- United States

- /

- Entertainment

- /

- NasdaqGS:ROKU

August 2025's Noteworthy Stocks Estimated Below Intrinsic Value

Reviewed by Simply Wall St

As the Dow Jones Industrial Average reaches new record highs, driven by significant moves like UnitedHealth's surge following Berkshire Hathaway's investment, the S&P 500 and Nasdaq have experienced slight declines amidst mixed trading sessions. In this environment of fluctuating indices and economic data releases influencing market sentiment, identifying stocks that are potentially undervalued relative to their intrinsic value can offer investors opportunities for growth despite broader market volatility.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Willdan Group (WLDN) | $120.35 | $231.51 | 48% |

| UMB Financial (UMBF) | $117.06 | $225.65 | 48.1% |

| Udemy (UDMY) | $6.83 | $13.20 | 48.3% |

| Shoals Technologies Group (SHLS) | $4.59 | $9.03 | 49.2% |

| Royal Gold (RGLD) | $169.61 | $329.20 | 48.5% |

| Niagen Bioscience (NAGE) | $9.71 | $18.89 | 48.6% |

| Granite Ridge Resources (GRNT) | $5.33 | $10.25 | 48% |

| First Commonwealth Financial (FCF) | $16.95 | $32.97 | 48.6% |

| First Busey (BUSE) | $23.44 | $45.40 | 48.4% |

| Dime Community Bancshares (DCOM) | $29.47 | $56.95 | 48.3% |

Let's explore several standout options from the results in the screener.

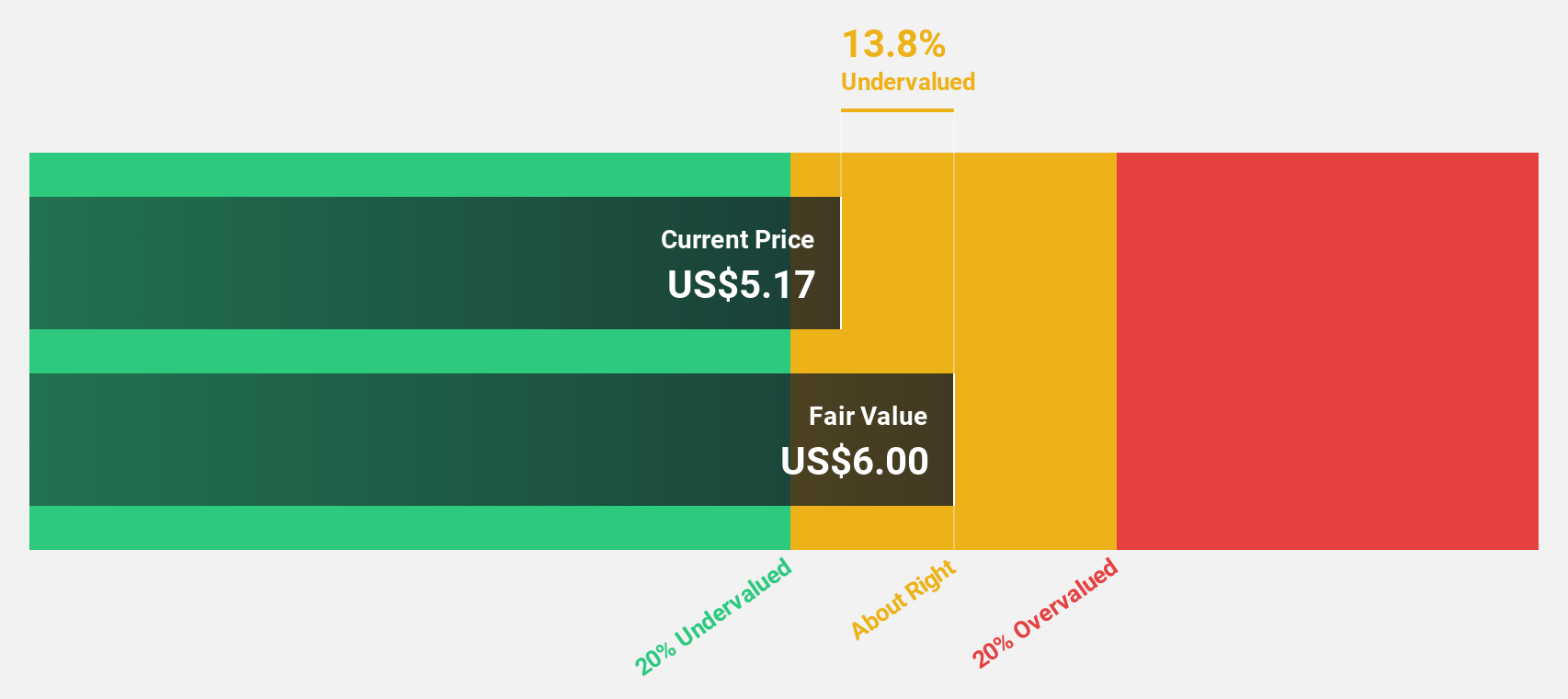

Grab Holdings (GRAB)

Overview: Grab Holdings Limited operates as a superapp provider across Southeast Asia, offering various services including transportation, food delivery, and digital payments, with a market capitalization of $20.87 billion.

Operations: Revenue Segments (in millions of $): Mobility: $516.00, Deliveries: $1,470.00, Financial Services: $43.00

Estimated Discount To Fair Value: 34.4%

Grab Holdings is trading at US$5.13, significantly below its estimated fair value of US$7.82, indicating potential undervaluation based on cash flows. The company has turned profitable this year with earnings expected to grow significantly over the next three years, outpacing the broader US market's growth rate. Recent earnings guidance projects a 19% to 22% revenue increase for 2025, alongside a completed share buyback worth approximately $499.6 million, enhancing shareholder value.

- Our growth report here indicates Grab Holdings may be poised for an improving outlook.

- Navigate through the intricacies of Grab Holdings with our comprehensive financial health report here.

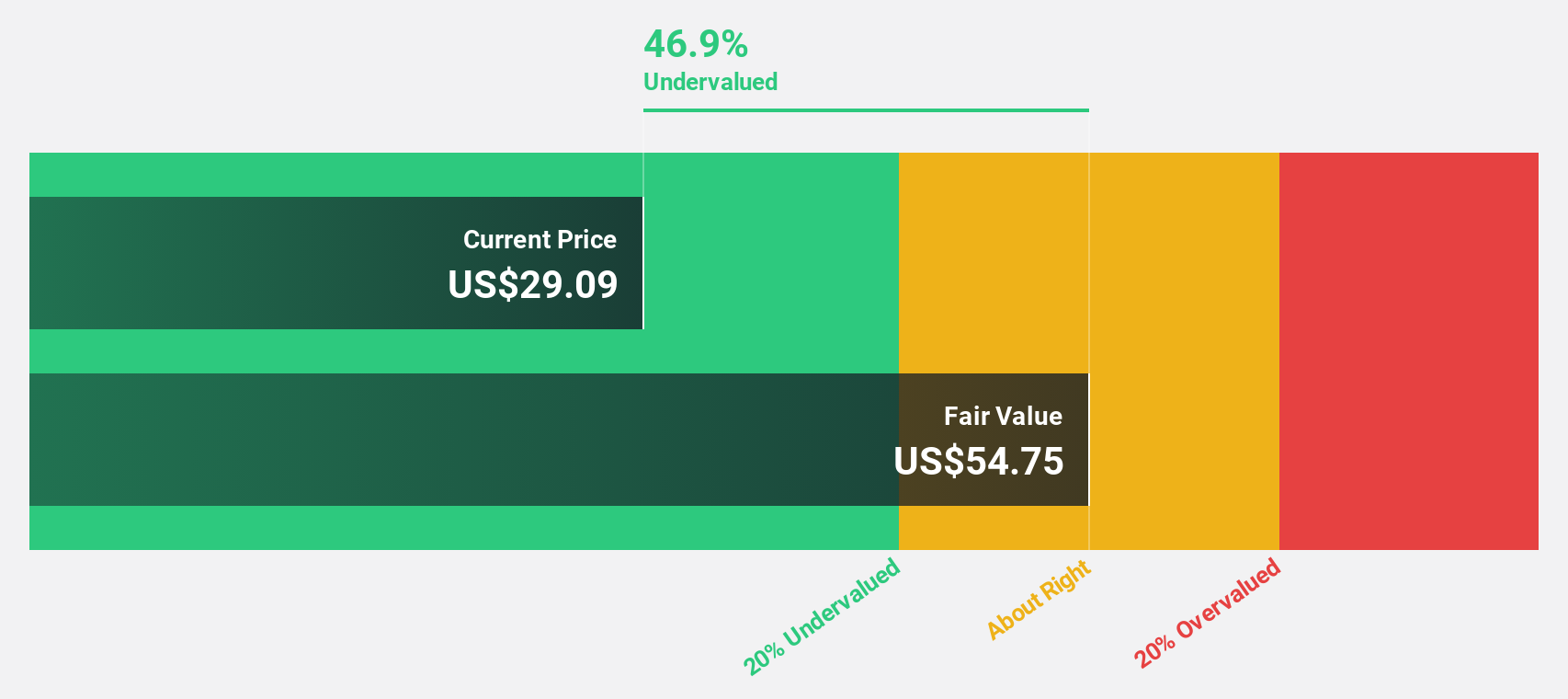

Roku (ROKU)

Overview: Roku, Inc. operates a TV streaming platform both in the United States and internationally, with a market cap of approximately $12.98 billion.

Operations: Roku generates revenue through two main segments: Devices, contributing $595.16 million, and Platform, accounting for $3.80 billion.

Estimated Discount To Fair Value: 44.3%

Roku is trading at US$87.51, well below its estimated fair value of US$157.04, highlighting potential undervaluation based on cash flows. The company recently reported a turnaround with net income of US$10.5 million for Q2 2025 and announced a share repurchase program worth up to $400 million, enhancing shareholder value. Additionally, Roku's new SVOD service launch and partnership with Amazon Ads could bolster future revenue growth beyond the market average rate.

- Upon reviewing our latest growth report, Roku's projected financial performance appears quite optimistic.

- Click here and access our complete balance sheet health report to understand the dynamics of Roku.

CareTrust REIT (CTRE)

Overview: CareTrust REIT is a self-administered, publicly-traded real estate investment trust focused on owning, acquiring, developing and leasing seniors housing and healthcare-related properties, with a market cap of $7.29 billion.

Operations: The company's revenue primarily comes from investments in healthcare-related real estate assets, totaling $373.42 million.

Estimated Discount To Fair Value: 43.9%

CareTrust REIT is trading at US$33.71, significantly below its estimated fair value of US$60.07, suggesting it may be undervalued based on cash flows. Despite recent shareholder dilution due to a US$640 million equity offering, the company's earnings are forecast to grow substantially at 20.34% annually over the next three years. However, its dividend yield of 3.98% is not well covered by earnings, and return on equity remains low at 8.4%.

- Our comprehensive growth report raises the possibility that CareTrust REIT is poised for substantial financial growth.

- Get an in-depth perspective on CareTrust REIT's balance sheet by reading our health report here.

Where To Now?

- Discover the full array of 190 Undervalued US Stocks Based On Cash Flows right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ROKU

Roku

Operates a TV streaming platform in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives