- United States

- /

- Biotech

- /

- NasdaqGS:ONC

BeOne Medicines And 2 Stocks That May Be Undervalued By The Market

Reviewed by Simply Wall St

The United States market has shown positive momentum, rising 1.6% over the last week and 12% over the past year, with earnings projected to grow by 14% annually in the coming years. In such a climate, identifying undervalued stocks like BeOne Medicines can offer potential opportunities for investors seeking value amidst broader market gains.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Verra Mobility (VRRM) | $24.37 | $47.84 | 49.1% |

| Valley National Bancorp (VLY) | $8.90 | $17.36 | 48.7% |

| TXO Partners (TXO) | $15.08 | $29.95 | 49.7% |

| Mid Penn Bancorp (MPB) | $26.53 | $52.26 | 49.2% |

| Lyft (LYFT) | $15.53 | $30.54 | 49.1% |

| Horizon Bancorp (HBNC) | $14.83 | $29.11 | 49.1% |

| Expand Energy (EXE) | $117.35 | $233.70 | 49.8% |

| Central Pacific Financial (CPF) | $26.72 | $51.99 | 48.6% |

| Brookline Bancorp (BRKL) | $10.43 | $20.74 | 49.7% |

| Berkshire Hills Bancorp (BHLB) | $25.04 | $49.25 | 49.2% |

We'll examine a selection from our screener results.

BeOne Medicines (ONC)

Overview: BeOne Medicines Ltd. is an oncology company focused on discovering and developing cancer treatments globally, with a market cap of $32.59 billion.

Operations: The company's revenue is primarily generated from its pharmaceutical products, amounting to $4.18 billion.

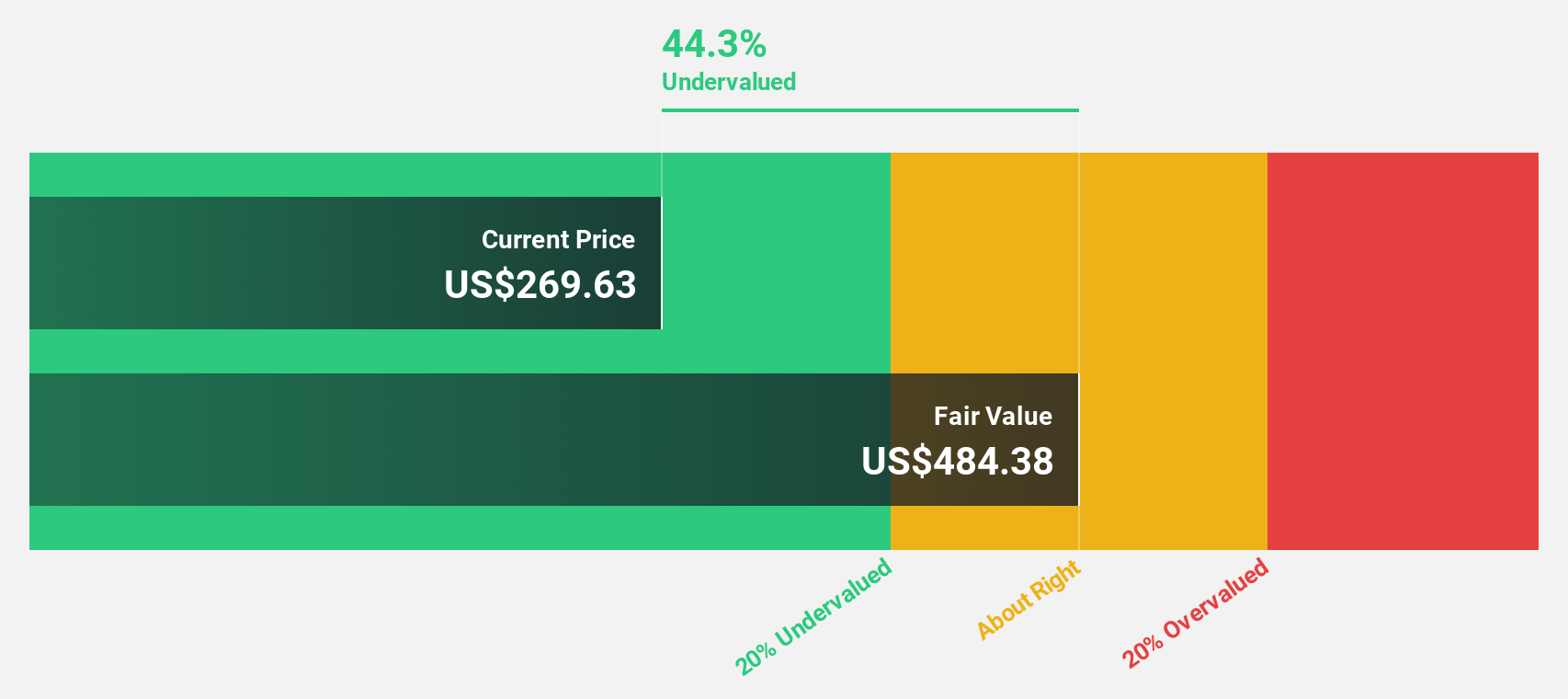

Estimated Discount To Fair Value: 47.2%

BeOne Medicines is trading at 47.2% below its estimated fair value, indicating a potential undervaluation based on cash flows. The company has a robust pipeline, including investigational medicines for breast cancer and the approved drug BRUKINSA®, which contributes to its hematology franchise. Recent strategic moves, such as redomiciliation to Switzerland and expanding manufacturing capabilities with an $800 million facility in New Jersey, bolster BeOne's growth strategy and operational resilience.

- Our expertly prepared growth report on BeOne Medicines implies its future financial outlook may be stronger than recent results.

- Take a closer look at BeOne Medicines' balance sheet health here in our report.

Elastic (ESTC)

Overview: Elastic N.V. is a search AI company providing hosted and managed solutions for hybrid, public, private, and multi-cloud environments globally, with a market cap of $9.12 billion.

Operations: Elastic generates its revenue primarily from its Software & Programming segment, which amounted to $1.48 billion.

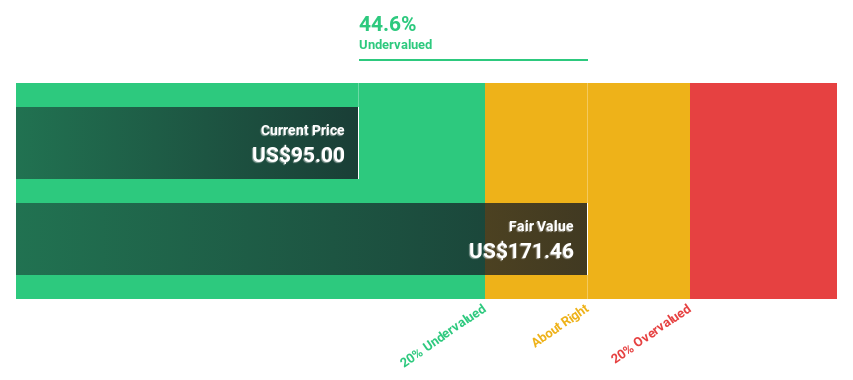

Estimated Discount To Fair Value: 33.9%

Elastic is trading at 33.9% below its estimated fair value, highlighting potential undervaluation based on cash flows. The company anticipates revenue growth of 11.5% annually, outpacing the broader US market. Despite recent insider selling and a current net loss of US$108.11 million for the year, Elastic's strategic collaboration with AWS aims to enhance AI capabilities and drive innovation, potentially supporting future profitability and operational scalability.

- Our earnings growth report unveils the potential for significant increases in Elastic's future results.

- Click here and access our complete balance sheet health report to understand the dynamics of Elastic.

Truist Financial (TFC)

Overview: Truist Financial Corporation is a financial services company offering banking and trust services in the Southeastern and Mid-Atlantic United States, with a market cap of approximately $53.25 billion.

Operations: Truist Financial's revenue is primarily derived from its Consumer and Small Business Banking segment at $11.04 billion and Wholesale Banking segment at $10.12 billion, while the Treasury & Corporate segment reported a negative contribution of -$9.62 billion.

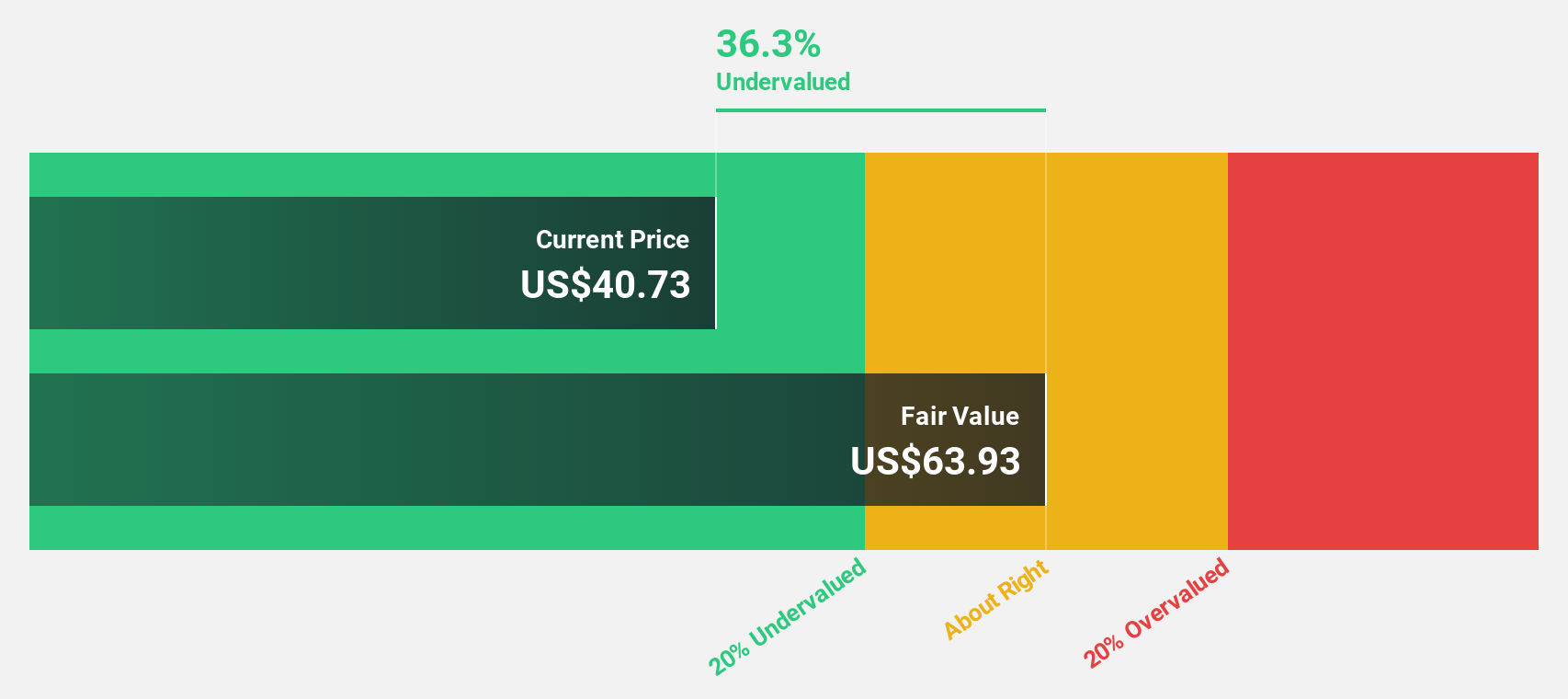

Estimated Discount To Fair Value: 36.4%

Truist Financial is trading over 20% below its estimated fair value, suggesting potential undervaluation based on cash flows. Despite a dividend yield of 5.12% that may not be fully covered by earnings, the company anticipates revenue growth of 15.2% annually, surpassing the US market average. Recent strategic moves include a $1.25 billion fixed-income offering and innovative payment solutions enhancing cash flow management and operational efficiency for clients, strengthening its financial position amidst board changes and technological advancements.

- According our earnings growth report, there's an indication that Truist Financial might be ready to expand.

- Delve into the full analysis health report here for a deeper understanding of Truist Financial.

Summing It All Up

- Unlock more gems! Our Undervalued US Stocks Based On Cash Flows screener has unearthed 160 more companies for you to explore.Click here to unveil our expertly curated list of 163 Undervalued US Stocks Based On Cash Flows.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BeOne Medicines might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ONC

BeOne Medicines

An oncology company, engages in discovering and developing various treatments for cancer patients in the United States, China, Europe, and internationally.

Very undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives