Narratives are currently in beta

Key Takeaways

- Expansion into audiobooks and AI-enhanced music discovery are set to boost user engagement and revenue growth.

- Improved monetization strategies and innovative advertising solutions could enhance margins and diversify earnings sources.

- Spotify's reliance on advertising and cost efficiency faces challenges from market volatility, competitive pricing pressures, and macroeconomic factors affecting revenue growth and profitability.

Catalysts

About Spotify Technology- Provides audio streaming subscription services worldwide.

- Expansion into audiobooks and new subscription tiers is likely to drive future revenue growth as these initiatives expand Spotify's offerings and user engagement.

- Integration of AI and transformative technological shifts in music discovery are expected to enhance user engagement and retention, potentially increasing overall earnings.

- Continued focus on monetization strategies like price increases and ARPU growth are likely to improve net margins by optimizing revenue per user.

- Record gross margins and operating income driven by favorable content costs indicate potential for sustained improvement in net margins and earnings.

- Development of new advertising solutions, including programmatic capabilities through Spotify's ad exchange, could diversify ad revenue sources and increase advertising earnings in the long term.

Spotify Technology Future Earnings and Revenue Growth

Assumptions

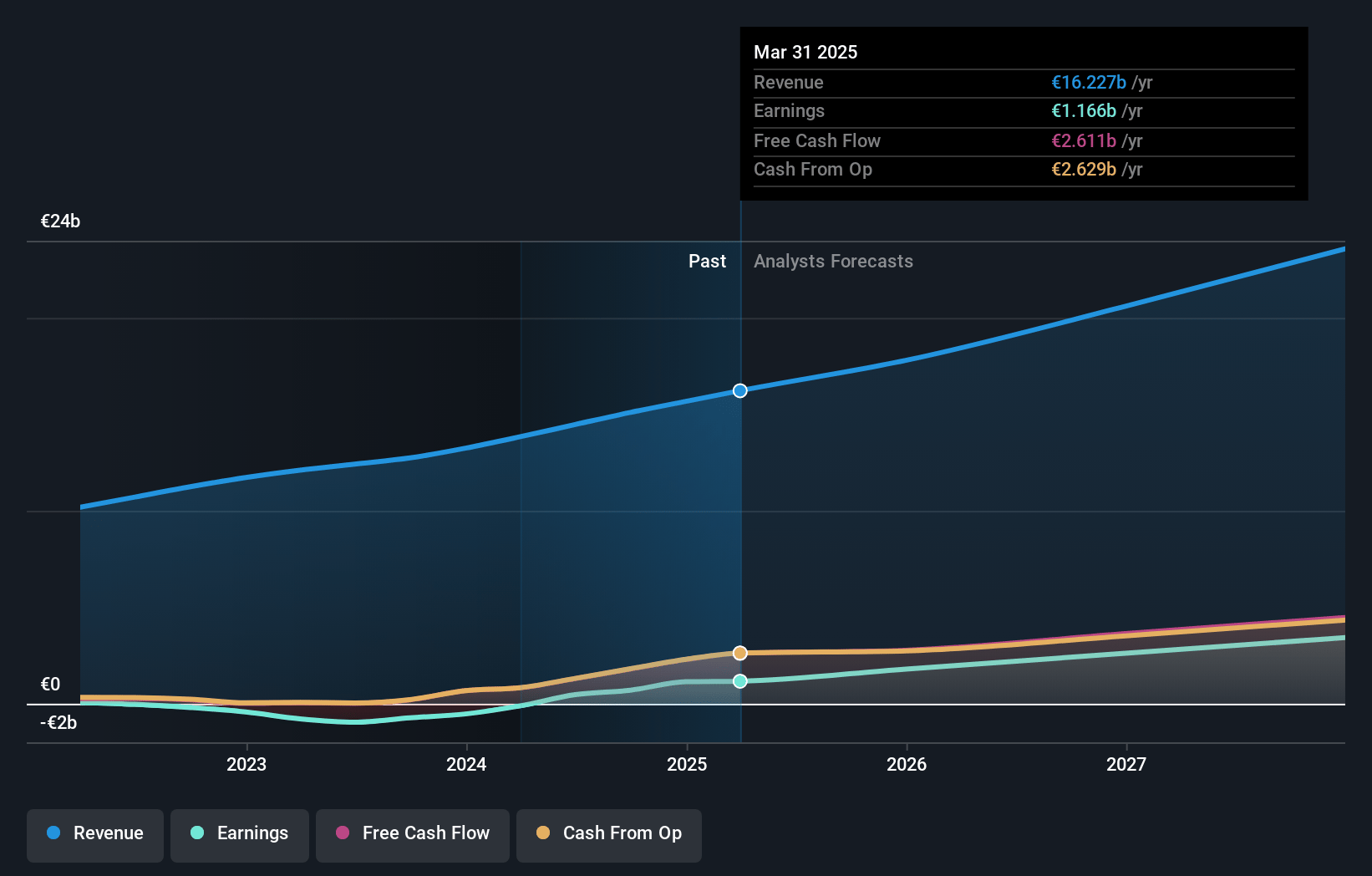

How have these above catalysts been quantified?- Analysts are assuming Spotify Technology's revenue will grow by 14.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 4.6% today to 11.4% in 3 years time.

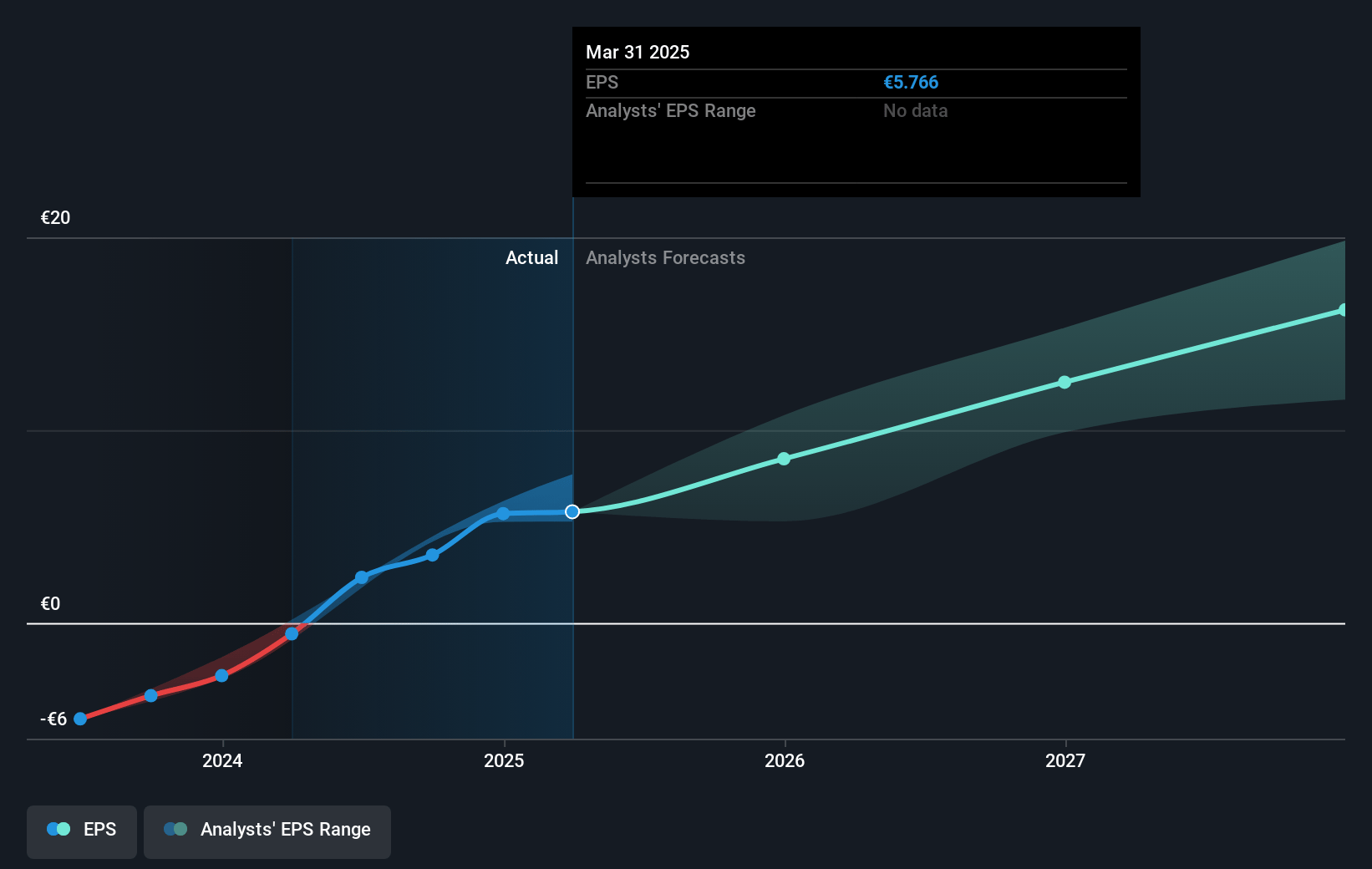

- Analysts expect earnings to reach €2.6 billion (and earnings per share of €12.53) by about January 2028, up from €701.0 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as €1.9 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 46.3x on those 2028 earnings, down from 146.7x today. This future PE is greater than the current PE for the US Entertainment industry at 19.0x.

- Analysts expect the number of shares outstanding to grow by 0.54% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.37%, as per the Simply Wall St company report.

Spotify Technology Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The advertising revenue grew only 7% year-on-year in constant currency terms, reflecting volatility in market spending on brand-related campaigns, which may impact future revenue growth given the reliance on advertising as part of their business model.

- Currency exchange rate movements created a larger-than-expected headwind, impacting Spotify's financial outlook by approximately €80 million in the fourth quarter, which could pressure overall revenues and net margins.

- The focus on cost efficiency amidst a macroeconomic shift suggests potential risks in balancing growth and profitability, especially if economic conditions worsen, which could impact operating income.

- Concerns about pricing in relation to industry movements indicate that while Spotify is a leader in some markets, competitive pressures and consumer price sensitivity might constrain future revenue from price increases.

- Growth in their ad-supported model, crucial for scaling, is uncertain and dependent on developing their programmatic offerings, which might delay advertising revenue acceleration relative to peers and impact earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $490.15 for Spotify Technology based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $608.14, and the most bearish reporting a price target of just $233.73.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €22.6 billion, earnings will come to €2.6 billion, and it would be trading on a PE ratio of 46.3x, assuming you use a discount rate of 7.4%.

- Given the current share price of $530.8, the analyst's price target of $490.15 is 8.3% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

MI

Content Lead

Industry Tailwinds, Increased Monetization and Changing Cost Structure Will Lead To Higher Cash Flows

Key Takeaways Spotify is wisely focusing on long-term objectives over short-term profitability. Leverage will shift from labels (suppliers) to Spotify (the aggregator) as scale continues to grow.

View narrativeUS$348.70

FV

57.8% overvalued intrinsic discount17.00%

Revenue growth p.a.

17users have liked this narrative

0users have commented on this narrative

8users have followed this narrative

4 months ago author updated this narrative

RI

Equity Analyst and Writer

Ad Revenue and Margin Improvement Will Lead to Stronger Cash Flows

Key Takeaways Premium revenue to be kept in check by competition and market saturation. Gross margin will improve, but remain below 30%.

View narrativeUS$222.00

FV

147.8% overvalued intrinsic discount17.45%

Revenue growth p.a.

5users have liked this narrative

0users have commented on this narrative

4users have followed this narrative

4 months ago author updated this narrative