- United States

- /

- Renewable Energy

- /

- NYSE:ORA

Ormat Technologies (ORA) Valuation After Strong Q3 Beat, Higher Guidance and Double-Digit Operating Income Growth

Reviewed by Simply Wall St

Ormat Technologies (ORA) just cleared a key hurdle for 2025, topping third quarter earnings expectations, lifting its full year revenue outlook, and posting a double digit jump in operating income.

See our latest analysis for Ormat Technologies.

That upbeat earnings surprise fits neatly with the trend in its stock, with the share price at $112.64 and a strong year to date share price return suggesting momentum is building, while multi year total shareholder returns point to steady, compounding gains.

If this earnings driven move has you rethinking your watchlist, it could be a good moment to explore fast growing stocks with high insider ownership for other fast moving opportunities with committed insiders.

With earnings accelerating, guidance rising, and the share price hovering just below analyst targets, the key question now is whether Ormat still trades at a meaningful discount or if the market is already fully pricing in its future growth.

Most Popular Narrative Narrative: 4.2% Undervalued

With Ormat Technologies last closing at $112.64 versus a narrative fair value of $117.60, the dominant storyline points to modest upside still on the table.

Recent federal permitting reforms and policy support have significantly expedited geothermal project development timelines in the U.S., enabling Ormat to accelerate greenfield expansion and release more projects for construction, likely driving faster revenue growth and increased long term cash flows. Extension of production and investment tax credits (PTC/ITC) for geothermal and energy storage projects through at least 2033 reduces capital costs, de risks new project development, and boosts net margins and earnings over the next decade.

Want to see why a steady, mid single digit uplift in fair value hinges on tightly calibrated revenue growth, resilient margins, and a premium future earnings multiple? The full narrative unpacks how those expectations stack up against today’s price and what needs to go right for that outlook to hold.

Result: Fair Value of $117.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, significant capital needs and heavy reliance on Chinese sourced batteries could squeeze returns if funding costs rise or new trade restrictions emerge.

Find out about the key risks to this Ormat Technologies narrative.

Another Angle on Valuation

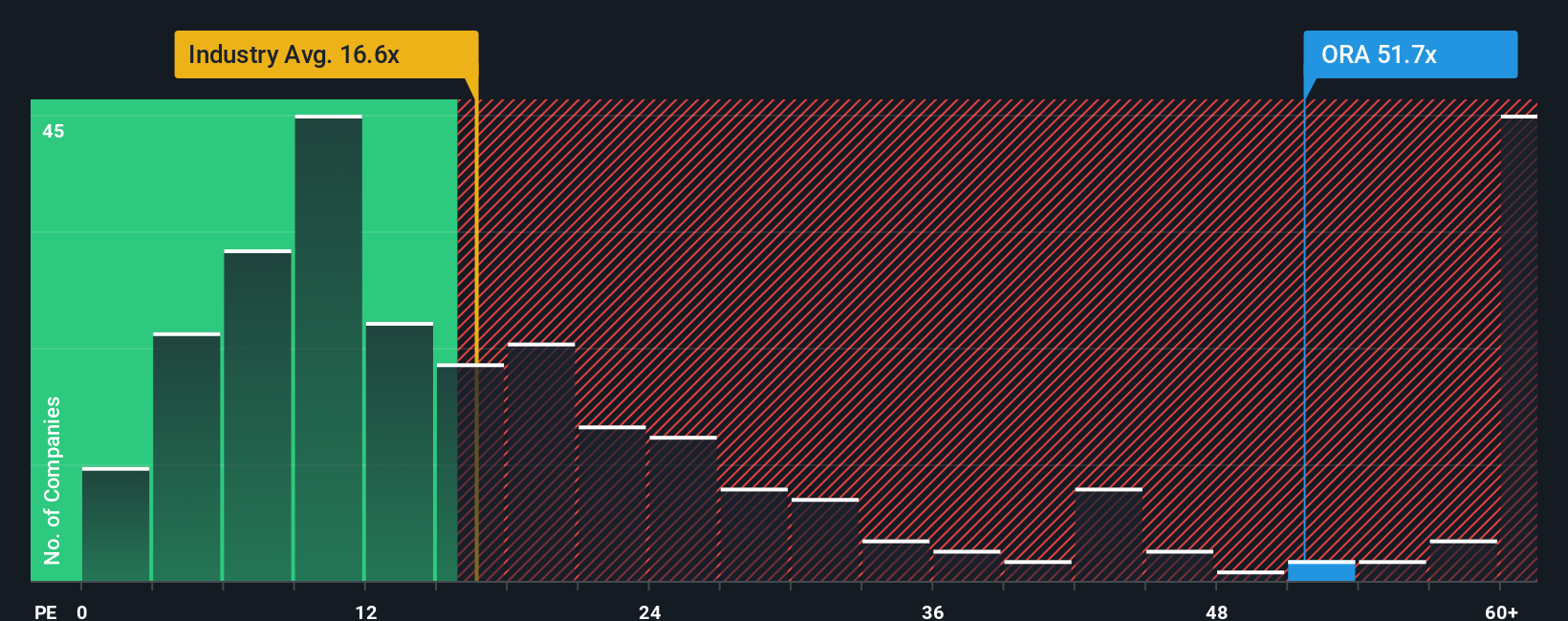

Not everyone sees Ormat as modestly undervalued. On earnings, the stock trades on a steep 51.3 times ratio, versus about 18.5 times for peers and a 16.8 times industry average, and well above a 22.7 times fair ratio, which suggests meaningful downside risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ormat Technologies Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom narrative in just minutes: Do it your way.

A great starting point for your Ormat Technologies research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, secure your next opportunity by using the Simply Wall St Screener to uncover focused, data driven ideas you will not want to overlook.

- Fuel your long term wealth plan by targeting dependable income plays through these 15 dividend stocks with yields > 3% that aim to keep cash flowing even when markets wobble.

- Seize cutting edge growth potential by zeroing in on these 26 AI penny stocks positioned at the front of the artificial intelligence wave, before sentiment fully catches up.

- Lock in potential bargains by filtering for these 904 undervalued stocks based on cash flows where current prices look misaligned with future cash flow potential and market expectations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ORA

Ormat Technologies

Engages in the geothermal and recovered energy power business in the United States, Indonesia, Kenya, Turkey, Chile, Guatemala, Guadeloupe, New Zealand, Honduras, France, Indonesia, the Philippines, and internationally.

Proven track record with very low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)