- United States

- /

- Biotech

- /

- NasdaqGS:RXRX

Recursion Pharmaceuticals (NasdaqGS:RXRX) Reports Increased Net Loss Despite Rising Sales

Reviewed by Simply Wall St

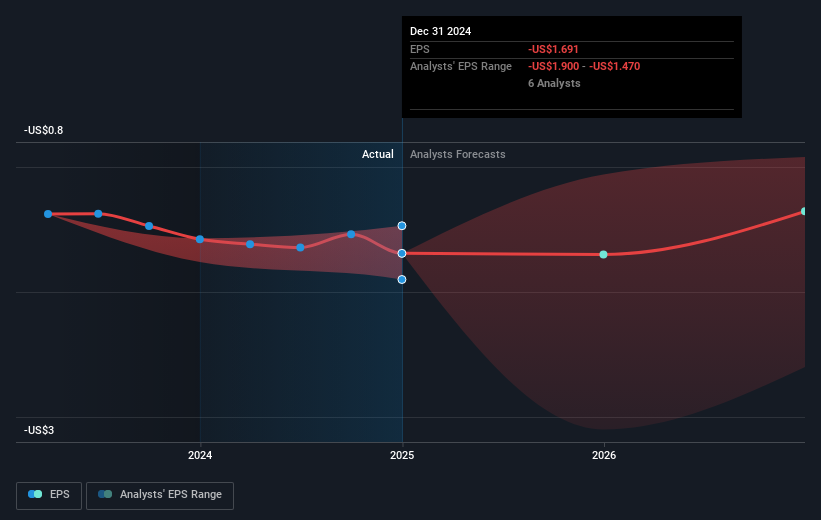

Recursion Pharmaceuticals (NasdaqGS:RXRX) reported a 10% decline in its share price last week as it announced first-quarter 2025 results with an increased net loss despite rising sales and revenue. However, the company's clinical progress, highlighted by preliminary results from its REC-4881 trial for Familial Adenomatous Polyposis, may have provided some counterbalance to this decline. While its price movement aligns with a broader market drop of 3%, the market has seen gains over the past year, suggesting Recursion's financial challenges may have weighed more heavily on short-term investor sentiment.

The recent decline in Recursion Pharmaceuticals' share price following the announcement of increased net loss despite rising sales and revenue underscores the company's current financial challenges. Over a longer period, the company's total return was a 33.87% decline over the past three years, reflecting ongoing struggles to balance cash flow against high R&D expenses and clinical uncertainties. Compared to broader market trends, Recursion has also underperformed, trailing both the US Market's 9% gain and the US Biotechs industry's 13.2% decline over the past year, highlighting investor concerns over profitability and financial stability.

The news of clinical progress in trials like REC-4881 does provide a glimmer of optimism for future revenue growth as these advancements might lead to marketable products. However, revenue and earnings forecasts remain clouded by high cash burn and reliance on unpredictable milestone payments, indicating potential volatility. The company's current US$5.72 share price trades at a discount to the consensus price target of US$8.71, suggesting that analysts see potential upside if Recursion can overcome its financial hurdles and realize expected efficiencies and computational advances. This gap highlights the market's cautious stance, driven by uncertainty over achieving the projected growth targets.

Understand Recursion Pharmaceuticals' earnings outlook by examining our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RXRX

Recursion Pharmaceuticals

Operates as a clinical-stage biotechnology company, engages in the decoding biology and chemistry by integrating technological innovations across biology, chemistry, automation, data science, and engineering to industrialize drug discovery in the United States.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)