- United States

- /

- Renewable Energy

- /

- NYSE:VST

Vistra (NYSE:VST) Jumps 15% Following Strong 2024 Earnings Report

Reviewed by Simply Wall St

Vistra (NYSE:VST) experienced a notable 15% rise in its share price over the past week, amid a backdrop of mixed market conditions with the major indexes struggling to rebound. This increase coincided with several developments, including the company's announcement of strong full-year earnings for 2024, with sales and net income both significantly up from the previous year. Meanwhile, Vistra also updated its share buyback program, having repurchased over 1.6 million shares recently. Additionally, the announcement of an increased quarterly dividend could be attractive to investors seeking income. Conversely, the company faced a lawsuit concerning its Moss Landing Battery Plant, yet the share price seemed unaffected by this issue. The broader market remained flat, with the Dow and Nasdaq facing recent slumps, further highlighting Vistra's relative outperformance in the current climate.

Jump into the full analysis health report here for a deeper understanding of Vistra.

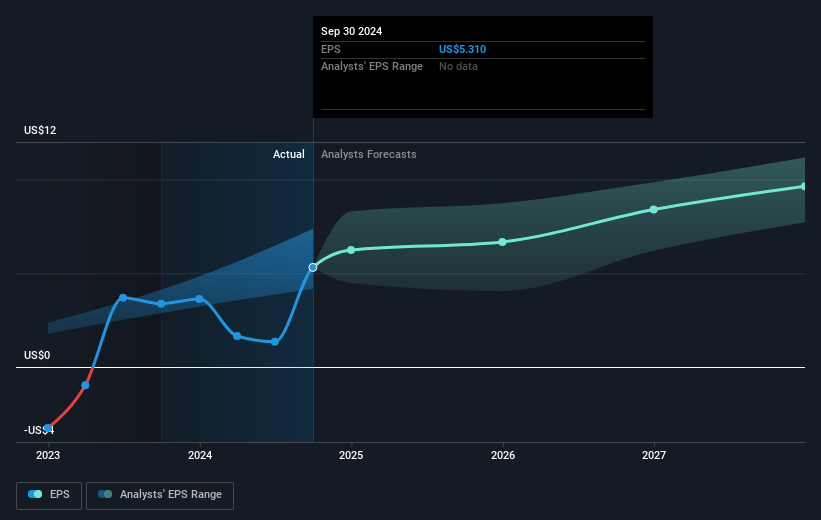

Vistra Corp has achieved a very large total return of approximately 988% over the last five years, a remarkable feat that signals its substantial outperformance amidst a turbulent economy. Notably, the company exceeded the US market and the Renewable Energy industry over the past year, underscoring its strong growth trajectory. A key factor has been its consistent earnings growth, averaging 26.5% per year over the five-year span and accelerating significantly in recent times. The expansion of its Moss Landing Energy Storage Facility in 2023, enhancing its electricity storage capabilities, further cemented its leadership position in renewable energy.

Vistra's active share buyback program since 2021 also supported shareholder returns, with a completion of share repurchases amounting to $4.74 billion. Moreover, increased dividends and declarations of future hikes have attracted income-focused investors, contributing favorably to overall returns. The company maintained a strong financial outlook by issuing $1.25 billion in senior secured notes in late 2024, which was intended for general corporate purposes. These elements combined indicate a robust focus on business growth and shareholder value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VST

Vistra

Operates as an integrated retail electricity and power generation company in the United States.

Solid track record and fair value.

Similar Companies

Market Insights

Community Narratives