- Australia

- /

- Metals and Mining

- /

- ASX:CHN

ASX Penny Stocks To Consider In September 2025

Reviewed by Simply Wall St

In the last week, the Australian market has stayed flat, but it is up 6.9% over the past year with earnings forecast to grow by 11% annually. Investing in penny stocks—once a niche area—can still present growth opportunities, especially when these stocks are supported by strong financial health and long-term potential. We'll explore several penny stocks that stand out for their financial strength, making them promising candidates for investors seeking under-the-radar companies poised for success.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.485 | A$139M | ✅ 4 ⚠️ 3 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.80 | A$49.81M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.70 | A$416.44M | ✅ 4 ⚠️ 3 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.30 | A$243.56M | ✅ 4 ⚠️ 2 View Analysis > |

| Pureprofile (ASX:PPL) | A$0.043 | A$50.3M | ✅ 3 ⚠️ 1 View Analysis > |

| Veris (ASX:VRS) | A$0.072 | A$37.28M | ✅ 4 ⚠️ 2 View Analysis > |

| SHAPE Australia (ASX:SHA) | A$4.86 | A$400.2M | ✅ 3 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$3.04 | A$3.47B | ✅ 4 ⚠️ 1 View Analysis > |

| Praemium (ASX:PPS) | A$0.75 | A$358.29M | ✅ 5 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.33 | A$1.43B | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 423 stocks from our ASX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Chalice Mining (ASX:CHN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Chalice Mining Limited is a mineral exploration and evaluation company with a market cap of A$929.96 million.

Operations: Chalice Mining Limited currently does not report any revenue segments.

Market Cap: A$929.96M

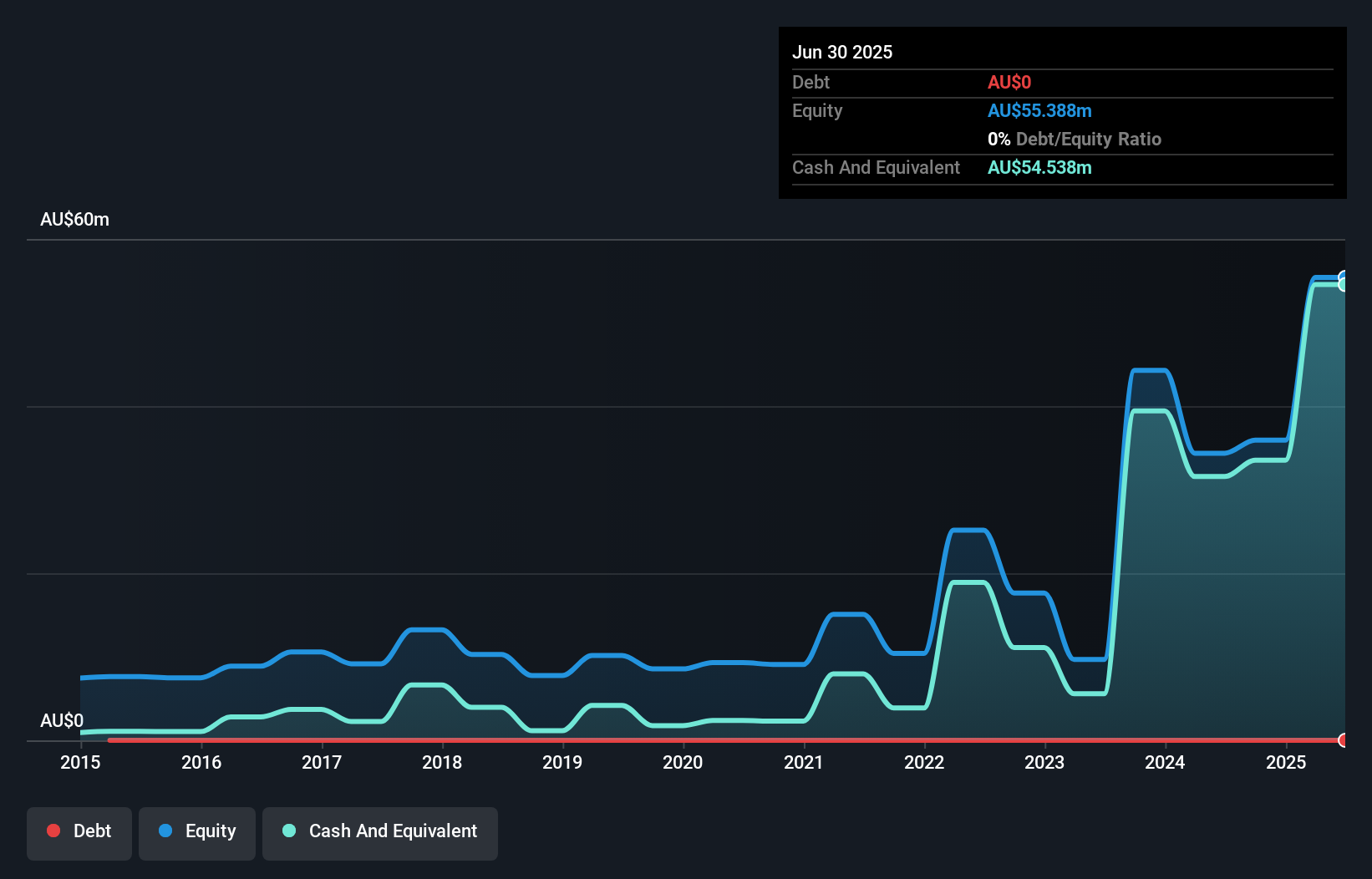

Chalice Mining Limited, with a market cap of A$929.96 million, is a pre-revenue company in the mining sector. Despite its unprofitability and increasing losses over the past five years, the company has no debt and sufficient cash runway for over three years based on current free cash flow trends. The management team is relatively new with an average tenure of 1.5 years, while the board is more seasoned at 4.5 years. Recent earnings results show a reduced net loss of A$24.21 million for the year ended June 2025, indicating some improvement from previous periods.

- Navigate through the intricacies of Chalice Mining with our comprehensive balance sheet health report here.

- Learn about Chalice Mining's future growth trajectory here.

Macmahon Holdings (ASX:MAH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Macmahon Holdings Limited offers surface and underground mining, mining support, and civil infrastructure services to mining companies in Australia and Southeast Asia, with a market cap of A$885.31 million.

Operations: The company's revenue is derived from two main segments: Mining, which generates A$1.97 billion, and Civil, contributing A$436.97 million.

Market Cap: A$885.31M

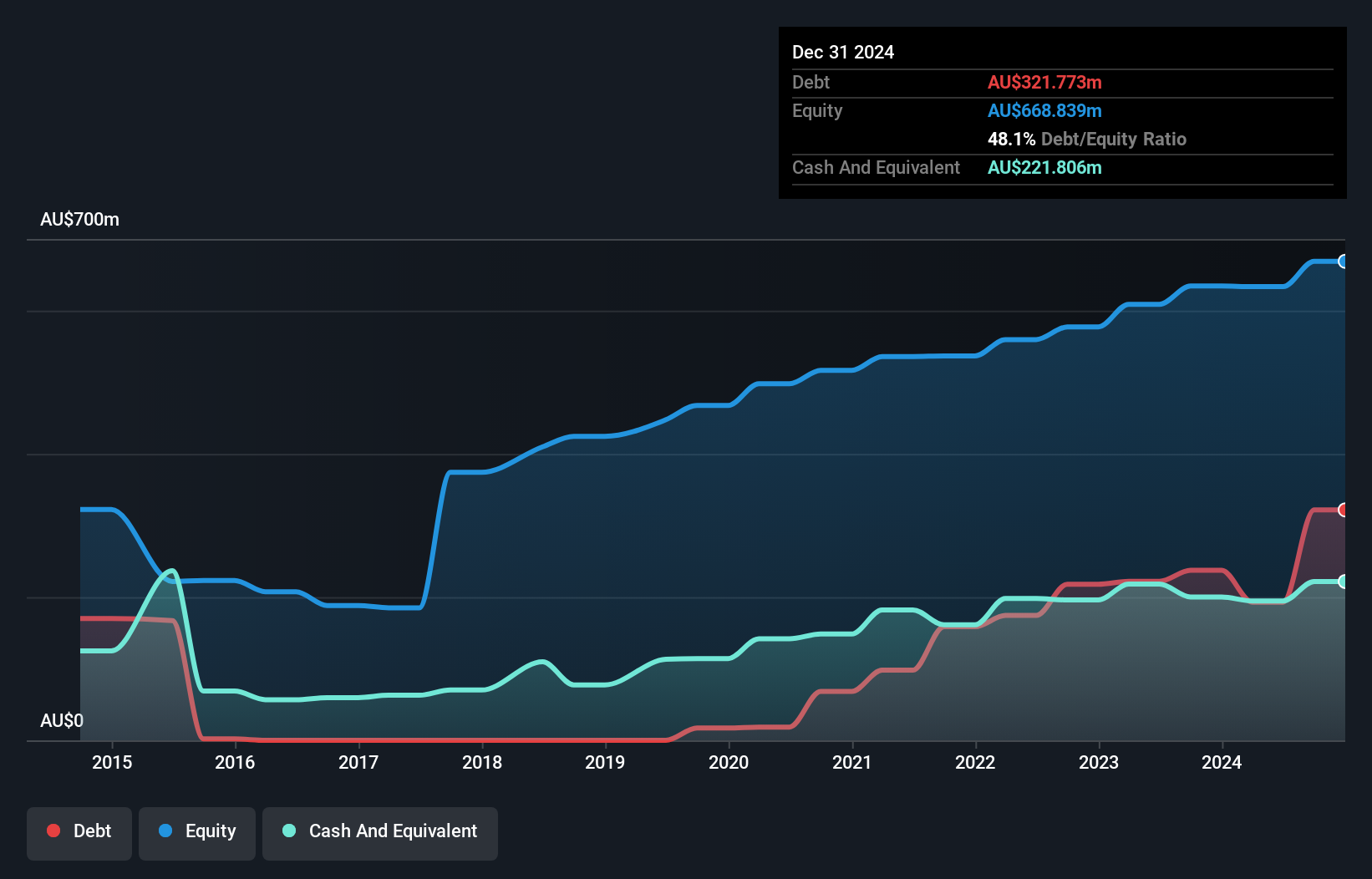

Macmahon Holdings, with a market cap of A$885.31 million, has demonstrated strong revenue growth, reporting A$2.43 billion for the year ended June 2025. Earnings have grown significantly by 38.9% over the past year, surpassing industry averages and reversing a five-year decline trend. The company maintains satisfactory debt levels with net debt to equity at 5.7%, and its interest payments are well covered by EBIT at 4.4 times coverage. Despite recent board changes and a relatively inexperienced board tenure of 1.9 years, Macmahon's management team is experienced with an average tenure of 3.7 years, contributing to stable operations amidst market volatility.

- Jump into the full analysis health report here for a deeper understanding of Macmahon Holdings.

- Gain insights into Macmahon Holdings' future direction by reviewing our growth report.

Sovereign Metals (ASX:SVM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Sovereign Metals Limited, with a market cap of A$449.62 million, is involved in the exploration and development of mineral resource projects in Malawi through its subsidiaries.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: A$449.62M

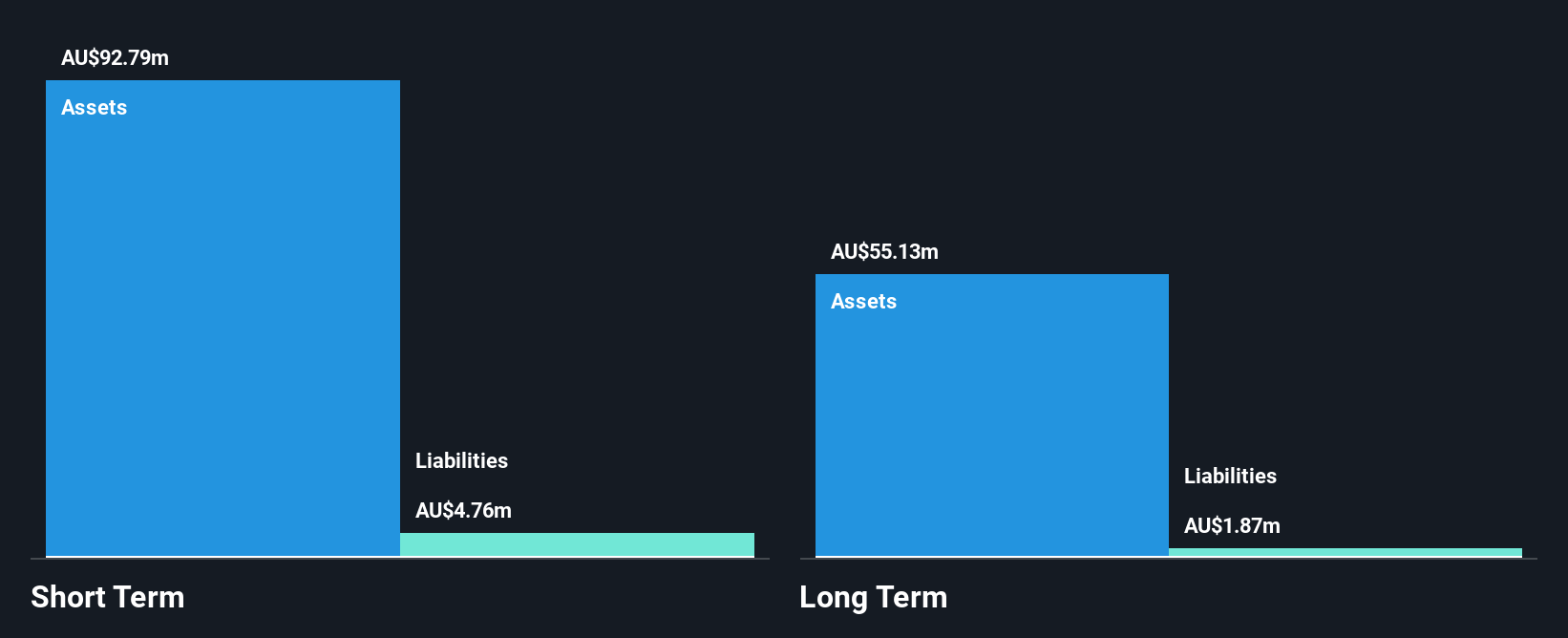

Sovereign Metals Limited, with a market cap of A$449.62 million, remains pre-revenue as it advances its Kasiya Rutile-Graphite Project in Malawi. The company has reported a net loss of A$40.44 million for the year ended June 2025, an increase from the previous year's loss. Despite these losses, Sovereign is debt-free and maintains sufficient short-term assets to cover liabilities. Recent inclusion in the S&P Global BMI Index highlights investor interest, while successful rehabilitation trials at Kasiya demonstrate potential for enhanced agricultural productivity post-mining, supporting environmental and community engagement goals integral to its Definitive Feasibility Study (DFS).

- Dive into the specifics of Sovereign Metals here with our thorough balance sheet health report.

- Assess Sovereign Metals' future earnings estimates with our detailed growth reports.

Seize The Opportunity

- Click through to start exploring the rest of the 420 ASX Penny Stocks now.

- Ready To Venture Into Other Investment Styles? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CHN

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion