- United States

- /

- Healthcare Services

- /

- NasdaqGS:PRVA

3 Stocks That May Be Undervalued By Up To 43%

Reviewed by Simply Wall St

As the U.S. stock market experiences fluctuations with recent declines in major indices like the Dow Jones, S&P 500, and Nasdaq, investors are keenly observing how interest rate changes by the Federal Reserve impact valuations. In such a volatile environment, identifying undervalued stocks can be crucial for investors looking to capitalize on potential growth opportunities while navigating these shifting economic conditions.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| SolarEdge Technologies (SEDG) | $35.93 | $70.27 | 48.9% |

| Royal Gold (RGLD) | $191.92 | $383.15 | 49.9% |

| Pinnacle Financial Partners (PNFP) | $95.08 | $186.59 | 49% |

| Peapack-Gladstone Financial (PGC) | $28.53 | $56.54 | 49.5% |

| Northwest Bancshares (NWBI) | $12.42 | $24.41 | 49.1% |

| Metropolitan Bank Holding (MCB) | $77.33 | $150.26 | 48.5% |

| Horizon Bancorp (HBNC) | $16.25 | $31.76 | 48.8% |

| Exact Sciences (EXAS) | $52.41 | $102.21 | 48.7% |

| Alnylam Pharmaceuticals (ALNY) | $454.41 | $899.41 | 49.5% |

| AbbVie (ABBV) | $222.61 | $439.60 | 49.4% |

Let's uncover some gems from our specialized screener.

Old National Bancorp (ONB)

Overview: Old National Bancorp is a bank holding company for Old National Bank, offering consumer and commercial banking services in the United States, with a market cap of $8.57 billion.

Operations: The company generates revenue primarily through its Community Banking segment, which accounts for $1.89 billion.

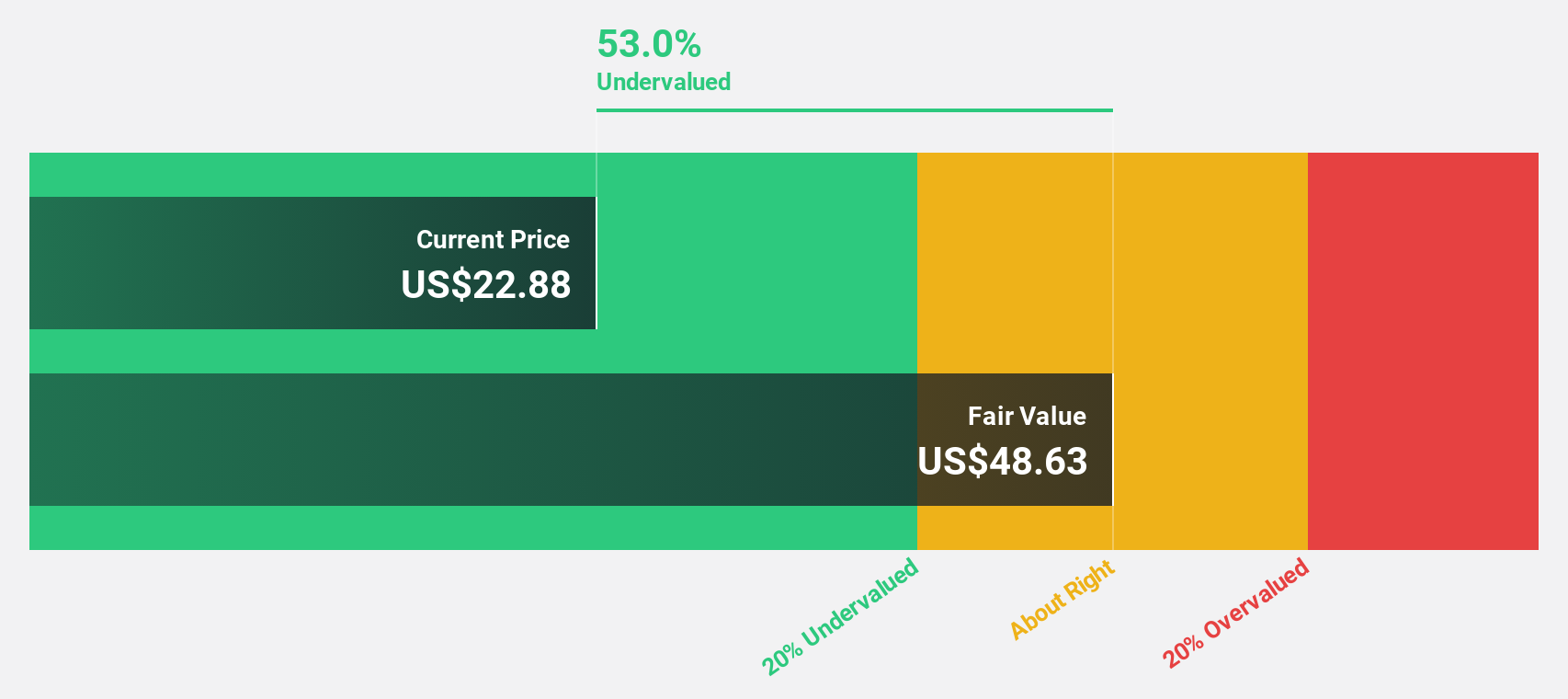

Estimated Discount To Fair Value: 43%

Old National Bancorp appears undervalued, trading 43% below its estimated fair value of US$39.03. Despite a low allowance for bad loans and recent shareholder dilution, the company shows strong growth potential with earnings forecasted to rise significantly by 34% annually over the next three years. Recent earnings reported net interest income of US$514.79 million for Q2 2025, highlighting robust cash flow generation capabilities amidst a reliable dividend yield of 2.52%.

- Insights from our recent growth report point to a promising forecast for Old National Bancorp's business outlook.

- Click to explore a detailed breakdown of our findings in Old National Bancorp's balance sheet health report.

Privia Health Group (PRVA)

Overview: Privia Health Group, Inc. is a national physician-enablement company operating in the United States with a market cap of approximately $2.81 billion.

Operations: Privia Health Group generates revenue primarily from its Healthcare Facilities & Services segment, which amounts to $1.90 billion.

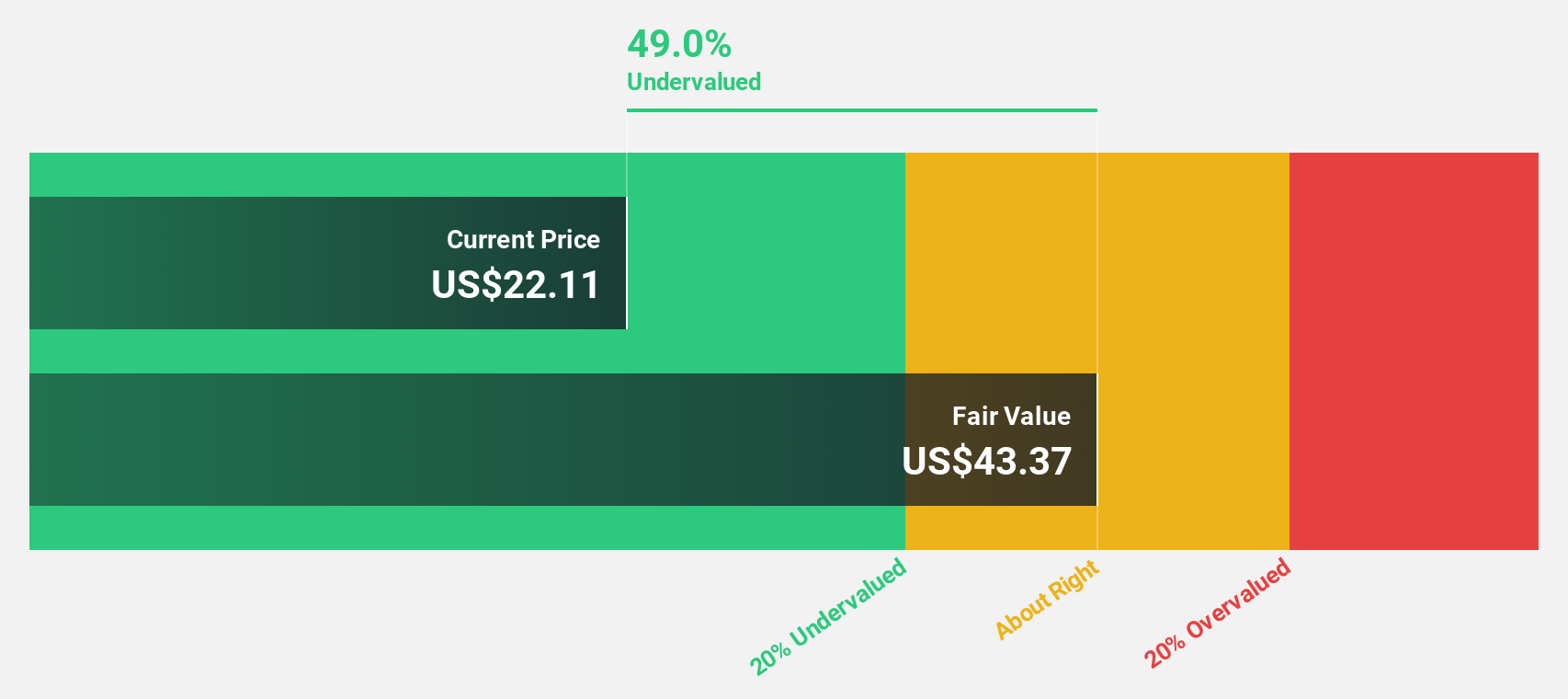

Estimated Discount To Fair Value: 40.8%

Privia Health Group is trading significantly below its estimated fair value of US$39.66, with analysts projecting a 29.1% price increase. Despite a modest return on equity forecast and recent earnings showing net income of US$2.69 million for Q2 2025, the company raised its revenue guidance above US$1.9 billion for 2025. With anticipated annual earnings growth of 36.8%, Privia demonstrates strong potential in cash flow valuation terms amidst market conditions.

- Our comprehensive growth report raises the possibility that Privia Health Group is poised for substantial financial growth.

- Take a closer look at Privia Health Group's balance sheet health here in our report.

Lazard (LAZ)

Overview: Lazard, Inc. is a financial advisory and asset management firm operating across the Americas, Europe, the Middle East, Africa, and the Asia Pacific with a market cap of approximately $5.32 billion.

Operations: Lazard's revenue is primarily derived from its Financial Advisory segment at $1.76 billion, followed by Asset Management at $1.19 billion, and Corporate at $103.16 million.

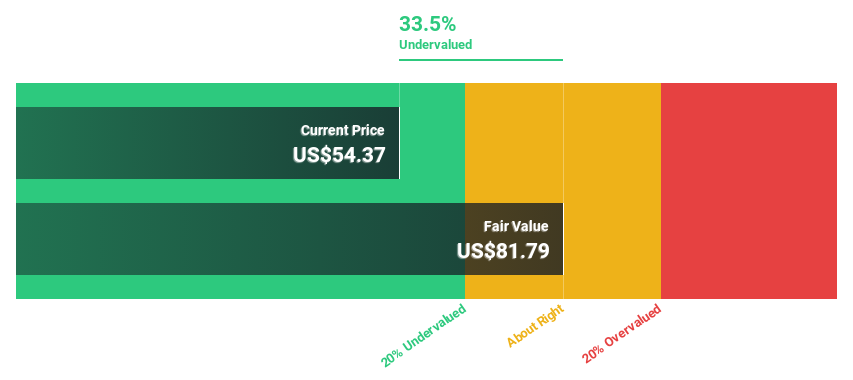

Estimated Discount To Fair Value: 19.1%

Lazard's stock is trading at US$56.13, below its estimated fair value of US$69.4, suggesting undervaluation based on cash flows. The company reported a net income increase to US$55.35 million for Q2 2025 and anticipates earnings growth of 30.6% annually over the next three years, outpacing the broader market's forecasted growth rate. However, Lazard carries a high debt level and has experienced significant insider selling recently, which may warrant caution for potential investors.

- Our expertly prepared growth report on Lazard implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of Lazard stock in this financial health report.

Key Takeaways

- Unlock our comprehensive list of 197 Undervalued US Stocks Based On Cash Flows by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PRVA

Privia Health Group

Operates as a national physician-enablement company in the United States.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives