Recent projects in the U.S., such as large-scale solar installations using Enphase microinverters, highlight strong demand and potential for enhanced cash flows through domestic content tax credits and energy cost savings initiatives.

- Insights from our recent growth report point to a promising forecast for Enphase Energy's business outlook.

- Delve into the full analysis health report here for a deeper understanding of Enphase Energy.

Bruker (BRKR)

Overview: Bruker Corporation, with a market cap of $5.80 billion, develops, manufactures, and distributes scientific instruments and analytical and diagnostic solutions globally.

Operations: The company's revenue is primarily derived from its BSI CALID segment at $1.15 billion, followed by BSI Nano at $1.11 billion, BSI BioSpin at $930.70 million, and BEST at $269.20 million.

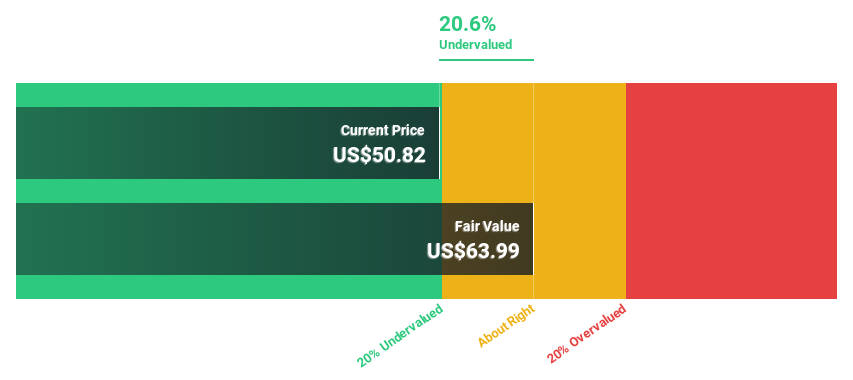

Estimated Discount To Fair Value: 12.4%

Bruker is trading at US$39.21, below its fair value estimate of US$44.76, suggesting potential undervaluation based on cash flows. Although its revenue growth forecast of 4.7% annually lags behind the U.S. market, Bruker's earnings are expected to grow significantly at 45.5% per year, surpassing market averages. Recent innovations in mass spectrometry and proteomics enhance its product offerings, potentially boosting future cash flows despite current challenges with profit margins and legal settlements impacting financials.

- Our comprehensive growth report raises the possibility that Bruker is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of Bruker stock in this financial health report.

Texas Capital Bancshares (TCBI)

Overview: Texas Capital Bancshares, Inc., the bank holding company for Texas Capital Bank, is a full-service financial services firm offering tailored solutions to businesses, entrepreneurs, and individual clients with a market cap of approximately $3.49 billion.

Operations: The company's revenue is primarily derived from its banking segment, which generated approximately $891.50 million.

Estimated Discount To Fair Value: 33.8%

Texas Capital Bancshares, trading at US$77.96, is below its fair value estimate of US$117.71, indicating undervaluation based on cash flows. Revenue and earnings are projected to grow at 17.4% and 44.2% annually, respectively, outpacing the U.S. market averages. However, profit margins have declined from last year’s figures of 16% to 9.1%. Recent strategic board appointments and product integrations aim to enhance operational efficiency and strengthen financial performance amidst buybacks and net charge-offs adjustments.

- The growth report we've compiled suggests that Texas Capital Bancshares' future prospects could be on the up.

- Click here to discover the nuances of Texas Capital Bancshares with our detailed financial health report.

Seize The Opportunity

- Delve into our full catalog of 169 Undervalued US Stocks Based On Cash Flows here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Bruker might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BRKR

Bruker

Develops, manufactures, and distributes scientific instruments, and analytical and diagnostic solutions in the United States, Europe, the Asia Pacific, and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion