- United States

- /

- Software

- /

- NYSE:QBTS

D-Wave Quantum (NYSE:QBTS) Reports Increased Sales & Reduced Net Losses

Reviewed by Simply Wall St

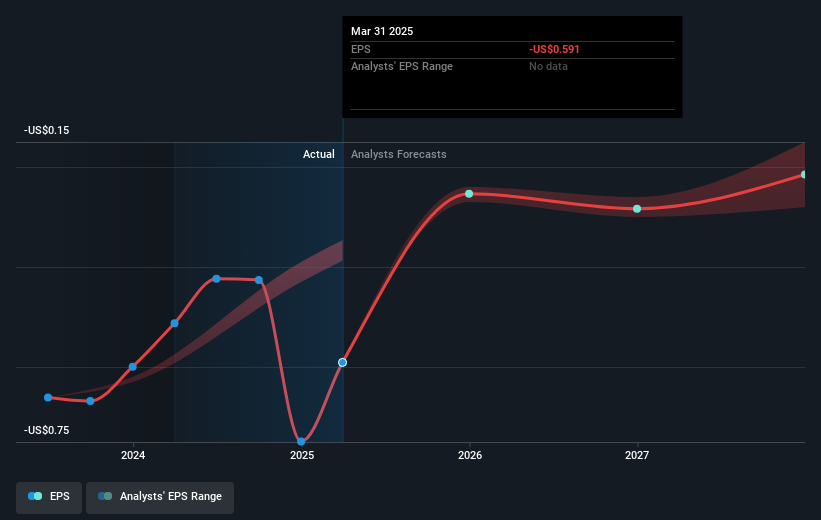

D-Wave Quantum (NYSE:QBTS) recently made headlines with the launch of its Advantage2™ quantum computing system, showcasing significant product advancements in solving complex computational problems. This development, alongside a promising earnings report reflecting increased sales and reduced net losses, likely played a role in the company's remarkable 206% stock price increase over the last quarter. These achievements occurred in a broader market context characterized by a tech sector rally influenced by trade policy relaxations, suggesting D-Wave's strong performance was both aided by positive internal events and coincided with favorable market trends.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Over the past year, D-Wave Quantum's shares experienced a very large total return of 1242.86%, considerably outperforming both the broader US market and the software industry, which saw returns of 9.1% and 14.8% respectively. This remarkable performance reflects investor confidence spurred by the company's advancements in quantum technology and stronger financial metrics.

The impressive developments detailed in the introduction, such as the launch of the Advantage2™ system and improved earnings report, suggest a positive impact on future revenue and earnings forecasts. D-Wave's quarterly sales surged significantly from US$2.47 million to US$15 million, indicating potential for continued growth. However, despite the recent price surge, the current share price is above analysts' consensus price target of US$12.83, suggesting possible overvaluation relative to expectations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:QBTS

D-Wave Quantum

Develops and delivers quantum computing systems, software, and services worldwide.

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)