- South Africa

- /

- Insurance

- /

- JSE:OUT

Don't Buy OUTsurance Group Limited (JSE:OUT) For Its Next Dividend Without Doing These Checks

It looks like OUTsurance Group Limited (JSE:OUT) is about to go ex-dividend in the next four days. The ex-dividend date is one business day before a company's record date, which is the date on which the company determines which shareholders are entitled to receive a dividend. It is important to be aware of the ex-dividend date because any trade on the stock needs to have been settled on or before the record date. Accordingly, OUTsurance Group investors that purchase the stock on or after the 16th of October will not receive the dividend, which will be paid on the 21st of October.

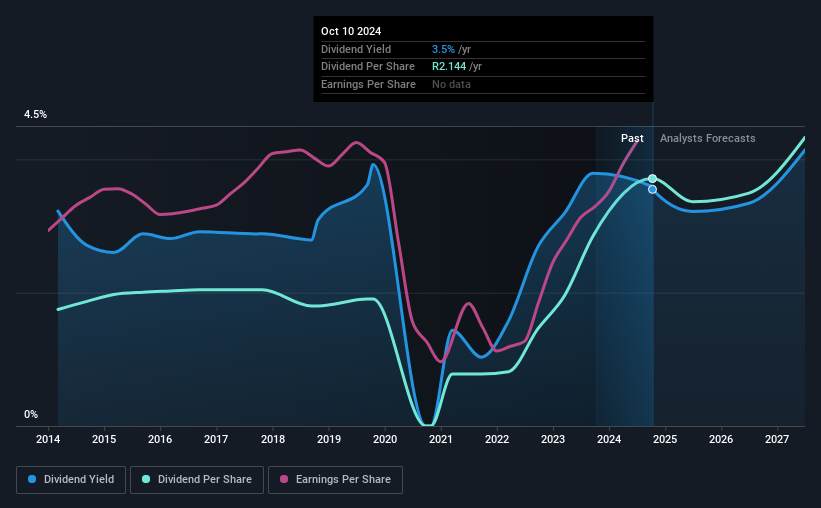

The company's next dividend payment will be R01.532 per share, on the back of last year when the company paid a total of R2.14 to shareholders. Based on the last year's worth of payments, OUTsurance Group stock has a trailing yield of around 3.5% on the current share price of R060.40. If you buy this business for its dividend, you should have an idea of whether OUTsurance Group's dividend is reliable and sustainable. So we need to investigate whether OUTsurance Group can afford its dividend, and if the dividend could grow.

See our latest analysis for OUTsurance Group

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. OUTsurance Group paid out 66% of its earnings to investors last year, a normal payout level for most businesses.

When a company paid out less in dividends than it earned in profit, this generally suggests its dividend is affordable. The lower the % of its profit that it pays out, the greater the margin of safety for the dividend if the business enters a downturn.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Stocks with flat earnings can still be attractive dividend payers, but it is important to be more conservative with your approach and demand a greater margin for safety when it comes to dividend sustainability. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. That explains why we're not overly excited about OUTsurance Group's flat earnings over the past five years. Better than seeing them fall off a cliff, for sure, but the best dividend stocks grow their earnings meaningfully over the long run.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. OUTsurance Group has delivered an average of 7.8% per year annual increase in its dividend, based on the past 10 years of dividend payments.

Final Takeaway

Should investors buy OUTsurance Group for the upcoming dividend? Earnings per share have not grown at all, and the company pays out a bit over half its profits to shareholders. OUTsurance Group doesn't appear to have a lot going for it, and we're not inclined to take a risk on owning it for the dividend.

With that in mind though, if the poor dividend characteristics of OUTsurance Group don't faze you, it's worth being mindful of the risks involved with this business. Our analysis shows 1 warning sign for OUTsurance Group and you should be aware of this before buying any shares.

Generally, we wouldn't recommend just buying the first dividend stock you see. Here's a curated list of interesting stocks that are strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About JSE:OUT

OUTsurance Group

A financial services company, provides insurance and investment products in South Africa, Australia, and Ireland.

Outstanding track record with excellent balance sheet.