- United States

- /

- Consumer Finance

- /

- NYSE:QD

eHealth And 2 Promising Penny Stocks To Consider

Reviewed by Simply Wall St

As major U.S. stock indexes continue to set new records, investors are navigating a landscape that seems to defy the uncertainties of a government shutdown. In such an environment, penny stocks—often representing smaller or newer companies—can offer intriguing opportunities for those looking beyond the market giants. Despite their historically speculative reputation, these stocks can provide a blend of affordability and growth potential when backed by solid financials, making them worthy considerations for discerning investors seeking hidden gems in the market.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $2.06 | $441.47M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.89 | $683.54M | ✅ 4 ⚠️ 0 View Analysis > |

| Performance Shipping (PSHG) | $1.89 | $24.24M | ✅ 4 ⚠️ 2 View Analysis > |

| CI&T (CINT) | $4.89 | $654.03M | ✅ 5 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| Table Trac (TBTC) | $4.59 | $21.81M | ✅ 2 ⚠️ 2 View Analysis > |

| BAB (BABB) | $1.00 | $6.9M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.83 | $85.87M | ✅ 3 ⚠️ 2 View Analysis > |

| Universal Safety Products (UUU) | $4.60 | $11.06M | ✅ 2 ⚠️ 3 View Analysis > |

| Resources Connection (RGP) | $4.88 | $168.52M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 365 stocks from our US Penny Stocks screener.

Let's review some notable picks from our screened stocks.

eHealth (EHTH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: eHealth, Inc. operates a health insurance marketplace offering consumer engagement, education, and enrollment solutions in the United States with a market cap of approximately $127.42 million.

Operations: The company generates revenue primarily from its Medicare segment, which accounts for $520.73 million, and its Employer and Individual segment, contributing $26.76 million.

Market Cap: $127.42M

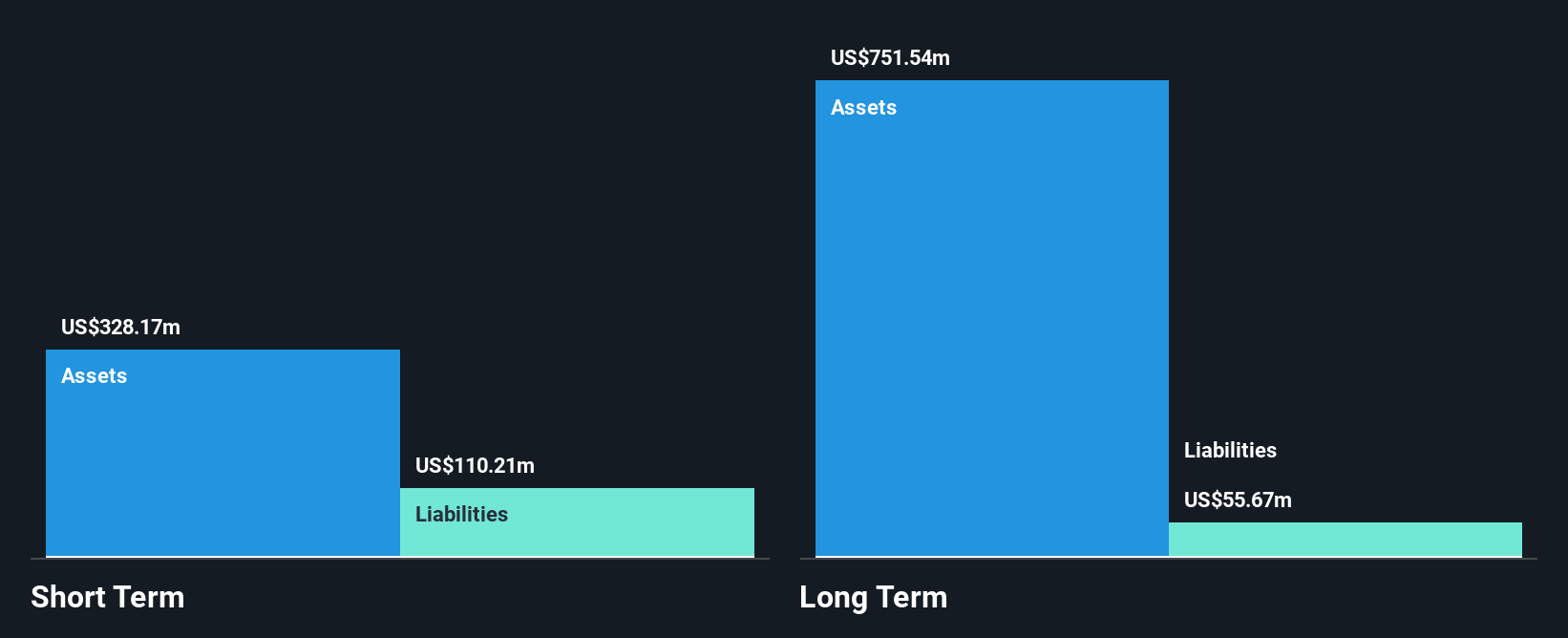

eHealth, Inc., with a market cap of approximately US$127.42 million, operates primarily in the Medicare segment, generating significant revenue despite its unprofitability. The company has seen increased losses over the past five years and is not expected to achieve profitability soon. Recent executive changes include Derrick Duke's appointment as CEO amidst ongoing board restructuring. eHealth's recent survey highlights consumer confusion during the Medicare Annual Enrollment Period, which could impact future enrollment volumes and revenue growth. Despite challenges, eHealth maintains a strong cash position relative to debt and covers both short- and long-term liabilities effectively.

- Click here to discover the nuances of eHealth with our detailed analytical financial health report.

- Understand eHealth's earnings outlook by examining our growth report.

Qudian (QD)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Qudian Inc. is a consumer-oriented technology company operating in the People's Republic of China, with a market cap of approximately $724.91 million.

Operations: The company's revenue is derived from its Installment Credit Services segment, amounting to CN¥136.53 million.

Market Cap: $724.91M

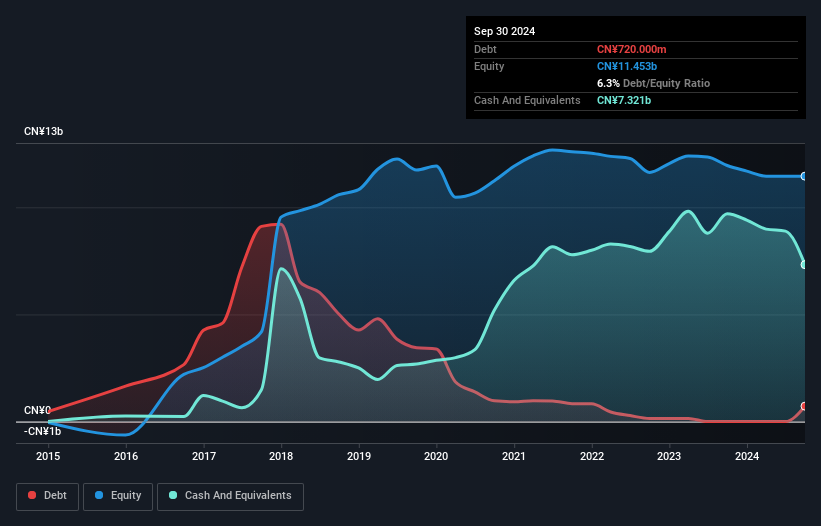

Qudian Inc., with a market cap of approximately $724.91 million, has shown financial resilience despite challenges. The company became profitable this year, though its revenue from installment credit services has decreased significantly to CN¥3.49 million from CN¥53.33 million the previous year. Qudian's short-term assets far exceed both its short- and long-term liabilities, highlighting strong liquidity. The debt-to-equity ratio has improved over five years, and no significant shareholder dilution occurred recently. However, operating cash flow remains negative, indicating potential cash management issues despite high-quality earnings and a low price-to-earnings ratio compared to the US market average.

- Jump into the full analysis health report here for a deeper understanding of Qudian.

- Gain insights into Qudian's past trends and performance with our report on the company's historical track record.

NameSilo Technologies (URLO.F)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: NameSilo Technologies Corp. operates through its subsidiaries to provide domain name registration services across the United States, East and South Asia, South East Asia, Australasia, and internationally, with a market cap of $99.70 million.

Operations: The company's revenue is primarily derived from Domain Registration and Related Services, totaling CA$61.25 million.

Market Cap: $99.7M

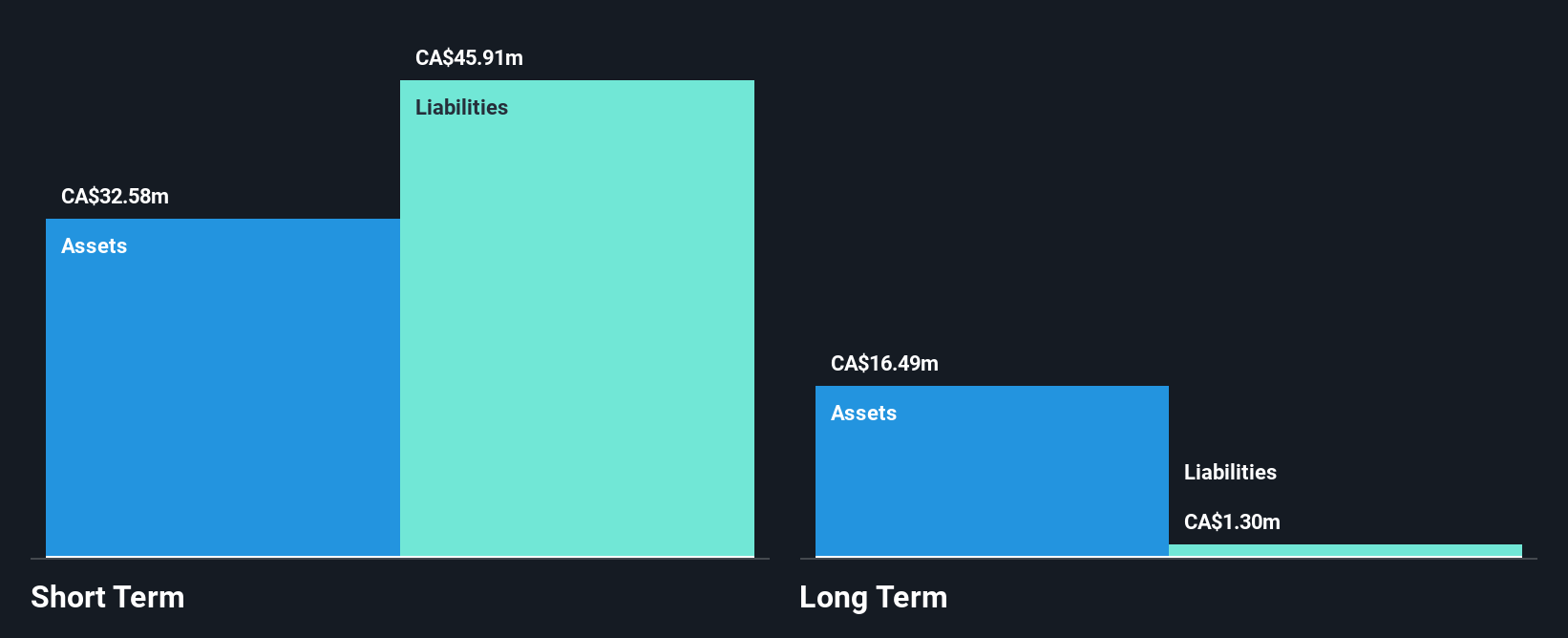

NameSilo Technologies Corp., with a market cap of CA$99.70 million, has demonstrated strong financial performance with significant earnings growth of 81.5% over the past year, surpassing industry averages. The company's revenue from domain registration services reached CA$61.25 million, contributing to improved net profit margins and profitability. Despite this growth, short-term assets do not fully cover short-term liabilities, indicating potential liquidity challenges. However, debt levels are well managed with more cash than total debt and operating cash flow significantly exceeding debt obligations. Recent board changes include the appointment of Dan Milic to enhance strategic direction and business development efforts.

- Click to explore a detailed breakdown of our findings in NameSilo Technologies' financial health report.

- Understand NameSilo Technologies' track record by examining our performance history report.

Summing It All Up

- Embark on your investment journey to our 365 US Penny Stocks selection here.

- Ready For A Different Approach? The end of cancer? These 28 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Qudian might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:QD

Qudian

Operates as a consumer-oriented technology company in the People’s Republic of China.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)