- South Africa

- /

- Oil and Gas

- /

- JSE:EXX

Investors Aren't Buying Exxaro Resources Limited's (JSE:EXX) Earnings

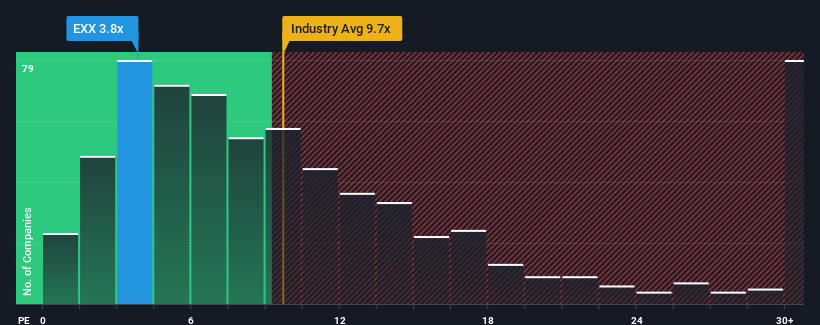

Exxaro Resources Limited's (JSE:EXX) price-to-earnings (or "P/E") ratio of 3.8x might make it look like a strong buy right now compared to the market in South Africa, where around half of the companies have P/E ratios above 9x and even P/E's above 13x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

Exxaro Resources hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Exxaro Resources

How Is Exxaro Resources' Growth Trending?

The only time you'd be truly comfortable seeing a P/E as depressed as Exxaro Resources' is when the company's growth is on track to lag the market decidedly.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 18%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 66% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Shifting to the future, estimates from the eight analysts covering the company suggest earnings growth is heading into negative territory, declining 7.0% per annum over the next three years. That's not great when the rest of the market is expected to grow by 11% per annum.

In light of this, it's understandable that Exxaro Resources' P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Exxaro Resources maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Plus, you should also learn about these 2 warning signs we've spotted with Exxaro Resources (including 1 which is concerning).

If you're unsure about the strength of Exxaro Resources' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Exxaro Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About JSE:EXX

Exxaro Resources

Engages in coal, iron ore investment, pigment manufacturing, and renewable energy businesses in South Africa, Europe, Australia, and Asia.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives