Global Market's Trio Of Value Stocks Trading Below Estimated Worth

Reviewed by Simply Wall St

In the midst of recent global market volatility, spurred by tariff threats and fluctuating Treasury yields, investors are increasingly seeking opportunities to capitalize on stocks that may be trading below their intrinsic value. Identifying undervalued stocks can be particularly appealing in such an environment, as these equities often present potential for growth when market conditions stabilize or improve.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Pansoft (SZSE:300996) | CN¥14.23 | CN¥28.33 | 49.8% |

| Xiamen Amoytop Biotech (SHSE:688278) | CN¥77.56 | CN¥153.79 | 49.6% |

| Fuji (TSE:6134) | ¥2254.00 | ¥4466.70 | 49.5% |

| Shenzhen Yinghe Technology (SZSE:300457) | CN¥17.28 | CN¥34.49 | 49.9% |

| adidas (XTRA:ADS) | €218.70 | €433.38 | 49.5% |

| Clemondo Group (OM:CLEM) | SEK10.70 | SEK21.24 | 49.6% |

| TLB (KOSDAQ:A356860) | ₩17600.00 | ₩34900.33 | 49.6% |

| BalnibarbiLtd (TSE:3418) | ¥1162.00 | ¥2305.50 | 49.6% |

| Nexstim (HLSE:NXTMH) | €7.86 | €15.69 | 49.9% |

| Northern Data (DB:NB2) | €24.78 | €49.42 | 49.9% |

Let's dive into some prime choices out of the screener.

Xiamen Amoytop Biotech (SHSE:688278)

Overview: Xiamen Amoytop Biotech Co., Ltd. focuses on the research, development, production, and sale of recombinant protein drugs in China with a market cap of CN¥30.42 billion.

Operations: The company generates revenue primarily from its biologics segment, amounting to CN¥2.95 billion.

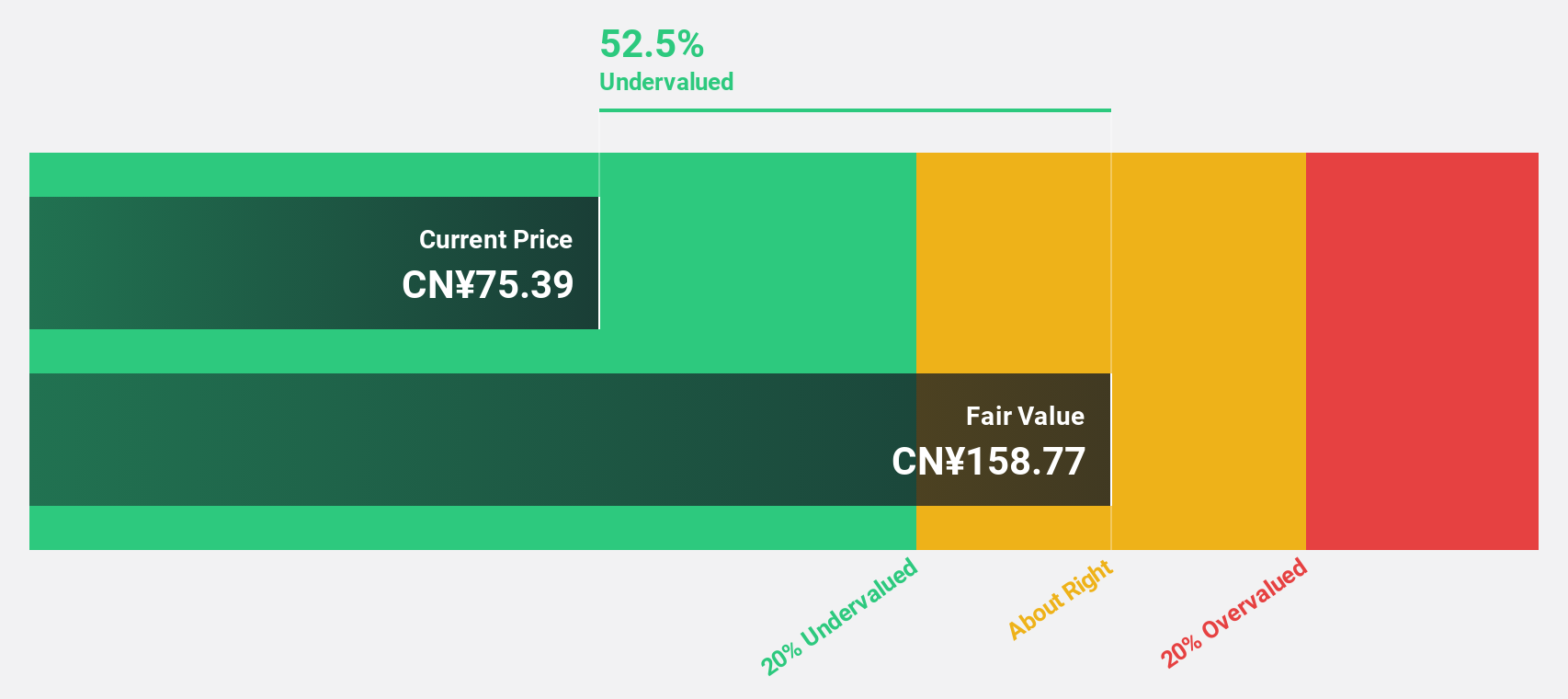

Estimated Discount To Fair Value: 49.6%

Xiamen Amoytop Biotech is trading at CN¥77.56, significantly below its estimated fair value of CN¥153.79, suggesting it may be undervalued based on cash flows. The company's earnings grew by 46.8% last year and are forecast to grow 28.5% annually, outpacing the market's growth rate. Recent transactions include a 5.7% stake acquisition by Tibet Trust Corporation for CNY 1.3 billion, highlighting investor interest amidst robust financial performance and growth prospects.

- In light of our recent growth report, it seems possible that Xiamen Amoytop Biotech's financial performance will exceed current levels.

- Take a closer look at Xiamen Amoytop Biotech's balance sheet health here in our report.

Visional (TSE:4194)

Overview: Visional, Inc., along with its subsidiaries, offers human resources platform solutions in Japan and has a market cap of approximately ¥364.20 billion.

Operations: The company's revenue is primarily derived from its HR Tech segment, which generated ¥69.50 billion, and its Incubation segment, contributing ¥2.10 billion.

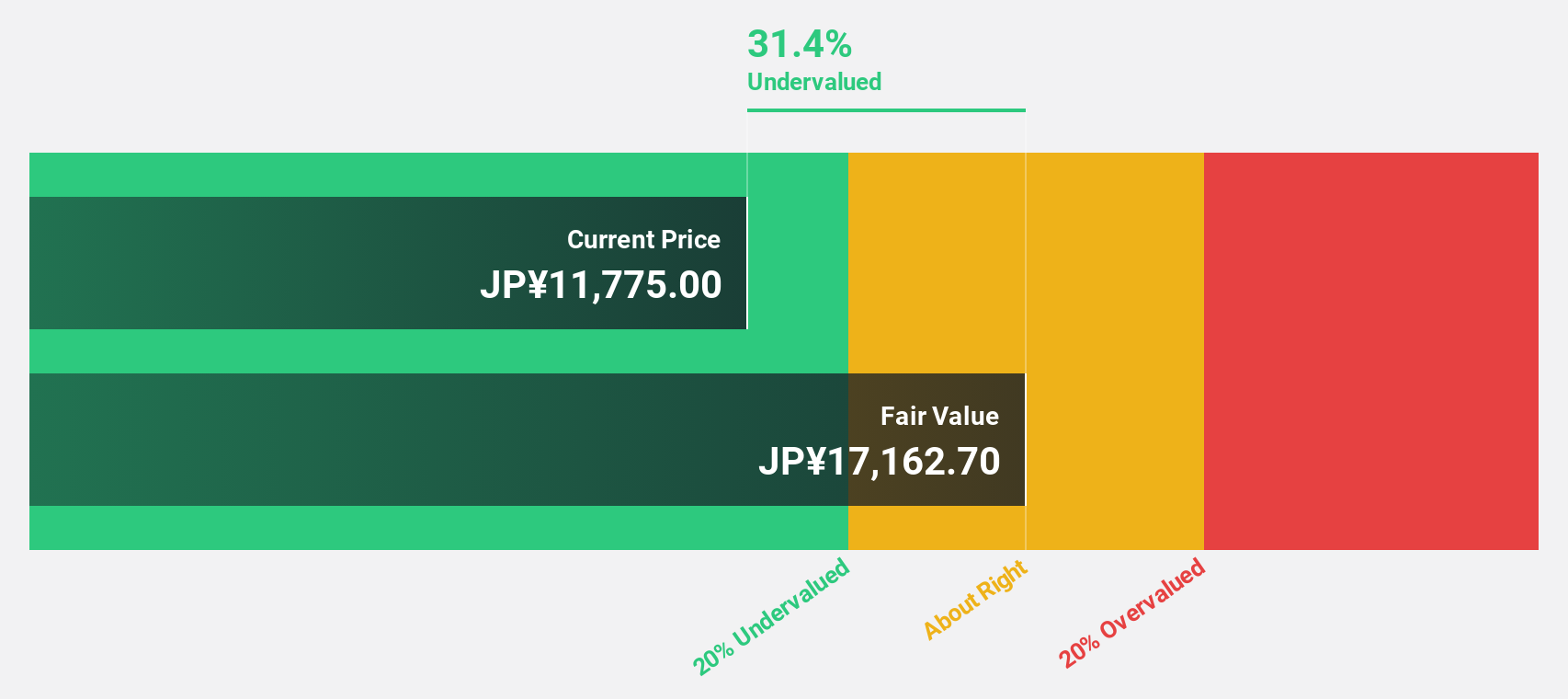

Estimated Discount To Fair Value: 43.7%

Visional is trading at ¥9,211, considerably below its estimated fair value of ¥16,356.88, indicating potential undervaluation based on cash flows. Earnings are projected to grow at 14.7% annually, surpassing the JP market's growth rate of 7.6%. Revenue is expected to increase by 12.3% per year, also outpacing market averages. The company's return on equity is forecasted to reach a high level of 22.8% within three years, enhancing its investment appeal.

- Upon reviewing our latest growth report, Visional's projected financial performance appears quite optimistic.

- Dive into the specifics of Visional here with our thorough financial health report.

KOSÉ (TSE:4922)

Overview: KOSÉ Corporation is a company that manufactures and sells cosmetics and cosmetology products both in Japan and internationally, with a market cap of ¥313.40 billion.

Operations: The company's revenue is primarily derived from its Cosmetics Business, which accounts for ¥256.70 billion, followed by Cosmetaries at ¥64.72 billion.

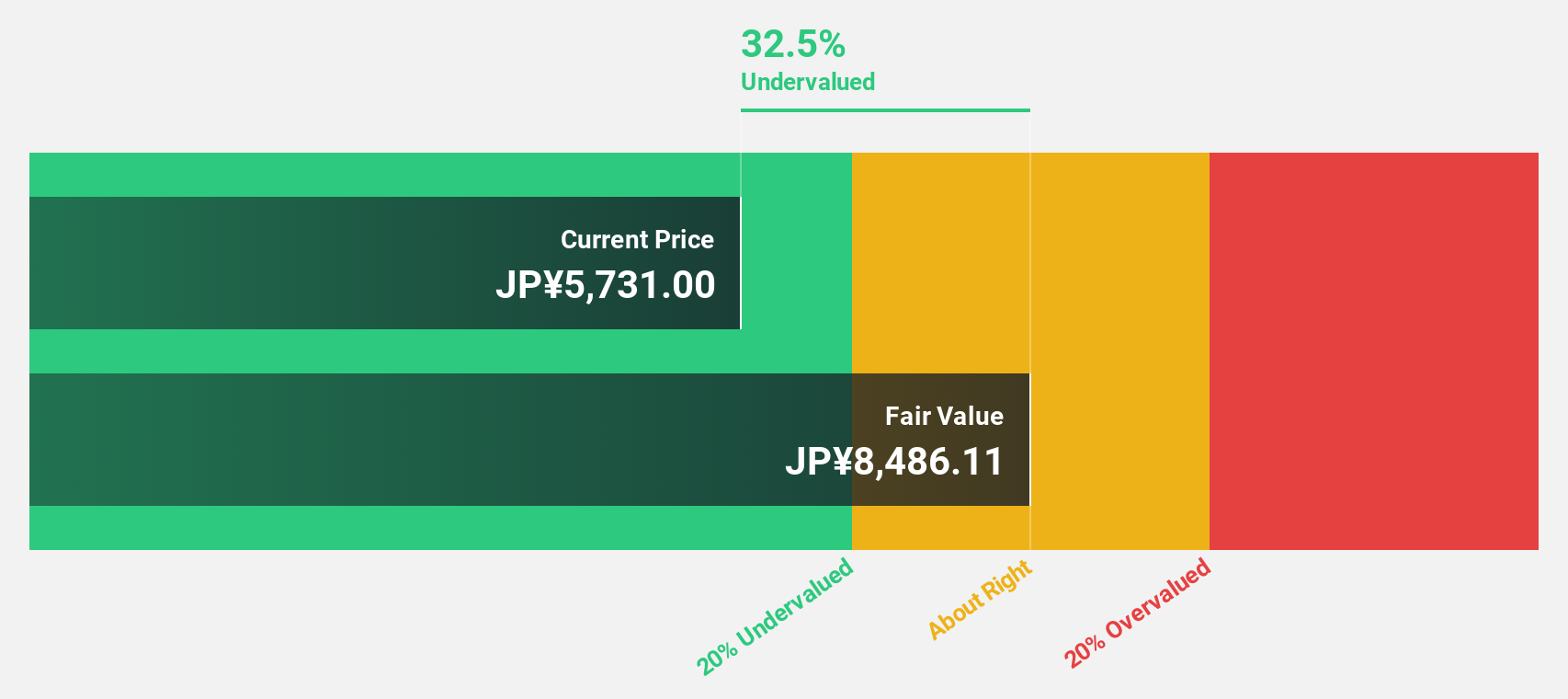

Estimated Discount To Fair Value: 38.5%

KOSÉ is trading at ¥5,566, significantly below its estimated fair value of ¥9,055.82. This undervaluation is highlighted by a forecasted annual earnings growth rate of 20.3%, outpacing the broader JP market's 7.6%. However, profit margins have decreased to 1.8% from last year's 4.7%, and the dividend yield of 2.52% isn't well covered by earnings or cash flows, presenting some challenges despite its attractive valuation based on cash flows.

- The analysis detailed in our KOSÉ growth report hints at robust future financial performance.

- Get an in-depth perspective on KOSÉ's balance sheet by reading our health report here.

Make It Happen

- Click this link to deep-dive into the 520 companies within our Undervalued Global Stocks Based On Cash Flows screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688278

Xiamen Amoytop Biotech

Engages in research, development, production, and sale of recombinant protein drugs in China.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives