- Canada

- /

- Metals and Mining

- /

- TSX:NGD

New Gold (TSX:NGD) Acquires Remaining Stake In New Afton Mine

Reviewed by Simply Wall St

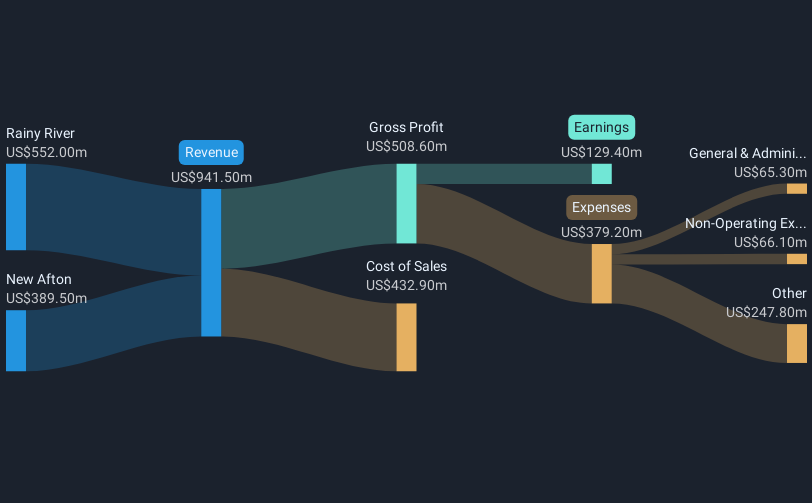

New Gold (TSX:NGD) recently finalized the acquisition of the remaining 19.9% free cash flow interest in its New Afton Mine, signaling its commitment to enhancing shareholder value through fully consolidated cash flows. The company's Q1 earnings report showed a reduction in net loss, further supported by confirmed production guidance for 2025. As the company enhanced its financial position, bond yields retreated, and the major stock indexes began to recover from earlier declines. Despite these positive developments, New Gold's price move of 38% over the last quarter was in line with markets showing broader rebounds and would not defy traditional market trends.

You should learn about the 1 warning sign we've spotted with New Gold.

The recent acquisition announcement strengthens New Gold's position to fully benefit from New Afton's cash flows, potentially boosting future revenue and earnings projections. This move aligns with strategies to extend mine life and increase production, factors that may improve operational efficiencies and profit margins. The focus on consolidating cash flow interests is likely to translate into enhanced shareholder returns, as evidenced by the company's total return of 261.35% over five years. This return provides a stark contrast against New Gold's annualized return over the past year, which exceeded both the Canadian Market and the Canadian Metals and Mining industry.

These developments are expected to impact New Gold's revenue, which analysts forecast to grow significantly over the next three years, with earnings reflecting a similar trajectory. However, potential risks from operational challenges, deferred capital projects, and reliance on gold prices could influence these forecasts. The current share price, with a discount of 18.64% to the consensus price target of CA$6.42, indicates a significant potential upside based on analyst predictions. Investors should weigh these forecasts against their own understanding of the company's strategic moves and market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if New Gold might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:NGD

New Gold

An intermediate gold mining company, engages in the development and operation of mineral properties in Canada.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives