- United States

- /

- Renewable Energy

- /

- NYSE:VST

Vistra (VST): Exploring Valuation After Recent Share Price Pullback

Reviewed by Kshitija Bhandaru

Vistra (VST) shares have cooled off slightly over the past month, down about 6%. Despite the retreat, the utility's strong year-to-date gains and steady financials have kept investors paying attention.

See our latest analysis for Vistra.

While Vistra’s share price has pulled back in recent weeks, its momentum over the year stands out. The stock still boasts a robust 31.5% share price return year to date, and an impressive 58% total shareholder return over the last 12 months, signaling strong investor confidence even after recent profit taking.

If you’re curious what other fast rising opportunities are out there, now’s the perfect chance to broaden your search and discover fast growing stocks with high insider ownership

That leaves investors wondering, after such a strong run, whether Vistra’s current price leaves room for more upside or if the market has already recognized all of its future growth potential.

Most Popular Narrative: 12.1% Undervalued

With Vistra’s popular narrative fair value set at $223.92, which is meaningfully above the most recent close, analysts see further upside potential. This perspective is built on powerful operational and market tailwinds, raising the stakes for what Vistra has to achieve for continued gains.

“Structural increases in electricity demand driven by AI, data centers, and U.S. manufacturing are expected to significantly boost the utilization of Vistra's generation assets, supporting sustained revenue and potential margin expansion as higher fixed cost absorption improves profitability.”

How do analysts arrive at such an ambitious value? The secret sauce: bold calls on future margins and premium profit multiples, which are normally reserved for leading innovators. What are the underlying numbers and growth bets fueling this target? Unpack the narrative to discover what makes Vistra’s story so compelling right now.

Result: Fair Value of $223.92 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing reliance on fossil assets and the risks from tighter regulation or sudden market shifts could quickly challenge Vistra’s bullish outlook.

Find out about the key risks to this Vistra narrative.

Another View: What Do Market Multiples Suggest?

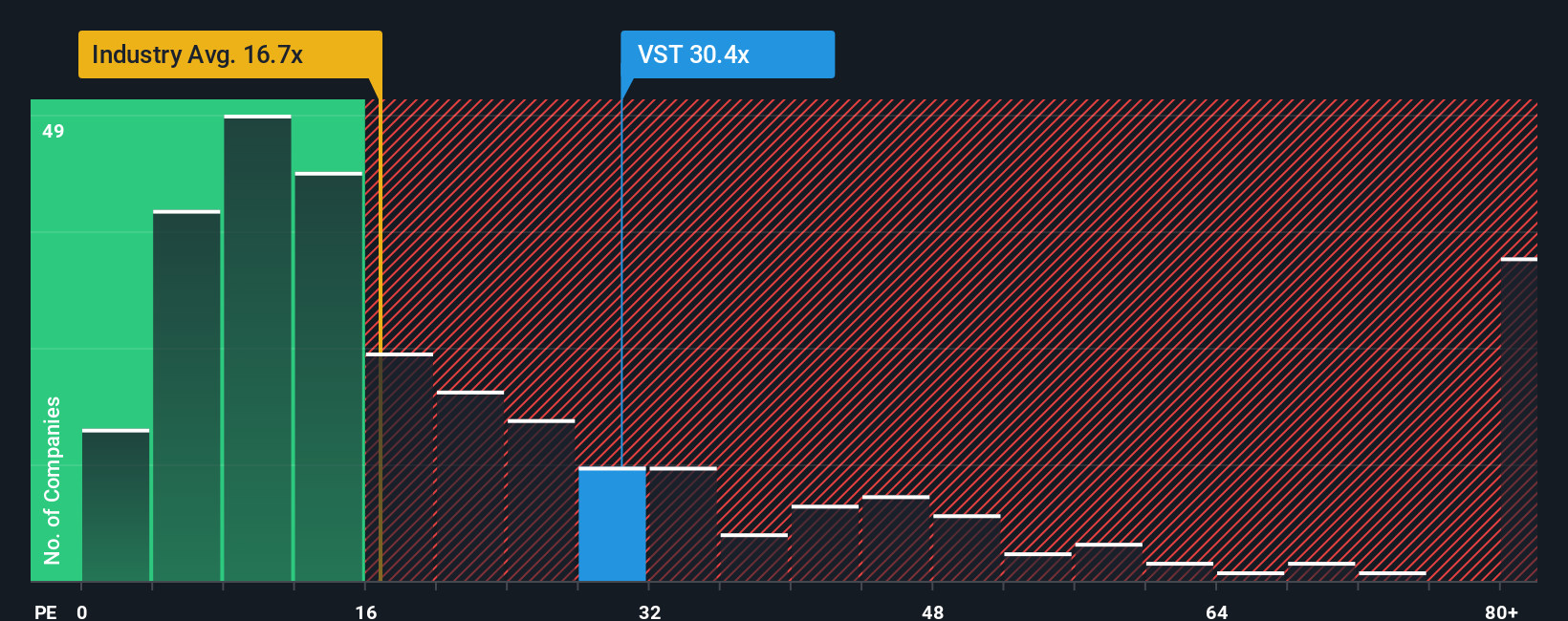

While some see value in Vistra’s future growth outlook, the market’s current pricing paints a more cautious picture. Vistra’s price-to-earnings ratio stands at 30.4x, which is not only above the global renewable energy industry average of 16.2x but also trails the peer group’s average of 36.7x. Interestingly, our fair ratio analysis suggests the market could move toward a P/E of 41.6x. This gap spotlights a tension between perceived value and market caution. Is the premium justified, or does it invite second thoughts?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Vistra Narrative

If you have a different take or want to dig into the numbers on your own terms, you can craft your own narrative in just a few minutes. Start now: Do it your way

A great starting point for your Vistra research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t wait while others snap up the next big opportunity. Take charge of your investing journey and find companies poised for breakout success right now.

- Spot income potential by tapping into these 19 dividend stocks with yields > 3%, which features standout yields for stable portfolio growth.

- Catch the AI wave early by reviewing these 24 AI penny stocks, transforming industries with smart automation and data-driven innovation.

- Seize outsized returns by searching these 898 undervalued stocks based on cash flows, identified as trading well below fair value by our proven cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VST

Vistra

Operates as an integrated retail electricity and power generation company in the United States.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives