- United States

- /

- Luxury

- /

- NYSE:VFC

3 Stocks Estimated To Be Trading Below Fair Value By Up To 47.8%

Reviewed by Simply Wall St

As the U.S. stock market navigates a period of volatility, with major indexes recently snapping a losing streak but still posting weekly losses, investors are increasingly on the lookout for opportunities to capitalize on undervalued stocks. In such an environment, identifying stocks that are trading below their fair value can offer potential for growth, particularly when inflation and economic policies continue to influence market dynamics.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| XPEL (XPEL) | $32.35 | $62.95 | 48.6% |

| Udemy (UDMY) | $7.04 | $13.67 | 48.5% |

| Royal Gold (RGLD) | $196.71 | $384.55 | 48.8% |

| Northwest Bancshares (NWBI) | $12.52 | $24.41 | 48.7% |

| NeuroPace (NPCE) | $10.20 | $20.04 | 49.1% |

| Metropolitan Bank Holding (MCB) | $76.33 | $150.26 | 49.2% |

| Horizon Bancorp (HBNC) | $16.20 | $31.76 | 49% |

| Customers Bancorp (CUBI) | $67.45 | $131.16 | 48.6% |

| Ategrity Specialty Insurance Company Holdings (ASIC) | $19.52 | $38.76 | 49.6% |

| AbbVie (ABBV) | $220.61 | $438.05 | 49.6% |

Let's take a closer look at a couple of our picks from the screened companies.

Celsius Holdings (CELH)

Overview: Celsius Holdings, Inc. is engaged in developing, processing, manufacturing, marketing, selling, and distributing functional energy drinks across various regions including the United States and internationally, with a market cap of approximately $14.03 billion.

Operations: The company generates revenue primarily from its non-alcoholic beverages segment, which amounted to $1.67 billion.

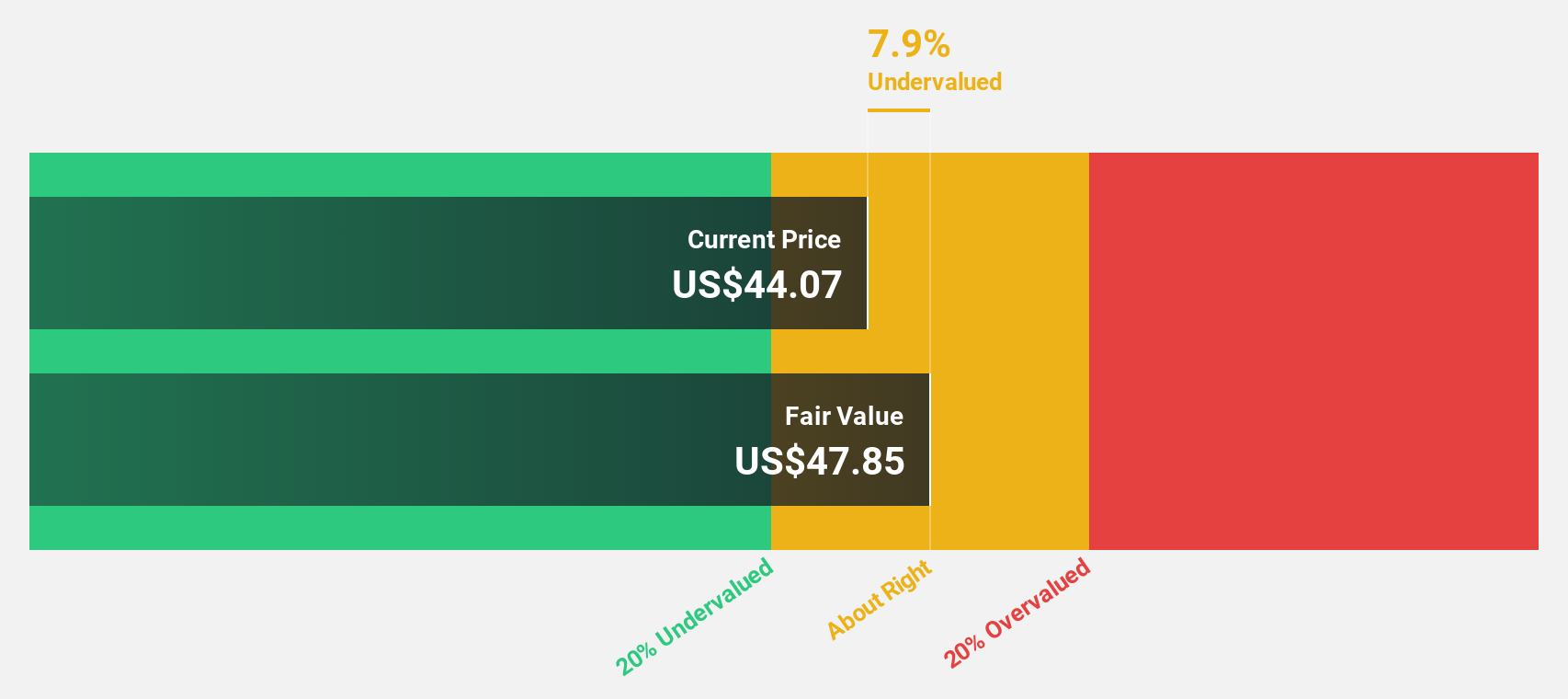

Estimated Discount To Fair Value: 12.6%

Celsius Holdings is trading at US$54.39, below its estimated fair value of US$62.25, indicating potential undervaluation based on discounted cash flow analysis. Despite a decline in profit margins from 16.2% to 5.8%, the company's earnings and revenue are forecast to grow significantly above market averages at 32.6% and 20.7% per year, respectively. Recent strategic partnerships with PepsiCo could enhance distribution capabilities and brand growth, potentially improving cash flows further.

- Our earnings growth report unveils the potential for significant increases in Celsius Holdings' future results.

- Delve into the full analysis health report here for a deeper understanding of Celsius Holdings.

AGNC Investment (AGNC)

Overview: AGNC Investment Corp. provides private capital to the U.S. housing market and has a market cap of $10.25 billion.

Operations: The company's revenue segment includes $496 million from REIT - Mortgage.

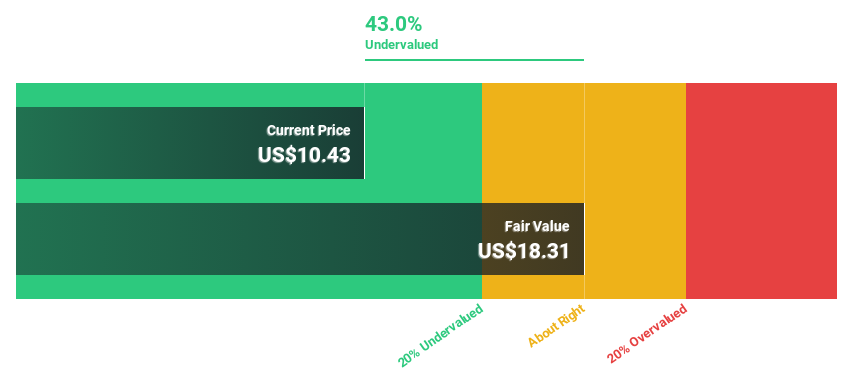

Estimated Discount To Fair Value: 47.8%

AGNC Investment is trading at US$9.84, below its fair value estimate of US$18.84, highlighting a significant undervaluation based on cash flow analysis. Revenue and earnings are projected to grow substantially above market averages at 44.5% and 62.2% per year, respectively, although dividends are not well covered by earnings or free cash flows. Recent fixed-income offerings raised US$300 million but insider selling has been significant over the past quarter.

- Insights from our recent growth report point to a promising forecast for AGNC Investment's business outlook.

- Navigate through the intricacies of AGNC Investment with our comprehensive financial health report here.

V.F (VFC)

Overview: V.F. Corporation, along with its subsidiaries, provides branded apparel, footwear, and accessories for men, women, and children across the Americas, Europe, and the Asia-Pacific region with a market cap of approximately $5.75 billion.

Operations: The company generates revenue through its Active segment at $3.02 billion and Outdoor segment at $5.64 billion.

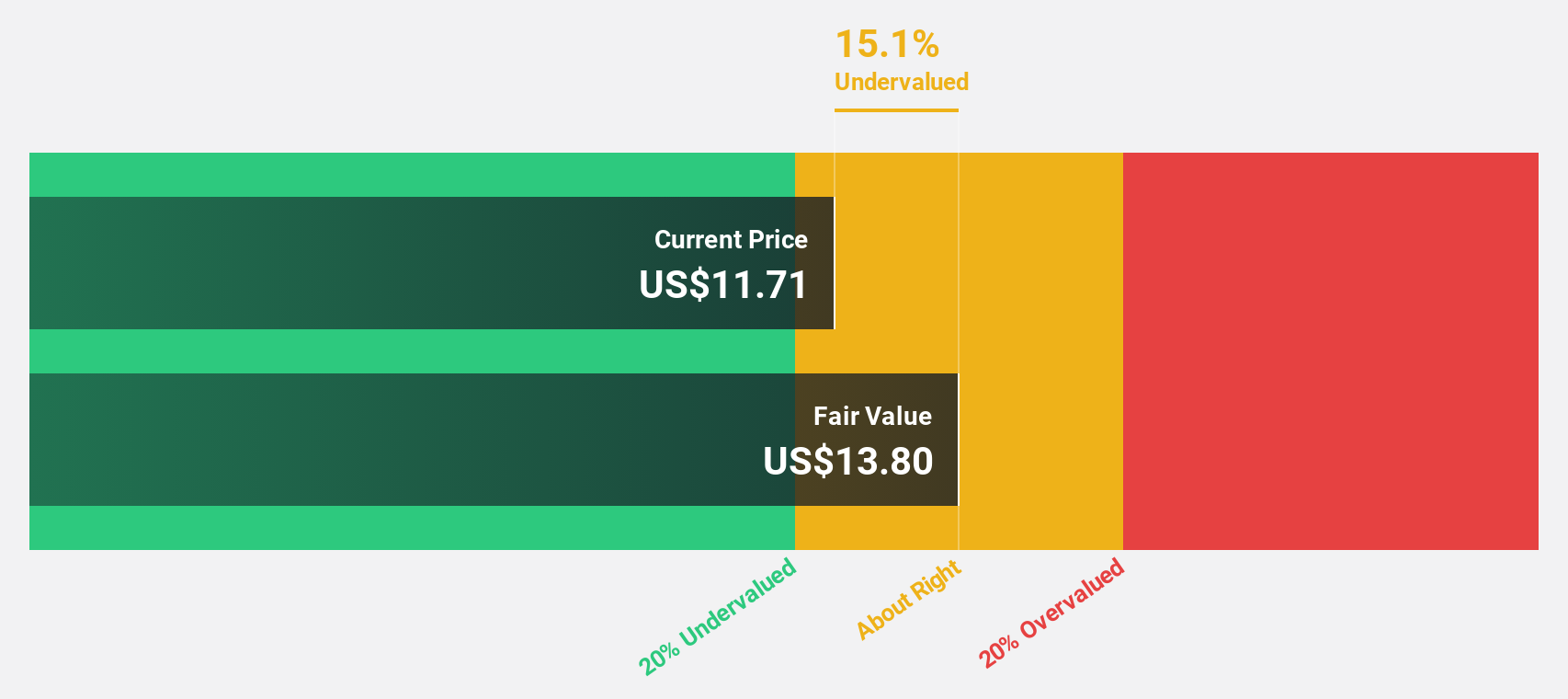

Estimated Discount To Fair Value: 30%

V.F. Corporation is trading at US$14.73, below its estimated fair value of US$21.06, indicating potential undervaluation based on cash flow analysis. Earnings are expected to grow significantly at 32.5% annually, though revenue growth lags behind market averages. The company's debt is not well covered by operating cash flow, and recent legal challenges have impacted investor sentiment and stock price performance following a significant decline in the Vans brand's growth trajectory.

- The growth report we've compiled suggests that V.F's future prospects could be on the up.

- Take a closer look at V.F's balance sheet health here in our report.

Taking Advantage

- Delve into our full catalog of 195 Undervalued US Stocks Based On Cash Flows here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VFC

V.F

Offers branded apparel, footwear, and accessories for men, women, and children in the Americas, Europe, and the Asia-Pacific.

Reasonable growth potential with low risk.

Similar Companies

Market Insights

Community Narratives