- United States

- /

- Other Utilities

- /

- NYSE:SRE

Sempra (NYSE:SRE) Declares US$0.65 Quarterly Dividend For Shareholders

Reviewed by Simply Wall St

Sempra (NYSE:SRE) recently affirmed a quarterly dividend of $0.645 per share, which aligns with the company's ongoing commitment to returning value to shareholders. This announcement, along with robust first-quarter earnings where net income rose to $917 million, may have helped sustain investor confidence amidst broader market gains. Over the past month, Sempra shares climbed 8.9%, aligning with the upward trend observed in major indices like the S&P 500, which also experienced increases. While the company's individual performance was noteworthy, it largely aligned with the broader market's positive trajectory.

The recent affirmation of Sempra's quarterly dividend at $0.645 per share underscores its dedication to shareholder returns, reinforcing investor confidence alongside strong first-quarter earnings. This aligns with the long-standing narrative of focusing on shareholder value, as evidenced by its significant five-year total return of 48.57%. This long-term performance highlights Sempra’s ability to deliver value compared to its yearly underperformance against the US Integrated Utilities industry, which saw an 8.3% increase.

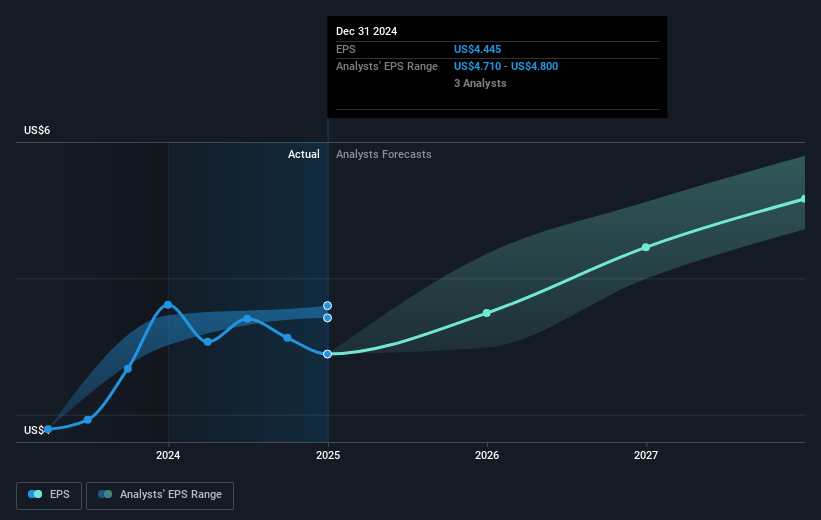

The broader market dynamics and Sempra's proactive revenue growth strategies, such as Oncor's capital investments and Sempra's expansive LNG projects, could potentially fuel future revenue and earnings growth. Analysts forecast Sempra's earnings to reach $3.6 billion by May 2028, supported by an anticipated 7.9% annual revenue growth. Despite this, revised EPS guidance and other financial pressures may temper expectations, contrasting the positive sentiment from the recent news.

In terms of valuation, Sempra's current share price of $75.07 juxtaposes its consensus price target of $79.50, reflecting a modest 5.6% potential upside. This suggests a general market perception of fair valuation, though individual investor perspectives may vary. The solid dividend announcement and positive first-quarter performance may buoy its stock price, closing the existing gap toward the price target as investors react to these developments and adjust their valuations accordingly.

Our valuation report here indicates Sempra may be undervalued.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SRE

Sempra

Operates as an energy infrastructure company in the United States and internationally.

Average dividend payer with slight risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)