- United States

- /

- Capital Markets

- /

- NYSE:MS

Morgan Stanley (NYSE:MS) Authorizes US$20 Billion Buyback And Raises Dividend

Reviewed by Simply Wall St

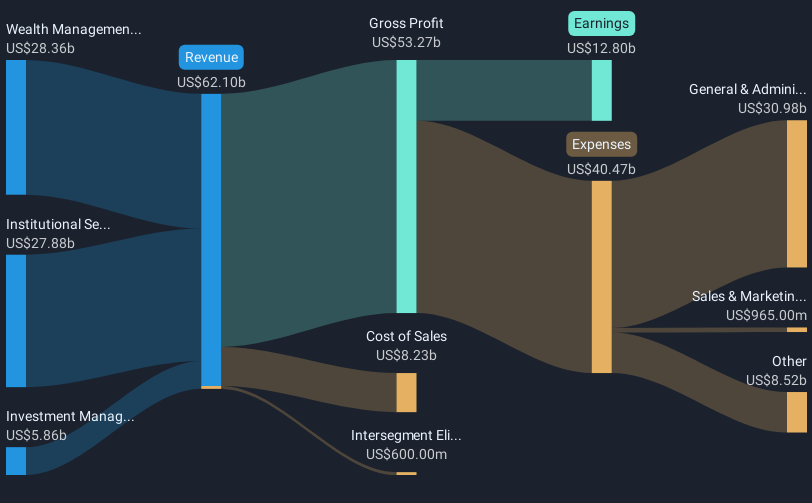

Morgan Stanley (NYSE:MS) has recently announced significant financial maneuvers, including a decision to repurchase up to $20,000 million worth of its shares and an increase in its quarterly dividend from $0.925 to $1.00 per share. These enhancements in shareholder value propositions could offer substantial context to the company's 18% share price increase over the last quarter. With the market also experiencing robust growth, with the S&P 500 and Nasdaq hitting record highs before recent slight declines, Morgan Stanley's strategic announcements may have further bolstered its performance, aligning with the broader positive market trends.

Morgan Stanley has 2 risks we think you should know about.

The recent announcement of Morgan Stanley's decision to repurchase up to US$20 billion in shares and increase quarterly dividends to US$1.00 per share may positively influence the company's overall narrative. With a solid footing in global equities and Asia, these moves may further bolster revenue growth and provide additional shareholder returns. Over the past five years, the company's total return, including share price appreciation and dividends, amounted to 248.91%, highlighting a robust long-term performance.

Compared to the previous year's market trends, Morgan Stanley outperformed both the S&P 500 and the US Capital Markets industry, achieving returns exceeding the market's 13.9% and the industry's 34.2%. Nevertheless, analysts project a slower revenue growth of 3.3% annually for Morgan Stanley, lower than the expected US market growth of 8.7% per year. With earnings forecast to grow at 2.9% annually, these figures suggest potential moderate growth in contrast to some expectations.

In terms of valuation, the current share price of US$135.90 stands slightly above analyst consensus estimates, which suggest a fair value of approximately US$124.97. This indicates a share price discount of 8.7% compared to immediate pricing expectations. The potential impact from the recent buyback and dividend declaration could improve future earnings forecasts, although market volatility and geopolitical concerns need to be considered. While Morgan Stanley maintains its competitive edge, these factors may affect revenue and earnings performance in the near term.

Understand Morgan Stanley's earnings outlook by examining our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MS

Morgan Stanley

A financial holding company, provides various financial products and services to governments, financial institutions, and individuals in the Americas, Asia, Europe, Middle East, and Africa.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives