As the Canadian market navigates through policy shifts and global uncertainties, the TSX is on track for its strongest calendar-year return since 2009, offering investors reasons to be thankful. In this climate of volatility and opportunity, identifying undervalued stocks can be a strategic move for those looking to capitalize on potential growth while maintaining a balanced portfolio.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Topicus.com (TSXV:TOI) | CA$125.78 | CA$226.78 | 44.5% |

| Savaria (TSX:SIS) | CA$21.67 | CA$35.28 | 38.6% |

| Neo Performance Materials (TSX:NEO) | CA$17.04 | CA$31.75 | 46.3% |

| NanoXplore (TSX:GRA) | CA$2.19 | CA$3.57 | 38.7% |

| kneat.com (TSX:KSI) | CA$4.72 | CA$9.24 | 48.9% |

| Haivision Systems (TSX:HAI) | CA$5.15 | CA$8.64 | 40.4% |

| Green Thumb Industries (CNSX:GTII) | CA$9.57 | CA$16.91 | 43.4% |

| Dexterra Group (TSX:DXT) | CA$11.90 | CA$22.90 | 48% |

| Decisive Dividend (TSXV:DE) | CA$7.20 | CA$14.15 | 49.1% |

| Constellation Software (TSX:CSU) | CA$3309.98 | CA$5862.92 | 43.5% |

Let's uncover some gems from our specialized screener.

Exchange Income (TSX:EIF)

Overview: Exchange Income Corporation, with a market cap of CA$4.35 billion, operates globally through its subsidiaries in aerospace and aviation services and equipment, as well as manufacturing businesses.

Operations: The company's revenue is derived from two main segments: CA$1.93 billion from aerospace and aviation services and equipment, and CA$1.10 billion from manufacturing businesses.

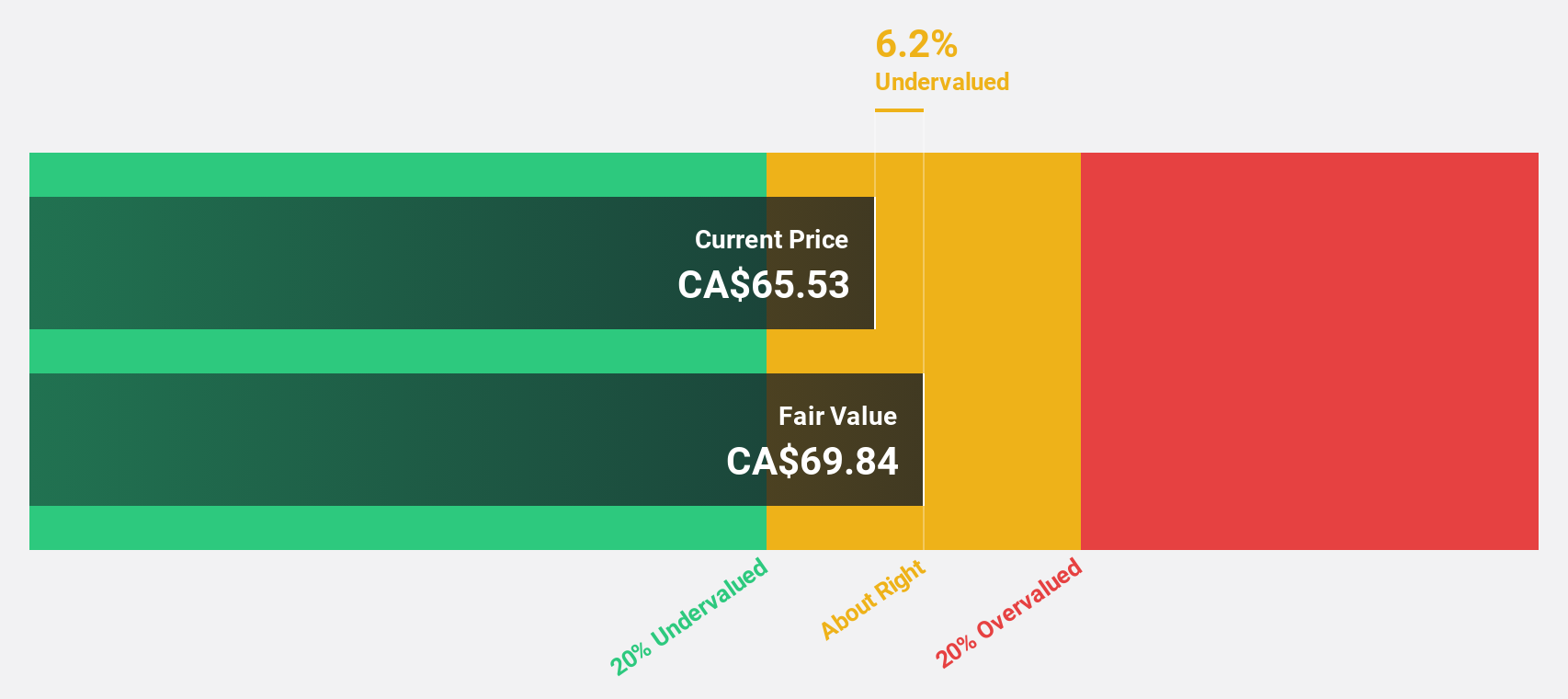

Estimated Discount To Fair Value: 37.7%

Exchange Income Corporation's recent financial activities highlight its potential as an undervalued stock based on cash flows. The company has completed the redemption of its debentures, converting CA$106.01 million into common shares, which may improve liquidity. Despite a dividend yield of 3.3% not being fully covered by earnings or free cash flows, Exchange Income is trading at CA$79.93, significantly below its estimated fair value of CA$128.25, suggesting it is undervalued by over 20%.

- The analysis detailed in our Exchange Income growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of Exchange Income.

kneat.com (TSX:KSI)

Overview: Kneat.com, Inc., along with its subsidiaries, provides software solutions for data and document management in regulated environments across North America, Europe, and the Asia Pacific, with a market cap of CA$449.99 million.

Operations: The company's revenue primarily comes from its software and programming segment, which generated CA$60.00 million.

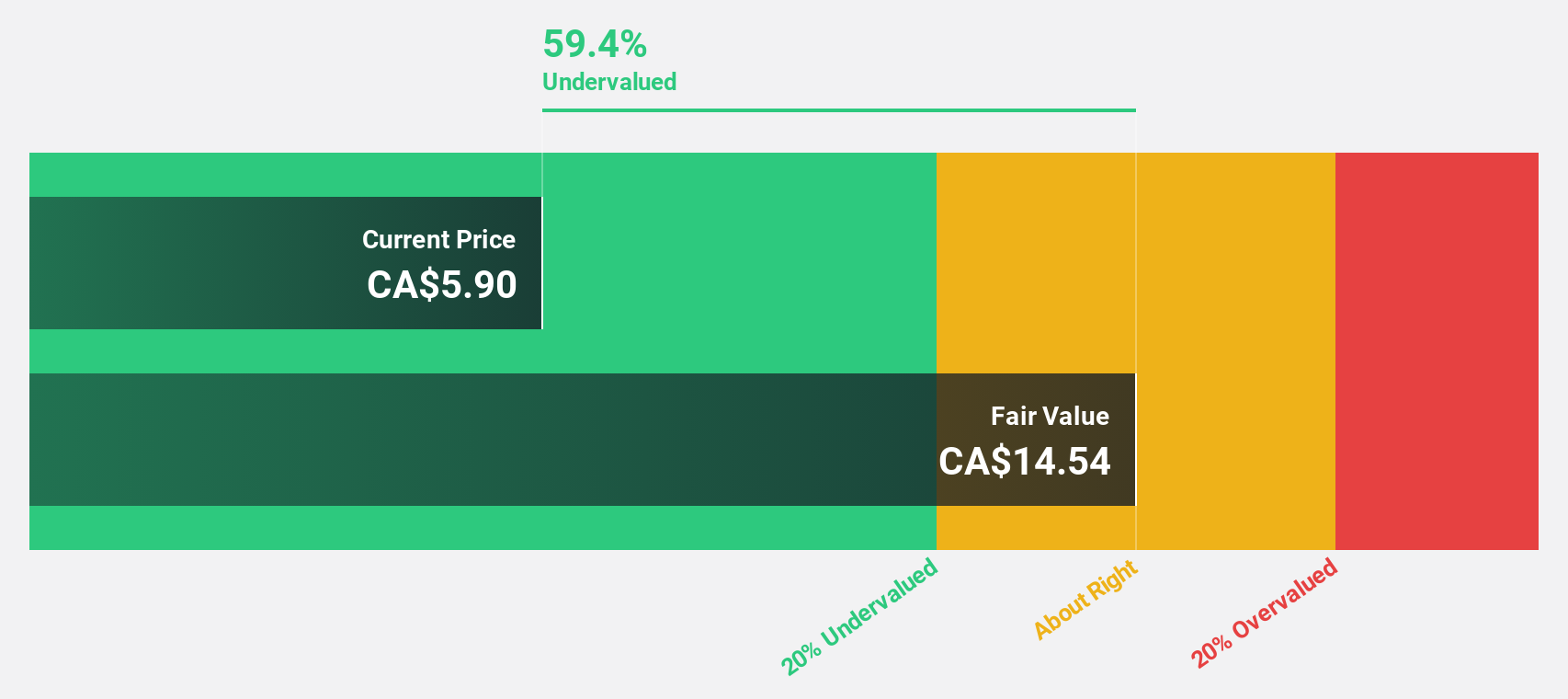

Estimated Discount To Fair Value: 48.9%

kneat.com is trading at CA$4.72, significantly below its estimated fair value of CA$9.24, indicating it is undervalued by over 20%. The company’s revenue growth forecast exceeds the Canadian market average, with a projected annual increase of 21.9%. Recent earnings showed sales growth but a net loss for the quarter; however, year-to-date figures reveal a turnaround to profitability compared to last year's losses, supported by strategic client agreements enhancing its market position.

- The growth report we've compiled suggests that kneat.com's future prospects could be on the up.

- Click to explore a detailed breakdown of our findings in kneat.com's balance sheet health report.

Savaria (TSX:SIS)

Overview: Savaria Corporation offers accessibility solutions for the elderly and physically challenged across Canada, the United States, Europe, and internationally with a market cap of CA$1.55 billion.

Operations: The company's revenue is derived from two main segments: Patient Care, generating CA$197.90 million, and Accessibility (including Adapted Vehicles), contributing CA$697.19 million.

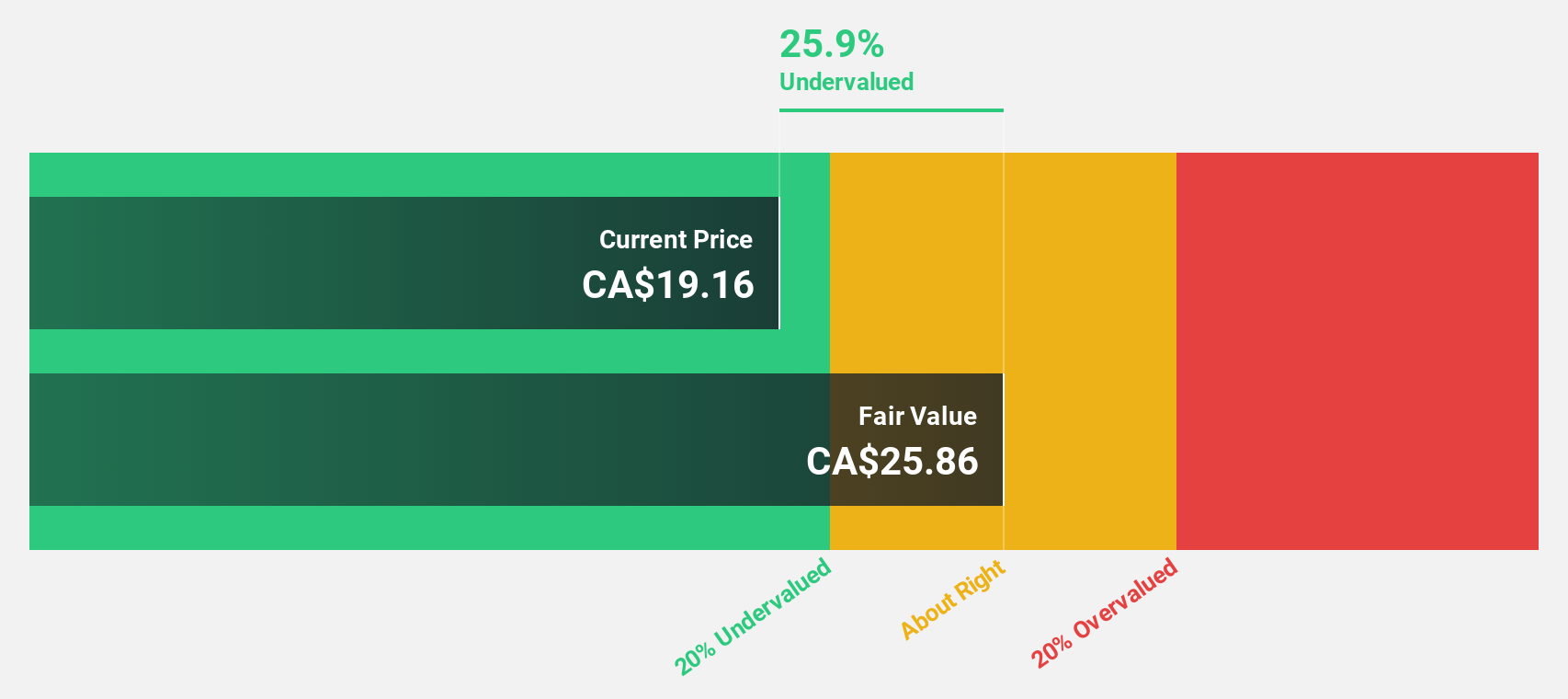

Estimated Discount To Fair Value: 38.6%

Savaria Corporation, trading at CA$21.67, is undervalued with a fair value estimate of CA$35.28. Despite significant insider selling recently, its earnings are projected to grow 29.48% annually, outpacing the Canadian market's average growth rate. The company reported strong Q3 results with net income rising to CA$19.47 million from CA$11.17 million year-on-year and continues to maintain a stable dividend policy while seeking strategic acquisitions supported by substantial available funds for investment.

- Our comprehensive growth report raises the possibility that Savaria is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of Savaria stock in this financial health report.

Where To Now?

- Embark on your investment journey to our 29 Undervalued TSX Stocks Based On Cash Flows selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SIS

Savaria

Provides accessibility solutions for the elderly and physically challenged people in Canada, the United States, Europe, and internationally.

Established dividend payer and good value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Cheap if able to sustain revenue, and a potential bargain if able to turn store openings into revenue growth

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)