- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:AMZN

Amazon.com (NasdaqGS:AMZN) Expands AI Partnerships With New Offerings In AWS Marketplace

Reviewed by Simply Wall St

Amazon.com (NasdaqGS:AMZN) experienced an 8% increase in its stock price over the last month, coinciding with several developments in its ecosystem. A significant event was EXL's achievement of the AWS Generative AI Competency designation, reinforcing Amazon's leadership within AI solutions. Additionally, Amazon's plan to expand its AWS infrastructure in Chile with a substantial $4 billion investment showcases its commitment to growing its cloud capabilities. These factors align with broader market dynamics that have been generally positive, although markets remained flat over the past week. Overall, these events likely supported Amazon's recent share price movement.

Buy, Hold or Sell Amazon.com? View our complete analysis and fair value estimate and you decide.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

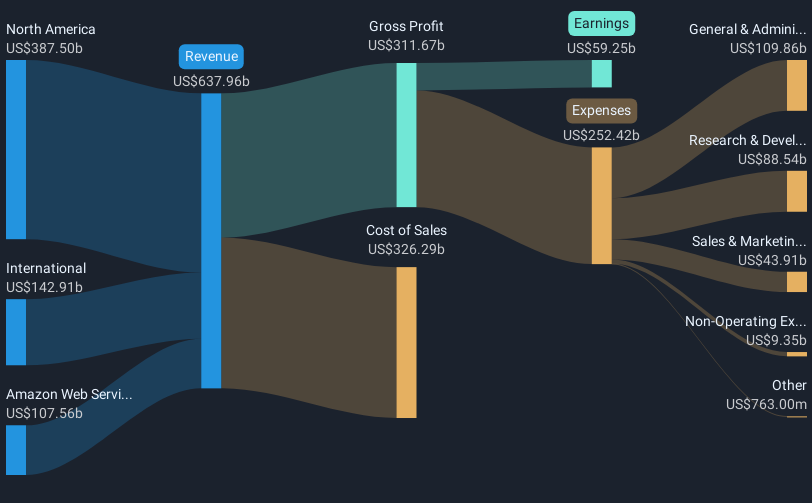

Recent developments, such as Amazon's AWS Generative AI Competency designation and its US$4 billion investment in expanding AWS infrastructure in Chile, have the potential to further enhance the company’s position in AI and cloud services. These initiatives align with the company's focus on improving operational efficiencies through optimized fulfillment, which could positively impact future revenue growth and margins. Analysts’ revenue and earnings forecasts, which anticipate a growth to US$856.20 billion and US$103.60 billion by 2028, respectively, reflect optimism around such projects.

Over the past three years, Amazon's total shareholder return was 67.24%. This longer-term gain illustrates the company's capacity to capitalize on growth opportunities, especially when contrasted with its one-year performance, where it exceeded the U.S. market return of 12.6%. Despite these promising metrics, potential risks related to tariffs, infrastructure costs, and competition in AI and cloud services could present challenges moving forward.

Currently, Amazon shares trade at US$185.01, which is lower than the average price target of US$239.33 set by analysts. Considering this, and the assumption that earnings will grow to justify a price-to-earnings ratio of 32.3 times by 2028, the share price increase coincides with optimistic analyst projections about Amazon’s growth potential. Investors might interpret this gap as indicative of further upside potential, provided the company meets expected performance targets.

Learn about Amazon.com's future growth trajectory here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMZN

Amazon.com

Engages in the retail sale of consumer products, advertising, and subscriptions service through online and physical stores in North America and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)