- United States

- /

- Electric Utilities

- /

- NYSE:PCG

Did PG&E's (PCG) AI Data Center Push Just Shift Its Investment Narrative?

Reviewed by Sasha Jovanovic

- In late September 2025, California utility PG&E provided an investor update outlining an extension of its investment plan through 2030, while also featuring prominently in discussions about powering major technology infrastructure including AI data centers like Microsoft's San Jose facility.

- This increased focus on PG&E’s critical role in supporting artificial intelligence and data center growth has drawn substantial investor interest, as the utility is also being identified as presenting attractive value opportunities within the sector.

- We'll examine how investor interest in PG&E’s connection to surging AI-driven electricity demand could reshape its investment narrative.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

PG&E Investment Narrative Recap

To be a PG&E shareholder right now, you need to believe that California’s surging demand for electricity, driven by the expansion of AI data centers, will steadily increase the company’s long-term revenues and rate base. The recent guidance update through 2030 reinforces this growth narrative, but it does not fundamentally shift the importance of regulatory outcomes for wildfire liability, which remains the biggest immediate risk to PG&E's business model.

Among PG&E’s recent announcements, the extension of its investment plan stands out as most relevant to AI-linked growth prospects. By laying out a detailed pipeline for capital deployments through 2030, PG&E signals its commitment to providing reliable infrastructure for higher load demand and future-proofing its network, both of which are critical for capturing the benefits of data center expansion as a key catalyst.

By contrast, investors should remain mindful of unresolved legislative and regulatory risks, particularly regarding wildfire liability and cost recovery...

Read the full narrative on PG&E (it's free!)

PG&E's outlook forecasts $27.6 billion in revenue and $4.0 billion in earnings by 2028. This implies a 4.1% annual revenue growth rate and a $1.6 billion increase in earnings from the current $2.4 billion.

Uncover how PG&E's forecasts yield a $20.39 fair value, a 26% upside to its current price.

Exploring Other Perspectives

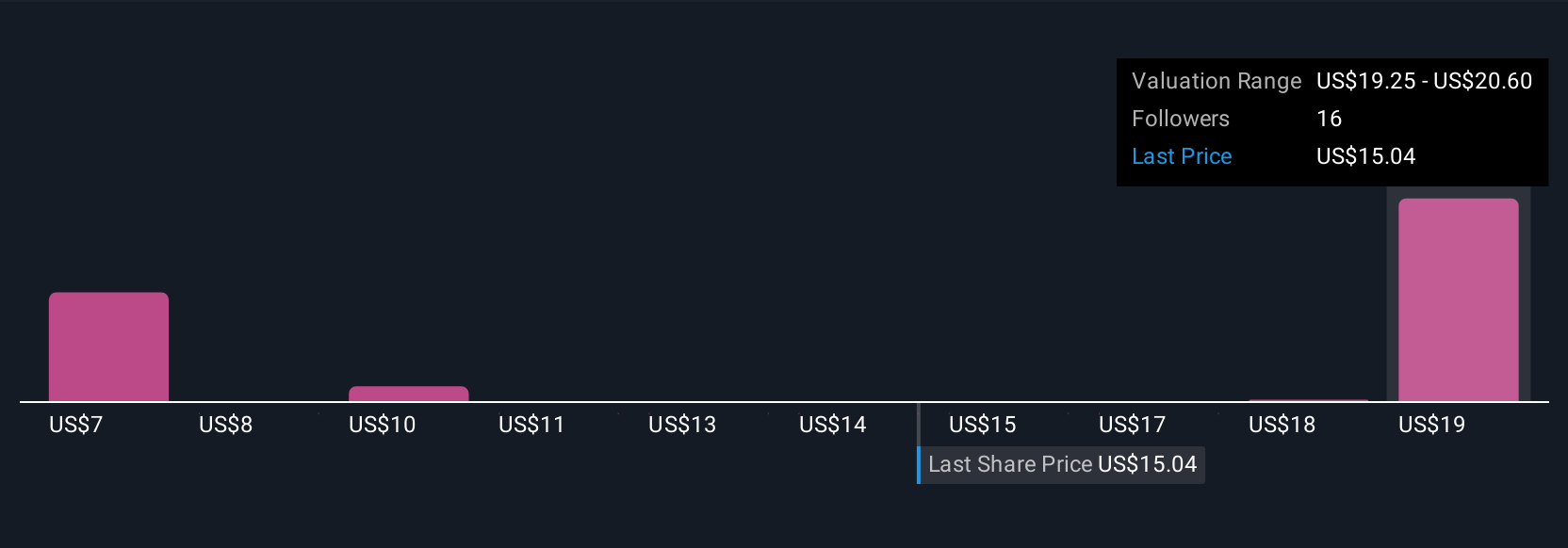

Five Simply Wall St Community members peg PG&E's fair value estimates between US$6.79 and US$20.39 per share, showing wide individual outlooks. With heightened regulatory uncertainty still in focus, you’ll want to compare community forecasts with your own view on policy risks and future earnings.

Explore 5 other fair value estimates on PG&E - why the stock might be worth as much as 26% more than the current price!

Build Your Own PG&E Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PG&E research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free PG&E research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PG&E's overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PCG

PG&E

Through its subsidiary, Pacific Gas and Electric Company, engages in the sale and delivery of electricity and natural gas to customers in northern and central California, the United States.

Good value with questionable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)