- South Africa

- /

- Diversified Financial

- /

- JSE:CTA

Capital Appreciation's (JSE:CTA) Dividend Will Be ZAR0.045

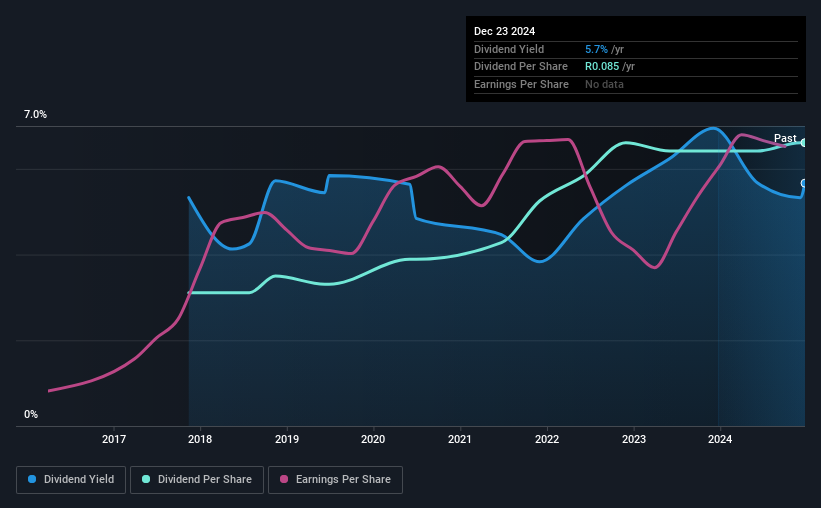

Capital Appreciation Limited's (JSE:CTA) investors are due to receive a payment of ZAR0.045 per share on 6th of January. This means that the annual payment will be 5.7% of the current stock price, which is in line with the average for the industry.

View our latest analysis for Capital Appreciation

Capital Appreciation's Payment Could Potentially Have Solid Earnings Coverage

Unless the payments are sustainable, the dividend yield doesn't mean too much. Prior to this announcement, Capital Appreciation's dividend was only 65% of earnings, however it was paying out 186% of free cash flows. This signals that the company is more focused on returning cash flow to shareholders, but it could mean that the dividend is exposed to cuts in the future.

Earnings per share could rise by 10.4% over the next year if things go the same way as they have for the last few years. Assuming the dividend continues along recent trends, our estimates say the payout ratio could reach 81%, which is definitely on the higher side, but we wouldn't necessarily say this is unsustainable.

Capital Appreciation Is Still Building Its Track Record

It is great to see that Capital Appreciation has been paying a stable dividend for a number of years now, however we want to be a bit cautious about whether this will remain true through a full economic cycle. Since 2017, the dividend has gone from ZAR0.04 total annually to ZAR0.085. This implies that the company grew its distributions at a yearly rate of about 11% over that duration. We're not overly excited about the relatively short history of dividend payments, however the dividend is growing at a nice rate and we might take a closer look.

The Dividend Looks Likely To Grow

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. We are encouraged to see that Capital Appreciation has grown earnings per share at 10% per year over the past five years. While on an earnings basis, this company looks appealing as an income stock, the cash payout ratio still makes us cautious.

In Summary

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. While the low payout ratio is a redeeming feature, this is offset by the minimal cash to cover the payments. This company is not in the top tier of income providing stocks.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. For example, we've picked out 1 warning sign for Capital Appreciation that investors should know about before committing capital to this stock. Is Capital Appreciation not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About JSE:CTA

Capital Appreciation

Operates as a financial technology company in South Africa, the Asia Pacific, the United States, the United Kingdom, Europe, the rest of Africa, and the Indian Ocean Islands.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives