As the European market experiences a modest upswing, buoyed by easing geopolitical tensions and potential economic stimuli from Germany, investors are increasingly turning their attention to dividend stocks as a source of steady income. In this environment, identifying stocks with strong fundamentals and reliable dividend yields can be an effective strategy for those seeking stability amidst fluctuating economic conditions.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.44% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.40% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.59% | ★★★★★★ |

| Les Docks des Pétroles d'Ambès -SA (ENXTPA:DPAM) | 5.73% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 4.85% | ★★★★★★ |

| Holcim (SWX:HOLN) | 5.26% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.58% | ★★★★★★ |

| ERG (BIT:ERG) | 5.39% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.81% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.48% | ★★★★★★ |

Click here to see the full list of 236 stocks from our Top European Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

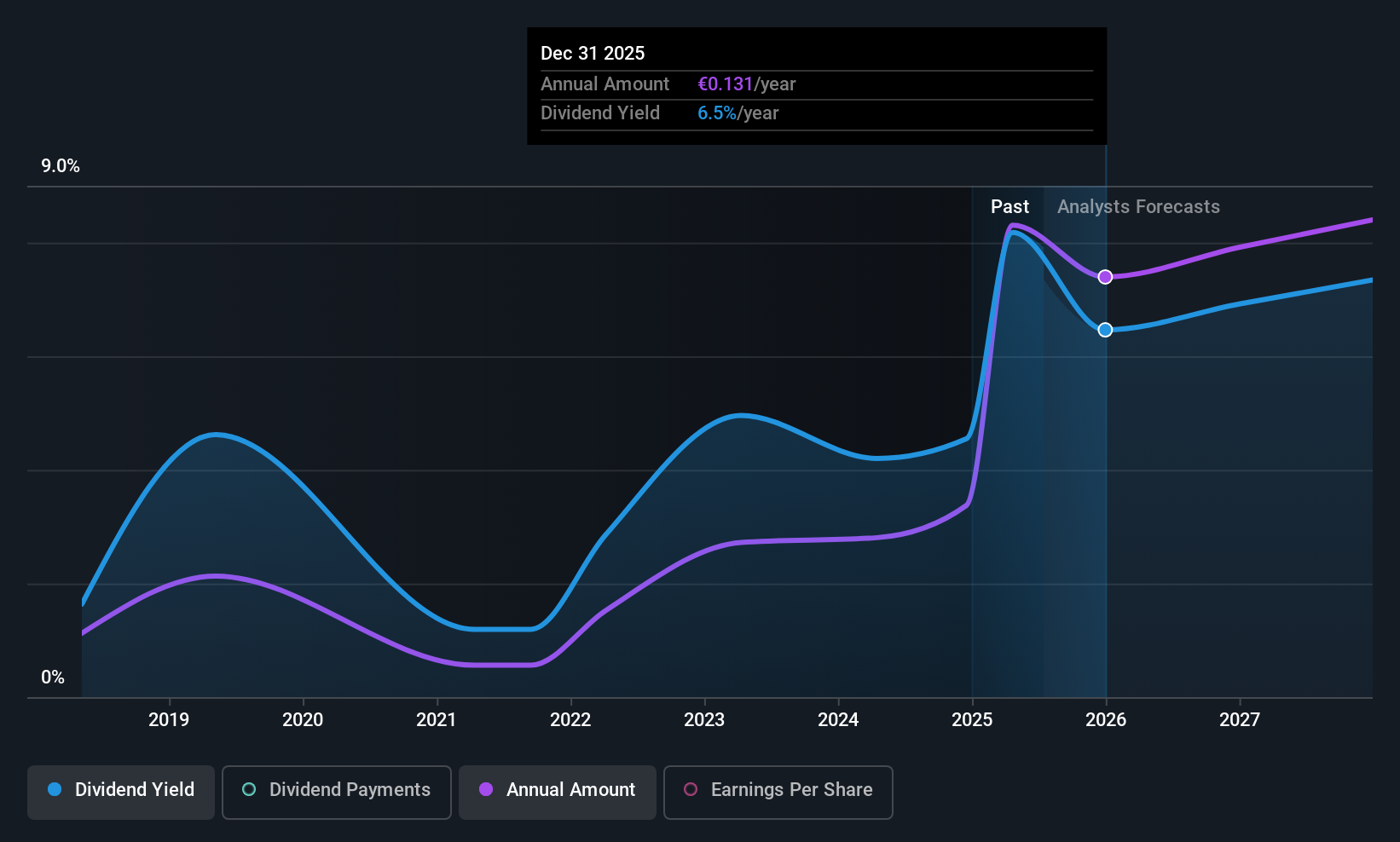

Unicaja Banco (BME:UNI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Unicaja Banco, S.A. operates in the retail banking sector in Spain with a market capitalization of €5.15 billion.

Operations: Unicaja Banco, S.A. generates its revenue primarily from the retail banking segment, amounting to €1.99 billion.

Dividend Yield: 7.4%

Unicaja Banco's dividend payments have been volatile over the past seven years, yet they remain covered by earnings with a current payout ratio of 61.7%. Despite a high dividend yield of 7.36%, which ranks in the top 25% within Spain, challenges persist due to a low allowance for bad loans (68%) and high non-performing loans (2.5%). Recent M&A rumors involving Banco de Sabadell were denied by Unicaja, maintaining focus on its financial stability amidst market volatility.

- Click here to discover the nuances of Unicaja Banco with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Unicaja Banco is priced higher than what may be justified by its financials.

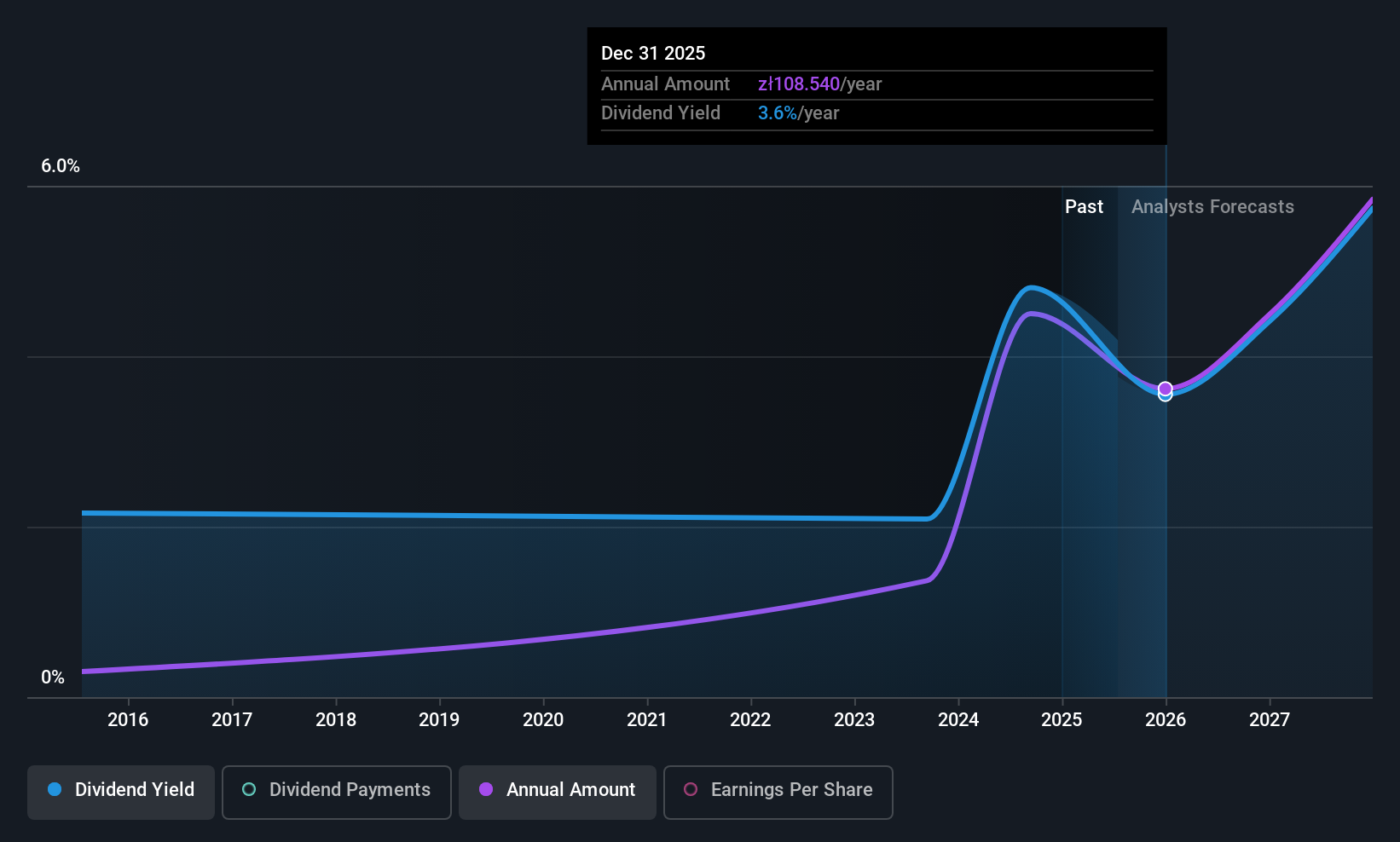

Benefit Systems (WSE:BFT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Benefit Systems S.A. offers non-pay employee benefits solutions across several countries including Poland, Czech Republic, Slovakia, Bulgaria, Croatia, and Turkey with a market cap of PLN9.50 billion.

Operations: Benefit Systems S.A. generates revenue primarily from its operations in Poland, including cafeteria services, amounting to PLN2.57 billion.

Dividend Yield: 4.3%

Benefit Systems' dividend payments, though increased over the past decade, have been volatile and unreliable. Current dividends are covered by earnings (payout ratio: 83.4%) and cash flows (cash payout ratio: 81.4%). Despite trading below estimated fair value, its dividend yield of 4.26% lags behind top Polish payers. Recent equity offerings raised PLN 1.36 billion, potentially impacting future dividends amidst fluctuating first-quarter earnings with net income at PLN 56.7 million compared to PLN 92.12 million last year.

- Delve into the full analysis dividend report here for a deeper understanding of Benefit Systems.

- Upon reviewing our latest valuation report, Benefit Systems' share price might be too pessimistic.

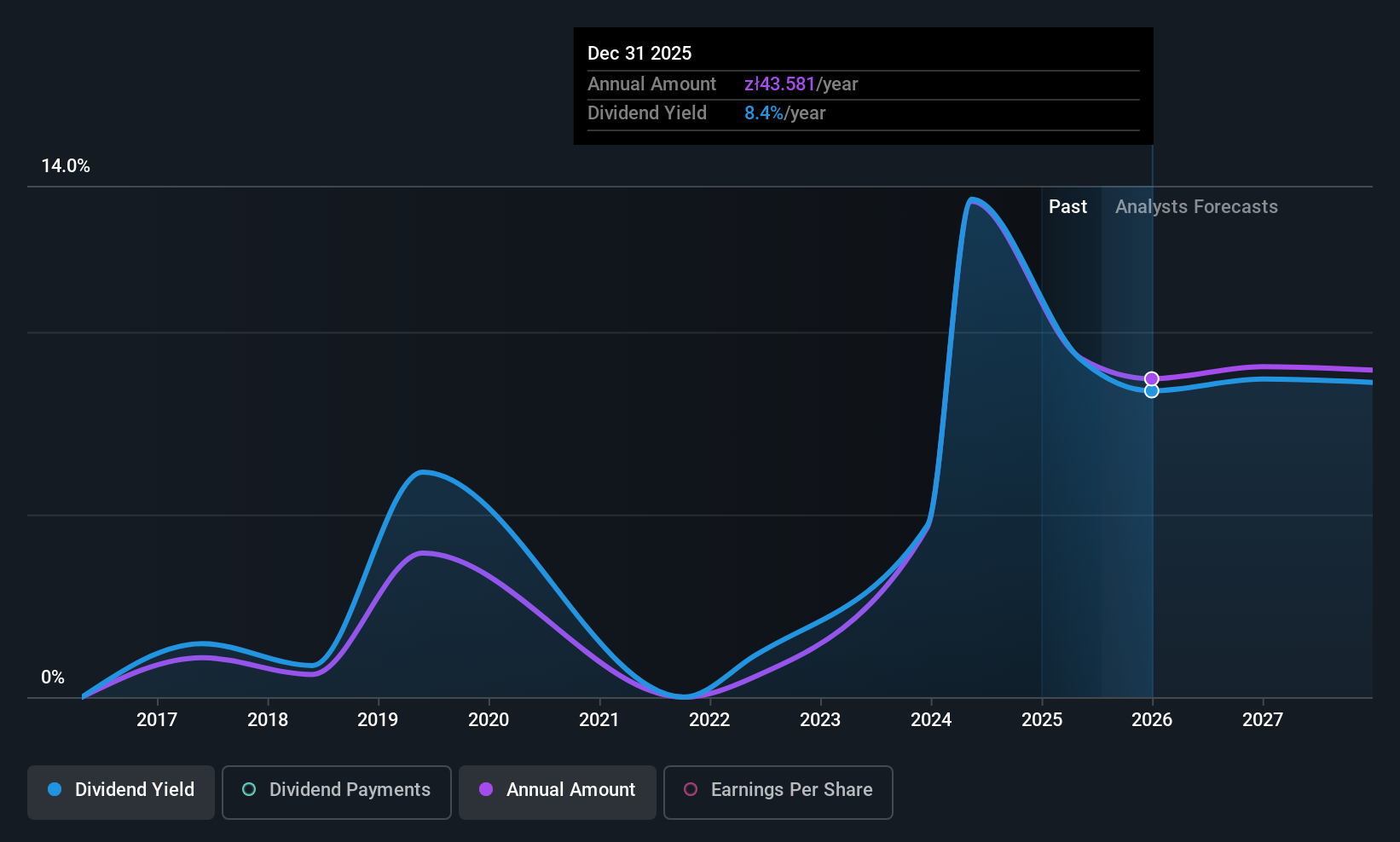

Santander Bank Polska (WSE:SPL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Santander Bank Polska S.A. offers a range of banking products and services to individuals, SMEs, corporate clients, and public sector institutions with a market cap of PLN50.44 billion.

Operations: Santander Bank Polska S.A.'s revenue segments include Retail Banking (PLN9.65 billion), Santander Consumer (PLN1.54 billion), Business and Corporate Banking (PLN2.86 billion), and Corporate & Investment Banking (PLN1.47 billion).

Dividend Yield: 9.4%

Santander Bank Polska's dividends, while covered by earnings with a current payout ratio of 88.1%, have been unreliable and volatile over the past nine years. Despite trading below estimated fair value, its dividend yield is among the top in Poland at 9.39%. Recent earnings showed growth, with net income rising to PLN 1.73 billion for Q1 2025. However, high bad loans at 4.1% and potential ownership changes due to Erste Bank's interest may impact future stability.

- Click here and access our complete dividend analysis report to understand the dynamics of Santander Bank Polska.

- Insights from our recent valuation report point to the potential undervaluation of Santander Bank Polska shares in the market.

Taking Advantage

- Navigate through the entire inventory of 236 Top European Dividend Stocks here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:SPL

Santander Bank Polska

Provides various banking products and services for individuals, small or medium-sized enterprises, corporate clients, and public sector institutions.

Good value with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives