- United States

- /

- Banks

- /

- NYSE:MTB

M&T Bank (NYSE:MTB) Declares US$1.35 Cash Dividend Per Share

Reviewed by Simply Wall St

M&T Bank (NYSE:MTB) recently affirmed a quarterly dividend of $1.35 per share, underscoring its commitment to shareholder value. Over the past month, the company's stock price experienced a notable increase of 16%. This upward movement in M&T Bank’s shares might partially reflect investor appreciation for the consistent dividend payout in an environment where broader markets, such as the S&P 500, saw fluctuations and slight declines. Meanwhile, heightened Treasury yields and uncertainty over pending tax legislation dominated market news, possibly adding volatility to other sectors. Nevertheless, M&T Bank maintained a positive trend despite these broader market dynamics.

Buy, Hold or Sell M&T Bank? View our complete analysis and fair value estimate and you decide.

The recent affirmation of M&T Bank’s quarterly dividend of $1.35 per share underscores a reinforced commitment to shareholder value, potentially influencing investor sentiment positively. Such actions align with its overall strategy to bolster capital management and liquidity strength. As the company focuses on optimizing loan and expense strategies, the underlying message to investors is one of financial stability and consistent returns.

Over the past five years, M&T Bank has provided a total shareholder return of more than 100%. This long-term performance significantly outpaces the broader US market's return of 11.7% over the past year, demonstrating the bank's resilience amidst varied market conditions. However, when looking at the past year, M&T Bank aligned with the US Banks industry, which yielded a 21.8% return, reaffirming its strong competitive positioning within the sector.

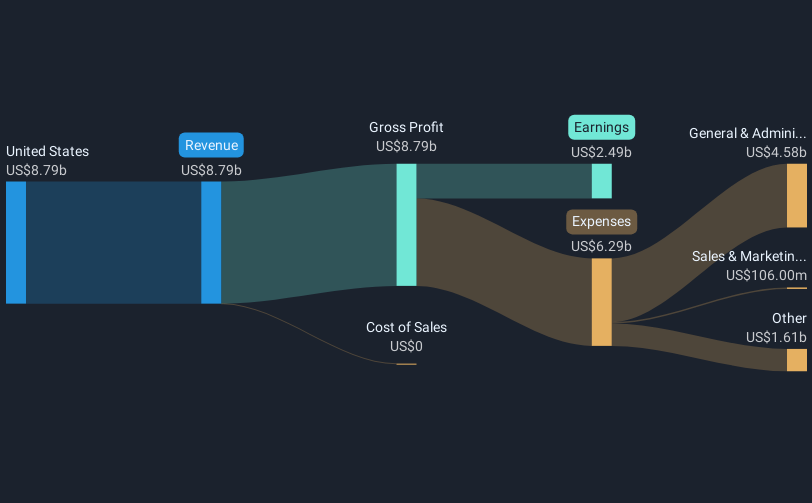

The recent share price increase and expressed price target of US$196.97 position the bank’s current share price at a discount of approximately 6% to the target, reflecting potential growth in revenue and earnings. Analysts anticipate revenue to grow by 5.1% annually, with earnings projected to reach US$2.9 billion by 2028. This forecast suggests a robust outlook despite potential risks such as declining deposits or increased expenses. The increased focus on fee income and efficient balance sheet management is expected to further enhance M&T Bank’s financial performance, potentially bridging the gap to the analysts' forecasted price target.

Click to explore a detailed breakdown of our findings in M&T Bank's financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade M&T Bank, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MTB

M&T Bank

Operates as a bank holding company for Manufacturers and Traders Trust Company and Wilmington Trust, National Association that provides retail and commercial banking products and services in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives