Narratives are currently in beta

Key Takeaways

- Weak construction activity in Europe and Asia/Pacific could suppress future revenues and earnings in Construction Industries.

- Pricing pressures and dealer rental fleet issues challenge margins and sales, impacting predictable revenue in multiple segments.

- Diverse market strength and innovation in energy solutions underpin revenue stability and growth, while strong cash flow supports shareholder returns and buffers against challenges.

Catalysts

About Caterpillar- Manufactures and sells construction and mining equipment, off-highway diesel and natural gas engines, industrial gas turbines, and diesel-electric locomotives in worldwide.

- Caterpillar anticipates ongoing weakness in construction activity in Europe and soft economic conditions in Asia/Pacific outside China. Continued low demand in these regions could suppress future revenues in Construction Industries.

- The company expects dealer rental fleet loading to remain weak in North America, which could lead to lower equipment sales and thus impact future revenues negatively in Construction Industries.

- Caterpillar reports expectations for further declines in Resource Industries machine volumes, with noted softness in sales of articulated trucks and off-highway trucks. This could suppress earnings growth potential in the Resource Industries segment.

- Caterpillar mentions that pricing pressures in Construction Industries, with expectations for intensified pricing headwinds, could compress net margins over time as the company adjusts reserves for dealer discounts.

- Though there is strong demand for solar turbines and reciprocating engines in Energy & Transportation, the company warns of potential delivery timing issues, which could affect predictable revenue and profit recognition in the short term.

Caterpillar Future Earnings and Revenue Growth

Assumptions

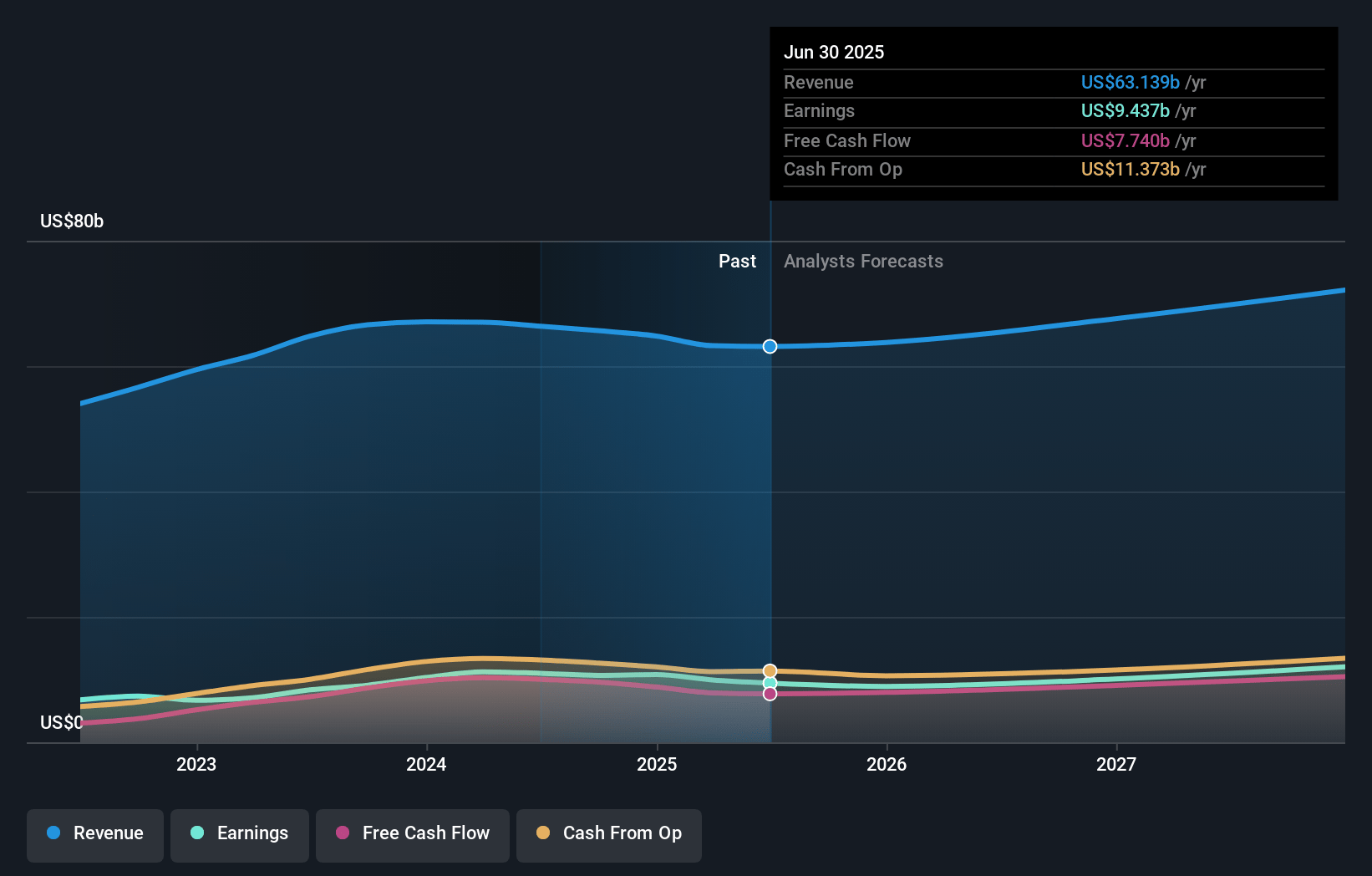

How have these above catalysts been quantified?- Analysts are assuming Caterpillar's revenue will grow by 1.8% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 16.3% today to 15.7% in 3 years time.

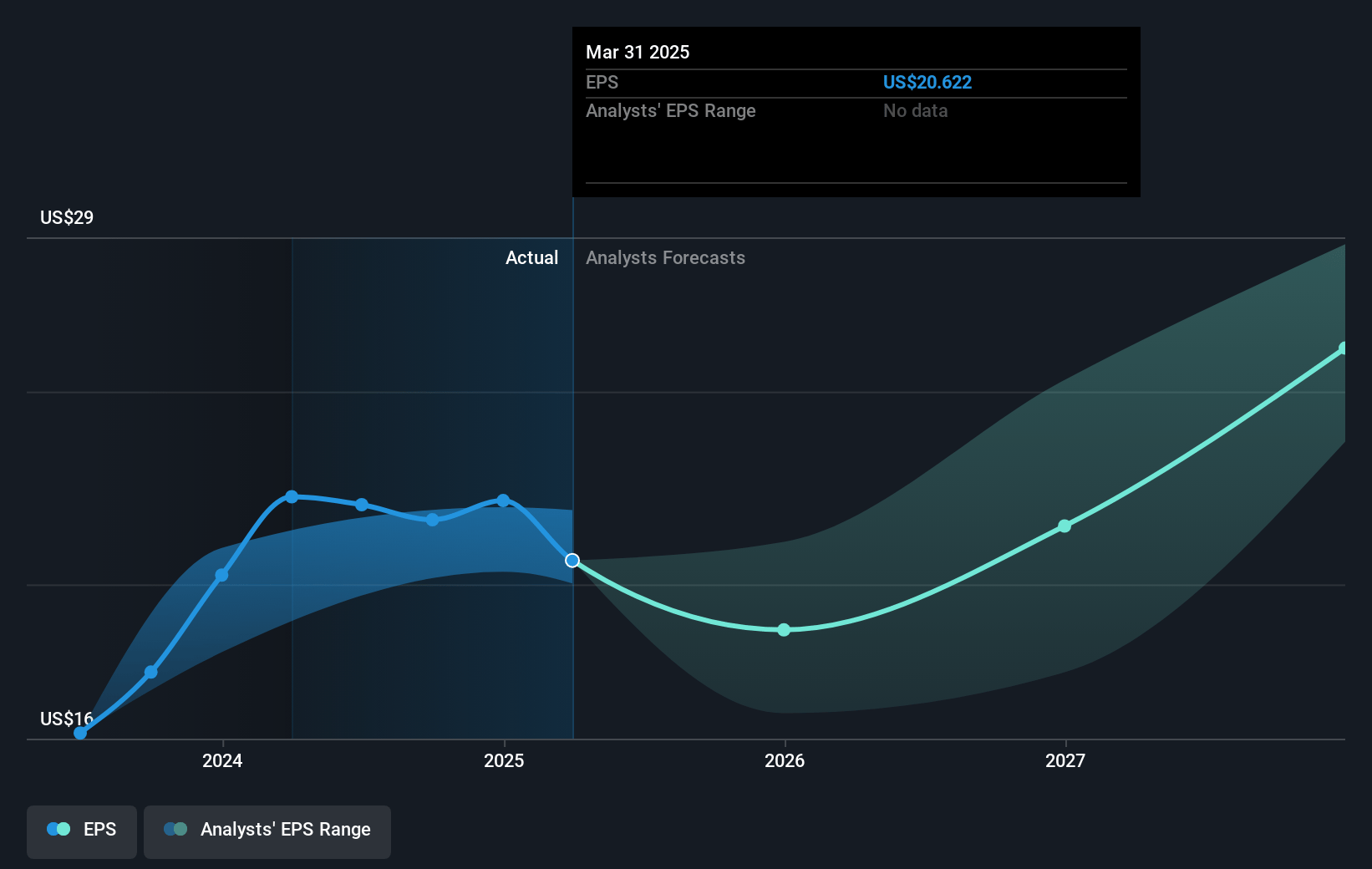

- Analysts expect earnings to reach $10.9 billion (and earnings per share of $23.89) by about December 2027, up from $10.7 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $12.0 billion in earnings, and the most bearish expecting $9.8 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 19.6x on those 2027 earnings, up from 17.6x today. This future PE is lower than the current PE for the GB Machinery industry at 24.4x.

- Analysts expect the number of shares outstanding to decline by 1.97% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.19%, as per the Simply Wall St company report.

Caterpillar Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Caterpillar's diverse end markets and strong demand in Energy & Transportation, especially for power generation and solar turbines, could support revenue and earnings stability even in the face of some challenges.

- The company's ability to generate robust ME&T free cash flow and maintain a strong balance sheet allows for substantial shareholder returns through dividends and share repurchases, which can support stock price and earnings per share.

- Despite some downward pressure on sales, backlogs, especially in Energy & Transportation, remain healthy, which can suggest a buffer against revenue declines.

- Increasing capacity for large engines due to anticipated demand in data centers and distributed power generation could bolster long-term revenue and profit margins as these segments expand.

- Continuing investment in technologies like Cat Dynamic Energy Transfer for mining energy management enhances Caterpillar's competitive edge and could support innovation-driven revenue growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $381.9 for Caterpillar based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $515.0, and the most bearish reporting a price target of just $250.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $69.3 billion, earnings will come to $10.9 billion, and it would be trading on a PE ratio of 19.6x, assuming you use a discount rate of 7.2%.

- Given the current share price of $388.87, the analyst's price target of $381.9 is 1.8% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

BA

Equity Analyst

Slow Innovation Will Hurt Revenue Growth in Global Markets

Key Takeaways Shrinking stock buybacks will turn away investors who are seeking guaranteed capital returns. Caterpillar being late to electrify and automate their heavy machinery could see customers shift to more technologically advanced competitors.

View narrativeUS$319.93

FV

14.2% overvalued intrinsic discount6.09%

Revenue growth p.a.

1users have liked this narrative

0users have commented on this narrative

3users have followed this narrative

4 months ago author updated this narrative

GO

Equity Analyst

Infrastructure Programs and Industry Growth Will Push Earnings Higher

Key Takeaways Government spending on energy and infrastructure globally will be the biggest growth drivers Market will re-rate CAT to industry PE of 20.2x, up from 15.6x as growth becomes appreciated Buyback program will support price appreciation of 5+% per year Industry is expected to grow earnings by 13% annually, but CAT won’t grow as quickly CAT can grow earnings by 5.75% annually to reach $10.4B in 2028 Catalysts Company Catalysts Growth in Latin American development projects For the company, regional development and government programs should be monitored because developing markets like LATAM and Asia Pacific have a lot more economic growth avenues to cover and require supporting machinery to build commercial, residential and industry projects. A well-established brand like CAT may be in a good position to secure new long-term public and private projects.

View narrativeUS$338.56

FV

7.9% overvalued intrinsic discount4.00%

Revenue growth p.a.

7users have liked this narrative

0users have commented on this narrative

2users have followed this narrative

5 months ago author updated this narrative

JU

julio

Community Contributor

cat valuation

Bullsu Increased infrastructure spending in the US and emerging markets will lead to more construction equipment purchases, substantially boosting Caterpillar's sales growth. Higher fixed-asset investment growth in China strengthens support for increased investment in mining capital expenditures, benefiting Caterpillar.

View narrativeUS$332.91

FV

9.8% overvalued intrinsic discount3.14%

Revenue growth p.a.

0users have liked this narrative

0users have commented on this narrative

2users have followed this narrative

7 months ago author updated this narrative

WA

WallStreetWontons

Community Contributor

Increased Infrastructure projects will continue, but not rapidly with current geopolitical and cyclical challenges

Catalysts Infrastructure Investment : Governments and private sectors worldwide are increasingly investing in infrastructure projects. CAT’s construction equipment, machinery, and services play a vital role in building roads, bridges, airports, and other critical infrastructure.

View narrativeUS$359.84

FV

1.6% overvalued intrinsic discount5.03%

Revenue growth p.a.

0users have liked this narrative

0users have commented on this narrative

2users have followed this narrative

7 months ago author updated this narrative