- United States

- /

- Banks

- /

- NYSEAM:BHB

Dividend Stocks To Consider For October 2025

Reviewed by Simply Wall St

As U.S. stock markets continue their upward momentum, setting new records despite concerns over a government shutdown, investors are increasingly looking for stable opportunities to capitalize on these gains. In this environment, dividend stocks can offer a reliable income stream and potential for growth, making them an attractive option for those seeking stability amid economic uncertainties.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Rayonier (RYN) | 10.74% | ★★★★★☆ |

| Peoples Bancorp (PEBO) | 5.51% | ★★★★★☆ |

| OceanFirst Financial (OCFC) | 4.61% | ★★★★★★ |

| Huntington Bancshares (HBAN) | 3.64% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 5.92% | ★★★★★★ |

| Ennis (EBF) | 5.47% | ★★★★★★ |

| Employers Holdings (EIG) | 3.02% | ★★★★★☆ |

| Douglas Dynamics (PLOW) | 3.78% | ★★★★★☆ |

| Columbia Banking System (COLB) | 5.55% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.69% | ★★★★★☆ |

Click here to see the full list of 125 stocks from our Top US Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

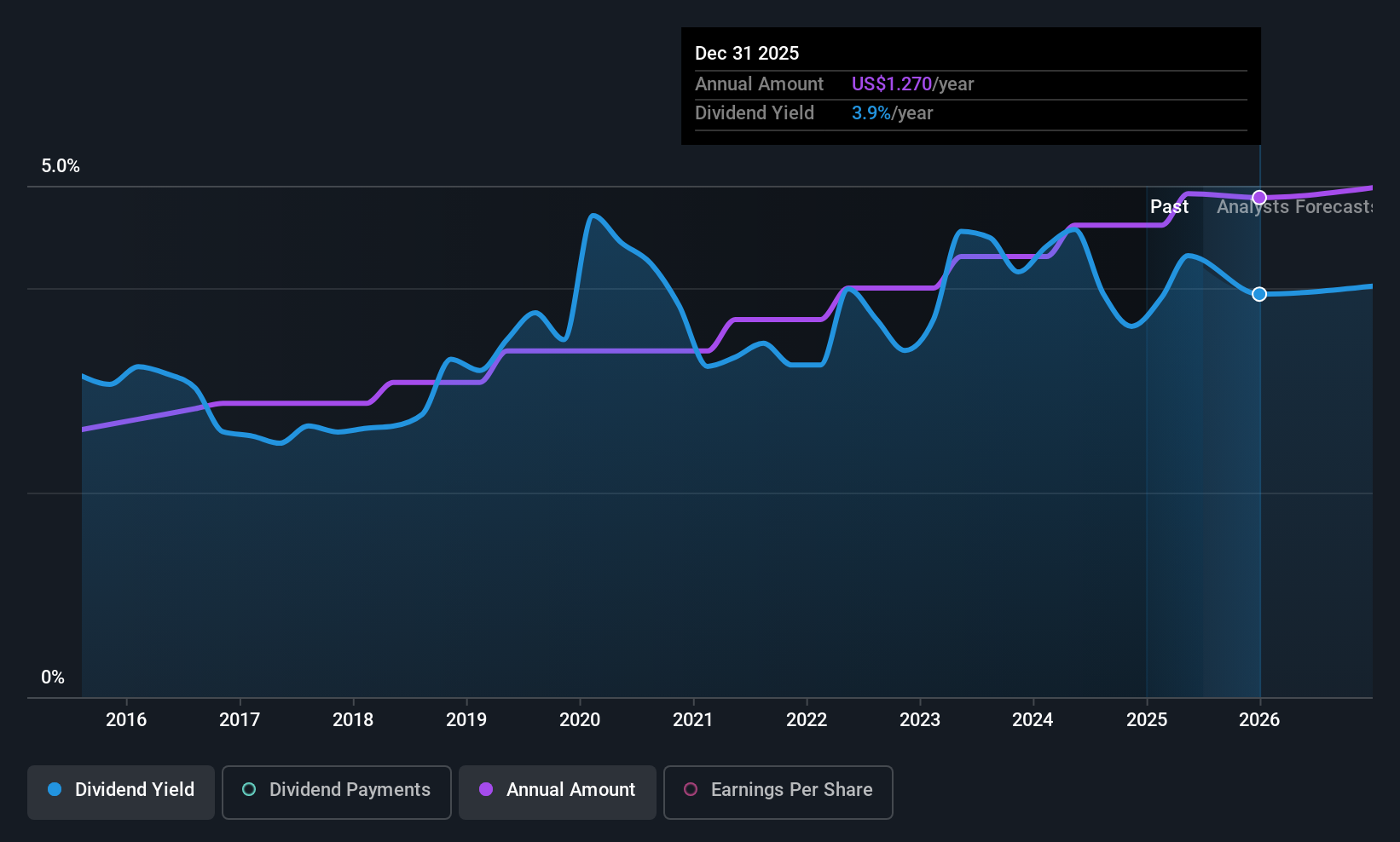

Bar Harbor Bankshares (BHB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bar Harbor Bankshares, with a market cap of $508.16 million, operates as the holding company for Bar Harbor Bank & Trust, offering a range of banking and nonbanking products and services to consumers and businesses.

Operations: Bar Harbor Bankshares generates its revenue primarily from the Community Banking Industry, amounting to $147.01 million.

Dividend Yield: 4.2%

Bar Harbor Bankshares offers a stable dividend profile with consistent payments over the past decade, currently yielding 4.2%, though slightly below the top quartile of US dividend payers. The recent quarterly dividend of US$0.32 per share underscores its reliability, supported by a reasonable payout ratio of 47.2%. Despite recent earnings declines—US$6.09 million in Q2 2025 compared to US$10.26 million a year prior—the bank's strategic board expansion and merger activities may support future growth and stability.

- Click to explore a detailed breakdown of our findings in Bar Harbor Bankshares' dividend report.

- Our expertly prepared valuation report Bar Harbor Bankshares implies its share price may be lower than expected.

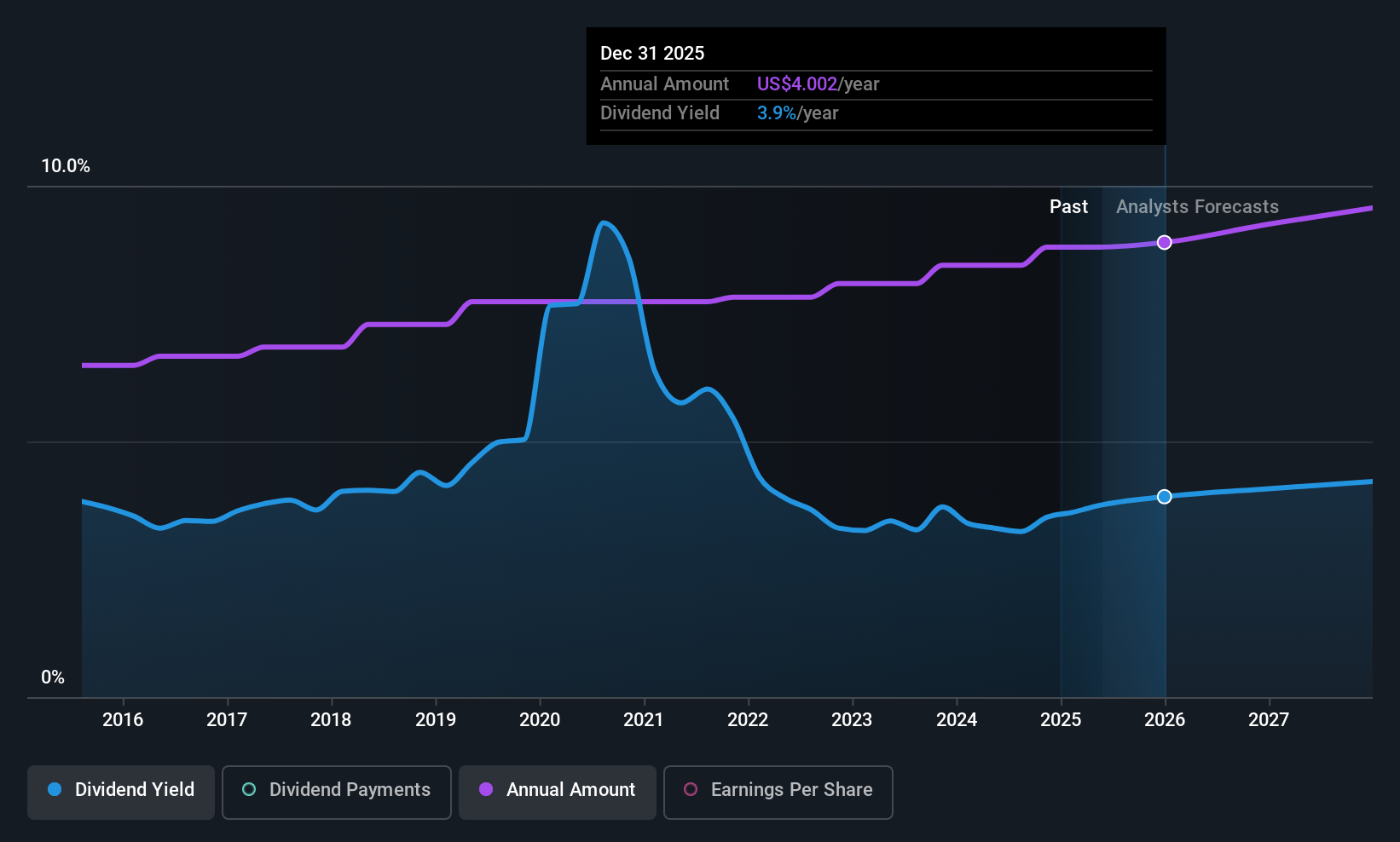

Exxon Mobil (XOM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Exxon Mobil Corporation is involved in the exploration and production of crude oil and natural gas across various countries including the United States, Guyana, and Canada, with a market cap of approximately $480.68 billion.

Operations: Exxon Mobil's revenue is derived from its Upstream operations in the United States ($52.41 billion) and internationally ($54.45 billion), Energy Products in the United States ($118.68 billion) and abroad ($174.19 billion), Chemical Products domestically ($15 billion) and internationally ($17.55 billion), as well as Specialty Products within the U.S. ($7.86 billion) and outside the U.S. ($12.85 billion).

Dividend Yield: 3.5%

Exxon Mobil maintains a stable dividend profile, with payments covered by earnings and cash flows, reflected in its payout ratios around 55.5% and 58%, respectively. Despite a lower yield of 3.54% compared to top-tier US dividend stocks, Exxon has consistently increased dividends over the past decade. Recent restructuring efforts and strategic investments like the Hammerhead project in Guyana indicate ongoing business adjustments that could impact future performance without directly affecting its current dividend reliability.

- Delve into the full analysis dividend report here for a deeper understanding of Exxon Mobil.

- Insights from our recent valuation report point to the potential undervaluation of Exxon Mobil shares in the market.

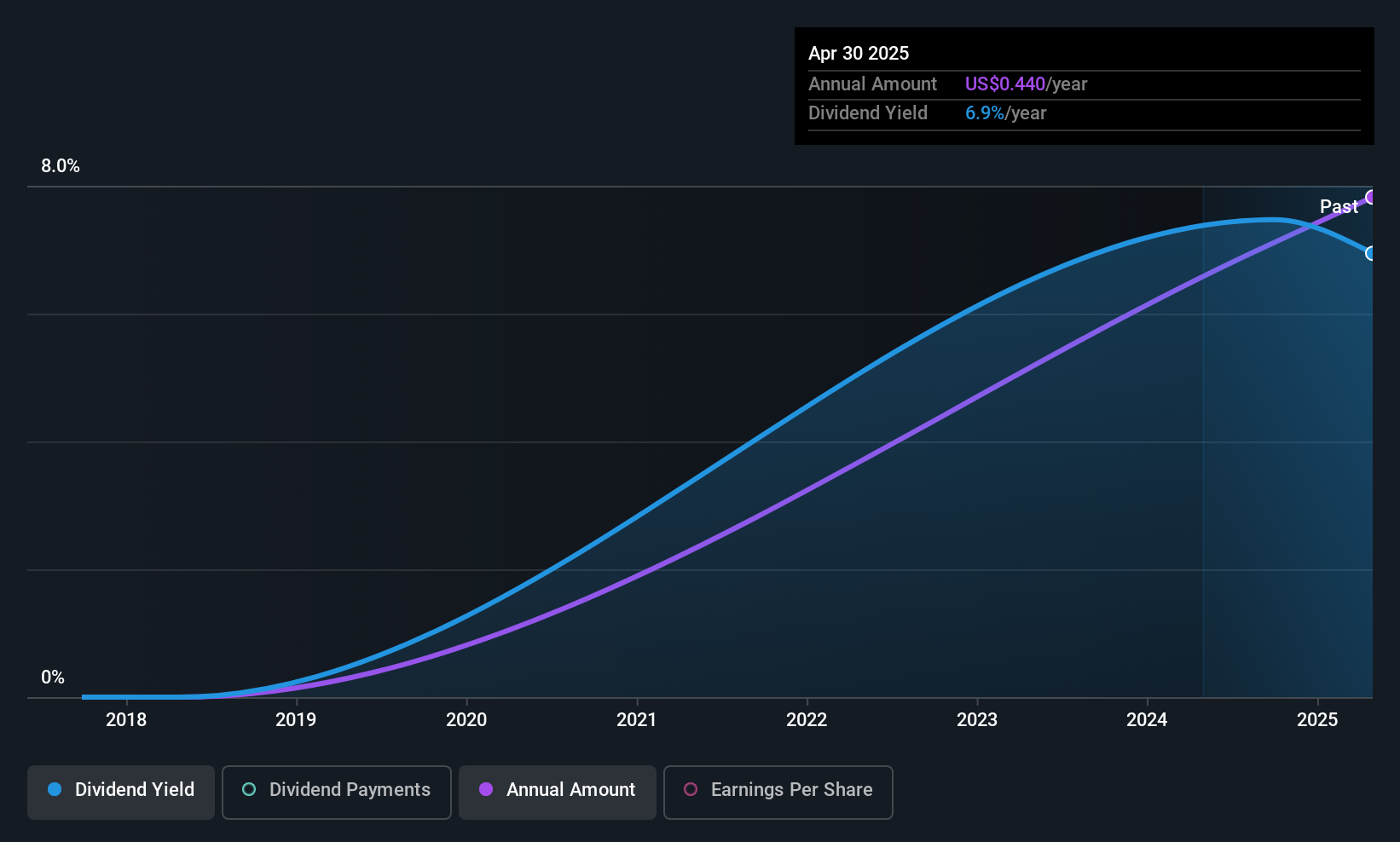

Yiren Digital (YRD)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Yiren Digital Ltd. operates an AI-powered financial services platform in China with a market cap of $512.39 million.

Operations: Yiren Digital Ltd. generates revenue from its Financial Services Business (CN¥4.67 billion) and Insurance Brokerage Business (CN¥321.51 million).

Dividend Yield: 6.9%

Yiren Digital's recent dividend announcement of US$0.20 per share marks a notable step, though it's too early to gauge long-term growth or stability. The company's dividends are well-covered by earnings and cash flows, with payout ratios at 21.3% and 20.7%, respectively, suggesting sustainability. Despite a decrease in net income compared to the previous year, Yiren Digital remains undervalued relative to its estimated fair value, presenting potential for investors seeking high-yield opportunities in the U.S. market.

- Click here and access our complete dividend analysis report to understand the dynamics of Yiren Digital.

- According our valuation report, there's an indication that Yiren Digital's share price might be on the cheaper side.

Make It Happen

- Click this link to deep-dive into the 125 companies within our Top US Dividend Stocks screener.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bar Harbor Bankshares might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:BHB

Bar Harbor Bankshares

Operates as the holding company for Bar Harbor Bank & Trust that provides banking and nonbanking products and services primarily to consumers and businesses.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives