The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Acsion (JSE:ACS). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

View our latest analysis for Acsion

How Quickly Is Acsion Increasing Earnings Per Share?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. To the delight of shareholders, Acsion has achieved impressive annual EPS growth of 49%, compound, over the last three years. Growth that fast may well be fleeting, but it should be more than enough to pique the interest of the wary stock pickers.

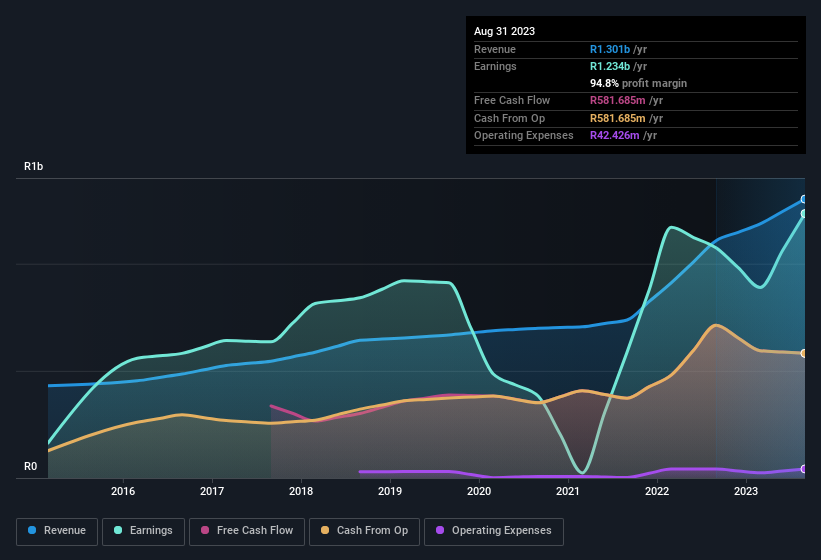

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. It's noted that Acsion's revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. On the one hand, Acsion's EBIT margins fell over the last year, but on the other hand, revenue grew. So if EBIT margins can stabilize, this top-line growth should pay off for shareholders.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Acsion isn't a huge company, given its market capitalisation of R2.5b. That makes it extra important to check on its balance sheet strength.

Are Acsion Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

First things first, there weren't any reports of insiders selling shares in Acsion in the last 12 months. Even better, though, is that the CEO & Executive Director, Kiriakos Anastasiadis, bought a whopping R9.6m worth of shares, paying about R5.60 per share, on average. It seems at least one insider thinks that the company is doing well - and they are backing that view with cash.

It's reassuring that Acsion insiders are buying the stock, but that's not the only reason to think management are fair to shareholders. To be specific, the CEO is paid modestly when compared to company peers of the same size. For companies with market capitalisations under R3.8b, like Acsion, the median CEO pay is around R6.2m.

The CEO of Acsion only received R2.9m in total compensation for the year ending February 2023. That looks like a modest pay packet, and may hint at a certain respect for the interests of shareholders. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Is Acsion Worth Keeping An Eye On?

Acsion's earnings per share growth have been climbing higher at an appreciable rate. The company can also boast of insider buying, and reasonable remuneration for the CEO. The strong EPS growth suggests Acsion may be at an inflection point. If these have piqued your interest, then this stock surely warrants a spot on your watchlist. What about risks? Every company has them, and we've spotted 3 warning signs for Acsion (of which 1 makes us a bit uncomfortable!) you should know about.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Acsion, you'll probably love this curated collection of companies in ZA that have witnessed growth alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About JSE:ACS

Acsion

Engages in property holding and development activities in South Africa and internationally.

Good value with proven track record.

Market Insights

Community Narratives