- United Kingdom

- /

- Oil and Gas

- /

- LSE:PHAR

ECO Animal Health Group And 2 Promising UK Penny Stocks To Consider

Reviewed by Simply Wall St

The London stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, highlighting the interconnectedness of global economies. In such fluctuating conditions, identifying stocks with strong fundamentals becomes crucial for investors seeking potential growth opportunities. Penny stocks, though often seen as a nod to past trading eras, continue to offer intriguing possibilities by combining affordability with the chance for significant returns when backed by solid financials.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.105 | £470.93M | ✅ 5 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.02 | £163.19M | ✅ 4 ⚠️ 2 View Analysis > |

| On the Beach Group (LSE:OTB) | £2.225 | £322.41M | ✅ 5 ⚠️ 1 View Analysis > |

| Ingenta (AIM:ING) | £0.91 | £13.74M | ✅ 2 ⚠️ 3 View Analysis > |

| System1 Group (AIM:SYS1) | £2.21 | £28.04M | ✅ 3 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.6475 | $376.41M | ✅ 4 ⚠️ 2 View Analysis > |

| Impax Asset Management Group (AIM:IPX) | £1.474 | £181.5M | ✅ 3 ⚠️ 2 View Analysis > |

| Spectra Systems (AIM:SPSY) | £1.435 | £69.3M | ✅ 3 ⚠️ 3 View Analysis > |

| M.T.I Wireless Edge (AIM:MWE) | £0.495 | £42.67M | ✅ 3 ⚠️ 3 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.095 | £174.76M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 306 stocks from our UK Penny Stocks screener.

We'll examine a selection from our screener results.

ECO Animal Health Group (AIM:EAH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: ECO Animal Health Group plc, along with its subsidiaries, manufactures and supplies animal health products internationally, with a market cap of £74.54 million.

Operations: The company generates revenue primarily from its Pharmaceuticals segment, which accounted for £85.81 million.

Market Cap: £74.54M

ECO Animal Health Group, with a market cap of £74.54 million, shows potential within the penny stock arena due to its robust financial position and strategic developments. The company is debt-free and has strong short-term asset coverage over liabilities. Despite a historical decline in earnings, recent performance indicates significant improvement with earnings growing by 359% over the past year, outpacing industry growth. Recent corporate guidance suggests increased revenue expectations bolstered by demand for Aivlosin and anticipated EU marketing authorisation for ECOVAXXIN® MS could enhance future prospects despite current net losses narrowing compared to previous periods.

- Click here and access our complete financial health analysis report to understand the dynamics of ECO Animal Health Group.

- Evaluate ECO Animal Health Group's prospects by accessing our earnings growth report.

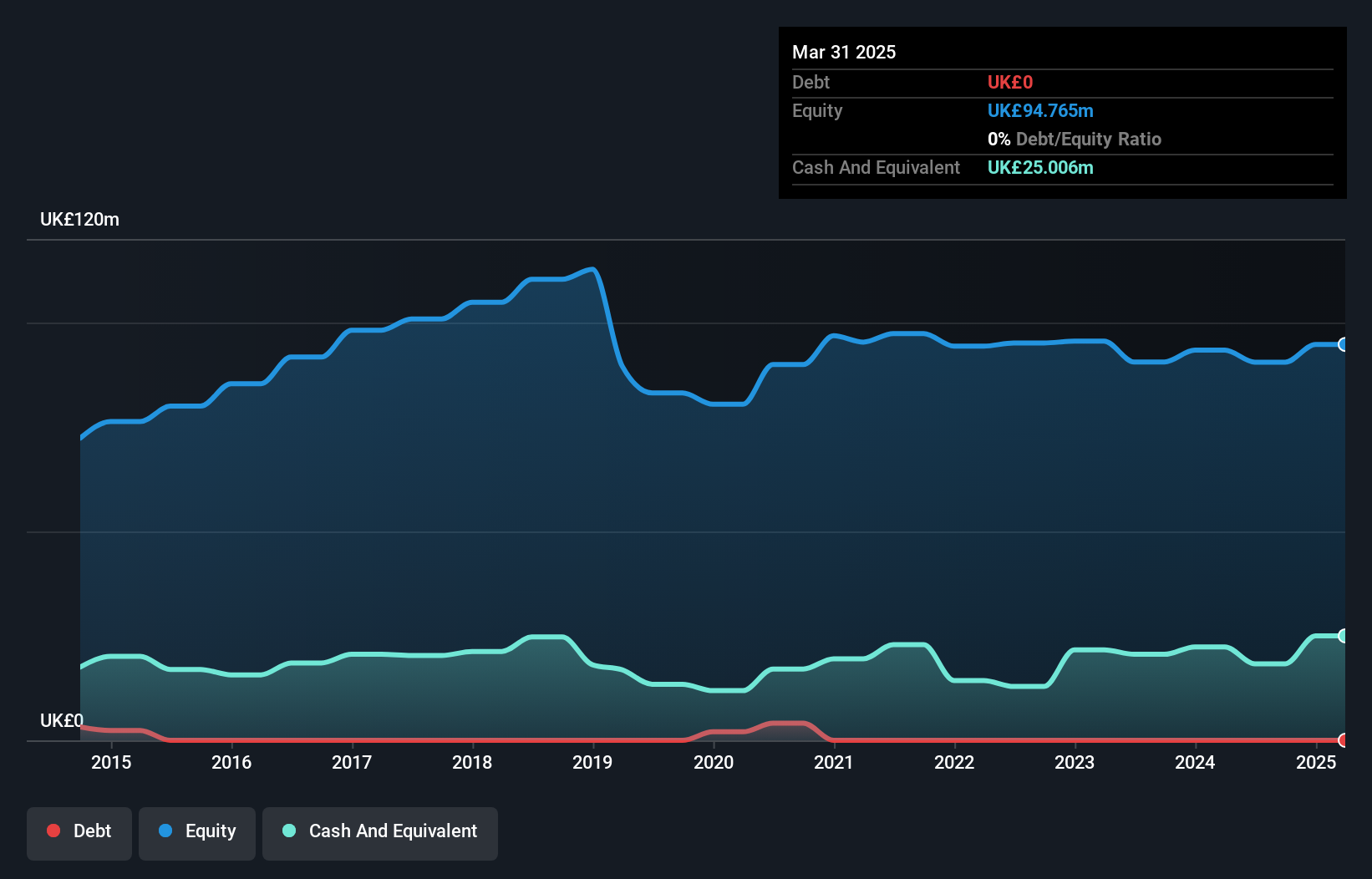

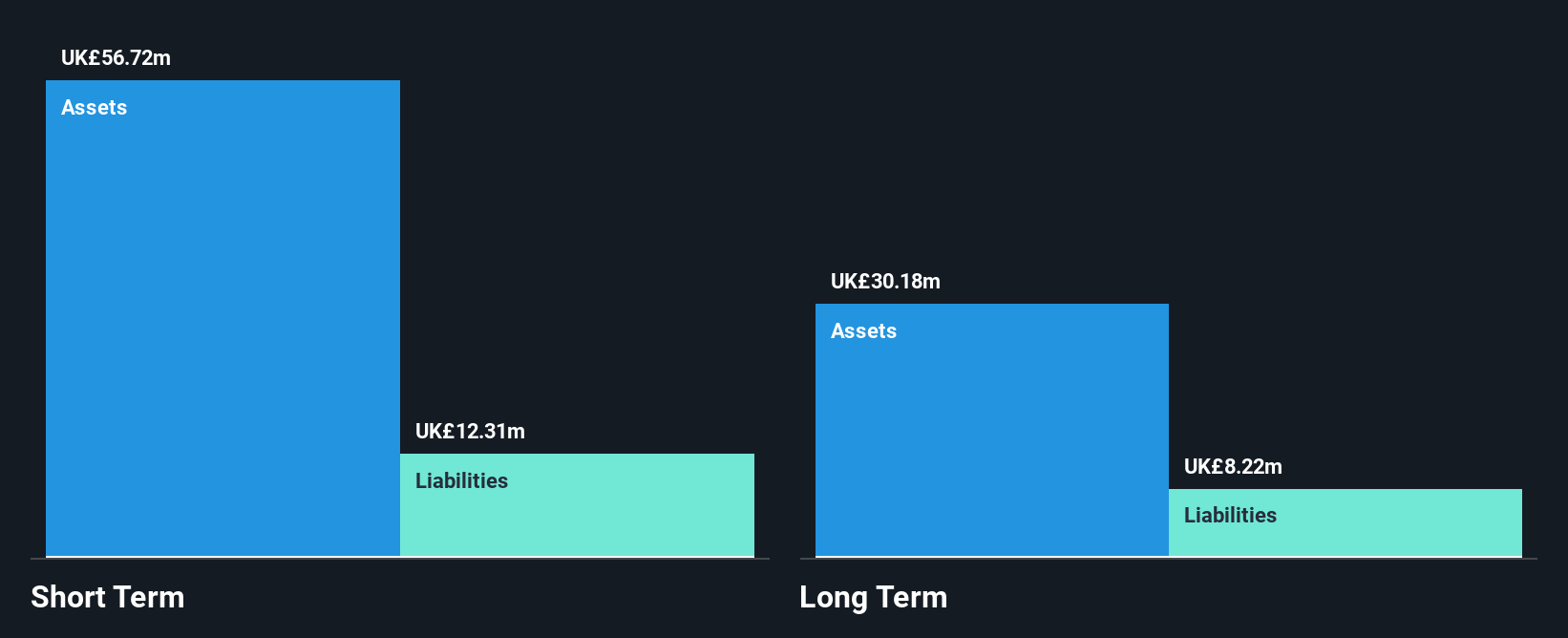

Oxford Metrics (AIM:OMG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Oxford Metrics plc is a UK-based smart sensing and software company with a market cap of £52.37 million.

Operations: The company generates revenue from its Smart Manufacturing segment, which accounted for £6.40 million.

Market Cap: £52.37M

Oxford Metrics, with a market cap of £52.37 million, stands out in the penny stock category due to its debt-free status and solid asset coverage over liabilities, with short-term assets at £57.8 million against long-term liabilities of £6.3 million. Despite being unprofitable and having a negative return on equity (-1.36%), it has reduced losses by 6.4% annually over five years and trades at 74.8% below estimated fair value compared to peers and industry benchmarks. Recent leadership changes include appointing Gary Bullard as Non-Executive Chair, potentially bringing strategic direction given his extensive experience across various sectors.

- Dive into the specifics of Oxford Metrics here with our thorough balance sheet health report.

- Explore Oxford Metrics' analyst forecasts in our growth report.

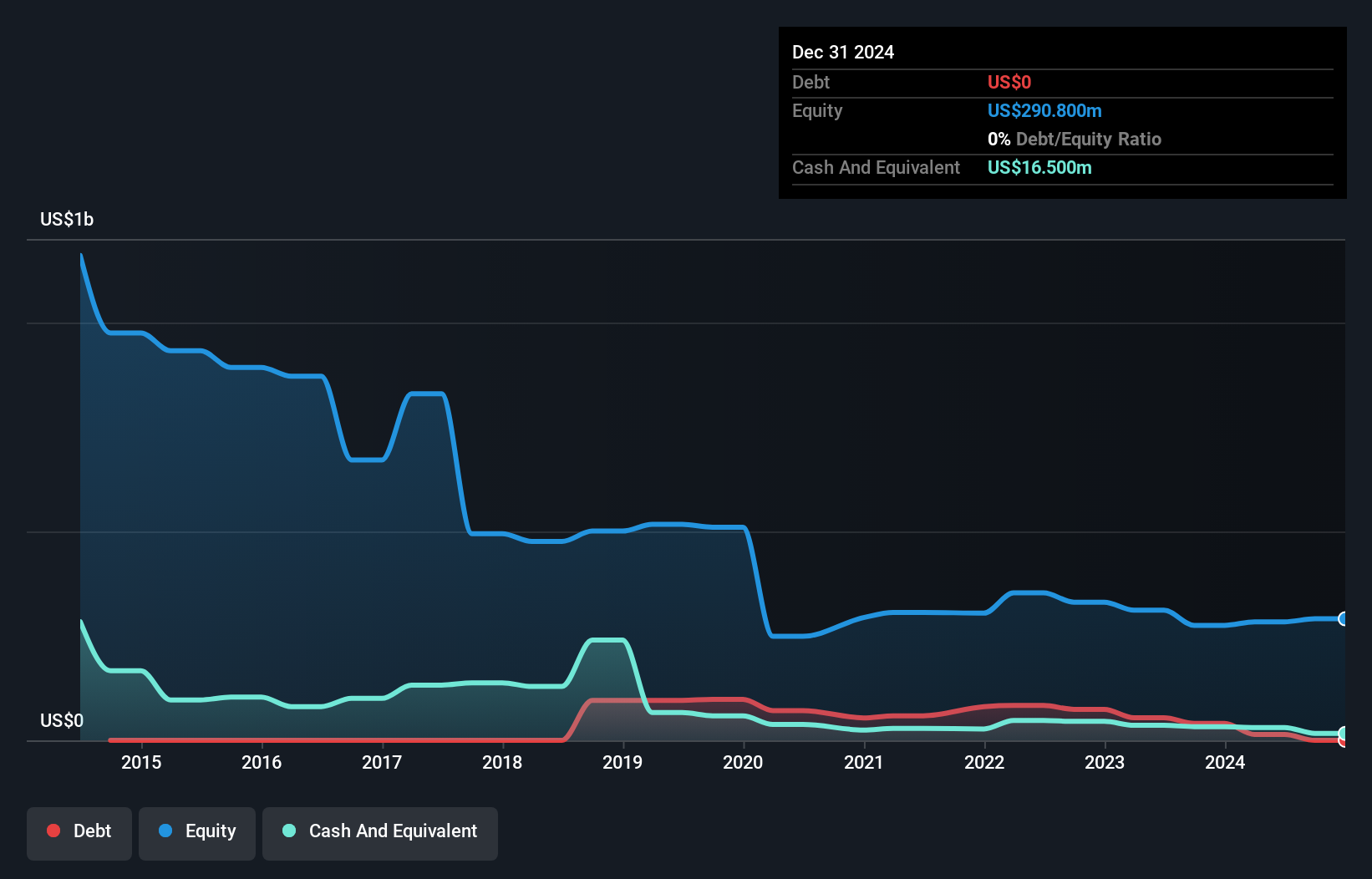

Pharos Energy (LSE:PHAR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Pharos Energy plc is an independent energy company focused on exploring, developing, and producing oil and gas properties in Vietnam and Egypt, with a market cap of £84.57 million.

Operations: The company's revenue is derived from its operations in Egypt, generating $20.8 million, and Southeast Asia, contributing $115.8 million.

Market Cap: £84.57M

Pharos Energy, with a market cap of £84.57 million, presents both opportunities and challenges typical of penny stocks. The company has recently commenced a six-well drilling program in Vietnam, fully funded by its balance sheet, which could potentially increase production volumes if successful. Despite becoming profitable this year and trading at 74% below estimated fair value, Pharos faces volatility with high weekly fluctuations compared to other UK stocks. While short-term assets cover liabilities comfortably ($80.4M vs $15.3M), long-term liabilities remain uncovered ($112.6M). Additionally, the dividend yield is not well-supported by earnings despite no debt burden on the company’s finances.

- Click here to discover the nuances of Pharos Energy with our detailed analytical financial health report.

- Examine Pharos Energy's earnings growth report to understand how analysts expect it to perform.

Taking Advantage

- Reveal the 306 hidden gems among our UK Penny Stocks screener with a single click here.

- Want To Explore Some Alternatives? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:PHAR

Pharos Energy

An independent energy company, explores, develops, and produces oil and gas properties in Vietnam and Egypt.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion