Key Takeaways

- Expanding backlogs and service offerings position Caterpillar for sustained growth tied to global infrastructure, energy transition, and digitalization trends.

- Effective capital allocation, manufacturing investment, and aftermarket focus are expected to drive higher margins and steady long-term earnings growth.

- Accelerating industry shifts, slow demand growth, trade headwinds, underinvestment in technology, and intensifying competition are pressuring Caterpillar's core business and profitability outlook.

Catalysts

About Caterpillar- Manufactures and sells construction and mining equipment, off-highway diesel and natural gas engines, industrial gas turbines, and diesel-electric locomotives in the United States and internationally.

- Record $35 billion backlog growth across all segments—including Energy & Transportation, Construction, and Resource Industries—positions Caterpillar to capitalize on waves of global infrastructure investment and urbanization, directly supporting future revenue growth as these orders convert to sales.

- Explosive demand for power generation equipment, especially engines and turbines for data centers and grid modernization, highlights Caterpillar’s leverage to secular growth in electricity infrastructure and digitalization; this drives both immediate revenue growth and longer-term expansion of high-margin service and aftermarket opportunities.

- Rising order rates and backlog in large mining equipment, coupled with healthy rebuild and utilization activity, signal Caterpillar will benefit from the long-term global need for minerals and metals, fueled by energy transition and resource-intensive development, supporting sustained future revenue and margin growth in Resource Industries.

- Ongoing expansion in services and aftermarket—including parts, digital solutions, and fleet management—provides a stable, higher-margin revenue base; growth in this area is expected to steadily lift Caterpillar’s net margins and earnings power beyond the typical cyclical swings of new equipment sales.

- Continued discipline in capital allocation, as evidenced by robust share repurchases and consistent dividend increases, combined with investments in manufacturing efficiency and technology leadership, underpins expectations for structurally higher free cash flow and a long-term upward trajectory for earnings per share.

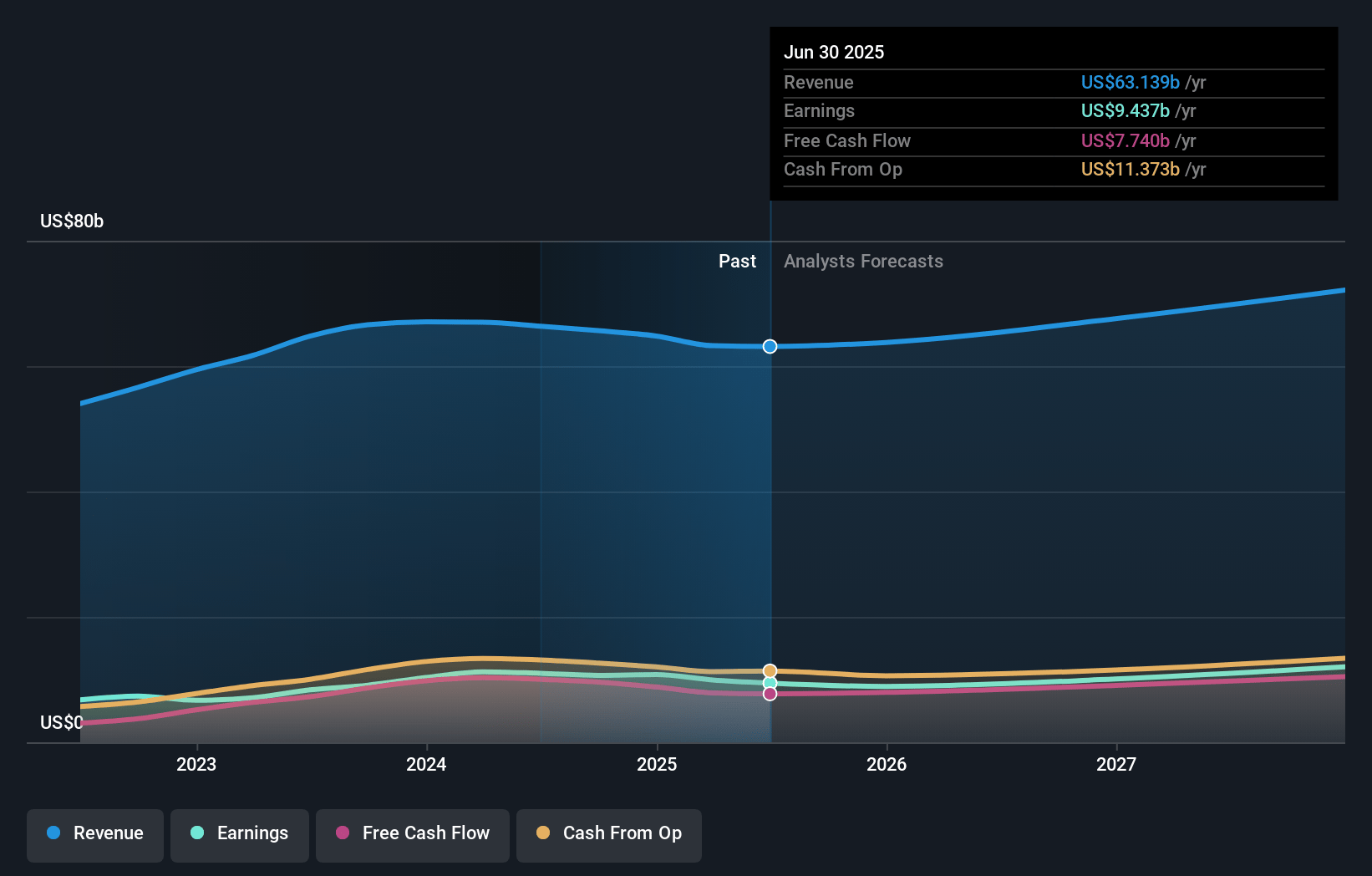

Caterpillar Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Caterpillar compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Caterpillar's revenue will grow by 9.9% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 16.7% today to 14.0% in 3 years time.

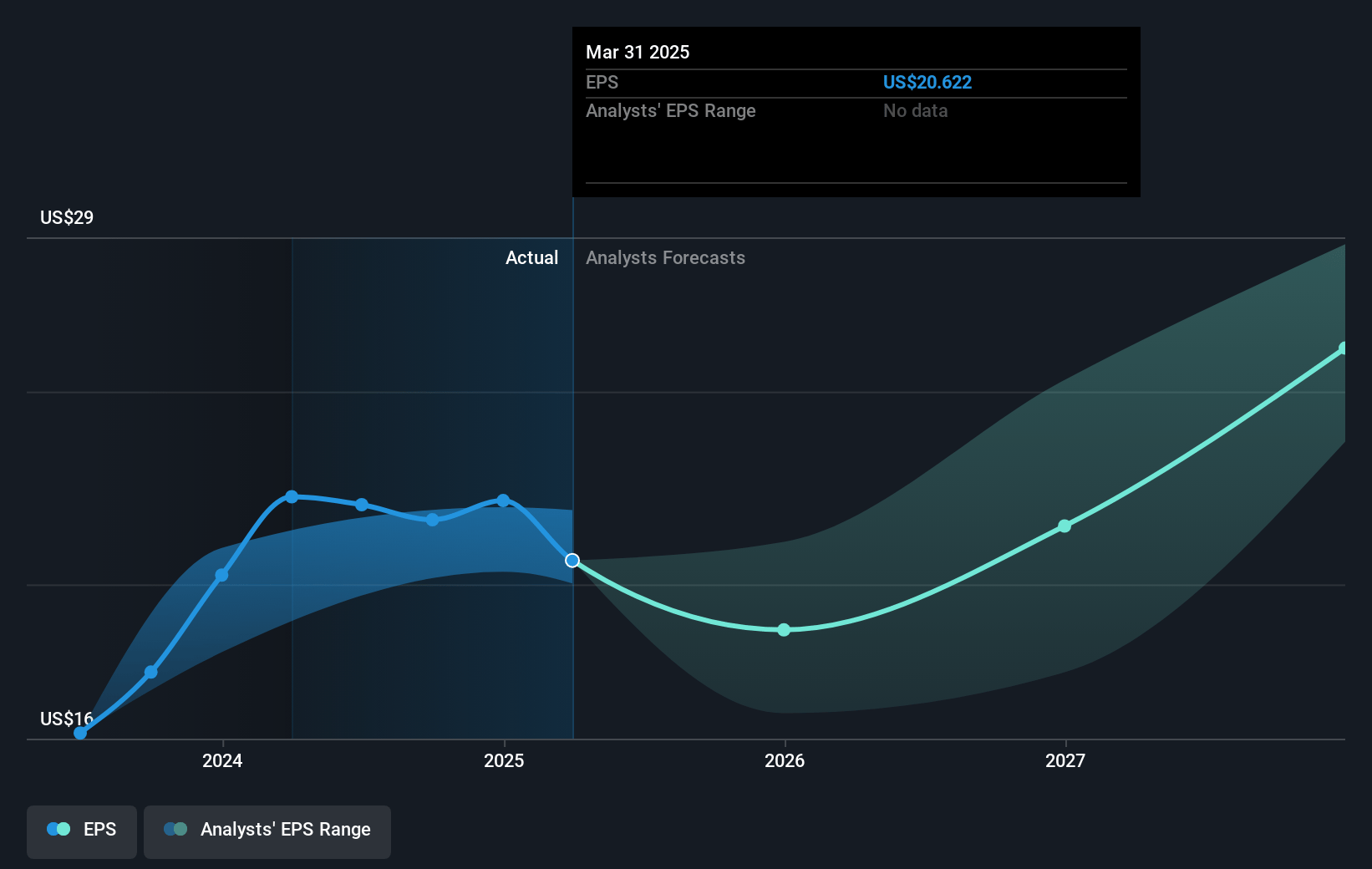

- The bullish analysts expect earnings to reach $12.0 billion (and earnings per share of $27.43) by about April 2028, up from $10.8 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 19.7x on those 2028 earnings, up from 13.6x today. This future PE is lower than the current PE for the GB Machinery industry at 21.3x.

- Analysts expect the number of shares outstanding to decline by 2.32% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.64%, as per the Simply Wall St company report.

Caterpillar Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Accelerating global electrification and decarbonization trends threaten Caterpillar’s core business model built on traditional diesel-powered machinery, requiring heavy R&D investment while risking revenue losses and diminished long-term growth if more agile, electric-first competitors outpace the company in innovation.

- The persistent global demographic slowdown, especially in China and developed markets, is fostering ongoing weakness in construction and infrastructure spending, as evidenced by tepid activity in China, Europe, and Asia-Pacific, thus setting Caterpillar up for prolonged soft demand and cyclical headwinds that may suppress sales and earnings.

- Greater trade fragmentation, including the current and potential escalation of tariffs, is already causing significant cost headwinds and supply chain uncertainty for Caterpillar, with the company highlighting a fluid and challenging tariff environment that could further disrupt exports, inflate production costs, and erode net margins if not mitigated effectively.

- Caterpillar continues to underinvest in digitalization and advanced autonomous technology relative to more innovative competitors, which risks long-term market share erosion and slower services revenue growth, challenging its ability to maintain profitability as the industry shifts toward smarter, connected machinery.

- Consolidation among equipment rental companies and intensifying global competition from low-cost international manufacturers are amplifying pricing pressures and potentially compressing Caterpillar's gross margins, while rising warranty and maintenance costs, particularly for complex models and aging fleets, threaten to further erode after-sales profitability over time.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Caterpillar is $427.41, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Caterpillar's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $427.41, and the most bearish reporting a price target of just $243.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $85.9 billion, earnings will come to $12.0 billion, and it would be trading on a PE ratio of 19.7x, assuming you use a discount rate of 7.6%.

- Given the current share price of $307.4, the bullish analyst price target of $427.41 is 28.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystHighTarget holds no position in NYSE:CAT. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.