- United States

- /

- Biotech

- /

- NasdaqGS:NBIX

3 Companies That May Be Priced Below Their Estimated Value

Reviewed by Simply Wall St

As the U.S. stock market rebounds from a recent tech sector downturn, major indices like the Nasdaq, Dow Jones Industrial Average, and S&P 500 have shown resilience despite ongoing economic uncertainties such as the government shutdown and trade policy debates. In this fluctuating environment, identifying stocks that may be undervalued can offer potential opportunities for investors seeking to capitalize on discrepancies between current prices and estimated intrinsic values.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| TowneBank (TOWN) | $32.76 | $64.47 | 49.2% |

| Nicolet Bankshares (NIC) | $124.00 | $247.04 | 49.8% |

| MoneyHero (MNY) | $1.25 | $2.43 | 48.6% |

| Horizon Bancorp (HBNC) | $15.97 | $31.28 | 49% |

| Fiverr International (FVRR) | $20.56 | $40.26 | 48.9% |

| Eagle Bancorp (EGBN) | $16.52 | $33.03 | 50% |

| Duolingo (DUOL) | $260.02 | $506.04 | 48.6% |

| Crocs (CROX) | $80.23 | $157.44 | 49% |

| CF Bankshares (CFBK) | $23.41 | $45.27 | 48.3% |

| Byrna Technologies (BYRN) | $18.46 | $35.68 | 48.3% |

Here we highlight a subset of our preferred stocks from the screener.

Exact Sciences (EXAS)

Overview: Exact Sciences Corporation specializes in cancer screening and diagnostic test products, operating both in the United States and internationally, with a market cap of approximately $13.19 billion.

Operations: The company generates revenue of $3.08 billion from its biotechnology segment focused on startups.

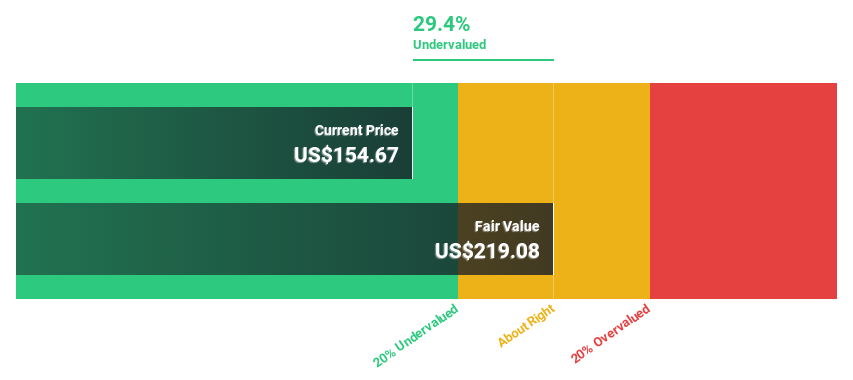

Estimated Discount To Fair Value: 40.6%

Exact Sciences is trading at US$69.63, significantly below its fair value estimate of US$117.15, suggesting it may be undervalued based on cash flows. The company raised its 2025 revenue guidance to US$3.22 billion - US$3.235 billion, reflecting strong sales growth and narrowing net losses compared to the previous year. With forecasted annual earnings growth above market averages and a promising new Cancerguard test launch, Exact Sciences presents potential for long-term value appreciation despite current low return on equity forecasts.

- Our growth report here indicates Exact Sciences may be poised for an improving outlook.

- Unlock comprehensive insights into our analysis of Exact Sciences stock in this financial health report.

Neurocrine Biosciences (NBIX)

Overview: Neurocrine Biosciences, Inc. is engaged in the discovery, development, and marketing of pharmaceuticals for neurological, neuroendocrine, and neuropsychiatric disorders globally, with a market cap of $14.28 billion.

Operations: The company's revenue is primarily derived from its research and development, commercialization, and sale of pharmaceuticals, totaling $2.68 billion.

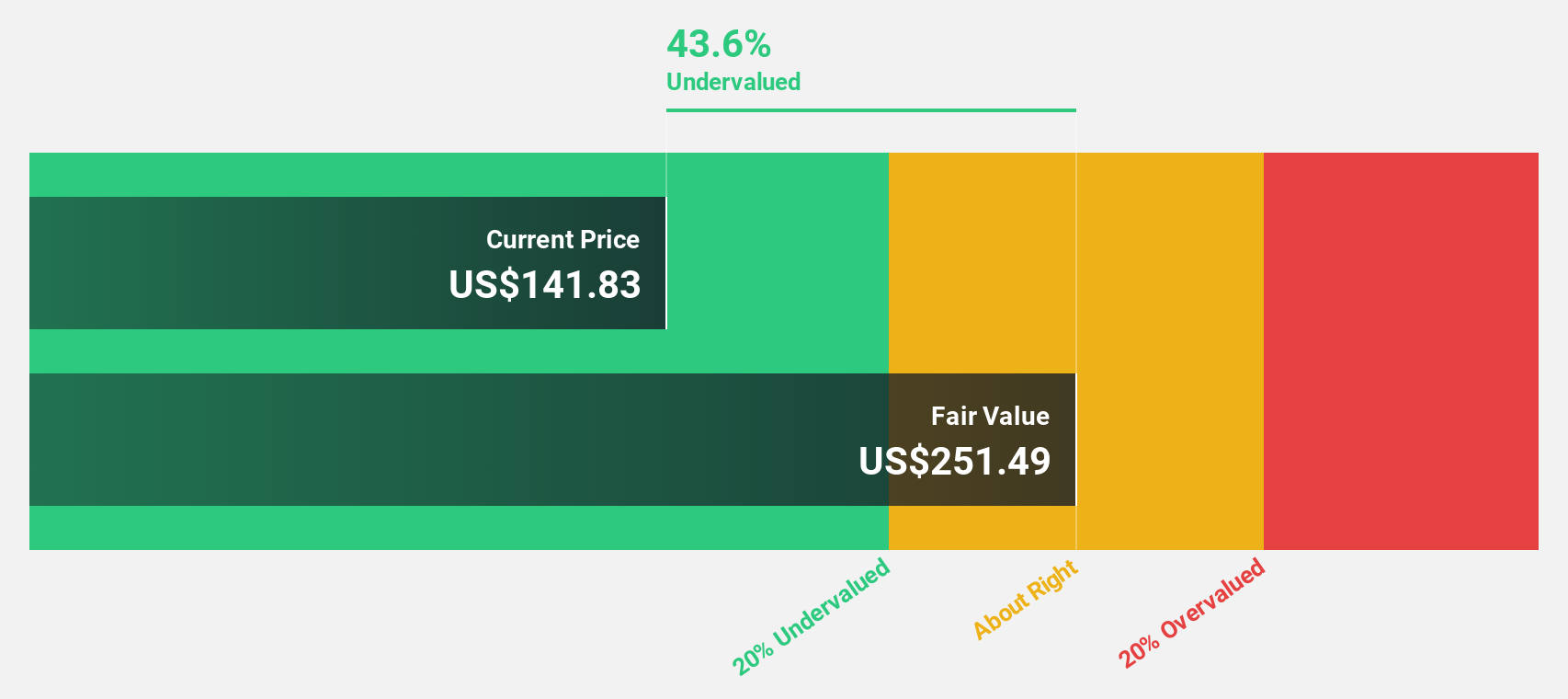

Estimated Discount To Fair Value: 39.4%

Neurocrine Biosciences, trading at US$153.75, is significantly undervalued with a fair value estimate of US$253.62. Recent earnings show strong cash flow performance, with Q3 2025 revenue reaching US$794.9 million and net income of US$209.5 million, both up from last year. Despite a low return on equity forecast of 17.2%, the company’s expected annual profit growth surpasses market averages, driven by robust sales in its neuropsychiatry portfolio including INGREZZA®.

- According our earnings growth report, there's an indication that Neurocrine Biosciences might be ready to expand.

- Click here to discover the nuances of Neurocrine Biosciences with our detailed financial health report.

Capital One Financial (COF)

Overview: Capital One Financial Corporation is a financial services holding company providing a range of financial products and services in the United States, Canada, and the United Kingdom, with a market capitalization of $140.29 billion.

Operations: Capital One's revenue is primarily derived from its Credit Card segment at $17.46 billion, followed by Consumer Banking at $8.43 billion, and Commercial Banking at $3.52 billion.

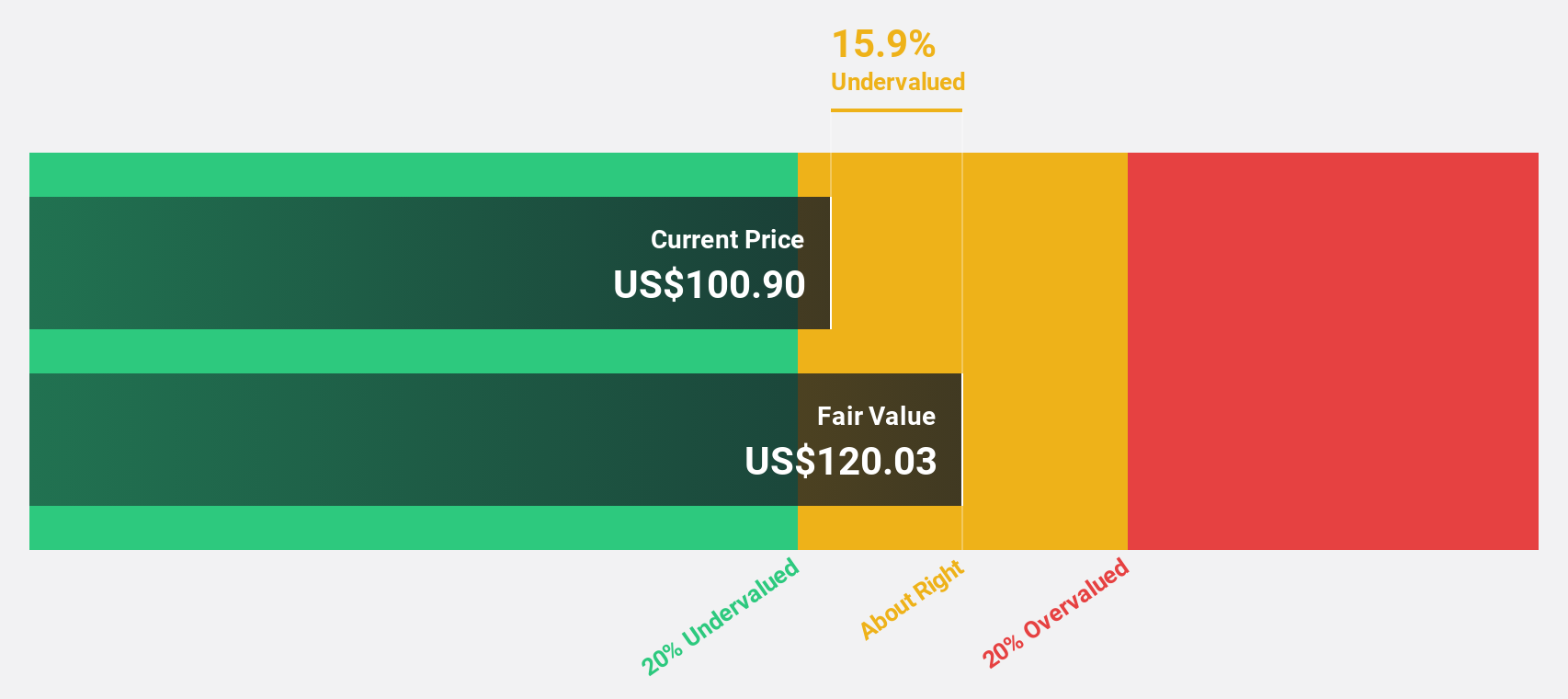

Estimated Discount To Fair Value: 26.2%

Capital One Financial, trading at US$221.40, is highly undervalued with a fair value estimate of US$300.06. Despite recent profit margin declines from 15.3% to 4%, the company forecasts significant earnings growth of over 50% annually, outpacing the market average. Recent initiatives include a share buyback program worth up to US$16 billion and collaboration with T-Mobile on a new credit card offering, enhancing cash flow potential through diversified revenue streams and strategic partnerships.

- Our earnings growth report unveils the potential for significant increases in Capital One Financial's future results.

- Delve into the full analysis health report here for a deeper understanding of Capital One Financial.

Make It Happen

- Reveal the 169 hidden gems among our Undervalued US Stocks Based On Cash Flows screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Neurocrine Biosciences might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NBIX

Neurocrine Biosciences

Neurocrine Biosciences, Inc. discovers, develops, and markets pharmaceuticals for neurological, neuroendocrine, and neuropsychiatric disorders in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives